By Sam Reid

Introduction

Our journey into the world of trading platform evaluation begins with an eye-opening insight: according to a BrokerChooser survey, 68% of traders rank low fees as the most crucial factor when selecting a trading platform.

We have observed the evolution of trading technology in the UAE, where local investors increasingly demand transparency, reliability, and cost efficiency. In our collective experience, choosing the right platform is more than a technical decision; it’s a strategic one that impacts every facet of our trading activity.

Every day, we see traders weighing the features, fees, and overall performance of their chosen platforms. Our research and hands-on trials have revealed that the best trading platform isn’t just about low costs—it’s about striking the perfect balance between technology, execution, and service.

Today, we’ll explore actionable insights and compare leading platforms, including recommendations like Exness, Amana, Equiti, and XTB. We’ll also look at the advantages of using a reliable broker comparison tool to make informed decisions. So, join us as we share what we’ve learned from countless hours of testing, reviewing, and trading!

We have observed the evolution of trading technology in the UAE, where local investors increasingly demand transparency, reliability, and cost efficiency. In our collective experience, choosing the right platform is more than a technical decision; it’s a strategic one that impacts every facet of our trading activity.

Every day, we see traders weighing the features, fees, and overall performance of their chosen platforms. Our research and hands-on trials have revealed that the best trading platform isn’t just about low costs—it’s about striking the perfect balance between technology, execution, and service.

Today, we’ll explore actionable insights and compare leading platforms, including recommendations like Exness, Amana, Equiti, and XTB. We’ll also look at the advantages of using a reliable broker comparison tool to make informed decisions. So, join us as we share what we’ve learned from countless hours of testing, reviewing, and trading!

The Evolution of Trading Platforms

What Is a Trading Platform?

A trading platform is an online software application that empowers traders and investors to execute trades and manage their market positions. These systems are network-based marketplaces that allow us to maintain funded accounts and engage in buying or selling of financial instruments like CFDs. They can range from stocks and ETFs to options, forex, and futures.

Core Functions

- Real-time interaction: Modern platforms offer live quotes, news feeds, and charting tools. These features enable us to monitor market movements and react promptly.

- Security and transparency: Advanced architecture and robust databases ensure our transactions are secure and transparent.

- Market depth: Tools such as Level 2 quotes and market depth charts help us gauge liquidity and price trends, which are crucial for short-term strategies like day trading.

- Customization: Platforms are tailored to suit different markets—whether you’re into stocks, options, or forex—so you have a wide array of functionalities at your fingertips.

Types of Trading Platforms

Trading platforms generally fall into two categories:

Proprietary Trading Platforms: These platforms are typically developed by large brokerage firms. They cater to institutional and experienced traders by mimicking the trading requirements and electronic brokerage models seen in professional environments. In our view, they often come with advanced features suited for high-frequency or algorithmic trading.

Commercial Trading Platforms: Targeting retail investors and day traders, these platforms prioritize ease of use and user-friendly interfaces. They come bundled with useful features such as real-time quotes, integrated news feeds, and charting tools. For those in the UAE looking to start trading with minimal fuss, commercial platforms offer an accessible entry point.

Proprietary Trading Platforms: These platforms are typically developed by large brokerage firms. They cater to institutional and experienced traders by mimicking the trading requirements and electronic brokerage models seen in professional environments. In our view, they often come with advanced features suited for high-frequency or algorithmic trading.

Commercial Trading Platforms: Targeting retail investors and day traders, these platforms prioritize ease of use and user-friendly interfaces. They come bundled with useful features such as real-time quotes, integrated news feeds, and charting tools. For those in the UAE looking to start trading with minimal fuss, commercial platforms offer an accessible entry point.

Features, Fees, and Performance

Key Features to Consider

Execution Quality

Execution quality is paramount, especially for active traders. It measures how effectively orders are filled at or above the National Best Bid and Offer (NBBO). Remember that stat we mentioned earlier? Achieving 96.95% execution quality can be the difference between a profitable trade and a missed opportunity. Fast, reliable order execution is essential—time is money!

Mobile and Desktop Experiences

Traders have busy lives. That's why a robust mobile trading app is indispensable. Platforms that offer intuitive mobile interfaces, verified by high iOS and Android reviews, empower us to trade on the go. Meanwhile, desktop platforms often provide enhanced analytical tools and customizable dashboards.

Execution quality is paramount, especially for active traders. It measures how effectively orders are filled at or above the National Best Bid and Offer (NBBO). Remember that stat we mentioned earlier? Achieving 96.95% execution quality can be the difference between a profitable trade and a missed opportunity. Fast, reliable order execution is essential—time is money!

Mobile and Desktop Experiences

Traders have busy lives. That's why a robust mobile trading app is indispensable. Platforms that offer intuitive mobile interfaces, verified by high iOS and Android reviews, empower us to trade on the go. Meanwhile, desktop platforms often provide enhanced analytical tools and customizable dashboards.

Fee Structures

Fees vary widely among platforms. While many have eliminated commissions on stock trades, options and forex trading can incur additional charges. It’s important to understand:

- Trading Fees: Some platforms, like eToro and tastytrade, offer low trading fees while others might charge per-contract fees for options.

- Deposit and Withdrawal Fees: Look for platforms with free or low-cost deposit and withdrawal options.

- Margin Rates: For traders using leverage, lower margin rates can improve profitability.

Research and Educational Tools

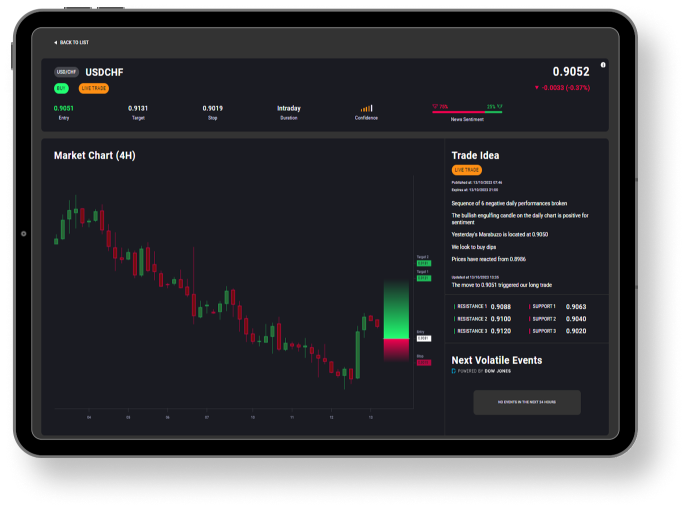

Platforms that integrate premium research data, educational resources, and live market news provide a competitive edge. Whether you’re a beginner or an advanced trader, these tools help you make informed decisions and refine your trading strategies. Some examples of high quality third party analysis tools offered by traders include Acuity, Trading Central or Autochartist.

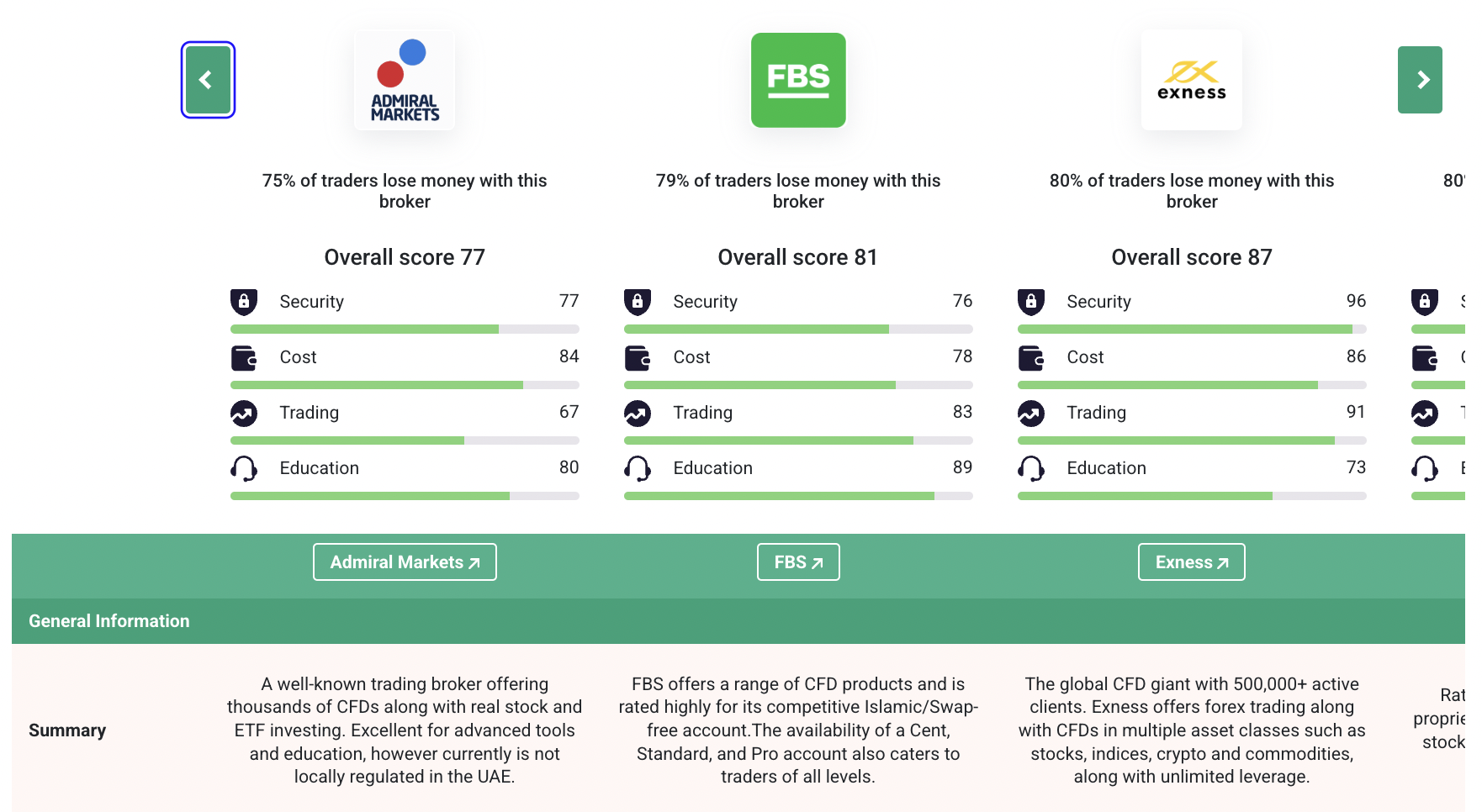

Evaluating Performance with a Broker Comparison Tool

When we compare online trading platform options, a broker comparison tool can be incredibly useful. These tools consolidate key data points—like fees, account requirements, and user ratings—into an easy-to-understand format. Our experiences have shown that a detailed broker comparison tool not only saves time but also highlights subtle differences that might otherwise go unnoticed.

After extensive testing and analysis, we recommend the following platforms for traders in the UAE and beyond:

Exness

Exness is renowned for its low fees and robust execution quality. It offers a user-friendly interface and supports both retail and professional trading. For those who value speed and transparency, Exness stands out as an excellent trading trading platform.

Read our Exness Review

Amana

Amana is another top contender that caters especially well to traders who prioritize ease of account opening and cost efficiency. It combines streamlined operations with a reliable trading environment, making it an ideal choice for beginners and seasoned traders alike.

Read our Amana Review

Equiti

Equiti shines with its diverse range of trading instruments and advanced research tools. This platform is designed to meet the demands of a sophisticated trader looking for an all-in-one solution. Its strong regulatory framework and competitive fee structure make it a preferred option in our broker reviews.

Read our Equiti Review

XTB

XTB impresses with its seamless account setup and comprehensive educational resources. Its platform is particularly beneficial for day traders who need access to real-time data and advanced charting tools. XTB’s balanced approach between user-friendliness and high functionality positions it as a top recommendation.

Read our XTB Review

Comparing Fees and Features

Fee Comparison

- Stock and ETF Fees

Many platforms have moved towards commission-free stock trading. However, our tests have shown that the fee structures can still vary based on service tiers. For instance, while eToro offers low fees on stocks and ETFs, platforms like XTB might provide even more competitive rates for high-volume traders.

- Forex and Options Fees

Forex trading fees are another important aspect. Exness, for instance, is noted for its low forex fees. When comparing trading trading platform options using a broker comparison tool, it becomes evident that even small differences in spreads can affect overall profitability, especially for active traders.

- Deposit, Withdrawal, and Inactivity Fees

Some platforms might charge fees for depositing or withdrawing funds, while others waive these fees altogether. It’s also important to consider inactivity fees. Our analysis shows that platforms like Equiti and Amana typically offer more favorable terms, reducing the overall cost of trading.

- Speed and Execution

The speed at which trades are executed can influence profitability dramatically. In our experience, platforms that prioritize high execution quality, like Exness and XTB, provide a significant advantage to traders who operate in fast-paced environments.

- User Experience

Ease of use is crucial. We’ve tested various platforms and found that a smooth, intuitive interface enhances the trading experience. Our collective feedback suggests that platforms with clear navigation and robust customer support are the ones that truly deliver under pressure.

- Research and Analysis Tools

Tools such as real-time quotes, advanced charting, and market news feeds are not just add-ons—they are essential for making informed decisions. Our broker comparison model often highlights these features, making it easier for us to choose a platform that aligns with our trading style and risk tolerance.

How to Choose the Right Trading Platform

Assess Your Trading Style

Before selecting a trading trading platform, consider your trading style:

Use a Broker Comparison Tool

Our recommendation is always to leverage a broker comparison tool. These tools help us quickly assess:

Using these tools can simplify the decision-making process and ensure that we select a platform that meets our specific needs.

Before selecting a trading trading platform, consider your trading style:

- For day traders: Fast execution and low trading fees are paramount. Look for platforms that offer advanced charting tools and market depth information.

- For options traders: Specialized tools for visualizing options strategies are critical.

- For beginners: User-friendly interfaces and educational resources can provide a smoother entry into the trading world.

Use a Broker Comparison Tool

Our recommendation is always to leverage a broker comparison tool. These tools help us quickly assess:

- Minimum deposit requirements.

- Fee structures across different asset classes.

- Execution quality and mobile platform reviews.

- Additional features like research tools and educational content.

Using these tools can simplify the decision-making process and ensure that we select a platform that meets our specific needs.

Actionable Tips for Traders

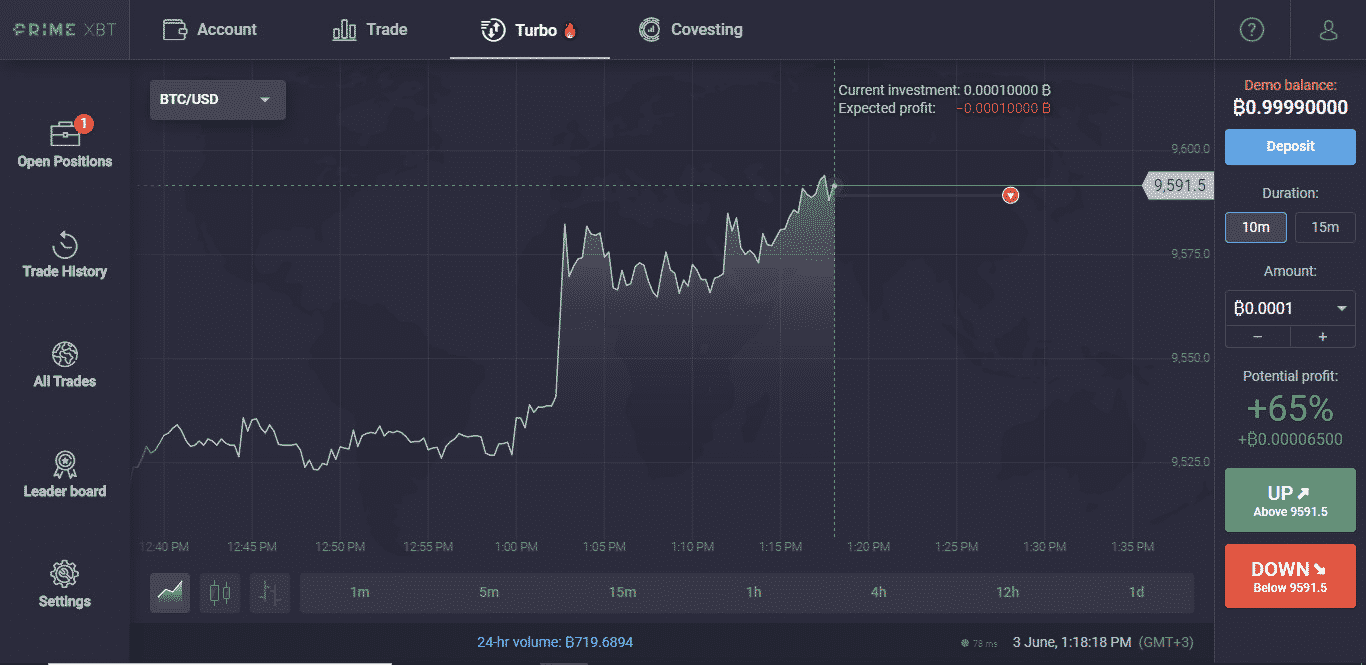

Experiment with Demo Accounts

Before committing your funds, it’s a good idea to try out demo accounts. Many leading trading trading platform providers offer paper trading options.

This not only helps us understand the platform’s features but also lets us test our strategies without financial risk.

Stay Informed

Keep up with the latest market trends and platform updates. Subscribing to newsletters and joining trading communities can provide valuable insights. Our collective experiences have shown that staying informed directly correlates with improved trading performance.

Manage Your Risks

Trading inherently involves risks. One rule you can follow is the 3-5-7 rule in trading (which we will detail in our FAQ section).

This simple guideline helps us manage risk while aiming for consistent returns. Balancing risk with opportunity is key to long-term success.

Before committing your funds, it’s a good idea to try out demo accounts. Many leading trading trading platform providers offer paper trading options.

This not only helps us understand the platform’s features but also lets us test our strategies without financial risk.

Stay Informed

Keep up with the latest market trends and platform updates. Subscribing to newsletters and joining trading communities can provide valuable insights. Our collective experiences have shown that staying informed directly correlates with improved trading performance.

Manage Your Risks

Trading inherently involves risks. One rule you can follow is the 3-5-7 rule in trading (which we will detail in our FAQ section).

This simple guideline helps us manage risk while aiming for consistent returns. Balancing risk with opportunity is key to long-term success.

FAQs

What is the 3-5-7 rule in trading?

The 3-5-7 rule is a guideline used by some traders to manage risk and set profit targets. Although interpretations vary, a common approach is:

This rule helps ensure that our losses remain manageable while providing a clear framework for taking profits.

What is the difference between trading platforms?

Trading platforms vary widely in terms of features, fees, and target audiences. Some are designed for high-frequency institutional trading, while others cater to retail investors and day traders. The main differences lie in:

Which trading platform gives the highest profit?

No single trading trading platform guarantees the highest profit; profitability depends on multiple factors including trading strategies, market conditions, and individual risk tolerance. However, platforms that offer low fees, high execution quality, and robust analytical tools—such as Exness and XTB—often enable traders to maximize their returns when used effectively. It’s important to remember that past performance is not indicative of future results.

Which stock trading platform has the lowest fees?

Many modern platforms now offer commission-free stock trading, but additional costs may arise from other fees. From our research, platforms like Amana and Equiti often present competitive fee structures for stocks and ETFs. A detailed broker comparison tool can help you compare these platforms side by side to identify which one truly offers the lowest overall costs based on your trading habits.

The 3-5-7 rule is a guideline used by some traders to manage risk and set profit targets. Although interpretations vary, a common approach is:

- 3% Loss: Limit the maximum loss on any trade to 3% of your trading capital.

- 5% Target: Aim for a 5% gain on profitable trades.

- 7% Rule: Combine these percentages to determine the overall risk/reward ratio before entering a trade.

This rule helps ensure that our losses remain manageable while providing a clear framework for taking profits.

What is the difference between trading platforms?

Trading platforms vary widely in terms of features, fees, and target audiences. Some are designed for high-frequency institutional trading, while others cater to retail investors and day traders. The main differences lie in:

- User Interface: Ease of use and accessibility.

- Execution Speed: How quickly orders are processed.

- Fee Structures: The costs associated with trading, including commissions and spreads.

- Additional Tools: Research, charting, and educational resources. Using a broker comparison tool can help us discern these differences effectively.

Which trading platform gives the highest profit?

No single trading trading platform guarantees the highest profit; profitability depends on multiple factors including trading strategies, market conditions, and individual risk tolerance. However, platforms that offer low fees, high execution quality, and robust analytical tools—such as Exness and XTB—often enable traders to maximize their returns when used effectively. It’s important to remember that past performance is not indicative of future results.

Which stock trading platform has the lowest fees?

Many modern platforms now offer commission-free stock trading, but additional costs may arise from other fees. From our research, platforms like Amana and Equiti often present competitive fee structures for stocks and ETFs. A detailed broker comparison tool can help you compare these platforms side by side to identify which one truly offers the lowest overall costs based on your trading habits.

Conclusion

In our collective experience, the choice of a trading trading platform can have a profound impact on our trading success. Whether you’re a day trader, an options specialist, or a novice entering the market, understanding the features, fees, and performance of each platform is essential.

Platforms like Exness, Amana, Equiti, and XTB stand out as top recommendations for their balanced mix of cost efficiency, advanced technology, and excellent user experience.

By using a robust broker comparison tool, we can make informed decisions that align with our trading strategies and financial goals. The right platform not only supports our day-to-day trading activities but also enhances our ability to respond to market changes swiftly and effectively. Let us continue to share our experiences and insights, ensuring that our trading journey is both profitable and rewarding.

The world of trading is fast-evolving, and staying ahead means continuously evaluating and adapting to new technologies and market conditions. As we embrace these changes, our focus remains on delivering actionable insights and maintaining a competitive edge.

Happy trading!

Platforms like Exness, Amana, Equiti, and XTB stand out as top recommendations for their balanced mix of cost efficiency, advanced technology, and excellent user experience.

By using a robust broker comparison tool, we can make informed decisions that align with our trading strategies and financial goals. The right platform not only supports our day-to-day trading activities but also enhances our ability to respond to market changes swiftly and effectively. Let us continue to share our experiences and insights, ensuring that our trading journey is both profitable and rewarding.

The world of trading is fast-evolving, and staying ahead means continuously evaluating and adapting to new technologies and market conditions. As we embrace these changes, our focus remains on delivering actionable insights and maintaining a competitive edge.

Happy trading!

This article has been crafted with insights from industry evaluations and personal experiences, ensuring that every trader finds value in the comparison of leading platforms. Our analysis is intended to guide you in choosing the best trading platform for your needs, using our broker comparison tool data to back every decision.