Exness Trading Instruments

Exness mainly offers forex and CFD products, and clients in the UAE can trade the following asset classes.

- 100+ forex pairs

- 80+ global stocks

- 6 commodities including metals and energies

- 9 crypto pairs

- 10 indices

While Exness hits most of the bases in terms of its product offering, this broker’s list of trading instruments isn’t as extensive as other brokers reviewed on this site. For example, Exness doesn’t offer ETFs or soft commodities, and its stock offering is limited mainly to US-listed companies.

Exness Commissions, Spreads and Fees

Trading Fees

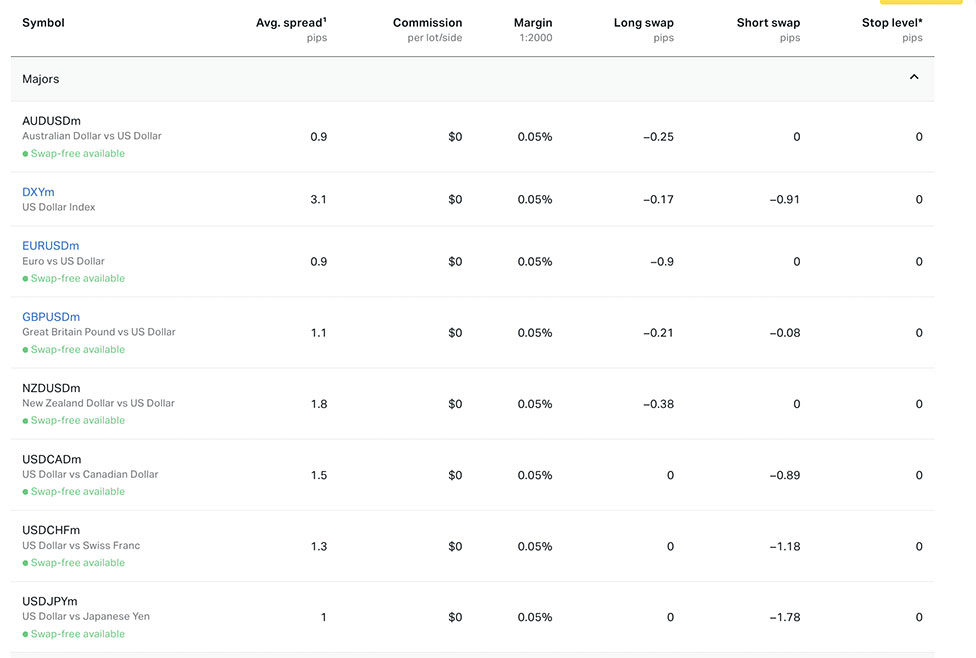

In this section of our Exness broker review for UAE traders, we take a look at Exness’ fees. Exness offers fairly competitive variable spreads and commission. But as always, the costs you incur trading with Exness will depend on your account type and the instruments you trade.

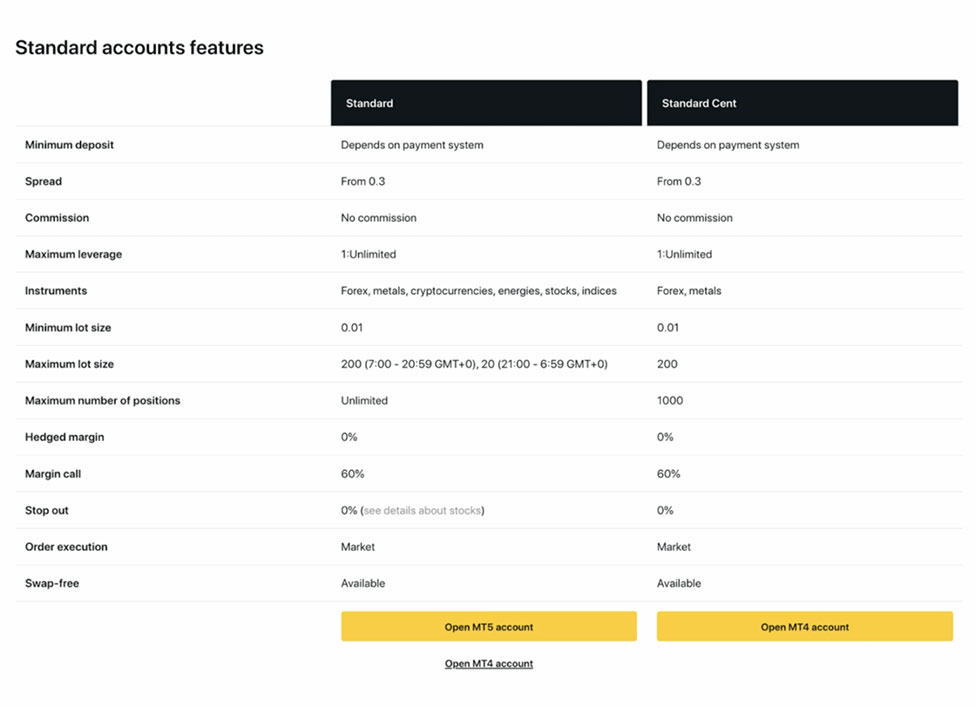

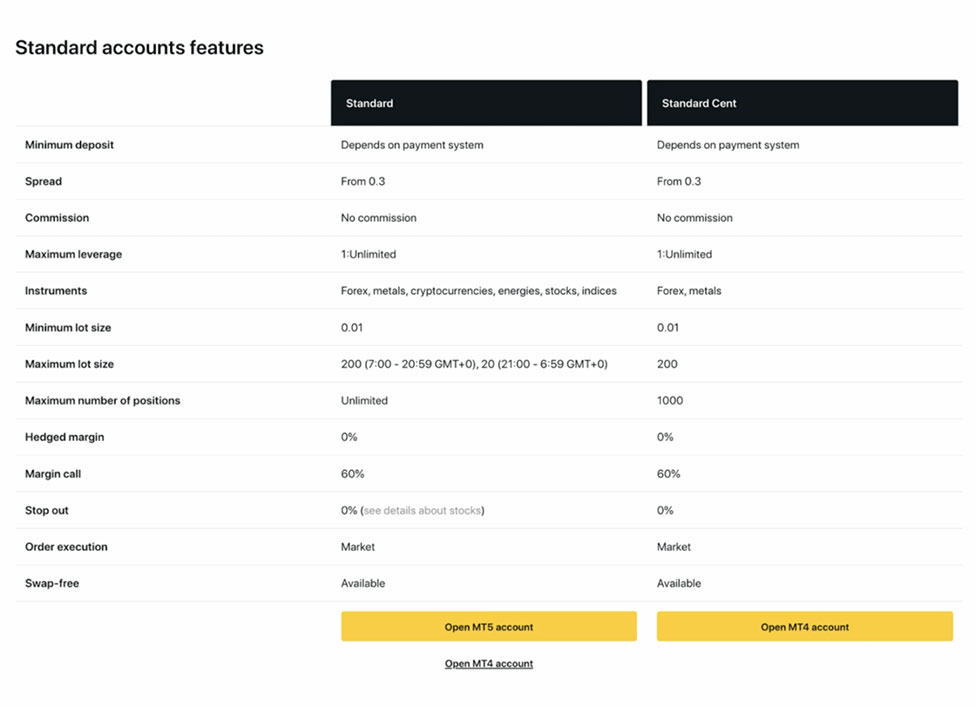

On the Standard and Standard Cent Accounts, spreads start from 0.3 pips, with no commissions on all trading volumes. The main difference between the two being that the Standard Cent account is designed for new traders, offering micro lots but fewer trading options.

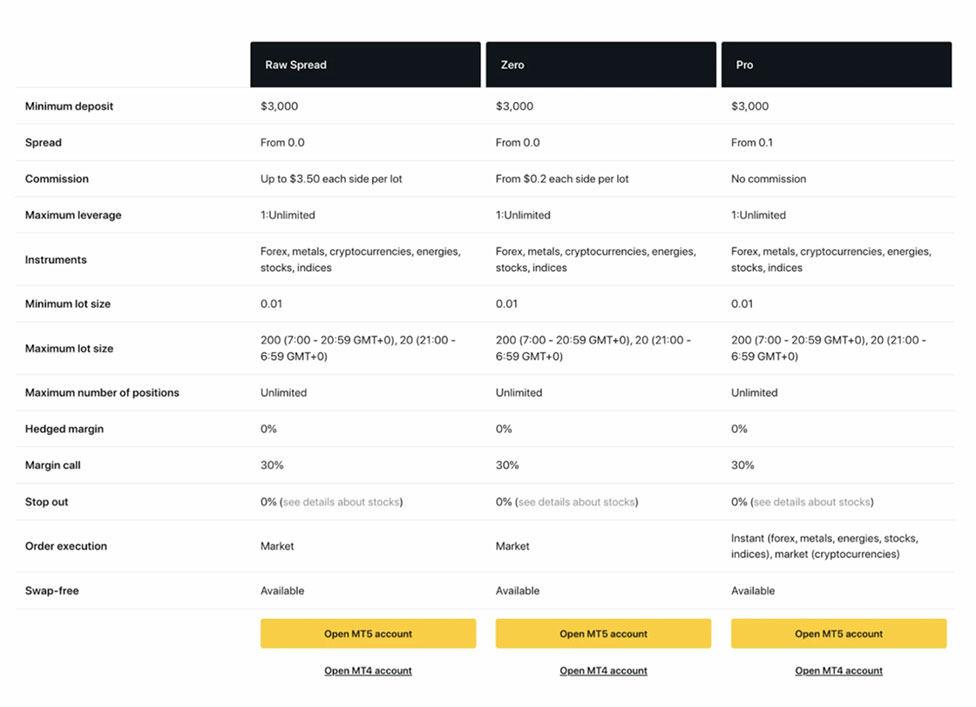

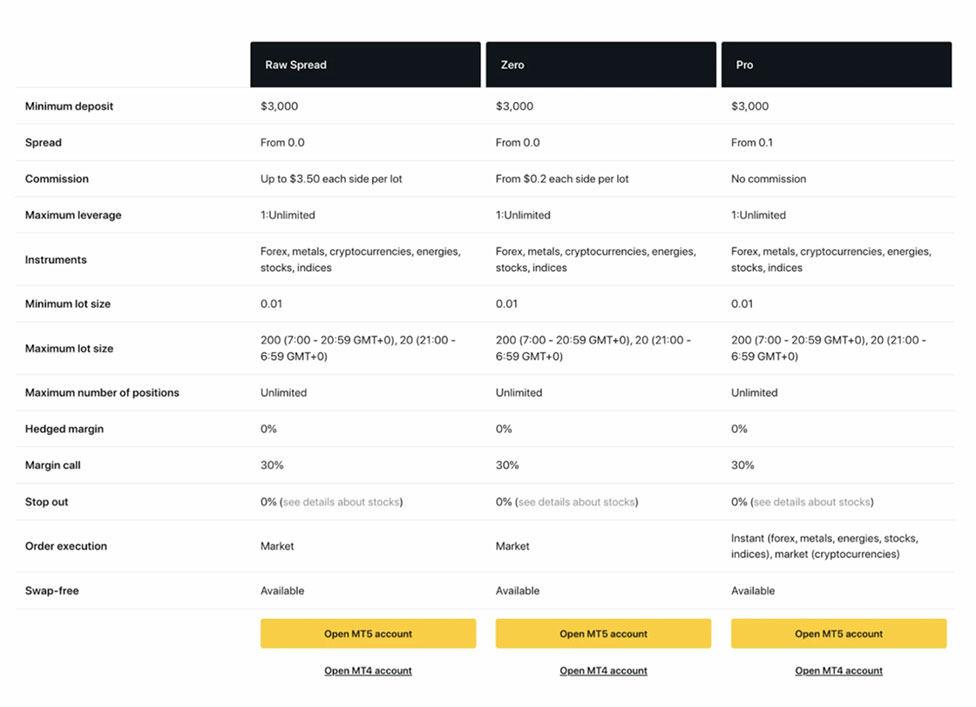

Looking at Exness professional accounts, the Raw Spread Account comes with spreads from 0.0 pips with commission of up to $3.50 each side per lot, while the Zero Account also offers spreads from 0.0 pips, but a lighter commission structure from $0.2 each side per lot. Finally, the Pro Account comes in at the most competitive for UAE traders, with spreads from 0.1 pips and 0% commission.

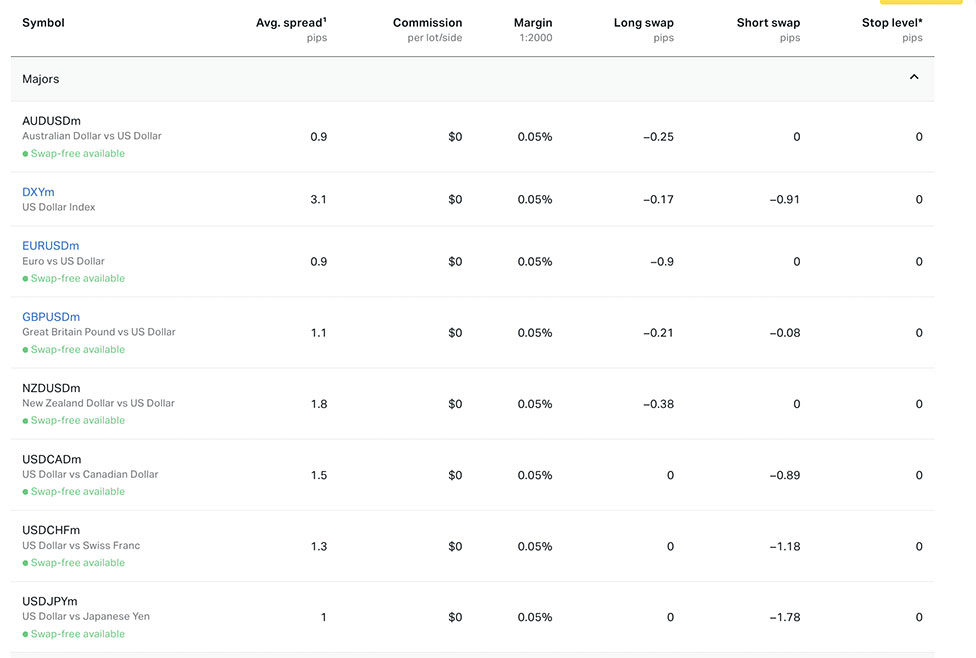

Let’s take a look at Exness’ spreads on some of the most popular currency pairs in the table below.

Swap Fees

Some asset classes offered by Exness are swap-free by default, such as crypto and stocks. Other asset classes however do incur these rollover costs when holding positions overnight.

With that said, Exness does offer Swap-Free accounts for traders looking to trade in line with Islamic principles. Exness also states on its website that no extra costs will be incurred by traders if they opt for this account type.

Non-Trading Fees

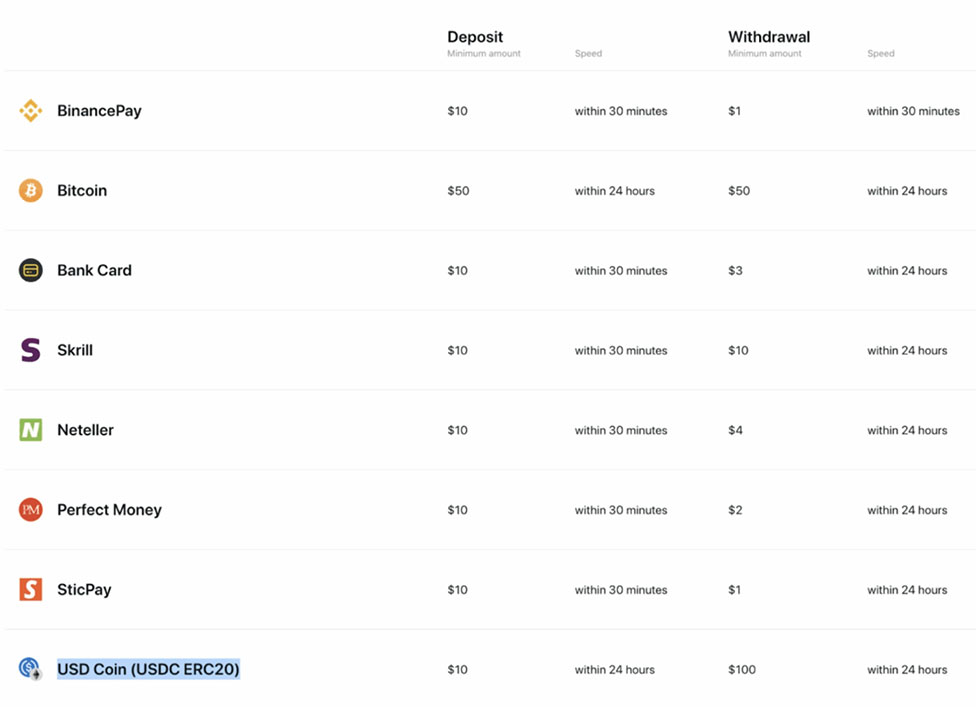

A big plus for Exness traders in the UAE is their free deposits and withdrawals. This broker also does not charge any inactivity fee. However MT4 accounts will be disabled if left inactive for 180 days, and MT5 accounts will be removed after just 21 days of inactivity.

Exness Deposits & Withdrawals

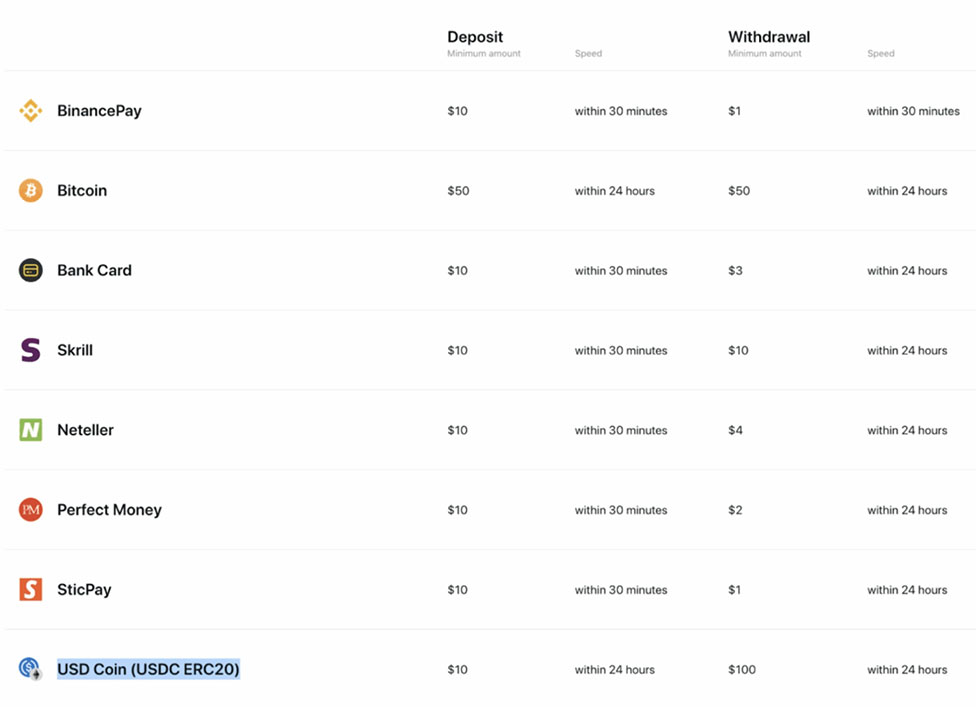

UAE traders will face zero cost when depositing and withdrawing funds with Exness. They also offer a wide selection of payment methods, including bank card and popular crypto wallets and eWallets including Neteller, Skrill and Perfect Money. Minimum deposit amounts range from $10 with a bank card up to $50 with Bitcoin. After completing identity verification, users are redirected to the Exness login area where all trading accounts and platform settings are managed. For withdrawals, the minimum amount ranges from $1 with SticPay to $100 if UAE traders opt to withdraw via USD Coin (USDC ERC20).

Note that Exness’ deposit and withdrawal options may differ depending on your durisdiction.

Exness Trading Platforms

When it comes to trading platforms, Exness has its own proprietary Terminal which combines with TradingView giving UAE traders a solid range of analytical tools and order types. The Exness terminal is an HTML 5 web app developed in-house by Exness’ own programmers and designers, making it a reliable, fast, and user-friendly web platform.

Exness also offers MetaTrader 4 and Metatrader 5. Out of these, MT4 is by far the most popular choice for Exness traders due to their competitive forex spreads.

Exness also offers an in-house developed trading app, offering over 200 instruments across forex, crypto, indices, stocks and energies. This line up of platforms gives traders in the United Arab Emirates lots of choice to accommodate all trading preferences.

Exness Account Types

Exness offers 2 Standard account types and 3 professional account types. Below is a breakdown of each account type to help traders in the UAE choose the right one for them.

Standard accounts types offered by Exness include the Standard Account and the Standard Cent Account.

When it comes to professional accounts at Exness, UAE clients can choose from 3 different accounts, including the Raw Spread Account, Zero Account, and the Pro Account. Here is a summary of these accounts and the main differences between each one.

Exness Research & Education

Exness Education

Exness has a simple yet comprehensive educational academy at insights.exness.com which is a sub domain from its main website. Educational resources are offered to Exness clients in the form of educational articles that explain key trading concepts, market pyschology, strategies and news. However, a lot of these category seem to be dormant and have not been updated for months in some cases.

Exness are more active on their main blog, where they post trending market news and insights.

Overall, educational resources at Exness are comprehensive but not regularly updated, meaning that beginner UAE clients that choose to trade with this broker may need to look for updated educational materials elsewhere.

Exness Research

Exness is much stronger when it comes to providing traders with research and analytical tools. They provide traders with trading signals and technical/fundamental analysis from the third-party trading tool, Trading Central. In addition, Exness provides market news feeds from FXStreet for clients. Both of these tools are available in the Exness client area or directly on the Exness Trade App.

Exness Regulation

Exness is made up of several entities which are licensed by well-known regulatory bodies such as CySEC of Cyprus, FSA of Seychelles, FSCA of South Africa, and FCA of the UK. Despite its global regulations, one disadvantage for Exness clients in Dubai and the UAE is that Exness is not regulated by any regulatory body in the United Arab Emirates.

Exness Customer Support

Overall, Exness ranks well when it comes to customer support. The broker offers 24/5 assistance in 14 languages. UAE clients will even find 24/7 support in English, Thai, and Chinese.

Exness offers live chat via the website, which is a convenient method for non-urgent matters. Clients can usually expect a reply back within the day. Exness also provides phone support for more urgent matters.

- Helpline Telephone Number – +35725245730

- Email Address – support@exness.com

- Headquarters Address – Siafi Street, Portobello, Office 401, 3042, Limassol, Cyprus

Exness: The Bottom Line

Highlights for Exness include its low forex spreads, unlimited leverage offering on certain instruments, and 24/7 english customer support. Exness is one of the world’s biggest brokers by trading volume and active client base, and certainly becoming more popular in the UAE.

At the same time, Exness doesn’t yet have a local UAE license which may be off-putting to some. Their product offering also isn’t as extensive as other brokers in the region. This is good for traders just looking for the basics, however more advanced traders looking for asset classes like ETFs and local MENA stocks will not find this with Exness.

To conclude this Exness broker review, we would recommend Exness for intermediate traders looking for reliability and a strong global presence, offering high leverage and highly competitive trading conditions.

Written by Sam Reid

Written by Sam Reid Fact checked by Freddie Ricks

Fact checked by Freddie Ricks Last updated 1 day ago

Last updated 1 day ago