XM Trading Instruments

XM offers over 1000 markets, including forex and CFDs across stocks, indices, commodities and cryptocurrencies. While XM covers the main bases in terms of its product offering, these assets may be considered thin compared to other brokers who offer extras, such as ETFs, bonds, options, and other asset classes. Here is a detailed list of XM’s instruments available for traders in the UAE.

- 57 currency pairs including exotic pairs

- 1000+ stocks across 18 different stock markets

- 20+ stock indices

- 8 commodities

- 31 cryptocurrencies

- 2 precious metals

The highlight of XM’s instrument list is its stocks, offering over 1000 individual CFD shares spanning across 18 different stock markets. So if you’re a UAE trader looking to trade a range of global stocks, you should definitely give XM a thought.

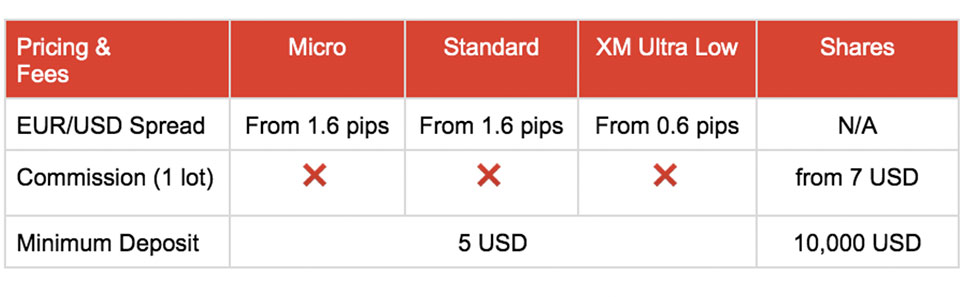

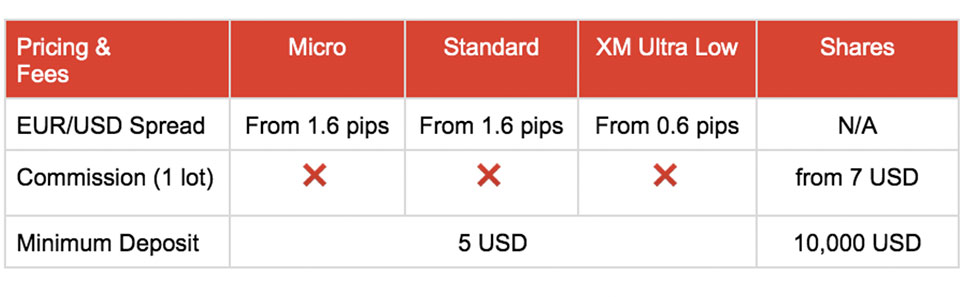

XM Commissions, Spreads and Fees

When testing XM’s trading and non-trading fees, we found that XM’s pricing is competitive for CFDs, but relatively average if you’re trading forex. As usual, the spreads/commision you will pay with XM ultimately depends on the account type you choose, and the instruments you trade.

XM offers several trading accounts for traders in the UAE: XM Standard, XM Micro, XM Ultra low and Shares Account. The first three accounts offer zero commission, while the Shares account includes a variable commission along with a spread set by the underlying exchange.

Forex

The XM Standard and Micro accounts offer a floating spread from 1 pip on major forex pairs, whereas the Ultra Low account comes in with a floating spread as low as 0.6 pips. For EUR/USD, XM traders will face an average spread of 1.6 pips. Despite being commission-free, this is still very high for the industry.

CFDs

Index CFDs are competitively priced, with a minimum spread of 0.7 pips on the S&P 500. Precious metal traders will find spreads from 0.25 and 0.03 on gold and silver, respectively, on Standard and Micro accounts. This falls to 0.12 for gold and 0.02 for silver with the Ultra Low account.

While XM does not offer the most competitive pricing environment, its fee structure does favor traders with lower trading sizes and smaller portfolios.

Non Trading Fees

XM has zero deposit and withdrawal fees. However, traders will face an inactivity fee if their account remains dormant. The inactivity fee includes a one-off fee of $15 if the account is dormant for 12 months, followed by a month charge of $5 if the account remains inactive. For more information on XM’s trading and non-trading fees, find the brokers full pricing breakdown here.

XM Deposits and Withdrawals

The minimum deposit amount at XM is $5, which is a major advantage for beginner traders looking to trade in lower volumes. There are zero deposit fees as well. UAE traders can deposit in any currency, and XM will automatically convert this into the base currency of your account.

XM offers accounts in 11 different base currencies: USD, EUR, GBP, AUD, RUB, JPY, CHF, ZAR, SGD, PLN, HUF, except for the Shares account which is only available in USD. The following methods are also available to deposit and withdraw your funds:

- Credit/Debit cards (Visa, MasterCard, Maestro)

- eWallets (Skrill, Neteller, Perfect Money)

- Bank Transfer

- Apple Pay / Google Pay

Withdrawals with XM are also fast and simple. You can withdraw with the same method used to deposit with a tiny minimum withdrawal amount of $2, depending on the withdrawal method chosen.

Withdrawal processing times vary from instantly to 1 working day, and withdrawals are free of charge. While bank transfer fees are usually incurred by the trader, XM is one of the few brokers that will absorb this fee for withdrawals above $200.

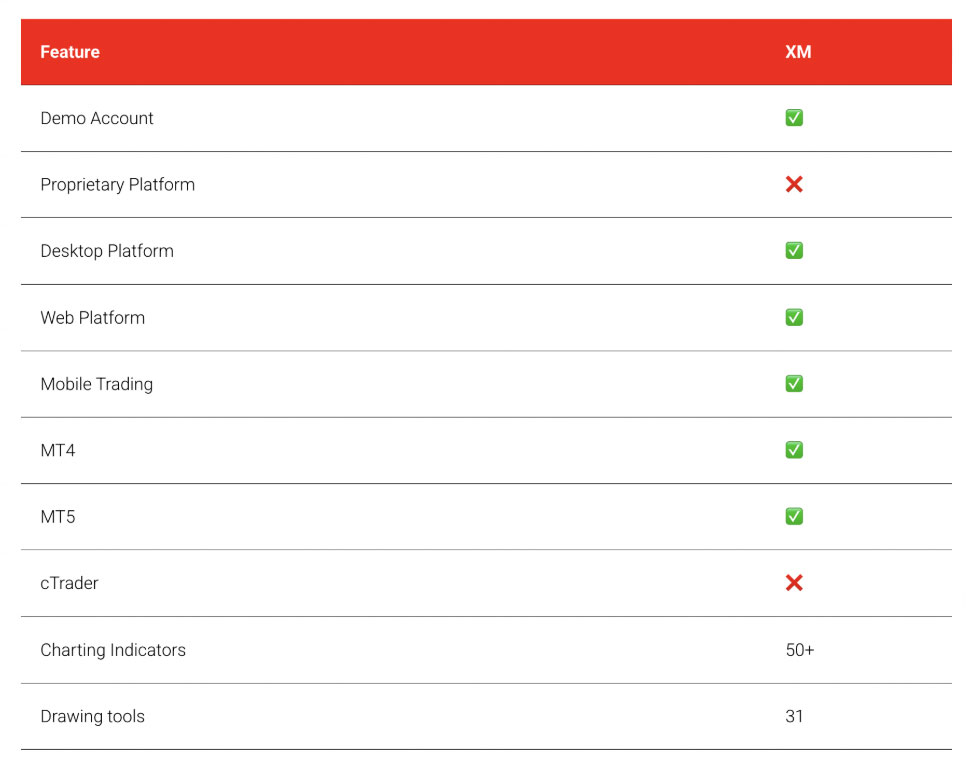

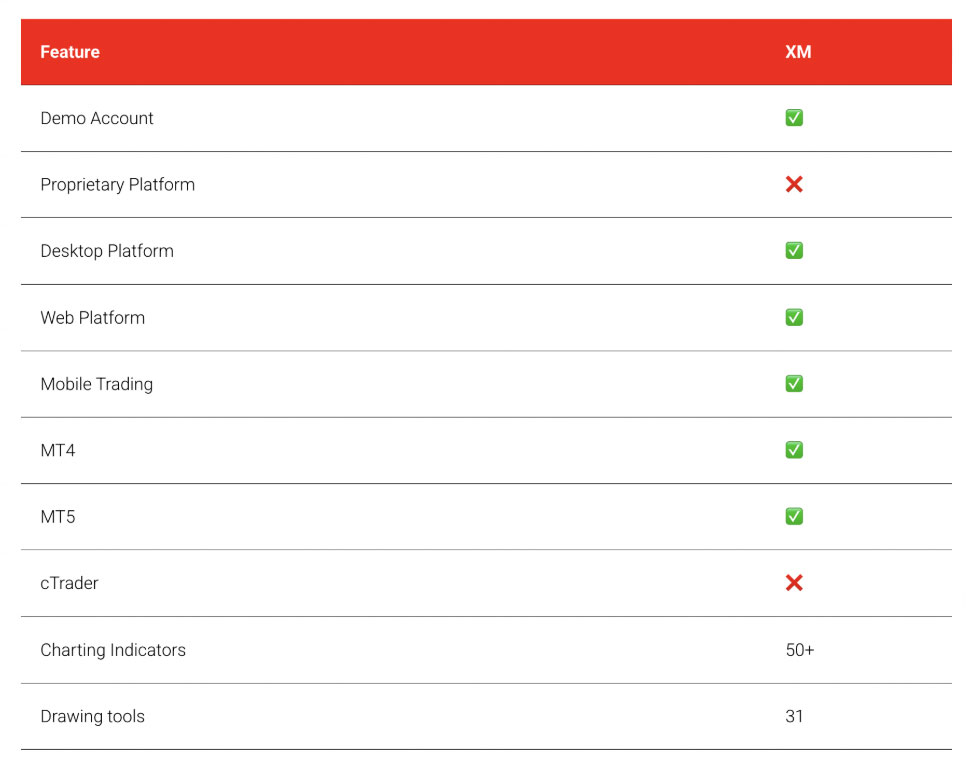

XM Trading Platforms

XM sticks to the traditional MetaTrader 4 and MetaTrader 5 platforms for its traders in the UAE and globally. Their upgraded MT4 and MT5 suites are versatile and highly customizable. Both platforms are also available across all mediums and devices, including web, desktop and mobile.

While XM’s platform offering is more classic, it’s worth noting that MetaTrader platforms were launched many years ago, so the appearance and feel of these platforms are much older than other brokers with their in-house, customized platforms. However, XM platforms do offer price alerts on the web version, and the platforms are available in over 30 languages.

Traders should also note that XM MT5 offers more features compared to XM MT4.

XM MT4

XM’s MT4 platform offers over 100 tradable instruments, including forex, CFDs and futures, full EA functionality for algorithmic trading, 51 indicators, 31 drawing tools, 3 different chart types, and watchlists. MT4 is also available on mobile for people who like to trade on the go.

XM MT5

XM MT5 offers many additional features to analyze the markets. Traders can perform different order types such as ‘Fill or Kill’ and Immediate or Cancel’, along with 70+ tools for fundamental and technical analysis. XM MT5 is available on PC, WebTrader, Mac, iPhone, and Android.

XM App

The XM App provides traders with a seamless and user-friendly mobile trading experience. Available for both iOS and Android devices, the app allows users to manage their accounts, monitor market prices in real-time, and execute trades on the go.

With one-click trading, live charts, and real-time price updates, the app ensures traders stay connected to the markets wherever they are. The app also offers secure deposits and withdrawals, making account management hassle-free. Additionally, traders can access XM’s educational content, market analysis, and news directly from the app, ensuring they’re always informed.

The XM App stands out for its intuitive interface and stability, making it an excellent choice for both beginner and experienced traders who value flexibility and convenience.

XM Account Types

XM Dubai offers 4 main account types for traders in the UAE. These include the Micro, Standard, XM Ultra Low, and Shares Account. All of the listed accounts come with identical order execution quality, market updates and built-in technical analysis tools, and negative balance protection.

XM Micro Account

The Micro Account is suited towards low volume traders, allowing you to operate in micro lots (1000 currency units) with a minimum volume of 0.01 lots on MT4 and MT5. The minimum deposit for this account is $5.

XM Standard

The Standard Account is best for more experienced traders, offering floating spreads starting from 1 pip on forex. This account features no re-quotes, along with leverage of 1:30 for UAE clients and a minimum deposit amount of $5. However, traders can still trade in smaller lot sizes.

XM Ultra Low

The XM Ultra Low account features spreads from 0.6 pips along with leverage of up to 1:30. The account allows you to trade either micro or standard lots with a minimum trading volume of 0.01 lots and a limit of 50 lots per ticket for the Standard Ultra, and 0.1 lots and 100 entry lots per ticket for the Micro Ultra. The minimum deposit is also the same at $5.

XM Shares

The XM Shares Account comes with a much higher initial deposit amount of $10,000 and is suited to UAE investors looking to physically invest in shares (non CFDs) with no leverage or swap fees. This account is only available in USD, and includes commission fees and no hedging.

Swap-Free / Islamic Accounts

XM also offers the option to convert the Micro, Standard and Ultra Low Accounts into an Islamic swap-free account to accommodate traders looking to trade in line with Islamic principles. This will waive any swap/rollover interest fees for positions held overnight. XM also states on its website that while other forex brokers substitute these fees by widening the spread on Islamic accounts, XM imposes no additional charges.

XM Research & Education

Some brokers tend to add sub-par research and education just for the sake of having it. However this isn’t the case with XM. As part of our XM broker review, we had a look at their additional tools. They offer a comprehensive library of beneficial educational resources and research tools to provide traders with knowledge and make better trading decisions.

Research

XM provides clients with a variety of tools to stay updated on market trends and trading opportunities. Traders can access XM TV and the XM Podcast both of which offer daily market updates and expert insights. These resources allow traders to gain a deeper understanding of the forex market through engaging, easy-to-digest formats.

In addition, XM has strengthened its partnership with Trading Central, giving clients access to award-winning analytics and actionable insights directly from a trusted leader in financial research. The tools provided by Trading Central, such as Technical Insight®, Fundamental Insight®, Economic Insight®, and Crowd Insight®, enable traders to monitor market trends, analyze sentiment, and discover new trading opportunities—all designed to help traders make informed decisions.

One significant advantage is that these insights are integrated within the XM platform, allowing traders to access real-time trading signals, news sentiment analysis, and technical indicators without needing to leave the platform. This seamless integration sets XM apart from brokers who offer research tools separately, making it more convenient for clients to act on opportunities quickly and efficiently.

With XM and Trading Central, traders can access resources that cater to both technical and fundamental analysis, making their trading experience more informed and comprehensive.

From the technical indicators that we tested inside the platform, we found a total of 31 charting tools inside the MetaTrader platforms. Some of these were difficult to use due to the outdated design. But overall, XM traders can be confident in the broker’s outstanding selection of high-quality research.

Education

XM has an excellent educational suite for traders, providing its UAE and global client base with an extensive range of material. These include, Forex & CFD webinars & seminars, educational videos, platform tutorials, trading workshops, and much more. As a testament to XM’s trader resources, Capital Finance International Magazine awarded XM the global title of ‘Best Market Research and Education 2019’.

XM Regulation

XM is regulated in the United Arab Emirates by the DFSA, ensuring its strict compliance with one of the UAE most stringent regulatory frameworks. This includes keeping its customer funds safe and secure with segregated accounts within Tier 1 banks exclusively. In addition to its DFSA regulation in the UAE, XM is also regulated by the FCA in the United Kingdom, ASIC in Australia, and CySEC in Cyprus.

XM’s customer support is overall rated good. Traders in the UAE can access XM’s support via:

- Phone: +501 223-6696

- Email: support@xm.com

- Livechat

- Social Media

XM also offers personal support managers that are multilingual and very helpful when it comes to setting up your account or fixing any issues that may arise. For instant responses, XM’s live chat feature is the best tool to use.

According to their website, XM’s phone and livechat support are available 24/7.

XM: The Bottom Line

To conclude our XM review, we recommend XM as a solid choice for CFD traders in the UAE, especially those looking for the best of the best in terms of education and research tools. XM’s highlights include being locally regulated by the DFSA, low minimum deposits of $5, and extremely fast order execution.

However, XM is restricted to MT4 and MT5 only, which may seem like an outdated offering for traders looking for a sleek and modern trading platform. In addition, despite XM’s huge trading volumes, its fees are still above the industry average for forex, and also charges quite high on the subject of inactivity fees.

Overall, a solid, safe and secure broker in Dubai. Feel free to test XM out yourself.

Written by Sam Reid

Written by Sam Reid Fact checked by Freddie Ricks

Fact checked by Freddie Ricks Last updated 1 day ago

Last updated 1 day ago