Amana Trading Instruments

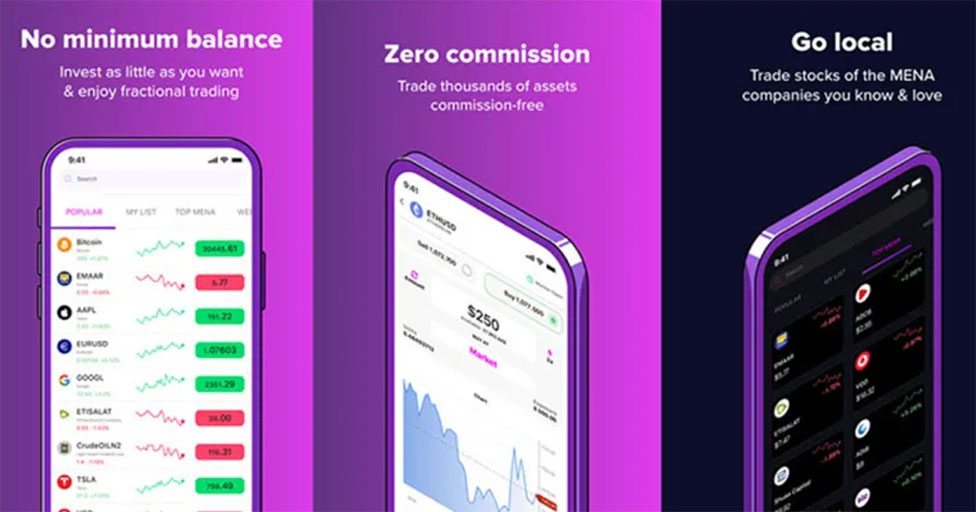

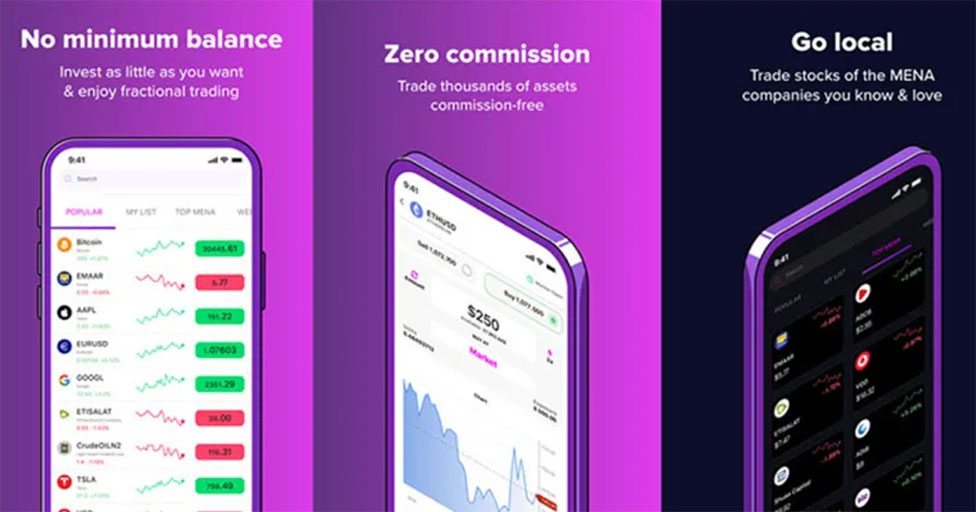

With amana, you can trade the standard CFD and forex products across stocks, forex, ETFs, indices, commodities and 100+ cryptos with competitive pricing, zero commission and fast execution.

However, amana differentiates itself as one of the only UAE brokers to offer retail clients the opportunity to invest in local and global stocks as well. With amana, you can buy:

- Regional stocks: Find the largest MENA stocks available to invest in, including EMAAR, ADCB, ADIB, Aramco, Al Rajhi, Salik, and more.

- Global stocks: Physically invest in the biggest US-listed companies such as Apple, Tesla, Google, Microsoft, and others.

Amana also offers fractional trading, meaning that you can invest as little money as you want when it comes to buying a share, even if the amount is less than the price of the stock.

For example, if you want to invest in Apple stock and the price of one share is $160, with fractional trading you can invest even less than this amount if you wish to, giving you greater flexibility and access when it comes to investing.

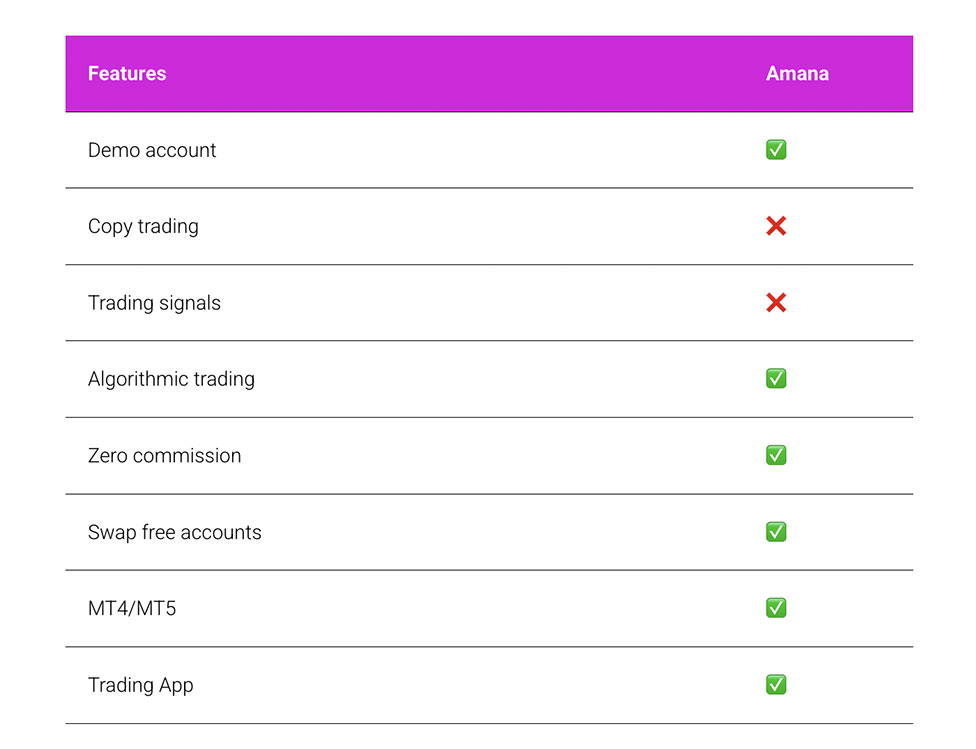

Amanainvest: Amanainvest is an automated wealth-building product designed for traders of all experience levels. It lets clients invest in line with their financial goals and risk preferences, promoting a ‘set it and forget it’ model. It offers zero management or subscription fees and allows clients to build their wealth without complexity. amanainvest provides options tailored to any investment strategy, including:

- Pre-built plans with curated portfolios organized by asset class or risk level.

- Customizable plans that allow investors to modify existing plans to align with personal financial goals.

- Build-Your-Own plans enabling users to create a unique portfolio with up to 20 assets, including stocks, ETFs, and crypto.

amana Commissions, Spreads and Fees

Spreads on leveraged products on amana start from 1.4 pips for EUR/USD, 1.9 pips for GBP/USD, and 1.5 pips for cash indices such as the FTSE 100, which are a little higher than the industry average.

amana charges zero commission on forex, however futures, indices, metals and commodities come with a $10 fee per lot. For US shares, amana charges a $0.02 commission per share.

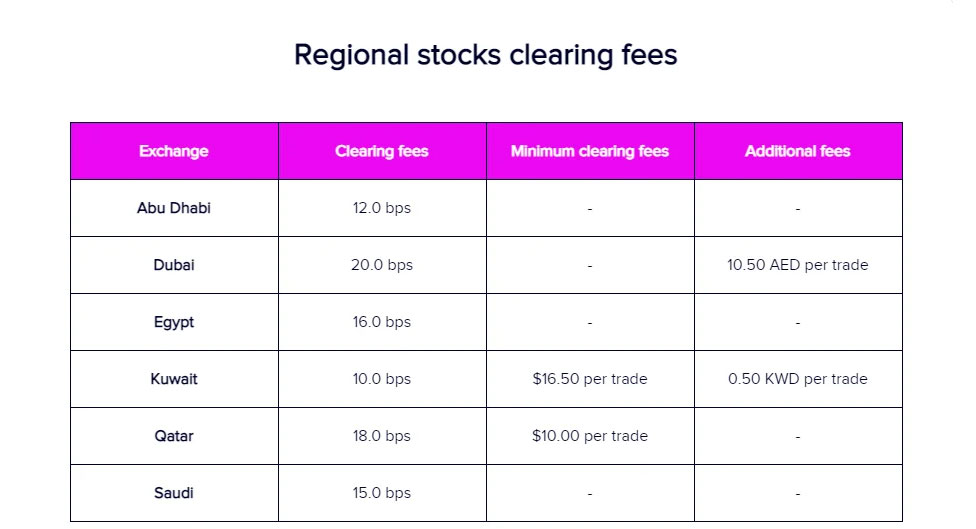

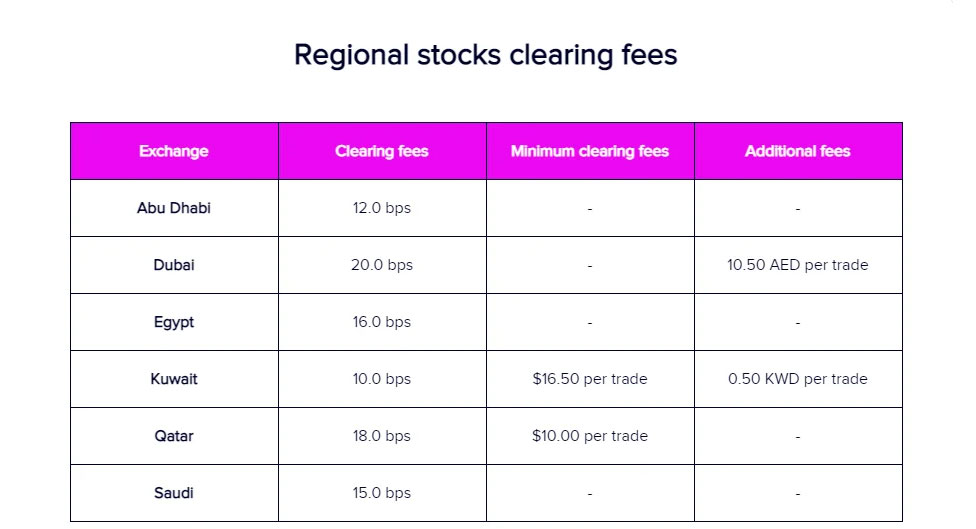

For local MENA stock investing, there are clearing fees and additional fees in some cases. These costs are outlined below. However it is known than amana does not profit from these trades, since 100% of amana’s cost is transferred to the investor without making any markup.

Amana only charges overnight swap fees on some of its leveraged products, including forex CFDs, stock CFDs, ETF CFDs, regional stock CFDs, international stock CFDs and crypto CFDs.

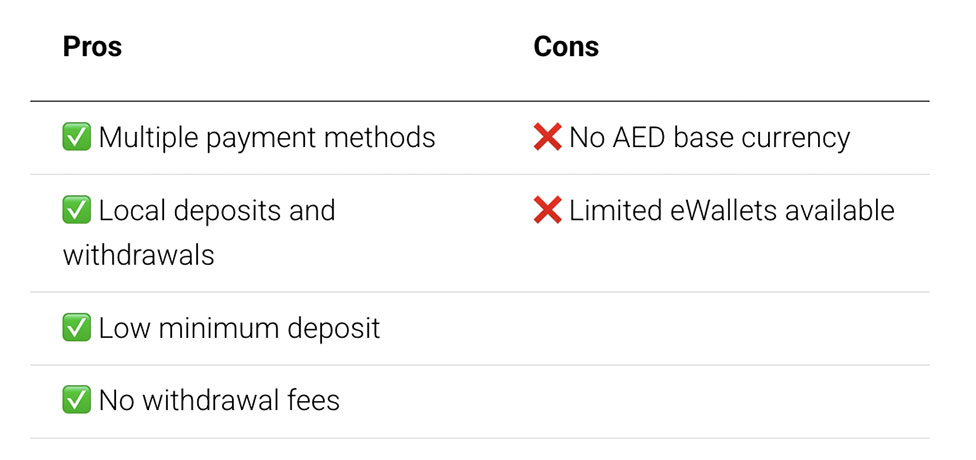

There are also no deposit fees, withdrawal fees or inactivity fees when trading with amana in the UAE.

Amana Deposits & Withdrawals

Deposits

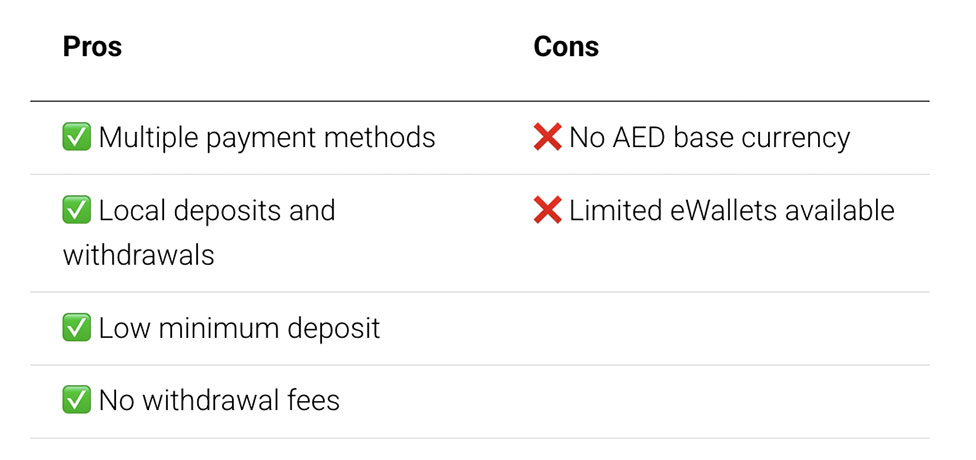

The amana app allows traders in the UAE to deposit via the following methods.

- Credit/Debit card

- Amana Prepaid Card

- Apple Pay

- UAE instant banking

- Wire transfer

- Whish Money (Lebanon)

- Neteller

- Skrill

- Digital currencies

The minimum deposit amount with amana is $50, which is a good amount if you’re looking to make money when trading in the UAE.

Amana offers only USD as an account base currency. If you deposit your funds in AED, this will be converted at a fixed exchange rate of 3.68 for incoming and outgoing funds.

Withdrawals

Options for withdrawal on amana are the same as those mentioned above for deposits. amana does not impose fees on deposits or withdrawals, however some methods may incur fees from the payment provider.

Amana states that they only process withdrawal and deposit requests Monday to Friday, so requests over the weekend can’t be processed until working hours.

Amana Trading Platforms

Amana App Review

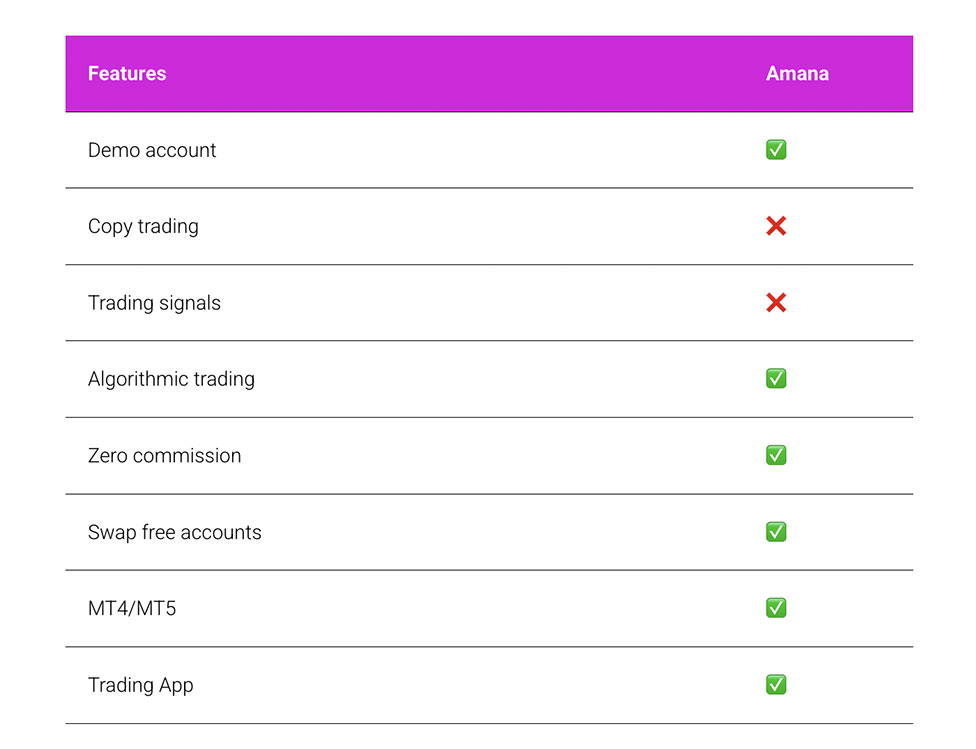

Amana provides its own “all in one” trading platform with access to 1000+ financial instruments across forex, CFDs and physical stocks. The platform is only available via mobile application on Apple and Android devices.

The amana app allows you to deposit, withdraw, trade, analyze and learn – all available inside the platform. The app layout offers a sleek design and a user-friendly experience with personalized watch lists, news, notifications and more.

MT4 and MT5

While amana heavily promotes its app, this broker still offers the classic MetaTrader 4 and MetaTrader 5 accounts for its UAE clients. MT4 and MT5 are two of the most popular platforms used by traders globally. amana’s MetaTrader 4 and MetaTrader 5 platforms offer clients a range of order types, technical analysis tools and automated trading options, great for experienced traders.

Clients in the UAE can trade forex, crypto, MENA and global shares, commodities and more. However, the amana app still offers a wider range of assets to trade compared to MT4 and MT5.

Amana Account Types

From our amana review, we find that they take a much different approach when it comes to account types, compared to other brokers. While other online trading brokers offer multiple account types with different spreads, instruments and features, amana offers everyone the default standard account when they sign up either via the app or MT4/MT5.

But you should note that the amana app and amana’s MT4/MT5 accounts are two different things, if you want to trade on both, you’ll need to create a separate account for each with a different email address.

Amana Research & Education

Amana recently upgraded its suite of educational and research materials to assist and educate its clients on the financial markets. Overall, we rate amana highly when it comes to educating clients, with extremely high quality resources to learn from.

Amana Blog

The amana blog page features a collection of 100+ articles on how to trade, different asset classes, risk management, amongst other useful trading tips and tricks.

Amana Videos

These are amana’s short but engaging and helpful videos for traders that prefer to learn visually. You’ll find different categories of topics, including Trading Basics, Stocks, Forex, Cryptocurrencies, Fundamental Analysis, Technical Analysis, Trading Skills and How To Trade With amana, with multiple videos for each topic.

Real Vision

This is amana’s partnership with the financial media and educational platform, Real Vision. It offers amana’s clients access to advanced trading and investing insights and financial literacy courses that would otherwise need to be bought to access. While you can find a small taster of videos from Real Vision on the amana website, the full access can only be unlocked by clients that have signed up to the amana app, deposited $1000 and placed their first trade.

Amana Regulation

From our research, we find that amana is a safe and secure broker, with a solid reputation in the UAE. amana complies with strict regulatory requirements, with its operations overseen by several tier one regulators, including DFSA (Dubai), FCA (UK), CySEC (Cyprus), LFSA (Malaysia) and FSC (Mauritius).

For UAE clients, amana is locally regulated in the region by the DFSA, with its local office headquarters also located in Dubai. Overall, amana is considered a highly safe and reliable broker to trade with.

Amana Customer Support

We were impressed with amana’s client support, with a range of methods to get in touch with the support team, including email (support@amana.app), live chat via the amana website, and a local phone number in the UAE (+971 4 276 9525). You can find amana’s local Dubai office located in DIFC.

When testing amana’s support and service, we found it to be fast, professional and helpful. On live chat, their assistance helped fix some issues experienced with the signup and login process with an average response time of 2 minutes.

However, amana does not offer 24/7 support. They are available 24/5 Monday-Friday, putting them at a disadvantage compared to brokers offering around the clock support.

Amana: The Bottom Line

In summary, amana has grown as one of the UAE’s most well known local brokers. They are not only a good choice for CFD traders but also for clients looking to invest in local MENA stocks, including the largest UAE, Qatai, Saudi, Kuwaiti and Egyptian shares.

We picked up on amana’s above average education and highly intuitive app, making investing easy even for beginner traders. However, professional traders may wish to stick to amana’s MT4/MT5 offering, with more advanced settings and analytical features.

Still, amana’s pricing isn’t the most competitive, and while this broker appeals to younger investors, we don’t recommend it as the number one choice for institutional/ professional clients.

Overall, from this amana trading review, they are an excellent local broker that is our number one for local MENA stock investing.

Still looking for the best forex brokers in UAE? Find the right one for you with Chooseabroker.ae.

Written by Sam Reid

Written by Sam Reid Fact checked by Freddie Ricks

Fact checked by Freddie Ricks Last updated 1 day ago

Last updated 1 day ago