How to Choose the Right Online Trading Broker: Green Flags for UAE Traders

Sam Reid Staff Writer

Sam Reid Staff Writer

Trading in the UAE has gained significant popularity in recent years, attracting a diverse community of traders looking to capitalize on global financial markets. Whether you’re a seasoned trader or just starting your journey, selecting the right online trading broker is paramount to your success.

To help you make an informed choice, it’s essential to recognize the green flags that set reputable brokers apart. These green flags indicate trustworthiness, reliability, and a commitment to UAE traders’ success. Here’s a guide tailored to UAE traders on what to look for:

1. Regulatory Compliance

Regulation should be your top priority when considering an online trading broker in the UAE. Reputable brokers operating in the region are licensed and regulated by respected financial authorities such as the UAE’s Securities and Commodities Authority (SCA) or the Dubai Financial Services Authority (DFSA). This regulatory oversight ensures that brokers adhere to stringent standards, safeguarding your investments and ensuring fair trading practices.

2. Asset Diversity

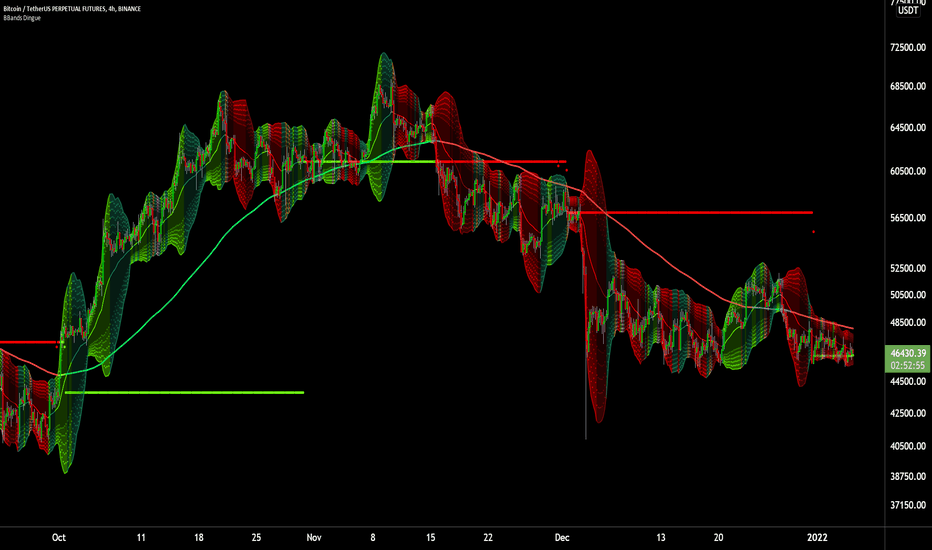

Successful trading often involves diversifying your portfolio across various asset classes. Green flags include brokers that offer a wide range of trading instruments, including forex, stocks, commodities, cryptocurrencies, and indices. This diversity allows you to explore different markets and seize opportunities as they arise.

3. User-Friendly Trading Platforms

A user-friendly trading platform is essential, especially if you’re new to trading. Look for brokers that offer intuitive platforms equipped with advanced charting tools, technical indicators, and a seamless mobile trading experience. The ability to execute trades swiftly is crucial in the fast-paced world of online trading.

4. Transparent Fee Structure

A trustworthy broker is transparent about its fee structure. Green flags here include brokers with clear information about spreads, commissions, and overnight financing rates. Hidden fees can erode your profits, so choose a broker that prioritizes transparency.

5. Excellent Customer Support

In the world of trading, timing is everything. Reliable customer support is a significant green flag. Look for brokers offering 24/5 or 24/7 customer support to address your concerns promptly. Furthermore, multilingual support can be invaluable for UAE traders from diverse backgrounds.

6. Educational Resources

Continuous learning is key to successful trading. Go for a broker that provides a wealth of educational resources, including webinars, tutorials, market analysis, and a demo account. These resources empower you to enhance your trading skills and make informed decisions. eToro and AvaTrade are great examples.

7. Competitive Spreads and Leverage

Low spreads and reasonable leverage ratios are green flags for cost-conscious UAE traders. Competitive trading conditions can significantly impact your profitability, so compare brokers in terms of these factors.

8. Positive Reputation and Reviews

Before making your final decision, research a broker’s reputation and read reviews from fellow UAE traders. Reputable brokers will have a track record of satisfied clients and a positive online presence.

9. Security Measures

The safety of your funds and personal information should never be compromised. Ensure the broker employs robust security measures such as encryption and segregated client accounts.

10. Customized UAE Trading Experience

Finally, consider brokers that cater specifically to UAE traders. These brokers understand the local market dynamics, which can be a significant advantage.

In conclusion, trading in the UAE offers tremendous opportunities, but selecting the right broker is crucial. By keeping an eye out for these green flags, you can navigate the online trading landscape with confidence and increase your chances of success in the dynamic world of trading in the UAE.

05th Oct 2023

05th Oct 2023