"The stock market is a device for transferring money from the impatient to the patient." – Warren Buffett.

But what if you could skip the steep learning curve and start leveraging the patience, knowledge, and strategies of seasoned traders? That’s where copy trading for beginners comes in—a game-changer for anyone looking to dip their toes into financial markets without feeling overwhelmed.

Copy trading is shaking up the investment world by making it easy to replicate the success of experienced traders. Imagine shadowing a professional investor while sipping your morning coffee, all without spending years mastering the markets. Sounds enticing, doesn’t it? Let’s dive in and explore how you can start using this powerful tool to build your portfolio.

But what if you could skip the steep learning curve and start leveraging the patience, knowledge, and strategies of seasoned traders? That’s where copy trading for beginners comes in—a game-changer for anyone looking to dip their toes into financial markets without feeling overwhelmed.

Copy trading is shaking up the investment world by making it easy to replicate the success of experienced traders. Imagine shadowing a professional investor while sipping your morning coffee, all without spending years mastering the markets. Sounds enticing, doesn’t it? Let’s dive in and explore how you can start using this powerful tool to build your portfolio.

What Is Copy Trading?

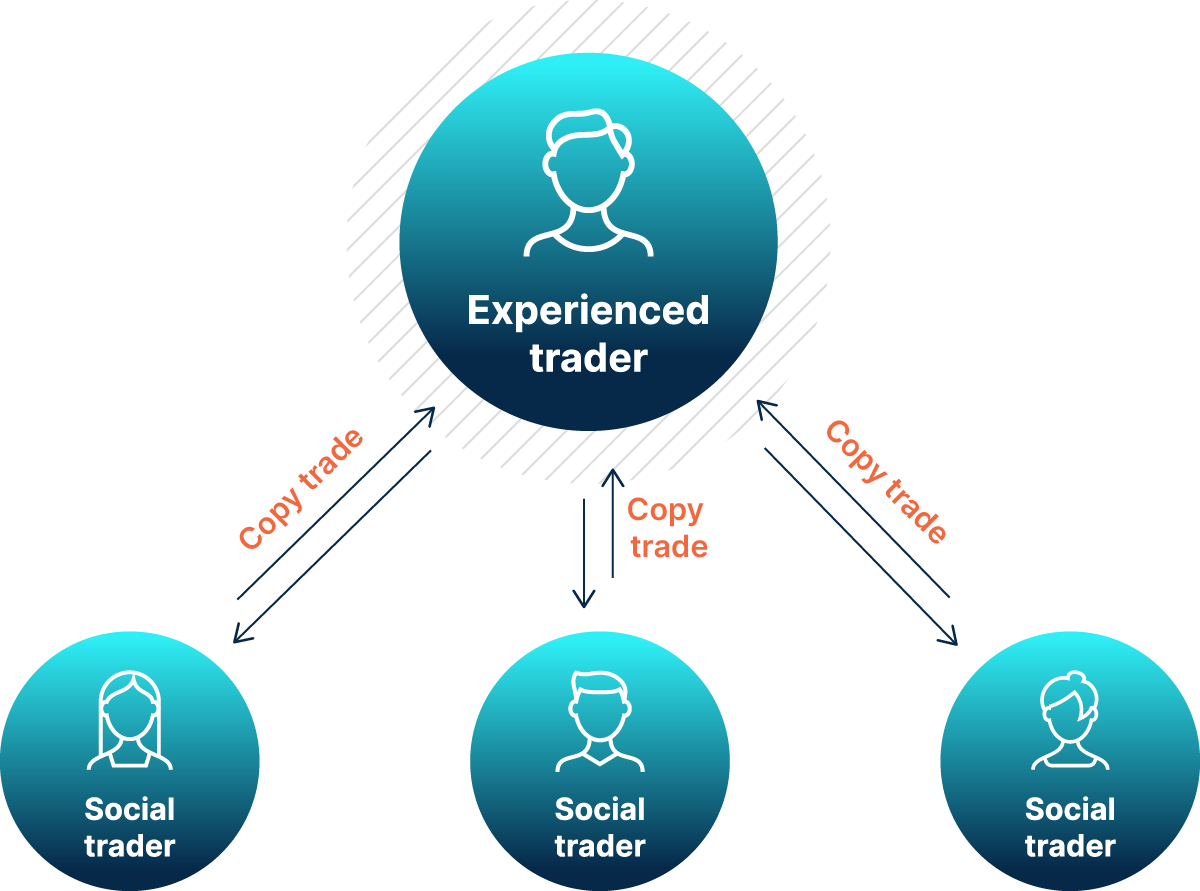

Copy trading is an innovative way to invest, enabling you to replicate the trades of seasoned professionals. It’s a system that allows your portfolio to mirror the positions of another trader in real-time, whether they’re trading forex, stocks, or cryptocurrencies.

For instance, let’s say a top trader opens a position in a CFD on Bitcoin. If you’re copying them, your account will automatically do the same. You can sit back and watch as their expertise works for you. But remember, it’s not a guaranteed money-maker. Like any investment strategy, it comes with risks.

Can copy trading make you rich? Not overnight. But it’s a great way to start learning and building wealth if you’re patient and strategic.

Can copy trading make you rich? Not overnight. But it’s a great way to start learning and building wealth if you’re patient and strategic.

How Does Copy Trading Work?

Here’s how it works in a nutshell:

Still unsure which broker to choose? Check out our trading broker comparison page!

- Choose a Broker: Platforms like Avatrade, XM, and Exness offer user-friendly tools to help beginners get started.

- Open an Account: Sign up, verify your identity, and deposit funds.

- Select a Trader: Browse detailed profiles, including performance stats, risk levels, and trading strategies.

- Allocate Funds: Decide how much of your capital to copy with. Diversification is key!

- Start Trading: Once set up, trades are automatically mirrored in your account.

- Monitor and Adjust: Regularly review your copied traders’ performance to ensure it aligns with your goals.

Still unsure which broker to choose? Check out our trading broker comparison page!

Why Is Copy Trading Good for Beginners?

For those new to investing, copy trading for beginners offers several benefits:

Ease of Use: You don’t need to analyze charts or track market trends. Simply follow an expert.

Learning Opportunity: Watch how successful traders make decisions and refine your skills over time.

Low Entry Barriers: Some platforms let you start with as little as $1!

Diverse Options: Trade forex, crypto, stocks, and more with platforms like XM or Avatrade.

Ease of Use: You don’t need to analyze charts or track market trends. Simply follow an expert.

Learning Opportunity: Watch how successful traders make decisions and refine your skills over time.

Low Entry Barriers: Some platforms let you start with as little as $1!

Diverse Options: Trade forex, crypto, stocks, and more with platforms like XM or Avatrade.

Example of Copy Trading

Imagine you’re a novice investor wanting to trade US stocks but lack the know-how. By copying a seasoned trader specializing in US markets, you can replicate their trades and benefit from their expertise. It’s that simple.

Best Copy Trading Platforms

Choosing the right platform is crucial. Here are some of the best copy trading platforms that cater to beginners and pros alike:

Avatrade: Offers a seamless experience with transparent fees and strong regulatory backing.

Check out our AvaTrade review

XM: Known for its free MT4 copy trading tools and excellent customer support.

Check out our XM review

Exness: A user-friendly platform with low minimum deposits and advanced analytics.

Check out our Exness review

These platforms provide demo accounts, enabling you to practice copy trading for free before committing real money.

Avatrade: Offers a seamless experience with transparent fees and strong regulatory backing.

Check out our AvaTrade review

XM: Known for its free MT4 copy trading tools and excellent customer support.

Check out our XM review

Exness: A user-friendly platform with low minimum deposits and advanced analytics.

Check out our Exness review

These platforms provide demo accounts, enabling you to practice copy trading for free before committing real money.

How Much Money Do You Need to Start Copy Trading?

One of the best things about copy trading is its accessibility. Many brokers require just a small deposit to get started:

XM: Minimum deposit as low as $5.

Avatrade: Minimum deposits typically start at $100, but promotions may lower this.

Exness: Some accounts allow you to start trading with as little as $1.

But keep in mind, while you can start small, allocating more funds to multiple traders can help diversify risk.

XM: Minimum deposit as low as $5.

Avatrade: Minimum deposits typically start at $100, but promotions may lower this.

Exness: Some accounts allow you to start trading with as little as $1.

But keep in mind, while you can start small, allocating more funds to multiple traders can help diversify risk.

Can Copy Trading Make You $1,000 a Day?

In theory, yes. But in practice, it’s unlikely for beginners. High returns often come with high risks. To make consistent gains, focus on:

- Diversifying your portfolio.

- Choosing traders with steady, long-term results.

- Avoiding over-leveraged, high-risk strategies.

Tips for Becoming a Successful Copy Trader

- Research Traders Thoroughly: Evaluate their performance, risk levels, and strategies.

- Diversify Your Portfolio: Follow multiple traders to spread risk.

- Monitor Regularly: Even the best traders can have bad days. Stay engaged.

- Start with a Demo Account: Practice risk-free on platforms offering free MT4 copy trading before using real money.

- Align Strategies with Your Goals: Ensure the traders you copy match your risk tolerance and objectives.

FAQs About Copy Trading

Is Copy Trading Good for Beginners?

Yes, it’s ideal for those new to investing. Platforms like Avatrade and XM simplify the process, allowing you to replicate trades while learning.

How Do I Start Copy Trading for Beginners?

How Much Money Do You Need to Start Copy Trading?

You can start with as little as $1 on some platforms, though $100–$200 is recommended for better diversification.

What is an Example of Copy Trading?

Replicating trades of a successful crypto trader specializing in Bitcoin or Ethereum is a common example.

Can I Start Trading with Just $1?

Yes, brokers like Exness allow you to start small, but you may want to allocate more for meaningful returns.

Can I Make $1,000 a Day Trading?

While possible, it’s rare for beginners. Focus on steady, long-term growth instead.

Yes, it’s ideal for those new to investing. Platforms like Avatrade and XM simplify the process, allowing you to replicate trades while learning.

How Do I Start Copy Trading for Beginners?

- Choose a broker (e.g., Exness or Avatrade).

- Open an account and deposit funds.

- Select traders to copy.

- Allocate funds and begin trading.

How Much Money Do You Need to Start Copy Trading?

You can start with as little as $1 on some platforms, though $100–$200 is recommended for better diversification.

What is an Example of Copy Trading?

Replicating trades of a successful crypto trader specializing in Bitcoin or Ethereum is a common example.

Can I Start Trading with Just $1?

Yes, brokers like Exness allow you to start small, but you may want to allocate more for meaningful returns.

Can I Make $1,000 a Day Trading?

While possible, it’s rare for beginners. Focus on steady, long-term growth instead.