If you’ve ever thought about diving into the financial markets, the idea of getting rich through forex trading might have crossed your mind. Given the tales of traders achieving incredible returns, it's understandable why this is such a frequent query. So, can forex trading make you rich? The brief answer is yes—but certainly, it’s not simple, and it’s not for everyone.

Foreign exchange trading (short for FX trading) can be lucrative but also offers great challenges. In this blog, we'll demystify the risks, the pros, the cons, and the facts of forex trading so you can handle it in a principled and pragmatic way, with sensible expectations.

Foreign exchange trading (short for FX trading) can be lucrative but also offers great challenges. In this blog, we'll demystify the risks, the pros, the cons, and the facts of forex trading so you can handle it in a principled and pragmatic way, with sensible expectations.

Key Takeaways

- It’s not a get-rich-quick scheme: Success in forex trading entails time, dedication, learning and discipline.

- High risks: Levitating, volatility and deregulation are all riskier parts of forex trading, not just for the experienced, but especially for those with little or no forex trading experience.

- Success is possible: With a solid trading plan, proper risk management, and consistent practice, forex trading can be profitable over time.

- High risks: Levitating, volatility and deregulation are all riskier parts of forex trading, not just for the experienced, but especially for those with little or no forex trading experience.

- Success is possible: With a solid trading plan, proper risk management, and consistent practice, forex trading can be profitable over time.

The Challenges of Forex Trading

1. All Forex Traders Lose Money at Some Point

Let’s get this out of the way—every forex trader loses money at some point. Even experienced traders encounter losses. The solution is to reduce, as much as possible, those losses and somehow learn from them. If you’re someone who hates losing or can’t handle risk, forex trading might not be for you.

2. Forex Trading Is Not for Everyone

Forex trading is a bad idea if:

- You’re unemployed or financially unstable.

- You’re knee-deep in debt.

- You can’t afford to lose your investment.

Successful traders never risk money that they are not able to afford to lose. If you’re struggling to make ends meet, focus on stabilizing your finances first.

- You’re unemployed or financially unstable.

- You’re knee-deep in debt.

- You can’t afford to lose your investment.

Successful traders never risk money that they are not able to afford to lose. If you’re struggling to make ends meet, focus on stabilizing your finances first.

3. Forex Trading Is NOT a Get-Rich-Quick Scheme

Too many people enter forex trading with a false sense of what it really is and aim for instant riches. In fact, it is the process of time and constant effort that leads to the outcome. The forex market is a very cutthroat market, and success rates claimed to be as low as 5–10%.

Common Mistakes That Can Derail Your Success

Mistake 1: Not Knowing if Forex Trading is For You

Forex isn’t for everyone. It requires a journey of learning, frustration and improvement to work towards financial autonomy. In the famous words, trading is the hardest way to make easy money. Remember, never trade using borrowed money, or money that you can not afford to lose.

Mistake 2: Unrealistic Goals

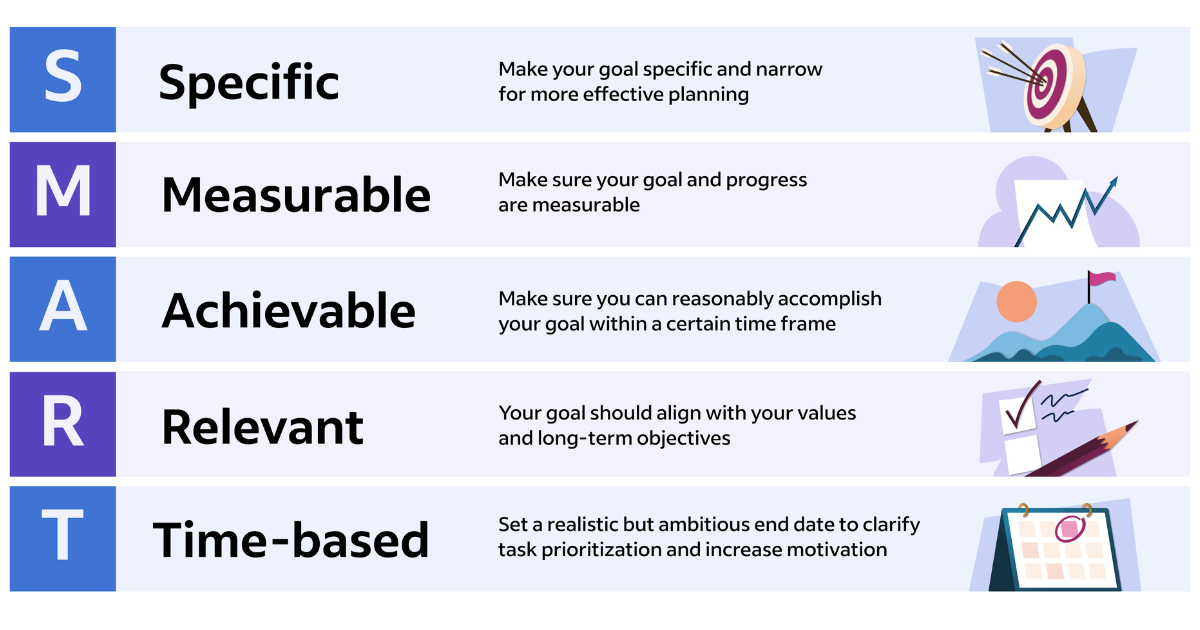

Saving $50 and aiming to turn into a millionaire is not realistic. Rather than strive to become a millionaire, strive for a sustainable profit. Use the SMART method to set Specific, Measurable, Attainable, Relevant, and Timely goals.

Mistake 3: Getting Into Forex With No Education

Forex trading is a skill and as with any skill, it takes time to master. Acquire high-quality teaching tools and do practice on a demo account before using in live trading. Technical and fundamental analysis is a must for making sound decisions.

Mistake 4: Trading Without a Plan

A trading strategy (entry and exit rules) isn’t enough. You need a comprehensive plan that includes:

Stick to your plan to avoid impulsive, emotion-driven decisions.

- Risk management rules.

- Your financial goals.

- Strategies for managing profits and losses.

Stick to your plan to avoid impulsive, emotion-driven decisions.

Mistake 5: Massive Leverage

Leverage is one of the two faces of the same coin. Leverage can grow potential returns but also losses. Many traders over-leverage, leading to significant financial setbacks. Leverage should not be used recklessly and only when you have a perfect comprehension of the risks.

Mistake 6: Poor Risk and Money Management

Risking big amounts in a single trade can result in wiping your entire account, that's if you don't have proper risk management in place. Employ smarter risk management with stop-loss orders, risk/reward ratios, and not risking more than 1% of your capital on a trade. You'll thank us in the long term.

Mistake 7: Not Cutting Losses

Holding on to losing positions (or buying more into losers) often results in increased losses (i.e., compounding). Instead, accept the loss, but always use stop-loss orders to minimize your downside and protect your capital.

Mistake 8: Choosing the Wrong Broker

It’s possible to lose money working with a low-quality, unregulated broker. Conduct research thoroughly and identify a credible, regulated broker with solid regulation, competitive conditions and expert education. At Chooseabroker.ae, helping you find the UAE’s best brokers is exactly what we’re here for.

Is Forex Trading Profitable?

Not only is forex trading a potentially profitable endeavor, but it is a game of patience. Concentrate on developing your skills, making a sound plan, and becoming a disciplined trader to consistently perform well over the long term.

Is Forex High Risk?

Absolutely. The volatility and leveraged nature of the forex market make it one of the most potentially dangerous trading markets when it comes to your capital. Nonetheless, with the right level of training and risk management, you can effectively manage this risk.

Can Forex Trading Be a Career?

Forex trading can become your professional, full-time career if the right mental attitude and strategy is adopted. However, this takes a lot of time, money, and work to get to that kind of consistency and profit.

FAQs About Forex Trading

Can forex trading make you rich?

Yes, but only with the right training, the right behavior, and the right risk management. It’s not a quick or guaranteed path to wealth.

How does forex trading work?

Forex trading involves buying one currency while selling another. Traders speculate on price movements to make profits.

When is the forex market open?

The forex market is 24/5, extending from Asia to Europe to North America.

Which forex broker is the best?

The best broker depends on your needs. Find regulated brokers with low spreads, strong platforms and good customer service. For more info on the top forex broker, check out our guide here.

Is forex trading better than stock trading?

It depends on your goals. Forex instruments provide greater leverage and liquidity, but are more risky than the investment in stock instruments.

Yes, but only with the right training, the right behavior, and the right risk management. It’s not a quick or guaranteed path to wealth.

How does forex trading work?

Forex trading involves buying one currency while selling another. Traders speculate on price movements to make profits.

When is the forex market open?

The forex market is 24/5, extending from Asia to Europe to North America.

Which forex broker is the best?

The best broker depends on your needs. Find regulated brokers with low spreads, strong platforms and good customer service. For more info on the top forex broker, check out our guide here.

Is forex trading better than stock trading?

It depends on your goals. Forex instruments provide greater leverage and liquidity, but are more risky than the investment in stock instruments.

The Bottom Line

There are opportunities to earn money in forex trading, but forex trading is not for everybody. Approach it with realistic expectations, invest in your education, and focus on building skills over time. With patience and effort, you can achieve consistent profits and possibly build wealth—but remember, there are no shortcuts to success.