When you go on holiday and exchange money for the local currency, you’ve participated in the foreign exchange market, or forex for short.

But, forex trading isn’t only for travel buffs. Forex trading is a worldwide currency market where any regular trader or investor is able to trade currencies and make profit when the exchange rates between currencies fluctuate.

So, how can you start forex trading? Let's break it down step by step.

But, forex trading isn’t only for travel buffs. Forex trading is a worldwide currency market where any regular trader or investor is able to trade currencies and make profit when the exchange rates between currencies fluctuate.

So, how can you start forex trading? Let's break it down step by step.

Understanding Forex Trading

Before getting into any details, it’s important to know what Forex trading is. Forex is the biggest financial market on the globe with average daily trading volume exceeding $6 trillion. In contrast to stock market trading, forex trading is a decentralized market trading across the world 24 hours a day, 5 days a week on the major financial capitals.

Traders, when buying and selling currency pairs (e.g. EUR/USD) have an economic goal of deriving profit from the following changes in exchange rates.

Traders, when buying and selling currency pairs (e.g. EUR/USD) have an economic goal of deriving profit from the following changes in exchange rates.

The Basics of Currency Pairs

In forex trading, currencies are always traded in pairs. The currency in the base on one side of the pair is called the base currency, and the currency in the quote on the other side of the pair is called the quote currency.

An exchange rate defines the number of units of the quote currency that are needed to purchase one unit of the base currency. There are 3 main types of currency pairs:

Knowing these types of pairs is important for traders as each pair holds different characteristics in terms of volatility and liquidity.

An exchange rate defines the number of units of the quote currency that are needed to purchase one unit of the base currency. There are 3 main types of currency pairs:

- Major Pairs: Involves the most widely traded currency pairs, i.e. EUR/USD, GBP/USD, and USD/JPY.

- Minor Pairs: These include currency pairs without USD, like EUR/GBP or AUD/JPY.

- Exotic Pairs: A pair with one key currency and one key currency from an emerging market, e.g., USD/TRY.

Knowing these types of pairs is important for traders as each pair holds different characteristics in terms of volatility and liquidity.

How to get Started Trading Forex

1. Educate Yourself

Knowledge is power, and even more so in forex trading. If you want to get started as a serious forex trader, you’ll need to gain a deeper understanding of trading and the financial markets as a whole. Here are some tips on where to focus your learning:

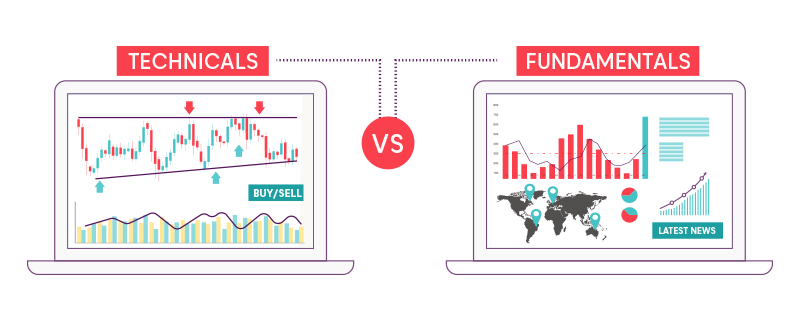

Technical Analysis: The analysis of charts and indicators to indicate future price behavior.

Fundamental Analysis: Using economic data and news reports to forecast future price movements in currencies.

Knowledge is power, and even more so in forex trading. If you want to get started as a serious forex trader, you’ll need to gain a deeper understanding of trading and the financial markets as a whole. Here are some tips on where to focus your learning:

- Market terminology: Understand terms like pips, lots, leverage (and), and margin.

- Types of Analysis: Learn the different types of analysis, including:

Technical Analysis: The analysis of charts and indicators to indicate future price behavior.

Fundamental Analysis: Using economic data and news reports to forecast future price movements in currencies.

2. Learn Important Trading Concepts

Study advanced trading concept such as:

Risk Management: Learn the rules of how to set stop-loss orders and take -profit orders, as well as how to size positions appropriately to preserve your capital.

Trading Psychology: Emotions will play a significant role in your decision making as a trader. Practice staying disciplined and how to prevent common psychological pitfalls, such as greed and fear.

Economic Indicators: Understand the impact of interest rates, employment data, and geopolitical events on currency value.

Remember, the more you learn, the more capable you’ll become to make smarter trading decisions.

Study advanced trading concept such as:

Risk Management: Learn the rules of how to set stop-loss orders and take -profit orders, as well as how to size positions appropriately to preserve your capital.

Trading Psychology: Emotions will play a significant role in your decision making as a trader. Practice staying disciplined and how to prevent common psychological pitfalls, such as greed and fear.

Economic Indicators: Understand the impact of interest rates, employment data, and geopolitical events on currency value.

Remember, the more you learn, the more capable you’ll become to make smarter trading decisions.

3. Practice on Demo

You don’t need to jump straight into a live account. You can get started as a forex trader on a demo account, offered by all leading forex brokers. Put your learning into practice with demo accounts without losing any real money.

This can also give you a valuable opportunity to back test, where you observe how your trading strategies perform under various historical conditions.

You don’t need to jump straight into a live account. You can get started as a forex trader on a demo account, offered by all leading forex brokers. Put your learning into practice with demo accounts without losing any real money.

This can also give you a valuable opportunity to back test, where you observe how your trading strategies perform under various historical conditions.

4. Choose the Right Forex Trading Broker

Your broker is your entry point into the forex world. So naturally, selecting the right one is extremely important. Here's what to consider:

Regulation and Trustworthiness

Your broker should be regulated and supervised by notable financial regulatory bodies, such as

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC)

-Cyprus Securities and Exchange Commission (CySEC)

-Dubai Financial Services Authority (DFSA)

-Securities and Commodities Authority (SCA)

Regulation safeguards you from fraud and assures that the broker’s conditions and activities are legal, fair, and trustworthy.

Trading Platforms and Tools

A comfortable-to-use and simple trading platform with sophisticated features can improve your trading on so many levels. Remember, the platforms you can access will depend entirely on the broker you choose and what they offer, so try to factor this in when selecting a broker. So, what exactly should you look out for in a trading platform?

- Real-Time Charts: A visual of market movements with multiple timeframes and features.

- Technical Indicators: Tools for price trend analysis, e.g. moving averages and oscillators.

- Automated Trading: The possibility of using Expert Advisors (EAs) for automated strategies.

AvaTrade: Our Recommended Broker

When it comes to comparing brokers, AvaTrade is great for several reasons:

- Regulation: AvaTrade is authorised by a number of jurisdictions, including the Central Bank of Ireland and ASIC, so your trading is protected in a very safe environment.

- Variety of Platforms: It offers a variety of platforms such as MetaTrader 4 and its proprietary AvaTradeGO, suitable for both beginners in trade and professional ones.

- Educational Resources: A whole lot of learning resources are available, such as webinars, tutorials and eBooks.

- Customer Support: It offers multi-language support 24/7 to help you with any questions you may have.

- Competitive Spreads: It has transparent fee structures that offer competitive spreads to maximize your profitability.

By selecting a good broker like AvaTrade, you're laying a firm foundation on which to build your trading.

Your broker is your entry point into the forex world. So naturally, selecting the right one is extremely important. Here's what to consider:

Regulation and Trustworthiness

Your broker should be regulated and supervised by notable financial regulatory bodies, such as

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC)

-Cyprus Securities and Exchange Commission (CySEC)

-Dubai Financial Services Authority (DFSA)

-Securities and Commodities Authority (SCA)

Regulation safeguards you from fraud and assures that the broker’s conditions and activities are legal, fair, and trustworthy.

Trading Platforms and Tools

A comfortable-to-use and simple trading platform with sophisticated features can improve your trading on so many levels. Remember, the platforms you can access will depend entirely on the broker you choose and what they offer, so try to factor this in when selecting a broker. So, what exactly should you look out for in a trading platform?

- Real-Time Charts: A visual of market movements with multiple timeframes and features.

- Technical Indicators: Tools for price trend analysis, e.g. moving averages and oscillators.

- Automated Trading: The possibility of using Expert Advisors (EAs) for automated strategies.

AvaTrade: Our Recommended Broker

When it comes to comparing brokers, AvaTrade is great for several reasons:

- Regulation: AvaTrade is authorised by a number of jurisdictions, including the Central Bank of Ireland and ASIC, so your trading is protected in a very safe environment.

- Variety of Platforms: It offers a variety of platforms such as MetaTrader 4 and its proprietary AvaTradeGO, suitable for both beginners in trade and professional ones.

- Educational Resources: A whole lot of learning resources are available, such as webinars, tutorials and eBooks.

- Customer Support: It offers multi-language support 24/7 to help you with any questions you may have.

- Competitive Spreads: It has transparent fee structures that offer competitive spreads to maximize your profitability.

By selecting a good broker like AvaTrade, you're laying a firm foundation on which to build your trading.

5. Open a Trading Account

Opening an account after selecting your broker is relatively easy:.

1. Registration: Register yourself online by providing your personal information.

2. Verification: Identify and include appropriate documentation, such as proof of identity and proof of current address, for compliance reasons.

3. Deposit Funds: Deposit your own initial capital via credit/debit card, bank wire, or e-wallets.

Opening an account after selecting your broker is relatively easy:.

1. Registration: Register yourself online by providing your personal information.

2. Verification: Identify and include appropriate documentation, such as proof of identity and proof of current address, for compliance reasons.

3. Deposit Funds: Deposit your own initial capital via credit/debit card, bank wire, or e-wallets.

6. Plan Your First Forex Trade

A well-thought-out plan is your road map to success as a forex trader. It should include:

• Trading Goals: Lay down what you intend to achieve, whether it be regular monthly returns or long-term capital growth.

• Risk Management: Determine the maximum amount of risk you are willing to put on each trade - a rough guideline is no more than 1-2% of one's trading capital.

- Strategy for Trading: Define entry and exit parameters including your preferred time frames and indicators to be used.

- Record Keeping: Keep a trading journal to track performance - note the reason for each trade, and the result.

Of course, it’s also important to remember that in the forex market, a consistent and disciplined approach is required. An effective plan keeps you on track and reduces impulse decisions.

A well-thought-out plan is your road map to success as a forex trader. It should include:

• Trading Goals: Lay down what you intend to achieve, whether it be regular monthly returns or long-term capital growth.

• Risk Management: Determine the maximum amount of risk you are willing to put on each trade - a rough guideline is no more than 1-2% of one's trading capital.

- Strategy for Trading: Define entry and exit parameters including your preferred time frames and indicators to be used.

- Record Keeping: Keep a trading journal to track performance - note the reason for each trade, and the result.

Of course, it’s also important to remember that in the forex market, a consistent and disciplined approach is required. An effective plan keeps you on track and reduces impulse decisions.

7. Start Trading Forex on a Live Trade

Converting from a demo to a real account is a huge leap. Here's how to make the process easier:

- Start Small: Put a few dollars into your first account deposit and never add an amount that you can’t afford to lose.

- Emotion Management: Real money in the forex market can quickly affect your feelings. Keep calm and composed, and never deviate from your trading strategy.

- Continuous Learning: The market is constantly moving. So, you’ll need to learn to continuously upgrade and develop your strategies accordingly.

Converting from a demo to a real account is a huge leap. Here's how to make the process easier:

- Start Small: Put a few dollars into your first account deposit and never add an amount that you can’t afford to lose.

- Emotion Management: Real money in the forex market can quickly affect your feelings. Keep calm and composed, and never deviate from your trading strategy.

- Continuous Learning: The market is constantly moving. So, you’ll need to learn to continuously upgrade and develop your strategies accordingly.

Tips for Forex Beginners

- Stay Updated: Watch out for global economic news which might be able to influence exchange rate movements. Economic calendars are useful tools for tracking important events.

- Avoid Overtrading: Quality over quantity trade with high probability but trade infrequently.

- Be Patient: Forex trading is not a get-rich-quick scheme. It requires time, dedication, and realistic expectations.

- Set Realistic Goals: Understand that losses are part of trading. Aim for consistent performance rather than perfection.

- Avoid Overtrading: Quality over quantity trade with high probability but trade infrequently.

- Be Patient: Forex trading is not a get-rich-quick scheme. It requires time, dedication, and realistic expectations.

- Set Realistic Goals: Understand that losses are part of trading. Aim for consistent performance rather than perfection.

Leverage and Margin

Understanding leverage is quite important in forex trading. In other words leverage is the tool that allows you to hold bigger positions with a small proportion of capital. Therefore, this magnifies potential gains as well as losses.

- Handle Leverage Wisely: Use a much smaller leverage ratio to control risk. High leverage can lead to significant losses if not managed properly.

- Watch Margin Levels: This can avoid margin calls from occurring, which may rapidly destroy all positions held. Make sure you have enough of a balance in your account to hold those positions.

Diversify Your Portfolio

Don't put all your eggs in one basket. Diversification may help manage risk.

- Trade Multiple Currency Pairs: By investing in different currencies, you may limit the potential damage of an adverse movement of a currency that you're investing in.

Mix Trading Styles: Using strategies extending across short-term trading-scalping and day trading-and long-term, swing and position trading-to optimally balance risks and returns.

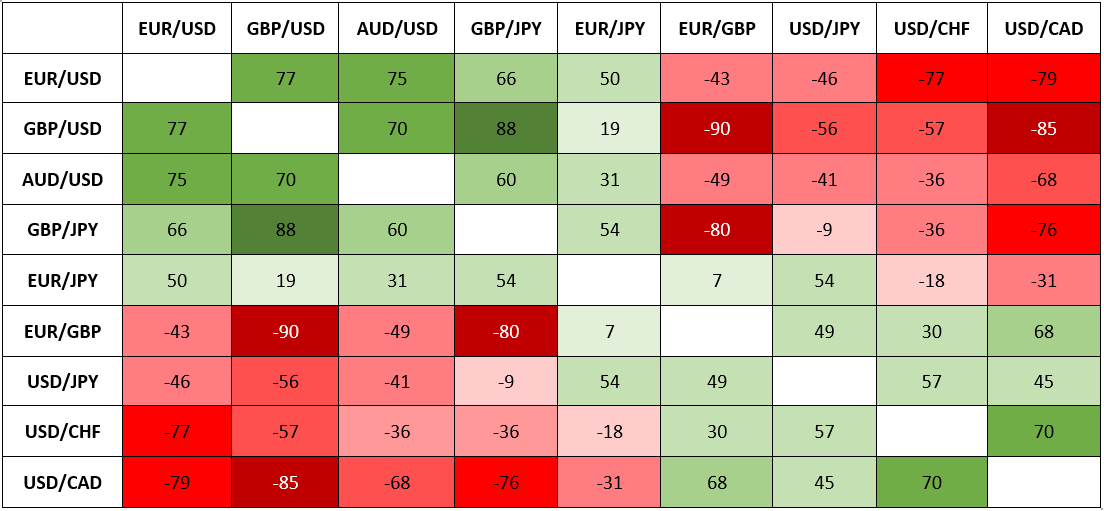

Understand Market Correlations

There is a tendency for some currency pairs to move together in, or in opposition to, other pairs because of real economic associations or commodity relations.

Positive Correlations The most common illustration is common movement of EUR/USD and GBP/USD.

Negative Correlations Pairs like USD/CHF and EUR/USD may be inversely correlated.

Identifying those relationships can be useful for the trader to take more informed decisions and not be overweighted in correlated positions.

Understanding leverage is quite important in forex trading. In other words leverage is the tool that allows you to hold bigger positions with a small proportion of capital. Therefore, this magnifies potential gains as well as losses.

- Handle Leverage Wisely: Use a much smaller leverage ratio to control risk. High leverage can lead to significant losses if not managed properly.

- Watch Margin Levels: This can avoid margin calls from occurring, which may rapidly destroy all positions held. Make sure you have enough of a balance in your account to hold those positions.

Diversify Your Portfolio

Don't put all your eggs in one basket. Diversification may help manage risk.

- Trade Multiple Currency Pairs: By investing in different currencies, you may limit the potential damage of an adverse movement of a currency that you're investing in.

Mix Trading Styles: Using strategies extending across short-term trading-scalping and day trading-and long-term, swing and position trading-to optimally balance risks and returns.

Understand Market Correlations

There is a tendency for some currency pairs to move together in, or in opposition to, other pairs because of real economic associations or commodity relations.

Positive Correlations The most common illustration is common movement of EUR/USD and GBP/USD.

Negative Correlations Pairs like USD/CHF and EUR/USD may be inversely correlated.

Identifying those relationships can be useful for the trader to take more informed decisions and not be overweighted in correlated positions.

Join a Trading Community

Market commentaries and idea sharing can provide a valuable source of information and support.

Online Forums and Groups: Participate in discussions and benefit from the experience of pro traders sharing their own experiences.

Mentorship Programs: Consider finding a mentor who can advise and guide you through the intricacies of forex trading.

Social Trading: There are platforms that brokers provide, which allow you to watch other successful traders and automatically copy their trades.

Stay Disciplined and Emotionally Detached

Emotions such as fear and greed may make you act impulsively.

Try to stick to your plan. Don’t deviate from your trading framework just because a trade doesn't go in your favor.

You can also protect your capital by using stop-loss orders to automatically exit trades at a certain level of loss.

But remember that at one point or another, every trader faces losses. Don’t try to chase and recoup losing traders, as this can lead to even bigger losses.

As you grow and gain experience, you’ll be developing yourself and improving your skills as a forex trader, improving your chances of achieving success.

Market commentaries and idea sharing can provide a valuable source of information and support.

Online Forums and Groups: Participate in discussions and benefit from the experience of pro traders sharing their own experiences.

Mentorship Programs: Consider finding a mentor who can advise and guide you through the intricacies of forex trading.

Social Trading: There are platforms that brokers provide, which allow you to watch other successful traders and automatically copy their trades.

Stay Disciplined and Emotionally Detached

Emotions such as fear and greed may make you act impulsively.

Try to stick to your plan. Don’t deviate from your trading framework just because a trade doesn't go in your favor.

You can also protect your capital by using stop-loss orders to automatically exit trades at a certain level of loss.

But remember that at one point or another, every trader faces losses. Don’t try to chase and recoup losing traders, as this can lead to even bigger losses.

As you grow and gain experience, you’ll be developing yourself and improving your skills as a forex trader, improving your chances of achieving success.

Conclusion

Starting forex trading is an exciting, though challenging, journey full of opportunities. By studying and developing, selecting the appropriate forex trading broker, and practicing daily, you can set yourself up for success.

Remember, comparing brokers is a very important step, and platforms like AvaTrade have all the necessary tools and support to help you enter the forex market with confidence.

Commitment, discipline, and a willingness to learn are all part of forex trading. Consider practicing on demo accounts and work out a solid trading plan. Anddon't rush things. Enjoy the learning curve, be patient, and build up your skills in trading slowly.

Ready to take the leap into forex trading? Join AvaTrade today and start your forex trading adventure. You'll get all the support you need with leading tools, enabling you to position yourself effectively in the dynamic world of forex trading.

Remember, comparing brokers is a very important step, and platforms like AvaTrade have all the necessary tools and support to help you enter the forex market with confidence.

Commitment, discipline, and a willingness to learn are all part of forex trading. Consider practicing on demo accounts and work out a solid trading plan. Anddon't rush things. Enjoy the learning curve, be patient, and build up your skills in trading slowly.

Ready to take the leap into forex trading? Join AvaTrade today and start your forex trading adventure. You'll get all the support you need with leading tools, enabling you to position yourself effectively in the dynamic world of forex trading.