Sam Reid

In today’s digital age, just about everything can be done online. Trading is no exception. Online trading platforms in the UAE have made it easier than ever to buy and sell digital financial products like CFDs on stocks, forex, crypto and gold.

But with that convenience comes one burning question that many new (and even experienced) traders ask: Are online trading platforms actually safe?

Let’s unpack that together.

In today’s digital age, just about everything can be done online. Trading is no exception. Online trading platforms in the UAE have made it easier than ever to buy and sell digital financial products like CFDs on stocks, forex, crypto and gold.

But with that convenience comes one burning question that many new (and even experienced) traders ask: Are online trading platforms actually safe?

Let’s unpack that together.

What are online trading platforms?

Online trading platforms are softwares or web-based tools that allow people like you and me to access the financial markets and execute trades from the comfort of their devices. Whether it’s trading stocks, forex, cryptocurrencies, or options, these platforms act like a bridge between you and the global markets.

Modern platforms offer:

- Real-time data and charts

- News and market analysis

- Access to every popular markets

- Trading tools and automation features

They’ve opened the doors for millions to participate in financial markets, democratizing trading like never before. But that accessibility comes with its own set of risks. You need to know what to look for in a proper platform so that you don’t run the risk of getting scammed.

So, are they safe?

The short answer? Some are. Some aren’t.

Just like you wouldn’t hand over your wallet to a stranger on the street, you shouldn't trust every online platform you come across. While many are legitimate and regulated, others can be outright scams.

Just like you wouldn’t hand over your wallet to a stranger on the street, you shouldn't trust every online platform you come across. While many are legitimate and regulated, others can be outright scams.

Here's what you should look out for.

1. Regulation matters

Always, always check if the platform is regulated by a recognized authority. In the UAE, look for platforms registered with SCA (Securities and Commodities Authority). Internationally, reputable platforms are often licensed by FCA (UK), ASIC (Australia), or CySEC (Cyprus).

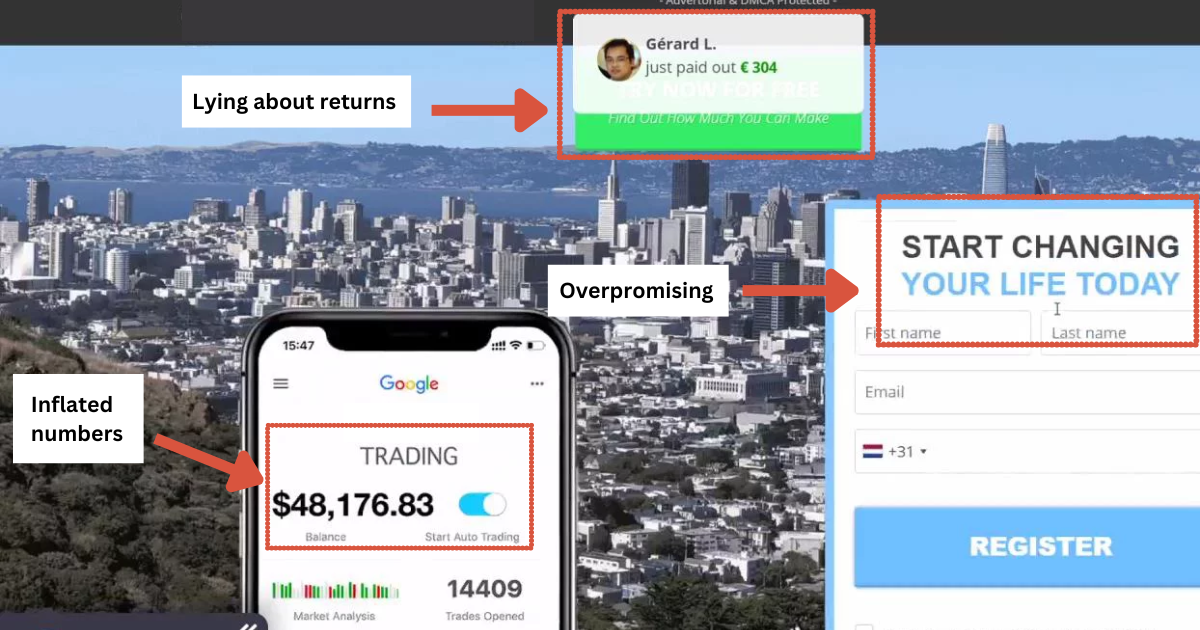

2. Too-good-to-be-true promises

If a platform promises guaranteed profits or "risk-free" trading, run. Real trading always involves risk. No broker can or should promise you returns. Below is one example.

Always, always check if the platform is regulated by a recognized authority. In the UAE, look for platforms registered with SCA (Securities and Commodities Authority). Internationally, reputable platforms are often licensed by FCA (UK), ASIC (Australia), or CySEC (Cyprus).

2. Too-good-to-be-true promises

If a platform promises guaranteed profits or "risk-free" trading, run. Real trading always involves risk. No broker can or should promise you returns. Below is one example.

3. Unclear ownership or location

Avoid platforms with no clear company information, address, or support structure. Transparency matters.

4. Payment red flags

If they won’t let you fund your account through bank transfer or major card providers, and instead ask for crypto transfers or gift cards—that's a red flag.

5. Poor user experience / Broken english

Many scam sites are made in a rush, often riddled with spelling and grammatical errors, broken links, or inconsistent information. Check reviews and ask around about a particular broker if you’re unsure. If there are no reviews or no one's heard of them before, you probably have your answer.

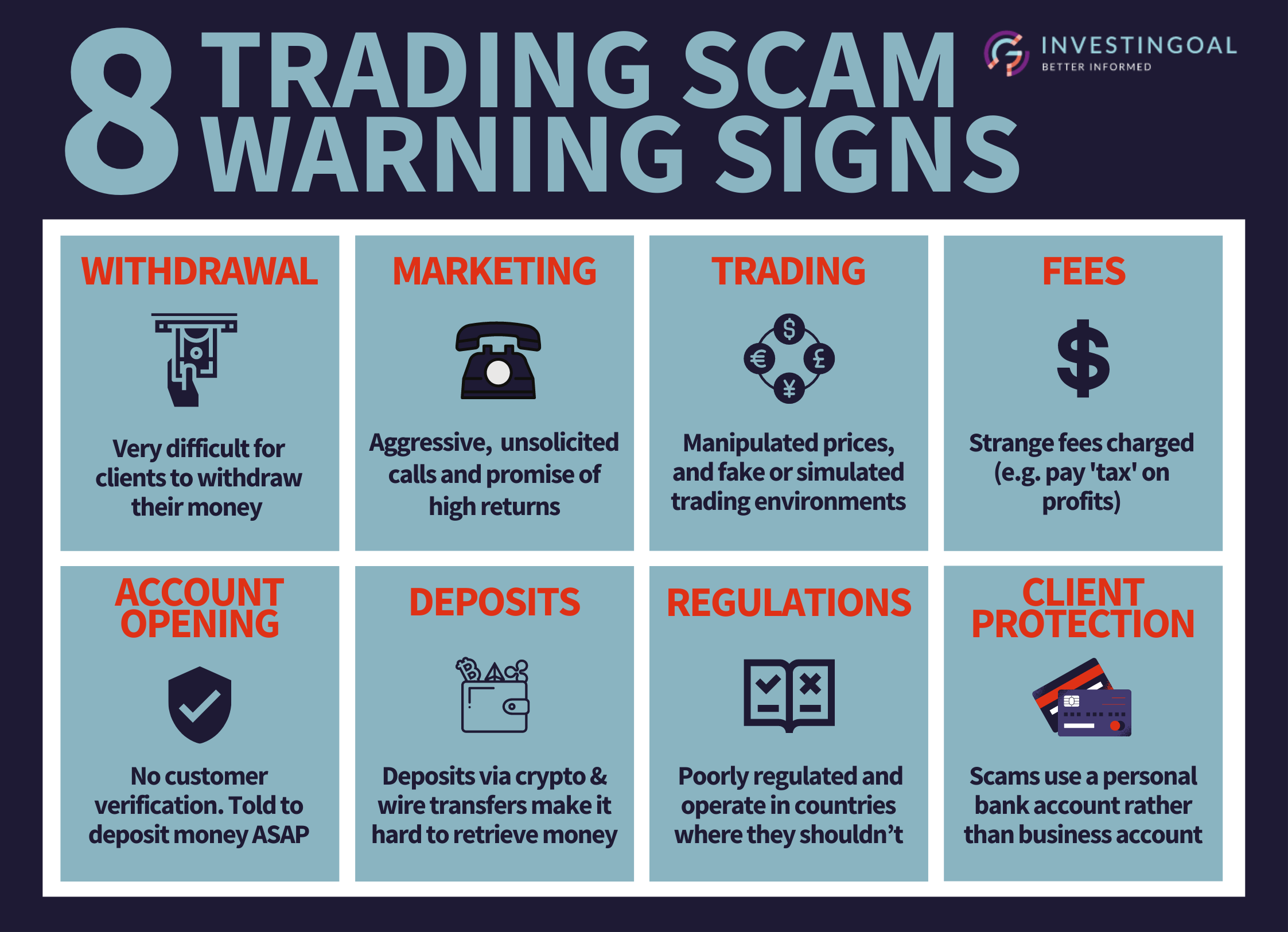

Source: InvestinGoal

The biggest risks with online trading platforms

Even legit and regulated platforms carry some risks, and it’s important to know what you’re up against just in case.

Cybersecurity threats

Hackers are constantly looking for vulnerabilities. From phishing scams to malware, your personal and financial info can be a target if you're not careful.

Cybersecurity threats

Hackers are constantly looking for vulnerabilities. From phishing scams to malware, your personal and financial info can be a target if you're not careful.

Market volatility

Trading itself is risky. Stocks, forex, and crypto can fluctuate wildly. Even with the most secure platform, you can still lose money if you’re not trading smart or emotionally prepared.

Trading itself is risky. Stocks, forex, and crypto can fluctuate wildly. Even with the most secure platform, you can still lose money if you’re not trading smart or emotionally prepared.

Hidden fees

Some platforms advertise zero commission but might include other costs like withdrawal fees, spreads, or inactivity charges. Even regulated brokers can sometimes avoid pricing transparency, so make sure you conduct thorough research through our broker reviews.

Some platforms advertise zero commission but might include other costs like withdrawal fees, spreads, or inactivity charges. Even regulated brokers can sometimes avoid pricing transparency, so make sure you conduct thorough research through our broker reviews.

How to stay safe

1. Start small

Don’t go all in on day one. Test the platform with a small amount and see how it handles your trades, deposits, and withdrawals.

2. Use strong passwords and 2FA

Treat your trading account like your online bank account. Use complex passwords and enable two-factor authentication (2FA) whenever possible.

3. Stay updated

Trading isn’t a "set and forget" activity. Keep learning about the platform, market movements, and security practices.

4. Stick to reputable names

Do your research. Read broker reviews, join trading communities, and see what real users are saying. Choosing the right broker can take time.

Don’t go all in on day one. Test the platform with a small amount and see how it handles your trades, deposits, and withdrawals.

2. Use strong passwords and 2FA

Treat your trading account like your online bank account. Use complex passwords and enable two-factor authentication (2FA) whenever possible.

3. Stay updated

Trading isn’t a "set and forget" activity. Keep learning about the platform, market movements, and security practices.

4. Stick to reputable names

Do your research. Read broker reviews, join trading communities, and see what real users are saying. Choosing the right broker can take time.

FAQs

Can I lose money even on a regulated platform?

Yes. Regulation ensures fairness and security, but it doesn’t eliminate trading risk. Markets are unpredictable.

Is forex riskier than stock trading?

Generally, yes. Forex is fast-moving and often highly leveraged, which can lead to bigger wins—and losses.

How do I know if a platform is regulated?

Check the footer of the website or the About Us section. Cross-check their license number with the regulator’s official site.

Is investing or trading better?

That depends on your goals. Investing is long-term and lower risk. Trading is short-term and higher risk, but can yield faster returns if done wisely.

Yes. Regulation ensures fairness and security, but it doesn’t eliminate trading risk. Markets are unpredictable.

Is forex riskier than stock trading?

Generally, yes. Forex is fast-moving and often highly leveraged, which can lead to bigger wins—and losses.

How do I know if a platform is regulated?

Check the footer of the website or the About Us section. Cross-check their license number with the regulator’s official site.

Is investing or trading better?

That depends on your goals. Investing is long-term and lower risk. Trading is short-term and higher risk, but can yield faster returns if done wisely.

Final thoughts

So, are online trading platforms safe?

They can be — if you choose the right one and approach it with a healthy dose of skepticism, discipline, and research. Remember, your best defense as a trader is staying informed.

Start small. Trade smart. And always choose platforms that are regulated, trusted, and transparent.

For more tips, broker reviews, and platform comparisons, stick with Chooseabroker.ae — your trusted guide for all things related to the UAE’s trading landscape.

They can be — if you choose the right one and approach it with a healthy dose of skepticism, discipline, and research. Remember, your best defense as a trader is staying informed.

Start small. Trade smart. And always choose platforms that are regulated, trusted, and transparent.

For more tips, broker reviews, and platform comparisons, stick with Chooseabroker.ae — your trusted guide for all things related to the UAE’s trading landscape.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.