By Sam Reid

"In investing, what is comfortable is rarely profitable." – Robert Arnott

Every day, over $7 trillion flows through the foreign exchange market—more than the GDP of some countries. And guess what? You don’t have to be a hedge fund titan to get in on the action. With the rise of online platforms and educational resources, forex trading has become more accessible than ever.

But if you're just starting out, the landscape can feel overwhelming. That's where this guide on forex for beginners comes in. We’ll cover the key concepts, essential strategies, risks to watch out for, and the steps you need to take to get started confidently.

But if you're just starting out, the landscape can feel overwhelming. That's where this guide on forex for beginners comes in. We’ll cover the key concepts, essential strategies, risks to watch out for, and the steps you need to take to get started confidently.

What is forex trading?

Forex, short for "foreign exchange," is the global marketplace for trading currencies. Unlike the stock market, where you invest in companies, forex involves exchanging one currency for another—like trading euros for U.S. dollars.

Why would anyone do this? Two main reasons.

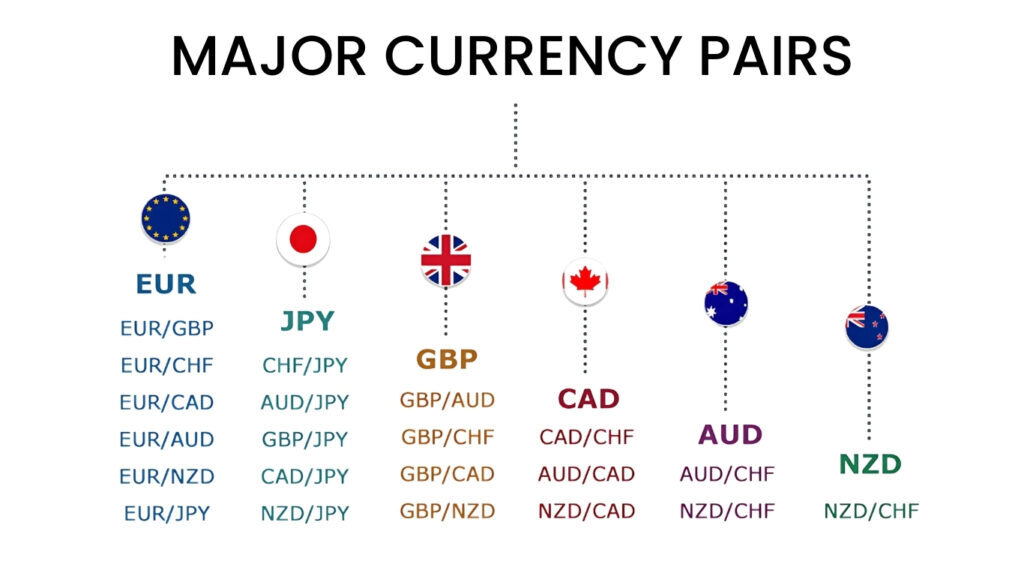

Currencies are traded in pairs (like EUR/USD or GBP/JPY), and their value fluctuates based on economic factors, interest rates, and global events.

Why would anyone do this? Two main reasons.

- Speculation: Traders aim to profit from changes in exchange rates.

- Hedging: Businesses manage risk from international transactions.

Currencies are traded in pairs (like EUR/USD or GBP/JPY), and their value fluctuates based on economic factors, interest rates, and global events.

Why forex appeals to beginners

- Massive liquidity: There's always someone buying and selling.

- Low entry barriers: You can start trading with just $100 using micro accounts.

- Flexibility: The market operates 24 hours a day, 5 days a week.

- Global scope: Trading runs through centers in London, New York, Tokyo, and more.

Despite the opportunities, jumping into forex without a plan is like sailing stormy seas without a compass.

Understanding the forex market structure

Let’s break down the four key types of forex markets:

1. Spot Market

Where most beginners start. Trades are executed on the spot at current market prices and settled within two business days.

2. Forward Market

Here, you agree today to trade a currency at a future date. Used mainly by businesses hedging against exchange rate risks.

3. Futures Market

Like forwards, but contracts are standardized and traded on regulated exchanges.

4. Options Market

Gives you the right, not the obligation, to buy or sell a currency at a specific price before a set date.

For forex for beginners, the spot market is the most straightforward and accessible starting point.

1. Spot Market

Where most beginners start. Trades are executed on the spot at current market prices and settled within two business days.

2. Forward Market

Here, you agree today to trade a currency at a future date. Used mainly by businesses hedging against exchange rate risks.

3. Futures Market

Like forwards, but contracts are standardized and traded on regulated exchanges.

4. Options Market

Gives you the right, not the obligation, to buy or sell a currency at a specific price before a set date.

For forex for beginners, the spot market is the most straightforward and accessible starting point.

Step-by-step: How to start trading forex

Step 1: Choose a Reputable Broker

Pick a forex broker regulated by authorities like the FCA (UK), CFTC (US), or DFSA/SCA (Dubai). Look for low spreads, responsive customer support, and a user-friendly platform.

One great choice for beginners is Exness. They offer a highly intuitive trading platform, extremely low spreads, and support multiple account types—including those with no minimum deposit. Their commitment to transparency and fast execution makes them an ideal starting point for anyone new to forex.

Step 2: Open a Demo Account

This lets you practice trading with virtual funds—risk-free. It’s your sandbox to learn the ropes before going live.

Step 3: Master the Basics

Understand terms like:

Pick a forex broker regulated by authorities like the FCA (UK), CFTC (US), or DFSA/SCA (Dubai). Look for low spreads, responsive customer support, and a user-friendly platform.

One great choice for beginners is Exness. They offer a highly intuitive trading platform, extremely low spreads, and support multiple account types—including those with no minimum deposit. Their commitment to transparency and fast execution makes them an ideal starting point for anyone new to forex.

Step 2: Open a Demo Account

This lets you practice trading with virtual funds—risk-free. It’s your sandbox to learn the ropes before going live.

Step 3: Master the Basics

Understand terms like:

- Pip: The smallest price movement.

- Leverage: Borrowed capital to amplify trades.

- Margin: The deposit needed to open a leveraged position.

Step 4: Build a Trading Plan

Your plan should cover:

- Trading goals

- Risk tolerance

- Capital allocation

- Strategy and timeframes

- Risk management rules

Discipline here is your best friend.

Step 5: Start Small

Focus on major pairs like EUR/USD or USD/JPY. These are more stable and have better liquidity and lower transaction costs.

Popular forex trading strategies for beginners

✅ Trend Trading

Ride the market’s momentum by identifying upward (bullish) or downward (bearish) trends.

✅ Range Trading

Look for currencies bouncing between fixed highs and lows. Buy low, sell high.

✅ Breakout Trading

Jump in when the price breaks past a defined resistance or support level. These moves can signal strong new trends.

✅ Swing Trading

Hold trades for a few days to capitalize on medium-term movements. Less stressful than scalping but still hands-on.

✅ Scalping

High-speed, high-frequency trades that capitalize on small price moves. Not recommended for absolute beginners.

Ride the market’s momentum by identifying upward (bullish) or downward (bearish) trends.

✅ Range Trading

Look for currencies bouncing between fixed highs and lows. Buy low, sell high.

✅ Breakout Trading

Jump in when the price breaks past a defined resistance or support level. These moves can signal strong new trends.

✅ Swing Trading

Hold trades for a few days to capitalize on medium-term movements. Less stressful than scalping but still hands-on.

✅ Scalping

High-speed, high-frequency trades that capitalize on small price moves. Not recommended for absolute beginners.

Risks to keep in mind

Trading forex isn’t a guaranteed money machine. Here are some potential pitfalls:

Managing these risks is half the game in forex trading.

- Volatility: Major news can swing markets in seconds.

- Leverage: While it can amplify profits, it also multiplies losses.

- Psychology: Emotional trading leads to poor decisions—especially after a loss.

- Broker risks: Stick with regulated brokers to avoid fraud.

- Interest rate risk: Central bank decisions can shift currency values dramatically.

- Geopolitical risk: A sudden war, election, or policy change can upend the markets.

Managing these risks is half the game in forex trading.

How much do you need to get started?

Most brokers offer micro or mini accounts, allowing you to start with $100–$500. With leverage, even a small amount can control larger positions. But remember—never trade what you can’t afford to lose.

Forex and regional markets

If you're trading from or focusing on regional markets, keep in mind:

▪️ Chooseabroker.ae: A popular hub for traders in the Middle East showcasing the UAE's best and well-regulated brokers.

▪️ Khaleej Times: To keep up with regional market movements and oil-related currencies can heavily influence trading in Gulf nations.

▪️ Forex Factory: A vital tool for tracking economic calendars, news events, and community strategies.

▪️ Chooseabroker.ae: A popular hub for traders in the Middle East showcasing the UAE's best and well-regulated brokers.

▪️ Khaleej Times: To keep up with regional market movements and oil-related currencies can heavily influence trading in Gulf nations.

▪️ Forex Factory: A vital tool for tracking economic calendars, news events, and community strategies.

FAQs: Answering beginner questions

How do I start learning forex?

Start with free online courses, demo accounts, and educational sites like Babypips or Forex Factory. Focus on understanding charts, currency pairs, and market drivers.

Is forex easy for beginners?

It’s easy to start, but hard to master. The technical setup is simple, but emotional control, risk management, and strategy take time to develop.

Can I teach myself forex?

Absolutely. Many successful traders are self-taught. Just make sure you learn from credible sources and practice on a demo account before using real money.

What is the 90% rule in forex?

It’s an unofficial rule that says 90% of traders lose 90% of their capital within 90 days. It underscores why discipline, education, and risk management are essential.

Start with free online courses, demo accounts, and educational sites like Babypips or Forex Factory. Focus on understanding charts, currency pairs, and market drivers.

Is forex easy for beginners?

It’s easy to start, but hard to master. The technical setup is simple, but emotional control, risk management, and strategy take time to develop.

Can I teach myself forex?

Absolutely. Many successful traders are self-taught. Just make sure you learn from credible sources and practice on a demo account before using real money.

What is the 90% rule in forex?

It’s an unofficial rule that says 90% of traders lose 90% of their capital within 90 days. It underscores why discipline, education, and risk management are essential.

Final thoughts

Forex for beginners is full of promise—but only for those who approach it with caution, curiosity, and commitment. Start slow, keep your expectations realistic, and never stop learning. The market rewards those who prepare and punishes those who rush.

Remember: It’s not about trading every day—it’s about trading smart every day you do.

Remember: It’s not about trading every day—it’s about trading smart every day you do.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.