by Sam Reid

According to recent industry data, the Forex and Contracts for Difference (CFD) market handles trillions of dollars in daily trading volume.

Within this vast marketplace, many brokers compete for traders’ attention by offering unique spreads, pricing models, and leverage ratios. One such broker—one that has steadily expanded into multiple regions, offers a suite of trading tools, and claims to serve over 80 countries—is the subject of this amana review.

Whether you’re a beginner or a seasoned trader, understanding a broker’s spreads, fees, and leverage structure is crucial for making informed decisions. In this article, we’ll look closely at Amana's regulatory status, account types, trading platforms, and overall user experience. We’ll also address some of the most common questions people ask related to amana, trading costs, and leverage.

Within this vast marketplace, many brokers compete for traders’ attention by offering unique spreads, pricing models, and leverage ratios. One such broker—one that has steadily expanded into multiple regions, offers a suite of trading tools, and claims to serve over 80 countries—is the subject of this amana review.

Whether you’re a beginner or a seasoned trader, understanding a broker’s spreads, fees, and leverage structure is crucial for making informed decisions. In this article, we’ll look closely at Amana's regulatory status, account types, trading platforms, and overall user experience. We’ll also address some of the most common questions people ask related to amana, trading costs, and leverage.

Amana's Background and Regulation

Amana, previously Amana Capital, traces its origins to 2010 and has grown from a small startup in Beirut to a multi-licensed entity headquartered in Dubai. It operates under various regulatory bodies, including the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC).

The broker’s willingness to operate under multiple jurisdictions highlights its intent to capture a wide client base while also providing certain protective measures like segregated client accounts and negative balance protection.

Some markets, such as the European Union, impose leverage caps of 1:30 for retail traders, but in many of its non-EU operations, Amana advertises leverage of up to 1:500. High leverage can magnify both profits and losses, so traders need to proceed carefully.

It’s also worth noting that the broker extends an insurance option for certain markets, offering coverage of up to 1,000,000 USD in the event of insolvency. This coverage, underwritten by syndicates like Lloyd’s of London, provides a degree of added security.

The broker’s willingness to operate under multiple jurisdictions highlights its intent to capture a wide client base while also providing certain protective measures like segregated client accounts and negative balance protection.

Some markets, such as the European Union, impose leverage caps of 1:30 for retail traders, but in many of its non-EU operations, Amana advertises leverage of up to 1:500. High leverage can magnify both profits and losses, so traders need to proceed carefully.

It’s also worth noting that the broker extends an insurance option for certain markets, offering coverage of up to 1,000,000 USD in the event of insolvency. This coverage, underwritten by syndicates like Lloyd’s of London, provides a degree of added security.

Range of Markets and Trading Instruments

The amana review would be incomplete without exploring the broker’s range of tradable instruments. Amana Capital offers more than 5,500+ instruments, spread across multiple asset classes:

This wide selection caters to a diverse range of trading strategies. For beginners, it might be overwhelming, but advanced traders appreciate the opportunity to diversify their portfolios into multiple markets.

- Forex: 50+ currency pairs reported, depending on the account type and jurisdiction. These pairs include major, minor, and some exotic currencies.

- Indices: CFDs on major global indexes such as the NASDAQ, Dow Jones, and DAX.

- Precious Metals: Spot and futures trading for gold, silver, and in some cases, other metals.

- Energies: Brent Oil, WTI, and Natural Gas.

- Commodities: Agricultural products like corn, soybeans, or coffee, typically offered as futures.

- Share CFDs: Over 280 US share CFDs from well-known companies like Netflix, Walmart, and Apple, along with select international and local MENA shares.

- Cryptocurrencies: CFDs on Bitcoin, Ethereum, Litecoin, and Ripple.

This wide selection caters to a diverse range of trading strategies. For beginners, it might be overwhelming, but advanced traders appreciate the opportunity to diversify their portfolios into multiple markets.

Account Types and Amana's Key Features

From our amana review, we find that they take a much different approach when it comes to account types, compared to other brokers. While other online trading brokers offer multiple account types with different spreads, instruments and features, amana offers everyone the default standard account when they sign up either via the app or MT4/MT5.

But you should note that the amana app and amana’s MT4/MT5 accounts are two different things, if you want to trade on both, you’ll need to create a separate account for each with a different email address.

But you should note that the amana app and amana’s MT4/MT5 accounts are two different things, if you want to trade on both, you’ll need to create a separate account for each with a different email address.

You can also opt for a demo account with Amana:

- Duration: Typically 30 days (though some brokers allow extending)

- Features: Virtual funds, real-time market quotes, full platform features

- Who It’s For: Anyone who wants to test the broker’s platform or practice trading strategies without risking actual funds

Spreads, Fees, and Overall Trading Costs

The hallmark of any amana review is its discussion of trading fees. While Amana advertises tight spreads—starting from 0.1 pips on certain high-deposit accounts—many traders on entry-level accounts face spreads that are higher than average.

For example, a 1.4-pip spread on EUR/USD can translate into a trading cost of roughly 14 USD per standard lot. Many competitive brokers will charge between 8 to 10 USD per standard lot on this major currency pair.

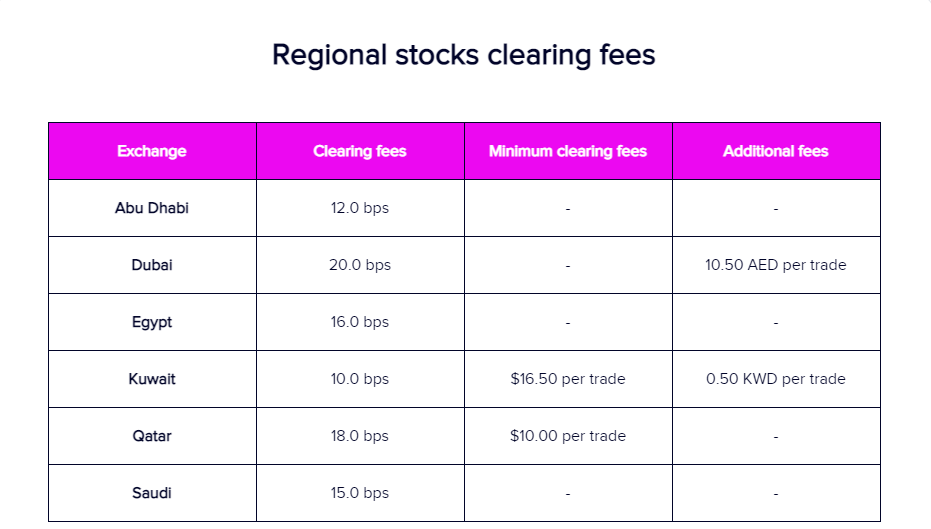

For local MENA stock investing, there are clearing fees and additional fees in some cases. These costs are outlined below. However it is known than amana does not profit from these trades, since 100% of amana's cost is transferred to the investor without making any markup.

For example, a 1.4-pip spread on EUR/USD can translate into a trading cost of roughly 14 USD per standard lot. Many competitive brokers will charge between 8 to 10 USD per standard lot on this major currency pair.

For local MENA stock investing, there are clearing fees and additional fees in some cases. These costs are outlined below. However it is known than amana does not profit from these trades, since 100% of amana's cost is transferred to the investor without making any markup.

Non-trading fees such as deposit and withdrawal charges are also a consideration. In many cases, card deposits attract a 1.5% fee, while e-wallet services like Neteller or Skrill charge between 1–3%. Some alternative payment systems come with even higher fees.

Additionally, traders wishing to withdraw via bank transfer may face a fixed or percentage-based charge depending on their region.

Amana Leverage Explained

Leverage can amplify returns but also magnify losses. This broker allows up to 1:500 in certain regions, meaning you can control 500 USD worth of trading exposure for every 1 USD in your account. While this might sound appealing, losing trades can quickly deplete your balance.

Because of the inherent risk, regulators in regions like the EU and UK cap retail leverage at 1:30. For that reason, it’s important to use high leverage responsibly and understand that certain positions, particularly overnight ones, can accumulate swap fees if they remain open past daily settlement times.

Because of the inherent risk, regulators in regions like the EU and UK cap retail leverage at 1:30. For that reason, it’s important to use high leverage responsibly and understand that certain positions, particularly overnight ones, can accumulate swap fees if they remain open past daily settlement times.

Trading Platforms and Tools

Amana Capital uses the well-known MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These are industry-standard, particularly favored for automated trading strategies via Expert Advisors (EAs) and for advanced charting features.

For traders specifically seeking an online trading broker in UAE, Amana's strong presence in the Middle East, especially with offices in Dubai regulated by the DFSA provides localized customer support and some region-specific services.

- MT4: Ideal for novice traders, with fewer complexities and robust analytics

- MT5: Targets advanced traders, offering more timeframes, deeper market insight, an integrated economic calendar, and netting as well as hedging capabilities

For traders specifically seeking an online trading broker in UAE, Amana's strong presence in the Middle East, especially with offices in Dubai regulated by the DFSA provides localized customer support and some region-specific services.

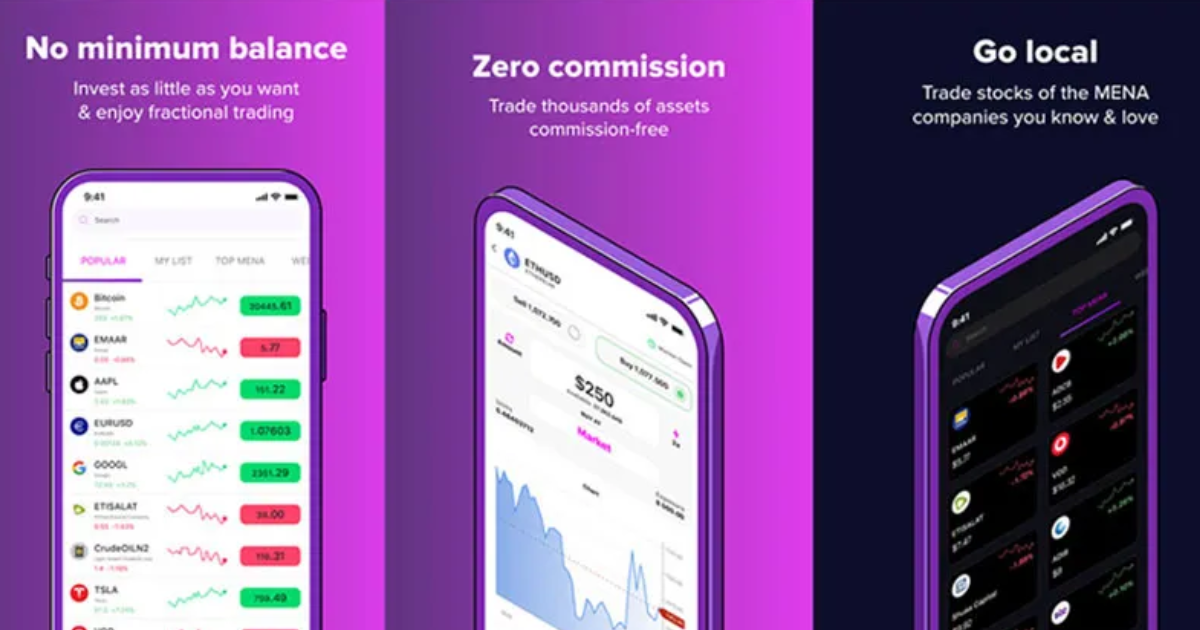

Amana App

Amana also provides its own “all in one” trading platform with access to 1000+ financial instruments across forex, CFDs and physical stocks. The platform is only available via mobile application on Apple and Android devices.

The amana app allows you to deposit, withdraw, trade, analyze and learn - all available inside the platform. The app layout offers a sleek design and a user-friendly experience with personalized watch lists, news, notifications, and more.

Amana also provides its own “all in one” trading platform with access to 1000+ financial instruments across forex, CFDs and physical stocks. The platform is only available via mobile application on Apple and Android devices.

The amana app allows you to deposit, withdraw, trade, analyze and learn - all available inside the platform. The app layout offers a sleek design and a user-friendly experience with personalized watch lists, news, notifications, and more.

Deposit and Withdrawal Methods

Deposits and withdrawals can be performed via bank wire transfer, credit/debit cards, e-wallets (Neteller, Skrill, etc.), UnionPay, and certain regional payment gateways.

While the broker allows flexible options, it also charges certain deposit and withdrawal fees. Traders must be mindful that these additional costs can impact profitability:

With multiple offices worldwide, the broker’s processing times may vary, but most withdrawals are confirmed within 24 to 48 hours, excluding weekends and holidays.

While the broker allows flexible options, it also charges certain deposit and withdrawal fees. Traders must be mindful that these additional costs can impact profitability:

- Bank Transfers: May take up to five business days, occasionally incurring a small processing fee.

- Credit/Debit Cards: Instant but can carry a 1.5% deposit fee and sometimes a similar or higher withdrawal fee.

- E-Wallets: Fees range from 1% to 3%, depending on the provider.

With multiple offices worldwide, the broker’s processing times may vary, but most withdrawals are confirmed within 24 to 48 hours, excluding weekends and holidays.

Amana Pros and Cons

Pros

- Multiple Regulations: Operates in many jurisdictions like the UAE, UK and Jordan, highlighting efforts toward transparency and security.

- Wide Range of Instruments: Forex, commodities, shares, indices, energies, cryptocurrencies.

- High Leverage for Some Regions: Offers up to 1:500, appealing to risk-tolerant traders.

- Great app: The amana app is beginner-friendly and easy to navigate.

- Transparent fees: Amana clearly states their fees in a transparent way

Cons

- Less advanced tools: Traders looking for more advanced trading tools may not find what they need.

- Higher spreads: Our review found that amana's spreads are slightly higher than the industry average.

- No 24/7 support: Amana's support is only available on weekdays.

Conclusion

For anyone seeking an online trading broker in the UAE, Amana's prominence in the Middle East might make it a convenient choice, especially given local offices, multilingual support, and region-specific payment channels.

Ultimately, a broker’s suitability depends on your individual preferences, risk tolerance, and trading style. If you’re a newcomer, testing their demo account can be a prudent first step before committing to a live environment.

Ultimately, a broker’s suitability depends on your individual preferences, risk tolerance, and trading style. If you’re a newcomer, testing their demo account can be a prudent first step before committing to a live environment.

Frequently Asked Questions (FAQs) on Amana

What can I trade with amana?

With amana, traders can access CFDs on forex, stocks (US, UK EU and MENA shares), commodities, indices, ETFs, and cryptocurrencies. Amana also offers physical stock investing on US and MENA shares.

What is the maximum leverage I trade use with amana?

Amana's maximum leverage is 1:500. Note that the leverage level you can access will vary depending on the amana entity you onboard with and the instrument you want to trade.

What is the spread fee in trading?

The spread fee in trading is the difference between the bid (selling) price and the ask (buying) price of a financial instrument. For instance, if EUR/USD is quoted at 1.4000 (ask) and 1.3999 (bid), the spread is 0.0001 (or 1 pip). Many brokers, including Amana, incorporate their revenue into this spread, which means traders pay this cost indirectly whenever they open or close a position.

How does leverage work with a broker?

Leverage allows traders to control larger positions with a smaller amount of capital. If a broker offers leverage of 1:500, for every 1 USD you deposit, you can control up to 500 USD in trading value. While this can amplify gains, it also magnifies losses, so risk management becomes essential. Regulations often limit leverage for retail traders in certain regions to protect them from potentially large losses.

Does leverage increase trading fees?

Leverage itself does not directly raise trading fees like spreads or commissions, but it can influence your overall costs. When you trade with higher leverage, you open larger positions, which means a single pip movement in the market can represent a bigger monetary gain—or loss. Additionally, higher leveraged positions may incur more significant overnight financing costs (swap fees) if held past the daily close.

What is amana trading?

“Amana trading” refers to the trading services provided by Amana Capital across various asset classes, including Forex, commodities, and share CFDs. The term often encapsulates the broker’s entire value proposition, including its platforms (MT4 and MT5 and amana app), proprietary trading tools, and educational resources aimed at helping clients refine their strategies.

With amana, traders can access CFDs on forex, stocks (US, UK EU and MENA shares), commodities, indices, ETFs, and cryptocurrencies. Amana also offers physical stock investing on US and MENA shares.

What is the maximum leverage I trade use with amana?

Amana's maximum leverage is 1:500. Note that the leverage level you can access will vary depending on the amana entity you onboard with and the instrument you want to trade.

What is the spread fee in trading?

The spread fee in trading is the difference between the bid (selling) price and the ask (buying) price of a financial instrument. For instance, if EUR/USD is quoted at 1.4000 (ask) and 1.3999 (bid), the spread is 0.0001 (or 1 pip). Many brokers, including Amana, incorporate their revenue into this spread, which means traders pay this cost indirectly whenever they open or close a position.

How does leverage work with a broker?

Leverage allows traders to control larger positions with a smaller amount of capital. If a broker offers leverage of 1:500, for every 1 USD you deposit, you can control up to 500 USD in trading value. While this can amplify gains, it also magnifies losses, so risk management becomes essential. Regulations often limit leverage for retail traders in certain regions to protect them from potentially large losses.

Does leverage increase trading fees?

Leverage itself does not directly raise trading fees like spreads or commissions, but it can influence your overall costs. When you trade with higher leverage, you open larger positions, which means a single pip movement in the market can represent a bigger monetary gain—or loss. Additionally, higher leveraged positions may incur more significant overnight financing costs (swap fees) if held past the daily close.

What is amana trading?

“Amana trading” refers to the trading services provided by Amana Capital across various asset classes, including Forex, commodities, and share CFDs. The term often encapsulates the broker’s entire value proposition, including its platforms (MT4 and MT5 and amana app), proprietary trading tools, and educational resources aimed at helping clients refine their strategies.