Understanding lot size in gold trading is incredibly important for managing risk and maximizing your profit potential. The lot size in gold trading refers to the trading volume you undertake with your CFD broker, typically measured in troy ounces.

Calculating the correct lot size can help traders manage their exposure and align their trades with their financial goals. Knowing how to calculate the right gold lot size is a key step toward trading smarter and safer.

Calculating the correct lot size can help traders manage their exposure and align their trades with their financial goals. Knowing how to calculate the right gold lot size is a key step toward trading smarter and safer.

What is Lot Size in Gold Trading?

In gold trading, lot size refers to the quantity of gold CFDs being bought or sold in a transaction. A lot is a standardized unit of measurement that helps traders understand how much they are trading.

Gold CFDs are usually traded in the following lot sizes:

Gold CFDs are usually traded in the following lot sizes:

Understanding these lot sizes for gold holds an important purpose. That is, to calculate a trader’s risk exposure and potential profits or losses, depending on how the markets move.

Why is Lot Size Important in Gold Trading?

The lot size you choose has a direct impact on your potential profit or loss and risk exposure in each trade.

For example:

Let’s say the price of gold moves by $1:

Entering your trades with the right lot size ensures that your trading behaviour aligns with your risk tolerance and financial goals. Of course, everyone wants to make lots of money trading. But you have to ask yourself, what is a sensible amount to risk based on my account size.

For example:

- Standard Lot (1.0) = 100 ounces of gold

- Mini Lot (0.1) = 10 ounces of gold

- Micro Lot (0.01) = 1 ounce of gold

Let’s say the price of gold moves by $1:

- A Standard Lot trade would result in a $100 change in your account balance.

- A Mini Lot trade would result in a $10 change.

- A Micro Lot trade would result in a $1 change.

Entering your trades with the right lot size ensures that your trading behaviour aligns with your risk tolerance and financial goals. Of course, everyone wants to make lots of money trading. But you have to ask yourself, what is a sensible amount to risk based on my account size.

How to Calculate Lot Size for Gold Trading

Getting to the right lot size for your account size and personal preference involves a simple formula to determine how much gold to trade based on your risk tolerance and stop loss distance.

Lot Size Formula:

Lot Size = Risk Amount / (Stop Loss Distance × Pip Value)

We will break this down with an example.

Suppose you want to risk $100 on a gold trade, and you’ve set your stop loss at 200 pips (equivalent to $20):

Lot Size = $100 / $20 = 5 ounces

This means you’d trade 0.05 lots (5 ounces of gold) to keep your risk within your target range.

Lot Size Formula:

Lot Size = Risk Amount / (Stop Loss Distance × Pip Value)

We will break this down with an example.

Suppose you want to risk $100 on a gold trade, and you’ve set your stop loss at 200 pips (equivalent to $20):

Lot Size = $100 / $20 = 5 ounces

This means you’d trade 0.05 lots (5 ounces of gold) to keep your risk within your target range.

Gold Trading Calculator

If maths isn't your strongest subject, don’t worry. Most people use a gold trading calculator to calculate their optimal lot size. You can just go to Google and type in ‘Gold trading calculator’ and select any of the top options, such as myfxbook.com. There you just need to input your details and it will provide you with the lot size you need.

Understanding Gold Lot Sizes on Popular Trading Platforms

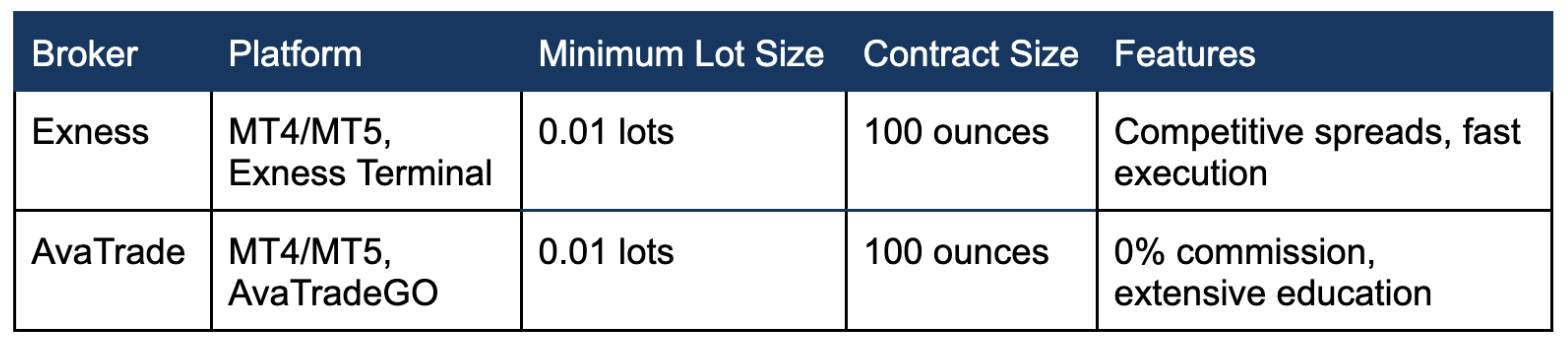

If you're using platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) with brokers such as Exness or AvaTrade, you can easily check the contract specifications for gold to confirm the lot sizes.

To do this:

1. Right-click on the gold symbol (XAUUSD) in the Market Watch window.

2. Select Specification to view details such as contract size, minimum volume, and volume step.

The contract size for gold is typically set at 100 ounces per 1.0 lot, but it’s important to verify this with your broker, as lot sizes and trading conditions can sometimes vary.

To do this:

1. Right-click on the gold symbol (XAUUSD) in the Market Watch window.

2. Select Specification to view details such as contract size, minimum volume, and volume step.

The contract size for gold is typically set at 100 ounces per 1.0 lot, but it’s important to verify this with your broker, as lot sizes and trading conditions can sometimes vary.

Gold Lot Sizes and Pip Values: What You Need to Know

We mentioned earlier that a higher lot size comes with higher potential profits or losses for each pip move. Understanding how lot size affects pip value is crucial to manage this. Let’s see what each pip movement would mean for your trading balance based on the lot size you select.

For example, if gold moves $1:

- Standard Lot (1.0): $10 per pip

- Mini Lot (0.1): $1 per pip

- Micro Lot (0.01): $0.10 per pip

For example, if gold moves $1:

- A Standard Lot will result in a $100 change in your balance.

- A Mini Lot will result in a $10 change.

- A Micro Lot will result in a $1 change.

Gold Lot Sizes with Featured Brokers

Tips for Managing Lot Size in Gold Trading

1. Start Small – If you're new to trading, consider starting with micro lots to minimize risk.

2. Use Risk Management Tools – Always set stop loss and take profit orders to protect your capital.

3. Stay Informed – Keep track of market news and volatility indicators to adjust your lot size accordingly.

2. Use Risk Management Tools – Always set stop loss and take profit orders to protect your capital.

3. Stay Informed – Keep track of market news and volatility indicators to adjust your lot size accordingly.

Final Thoughts

Calculating the right lot size in gold trading is an essential step in managing your risk and capital. Look for a reliable gold trading broker like Exness or AvaTrade and remember that lot size heavily impacts your potential profit and loss. It could be the difference between effective risk management and blowing your trading account.

If you take the time to familiarize yourself with the contract specifications, pip values, and market conditions, you can optimize your trading strategy and improve your chances of success when trading gold.

Looking to start trading gold?

Check out Exness or AvaTrade to explore their trading platforms, contract specifications, and gold trading conditions.

Or to learn more about these brokers, check out our Exness review and AvaTrade review!

If you take the time to familiarize yourself with the contract specifications, pip values, and market conditions, you can optimize your trading strategy and improve your chances of success when trading gold.

Looking to start trading gold?

Check out Exness or AvaTrade to explore their trading platforms, contract specifications, and gold trading conditions.

Or to learn more about these brokers, check out our Exness review and AvaTrade review!