By Sam Reid

Have you heard that the online brokerage market is expected to climb from around USD 10.15 billion in 2024 to approximately USD 16.71 billion by 2032? This noteworthy surge illustrates a highly competitive environment for investors and traders across the globe, with platforms racing to offer the most advanced features and attract an ever-growing number of retail participants.

We've gathered the key points from multiple industry reports and expert reviews to help you navigate the expanding world of online brokers. Whether you’re a new trader or seasoned investor, understanding the essentials of this dynamic market is crucial for building a strong foundation in your financial journey.

We've gathered the key points from multiple industry reports and expert reviews to help you navigate the expanding world of online brokers. Whether you’re a new trader or seasoned investor, understanding the essentials of this dynamic market is crucial for building a strong foundation in your financial journey.

Understanding the Global Landscape

Rapid Growth and COVID-19 Effects

The Online Brokers and Trading Platform Market has been expanding at a healthy pace, partly thanks to advanced connectivity and higher retail investor interest. In 2020-2021, the market saw an added boost when global volatility skyrocketed during the COVID-19 pandemic.

Many individuals who were stuck indoors became more inclined to try online trading, which made sense given the convenience of mobile and web-based platforms.

By 2024, the market valuation was about USD 10.15 billion, and it’s predicted to leap to USD 16.71 billion by 2032 at a CAGR of roughly 6.4%. This momentum is driven by increasingly robust features—such as real-time data, improved risk management tools, and rapid order execution—offered by each online trading broker keen to capture a wider audience.

The Online Brokers and Trading Platform Market has been expanding at a healthy pace, partly thanks to advanced connectivity and higher retail investor interest. In 2020-2021, the market saw an added boost when global volatility skyrocketed during the COVID-19 pandemic.

Many individuals who were stuck indoors became more inclined to try online trading, which made sense given the convenience of mobile and web-based platforms.

By 2024, the market valuation was about USD 10.15 billion, and it’s predicted to leap to USD 16.71 billion by 2032 at a CAGR of roughly 6.4%. This momentum is driven by increasingly robust features—such as real-time data, improved risk management tools, and rapid order execution—offered by each online trading broker keen to capture a wider audience.

Emergence of New Trends

Artificial intelligence, blockchain innovations, and zero-commission trading have become game-changers. Platforms are implementing AI-powered analytics that can pinpoint patterns in historical data, while blockchain technologies are streamlining settlements and elevating transparency. Meanwhile, zero-commission or low-fee models have lured many first-time traders. These developments broaden the market’s appeal and enhance the user experience, proving that “traditional” broker models must adapt or risk losing traction.

Artificial intelligence, blockchain innovations, and zero-commission trading have become game-changers. Platforms are implementing AI-powered analytics that can pinpoint patterns in historical data, while blockchain technologies are streamlining settlements and elevating transparency. Meanwhile, zero-commission or low-fee models have lured many first-time traders. These developments broaden the market’s appeal and enhance the user experience, proving that “traditional” broker models must adapt or risk losing traction.

Key Considerations When Choosing an Online Broker

Selecting the right online trading broker involves more than just opening an account. You’ll need to consider factors like regulation, trading fees, security, and the selection of available instruments. Different traders also have unique goals: some focus on forex trading, while others trade stocks, commodities, or indices. Below are points you should keep in mind before committing to any platform:

1. Regulatory Compliance

Make sure your broker follows reputable regulatory standards.

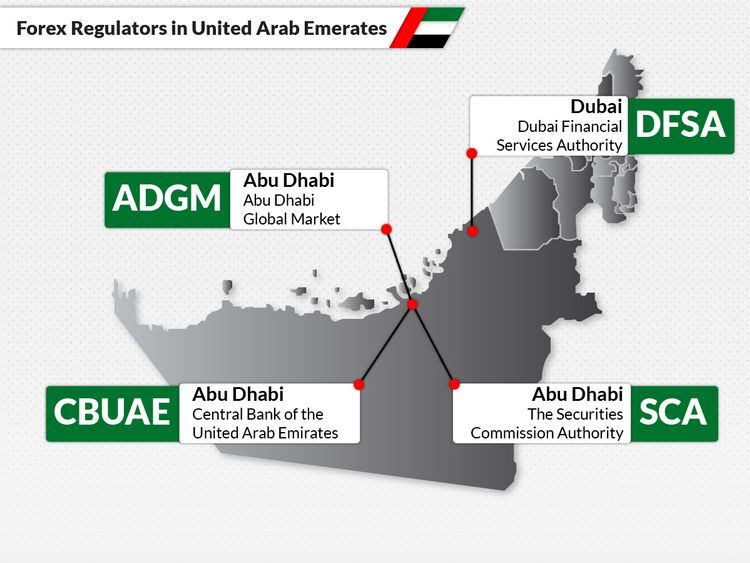

For example, in the United Arab Emirates (UAE), online brokers must adhere to guidelines set forth by the Securities and Commodities Authority (SCA), or they might operate under the frameworks of the Abu Dhabi Global Market (ADGM) or the Dubai Financial Services Authority (DFSA). A trustworthy online broker will highlight regulatory credentials on its website.

1. Regulatory Compliance

Make sure your broker follows reputable regulatory standards.

For example, in the United Arab Emirates (UAE), online brokers must adhere to guidelines set forth by the Securities and Commodities Authority (SCA), or they might operate under the frameworks of the Abu Dhabi Global Market (ADGM) or the Dubai Financial Services Authority (DFSA). A trustworthy online broker will highlight regulatory credentials on its website.

2. Account Types

Decide if you’re more inclined toward short-term speculation or if you prefer long-term investing. For instance, CFD trading accounts enable you to speculate on assets without owning them.

Meanwhile, cash equity or stock trading accounts allow you to purchase shares outright and possibly benefit from dividends. Many brokers provide both options, plus specialized accounts for margin, options, or forex trading.

3. Trading Platform and Tools

A user-friendly interface with robust charting tools, news feeds, and analysis features can greatly enhance your experience. If you’re new, you may want a straightforward platform with educational materials and a demo account.

If you’re advanced, you might need more sophisticated functionalities like algorithmic trading or deeper research integrations.

A user-friendly interface with robust charting tools, news feeds, and analysis features can greatly enhance your experience. If you’re new, you may want a straightforward platform with educational materials and a demo account.

If you’re advanced, you might need more sophisticated functionalities like algorithmic trading or deeper research integrations.

4. Fees and Commissions

Direct trading costs (spreads, commissions) and indirect charges (deposit fees, withdrawal fees, or inactivity fees) can vary significantly across brokers. For instance, some providers promote “free” or zero-commission stock trading, but they might recoup costs through spreads. Always review the fee schedule for clarity before making your choice.

5. Range of Markets

If you plan to diversify, confirm that your broker grants you access to stocks, bonds, commodities, and multiple currency pairs.

A diversified approach can help you spread risk, especially if you’re experimenting with new markets.

Direct trading costs (spreads, commissions) and indirect charges (deposit fees, withdrawal fees, or inactivity fees) can vary significantly across brokers. For instance, some providers promote “free” or zero-commission stock trading, but they might recoup costs through spreads. Always review the fee schedule for clarity before making your choice.

5. Range of Markets

If you plan to diversify, confirm that your broker grants you access to stocks, bonds, commodities, and multiple currency pairs.

A diversified approach can help you spread risk, especially if you’re experimenting with new markets.

6. Customer Support

Quick, reliable, and accessible customer service is crucial—particularly during periods of heightened market volatility. Look for brokers that offer 24/5 or 24/7 support through several channels (phone, email, live chat).

Quick, reliable, and accessible customer service is crucial—particularly during periods of heightened market volatility. Look for brokers that offer 24/5 or 24/7 support through several channels (phone, email, live chat).

Leading Brokers in the UAE

The UAE has a flourishing brokerage scene, supported by a strong financial infrastructure and a growing pool of tech-savvy retail investors. Recent data pinpoints the top international brokers favored in the region, including Interactive Brokers, Saxo, eToro, XTB, Swissquote, Oanda, Admirals (Admiral Markets), Trading 212, IG, and Tickmill. All these brands have carved out their niches by focusing on various aspects:

These brokers’ strengths highlight how localized preferences shape the competition. In a region like the UAE—where a large proportion of the population comprises expatriates—having access to wide-ranging international instruments is a massive selling point.

- Interactive Brokers: Known for very low fees, an extensive product range, and advanced research tools.

- Saxo: Features an excellent trading platform, in-depth research, and a broad product portfolio, though it has a relatively higher minimum deposit for some regions.

- eToro: Highly popular for social trading, user-friendly interface, and zero commission on stocks.

- XTB: Commended for commission-free stock and ETF trades (up to a monthly limit) and fast account opening procedures.

- Swissquote: Offers a diverse set of markets, strong regulation, and a reliable background.

- Oanda: Boasts powerful research tools and an easy account opening process, particularly for forex trading.

- Admirals (Admiral Markets): Great for those accustomed to the MetaTrader platform, with competitive forex CFD fees.

- Trading 212: Real stocks and ETFs are often commission-free, with a straightforward account setup.

- IG: Praised for its intuitive web platform and superb educational tools, plus a global presence.

- Tickmill: Low forex fees, easy onboarding, and free deposits/withdrawals stand out.

These brokers’ strengths highlight how localized preferences shape the competition. In a region like the UAE—where a large proportion of the population comprises expatriates—having access to wide-ranging international instruments is a massive selling point.

The Role of Technology and Innovation

AI and Machine Learning

From advanced charting to automated trade execution, AI solutions assist with market predictions and risk assessment. Meanwhile, machine learning algorithms sift through volumes of market data, spotting opportunities in real time for traders seeking a performance edge.

Blockchain

A transparent and efficient trade settlement mechanism, blockchain technology reduces back-office complexities and fosters an environment of trust. Expect continued experimentation among major brokers, which may lead to more integrated, user-centric experiences.

Mobile and Social Trading

With mobile adoption on the rise across the globe, brokers have had to adapt by building intuitive apps for smartphones and tablets. Many also integrate social features, enabling novice traders to follow experts, replicate portfolios, and glean insights from a community of fellow enthusiasts.

From advanced charting to automated trade execution, AI solutions assist with market predictions and risk assessment. Meanwhile, machine learning algorithms sift through volumes of market data, spotting opportunities in real time for traders seeking a performance edge.

Blockchain

A transparent and efficient trade settlement mechanism, blockchain technology reduces back-office complexities and fosters an environment of trust. Expect continued experimentation among major brokers, which may lead to more integrated, user-centric experiences.

Mobile and Social Trading

With mobile adoption on the rise across the globe, brokers have had to adapt by building intuitive apps for smartphones and tablets. Many also integrate social features, enabling novice traders to follow experts, replicate portfolios, and glean insights from a community of fellow enthusiasts.

Our Recommended Picks: XTB and Exness

When it comes to balancing affordability, reliability, and a rich toolkit, two brokers that consistently emerge in discussions are XTB and Exness.

XTB

Read our XTB Review

Exness

Read our Exness Review

Whether you’re zeroing in on low trading costs or advanced functionalities, both XTB and Exness deliver a compelling mix of services to meet your investing goals.

Still, it’s essential to conduct thorough research or even test brokers with a demo account to confirm they align with your personal style and strategy.

XTB

- Fast Registration: Many users appreciate the swift account creation and verification process, often completed in a single day.

- Commission-Free Options: XTB caters to traders seeking cost-effective ways to trade stocks and ETFs, offering zero commissions up to a certain monthly trade volume.

- User-Friendly Platforms: The proprietary xStation 5 platform is praised for its intuitive design, real-time performance statistics, and broad educational resources.

Read our XTB Review

Exness

- Competitive Spreads: With a focus on tight spreads, Exness is suitable for frequent traders, especially those who actively pursue short-term opportunities in forex pairs or CFDs.

- Flexible Leverage: Exness provides variable leverage options, giving both novice and advanced traders the chance to adjust their trading strategies according to personal risk tolerance.

- Seamless Transactions: Fast deposits and withdrawals, along with diverse payment methods, make it convenient for global clients.

Read our Exness Review

Whether you’re zeroing in on low trading costs or advanced functionalities, both XTB and Exness deliver a compelling mix of services to meet your investing goals.

Still, it’s essential to conduct thorough research or even test brokers with a demo account to confirm they align with your personal style and strategy.

Getting Started with an Online Trading Broker

1. Open and Fund Your Account

Choose a broker that aligns with your local regulatory requirements and trading objectives. Once you register, you can typically fund your account via bank transfer, credit card, or other payment gateways.

2. Select Your Markets

Decide whether you’ll trade equities, indices, commodities, or focus on forex trading pairs. A diversified portfolio may offer more resilience, but always ensure you understand the nuances of each market.

3. Monitor Market Movements

Stay informed about corporate announcements, macroeconomic data, and geopolitical developments. Good brokers often feature live news feeds, economic calendars, or integrated market data.

4. Practice Risk Management

Use stop-loss orders to limit potential losses, especially in volatile conditions. If your broker offers negative balance protection, it can provide an extra safety net for margin-based trades.

5. Stay Educated

Many platforms incorporate tutorials, educational articles, and webinars. If you’re new, leveraging these resources can help you develop a structured approach, reducing costly mistakes.

Choose a broker that aligns with your local regulatory requirements and trading objectives. Once you register, you can typically fund your account via bank transfer, credit card, or other payment gateways.

2. Select Your Markets

Decide whether you’ll trade equities, indices, commodities, or focus on forex trading pairs. A diversified portfolio may offer more resilience, but always ensure you understand the nuances of each market.

3. Monitor Market Movements

Stay informed about corporate announcements, macroeconomic data, and geopolitical developments. Good brokers often feature live news feeds, economic calendars, or integrated market data.

4. Practice Risk Management

Use stop-loss orders to limit potential losses, especially in volatile conditions. If your broker offers negative balance protection, it can provide an extra safety net for margin-based trades.

5. Stay Educated

Many platforms incorporate tutorials, educational articles, and webinars. If you’re new, leveraging these resources can help you develop a structured approach, reducing costly mistakes.

Frequently Asked Questions

Which brokerage is best for international trading?

The “best” brokerage depends on your personal criteria, including fees, instruments offered, regulatory compliance, and customer support. Major names such as Interactive Brokers, Saxo, and XTB often top the list for international trading because they provide a broad range of assets, competitive fees, and user-friendly platforms. However, Exness is another strong contender for those who emphasize flexible leverage and an efficient account setup process.

What is the best global trading platform?

There’s no one-size-fits-all, since traders have varying needs—some want an advanced platform with algorithmic capabilities, while others prefer an intuitive layout. Well-regarded platforms include Interactive Brokers’ Trader Workstation, XTB’s xStation 5, IG’s proprietary system, and MetaTrader 4/5 from multiple brokers. If you want a well-rounded global platform, look for a provider that offers 24-hour trading, quality charting tools, and stable mobile compatibility.

Which broker is best in the UAE?

The UAE brokerage scene features robust offerings like Interactive Brokers, eToro, IG, and Saxo. XTB also stands out because of its user-friendly registration process and cost-effective trading options. Ultimately, the “best” depends on your trading habits. For instance, an investor focusing on U.S. stocks might prefer an entirely different broker than someone trading local UAE equities or currency pairs.

What is an international broker?

An international broker is a trading service provider that operates across multiple jurisdictions, granting traders access to global markets. These brokers maintain compliance with the regulations in various countries and often cater to clients worldwide. By registering with such a broker, you can trade or invest in assets listed in different markets—such as European stocks, U.S. shares, or Asian indices—from the convenience of one account.

The “best” brokerage depends on your personal criteria, including fees, instruments offered, regulatory compliance, and customer support. Major names such as Interactive Brokers, Saxo, and XTB often top the list for international trading because they provide a broad range of assets, competitive fees, and user-friendly platforms. However, Exness is another strong contender for those who emphasize flexible leverage and an efficient account setup process.

What is the best global trading platform?

There’s no one-size-fits-all, since traders have varying needs—some want an advanced platform with algorithmic capabilities, while others prefer an intuitive layout. Well-regarded platforms include Interactive Brokers’ Trader Workstation, XTB’s xStation 5, IG’s proprietary system, and MetaTrader 4/5 from multiple brokers. If you want a well-rounded global platform, look for a provider that offers 24-hour trading, quality charting tools, and stable mobile compatibility.

Which broker is best in the UAE?

The UAE brokerage scene features robust offerings like Interactive Brokers, eToro, IG, and Saxo. XTB also stands out because of its user-friendly registration process and cost-effective trading options. Ultimately, the “best” depends on your trading habits. For instance, an investor focusing on U.S. stocks might prefer an entirely different broker than someone trading local UAE equities or currency pairs.

What is an international broker?

An international broker is a trading service provider that operates across multiple jurisdictions, granting traders access to global markets. These brokers maintain compliance with the regulations in various countries and often cater to clients worldwide. By registering with such a broker, you can trade or invest in assets listed in different markets—such as European stocks, U.S. shares, or Asian indices—from the convenience of one account.