By Sam Reid

Navigating that sea of options requires more than just clicking the lowest commission fee. It calls for an online broker comparison that digs into account types, trading tools, regulatory safeguards, and user experience. We’ve reviewed the key factors that matter so you can zero in on the right partner for your financial journey.

Why an Online Broker Comparison Matters

Choosing a broker is not a one-size-fits-all decision. Your trading style, capital commitment, and preferred markets all shape what features you need most. An effective online broker comparison helps you:

Without a structured approach, you risk hidden fees, subpar tools, or even regulatory pitfalls. Our in-depth look at XTB and its peers shines light on what truly moves the needle for traders of all levels.

- Clarify goals (long-term investing vs. active trading).

- Understand real costs (spreads, commissions, funding fees).

- Match platform capabilities (charting, mobile apps, order types).

- Verify safety nets (regulation, deposit protection, customer support).

Without a structured approach, you risk hidden fees, subpar tools, or even regulatory pitfalls. Our in-depth look at XTB and its peers shines light on what truly moves the needle for traders of all levels.

Our Top Pick: XTB

When we ran the numbers—spreads, funding options, platform scores, and service metrics—XTB emerged as our prime choice. Why XTB?

- Transparent fees: Zero commission on stock trades, ultra-tight forex spreads starting at 0.6 pips.

- No inactivity fee: Keeps your costs down if your strategy calls for long pauses.

- Strong regulation: FCA-UK and SCA-UAE oversight means your funds are ring-fenced and protected.

- Intuitive platform: Award-winning web and mobile experiences make charting and execution seamless.

As a leading trading broker Dubai investors trust, XTB checks every box. Whether you’re just dipping your toes into the market or scaling up a sophisticated strategy, XTB’s blend of transparency and power makes it our go-to recommendation.

Key Factors in Choosing a Broker

Account Types & Trading Styles

First, define your approach:

Scalpers profit from tiny price movements within minutes or seconds. XTB supports all of these styles with dedicated account settings and leverage options.

- Investment accounts for buy-and-hold strategies, dividend income, and ETFs.

- CFD accounts for margin-based trading across indices, commodities, and currency pairs.

- Demo accounts that let you practise risk-free with virtual capital before committing real funds.

First, define your approach:

- Position traders hold for months or years.

- Swing traders target days-to-weeks opportunities.

- Day traders close positions intraday.

Scalpers profit from tiny price movements within minutes or seconds. XTB supports all of these styles with dedicated account settings and leverage options.

Markets & Instruments

Your broker should offer the assets you care about:

- Equities: Hundreds of global stocks with zero-commission trading.

- Forex: Major, minor, and exotic currency pairs.

- Indices & Commodities: From S&P 500 CFDs to gold, oil, and agricultural goods.

- ETFs & Bonds: Diversify via baskets and fixed-income products.

Not all brokers list every market. Our survey showed XTB boasts coverage of over 2,000 instruments—ideal for multi-asset portfolios.

Costs & Fees

Direct and indirect fees can erode profits:

- Spreads: The bid-ask gap you pay on every trade.

- Commissions: Flat or tiered charges per trade.

- Overnight funding: Interest on leveraged positions held past market close.

- Inactivity fees: Penalties if you don’t trade frequently.

We’ve benchmarked dozens of platforms. XTB’s zero stock commissions and low forex spreads make it especially cost-efficient for active and passive traders alike.

Platform & Tools

A broker’s tech stack can make or break your trading workflow.

- Charting packages with technical indicators and drawing tools.

- Order types such as limit, stop, trailing stops, and one-cancels-the-other.

- Mobile apps for on-the-go monitoring and execution.

- APIs for automated or algorithmic trading.

XTB’s proprietary xStation platform earns top marks for speed, reliability, and ease of navigation. It also offers educational content and integrated news feeds.

Support & Education

Even experienced traders need backup:

- 24/5 customer service, with multi-channel access (live chat, email, phone).

- Webinars & courses to sharpen skills.

- Research reports on economic events and market outlooks.

- XTB’s free educational library and responsive support team made our list for best-in-class client care.

Trading Hours & Accessibility

Markets move around the clock. Choose a broker that opens the right windows:

- 24/5 forex & indices coverage.

- Extended hours for US equities and cryptos.

- Weekend markets on selected assets.

XTB offers some of the broadest trading windows available, so you never miss a key opportunity.

How We Evaluated Brokers

Our methodology blended qualitative and quantitative metrics:

1. Regulatory standing: Tier-1 licenses, segregation of client funds.

2. Price transparency: Real-time spread monitoring and commission disclosure.

3. Platform performance: Load times, feature sets, and mobile ratings.

4. Customer feedback: Independent user reviews and support-ticket resolution rates.

5. Account opening experience: Speed, documentation requirements, and ease of KYC checks.

This rigorous approach ensures our online broker comparison reflects the realities of real-world trading.

1. Regulatory standing: Tier-1 licenses, segregation of client funds.

2. Price transparency: Real-time spread monitoring and commission disclosure.

3. Platform performance: Load times, feature sets, and mobile ratings.

4. Customer feedback: Independent user reviews and support-ticket resolution rates.

5. Account opening experience: Speed, documentation requirements, and ease of KYC checks.

This rigorous approach ensures our online broker comparison reflects the realities of real-world trading.

Why XTB Leads the Pack

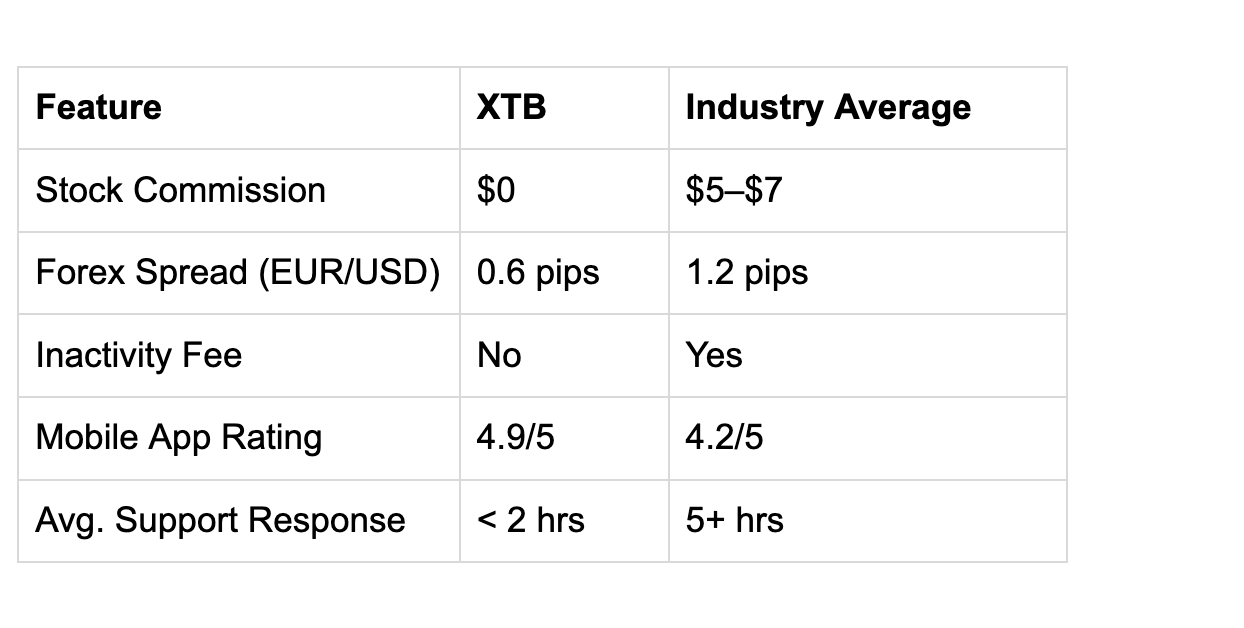

Across every category, pricing, product offering, platform stability, and client support, XTB consistently ranks at the top. Here’s a snapshot:

Whether you’re eyeing long-term growth or swift trade executions, XTB’s combination of low costs and high reliability makes it our undisputed top recommendation.

Getting Started with XTB

1. Open a demo account with $10,000 in virtual funds—no credit card required.

2. Explore xStation’s features, from advanced charting to one-click order entry.

3. Fund your live account via bank transfer, credit card, or e-wallet.

4. Begin trading across stocks, forex, CFDs, and more—powered by XTB’s award-winning support.

We guide new users every step of the way to ensure a smooth launch.

2. Explore xStation’s features, from advanced charting to one-click order entry.

3. Fund your live account via bank transfer, credit card, or e-wallet.

4. Begin trading across stocks, forex, CFDs, and more—powered by XTB’s award-winning support.

We guide new users every step of the way to ensure a smooth launch.

FAQs

What are the top 10 trading platforms?

Check out our top picks here.

What are the best online stock broker for beginners?

XTB’s zero-commission stock trading and intuitive interface make it the best online stock broker for beginners.

Where is the best place to buy stocks for beginners?

For new investors, XTB offers a user-friendly environment, comprehensive educational resources, and hands-on support—making it the best place to buy stocks for beginners.

Check out our top picks here.

What are the best online stock broker for beginners?

XTB’s zero-commission stock trading and intuitive interface make it the best online stock broker for beginners.

Where is the best place to buy stocks for beginners?

For new investors, XTB offers a user-friendly environment, comprehensive educational resources, and hands-on support—making it the best place to buy stocks for beginners.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

Not investment advise. Content above is only for educational purposes.