By Sam Reid

Many hesitate about unsure where to begin when it comes to UAE stock investing. In this guide, we’ll walk you through every step—no jargon, no fluff—so we can help you buy stocks in the Middle East with confidence.

Understanding Middle Eastern Stock Markets

While each country has its nuances, the core process is remarkably similar across the region. Here’s a quick look at the UAE exchanges, which illustrate the typical structure you’ll encounter:

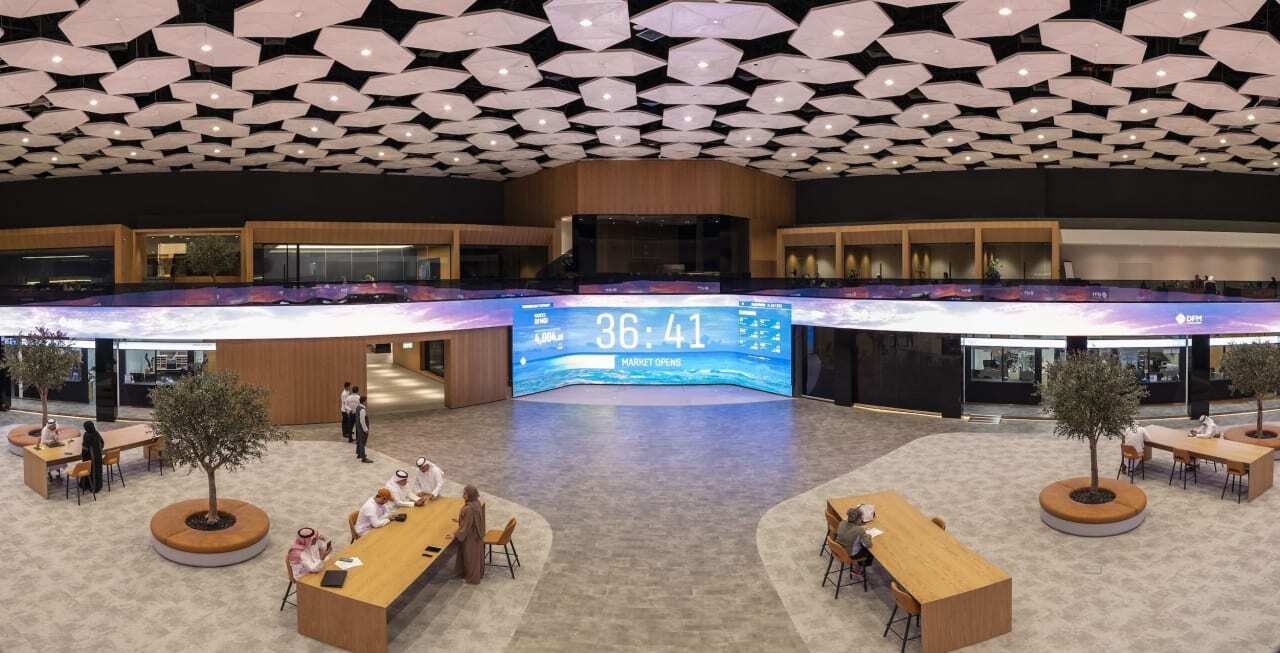

Dubai Financial Market (DFM):

Abu Dhabi Securities Exchange (ADX):

NASDAQ Dubai:

Dubai Financial Market (DFM):

- Established 2000, Sharia-compliant, 170+ securities.

- Trading: Sun–Thu, 10:00 AM–1:50 PM (GST).

Abu Dhabi Securities Exchange (ADX):

- Established 2000, 73 listings spanning local giants.

- Trading: Sun–Thu, 10:00 AM–1:50 PM.

NASDAQ Dubai:

- Launched 2005, 146 regional and international listings (shares, bonds, Sukuk, REITs).

- Trading: Sun–Thu, 10:00 AM–2:00 PM.

Although we focus on the UAE above, similar frameworks exist in Saudi Arabia’s Tadawul, Qatar Stock Exchange, and others. The steps remain consistent: get your ID number, choose a broker, place your orders, and monitor your holdings.

Step 1: Obtain Your Investor Number (NIN)

In the United Arab Emirates (UAE), obtaining a National Investor Number is a prerequisite for trading stocks on local exchanges such as the Dubai Financial Market (DFM), Abu Dhabi Securities Exchange (ADX), and Nasdaq Dubai.

1. Choose your exchange (DFM, ADX, NASDAQ Dubai).

2. Submit the application online or offline with a passport copy (for individuals) or corporate docs (for entities).

3. Receive your NIN—your key to accessing any UAE market.

Expats and even tourists can apply, provided they complete the required paperwork. Once they have that NIN, the door is wide open.

NOTE: If you're trading stocks as Contracts for Difference (CFDs) or investing through a custodial platform like amana, you do not need to obtain a National Investor Number (NIN) in the UAE.

CFDs allow you to speculate on price movements without owning the actual shares or interacting with UAE stock exchanges. Similarly, if you're investing in regional stocks through a broker like amana, which holds assets in custody on your behalf, the need for a NIN is bypassed.

These setups simplify access to both local and global markets without the administrative steps required for direct stock exchange participation.

1. Choose your exchange (DFM, ADX, NASDAQ Dubai).

2. Submit the application online or offline with a passport copy (for individuals) or corporate docs (for entities).

3. Receive your NIN—your key to accessing any UAE market.

Expats and even tourists can apply, provided they complete the required paperwork. Once they have that NIN, the door is wide open.

NOTE: If you're trading stocks as Contracts for Difference (CFDs) or investing through a custodial platform like amana, you do not need to obtain a National Investor Number (NIN) in the UAE.

CFDs allow you to speculate on price movements without owning the actual shares or interacting with UAE stock exchanges. Similarly, if you're investing in regional stocks through a broker like amana, which holds assets in custody on your behalf, the need for a NIN is bypassed.

These setups simplify access to both local and global markets without the administrative steps required for direct stock exchange participation.

Step 2: Select the Right Broker

Your broker is the bridge between you and the exchange. We always weigh up:

When we evaluate brokers for stock trading, we look at their fee structures, execution speeds, and educational resources. Reliability and transparency are essential qualities of any brokers for stock trading catering to the Gulf region.

We also compare trading brokers in middle east to identify which platforms offer seamless access to major markets. Our list of trading brokers in middle east highlights both local experts and global players, each bringing unique strengths to the table. Two platforms we often recommend are Multibank Group and Amana, thanks to their user-friendly interfaces, robust regional support, and competitive pricing.

- Fees & commissions

- Platform usability (desktop + mobile)

- Customer support (regional availability)

When we evaluate brokers for stock trading, we look at their fee structures, execution speeds, and educational resources. Reliability and transparency are essential qualities of any brokers for stock trading catering to the Gulf region.

We also compare trading brokers in middle east to identify which platforms offer seamless access to major markets. Our list of trading brokers in middle east highlights both local experts and global players, each bringing unique strengths to the table. Two platforms we often recommend are Multibank Group and Amana, thanks to their user-friendly interfaces, robust regional support, and competitive pricing.

Step 3: Place Your First Order

With your broker in hand, you can choose from these common order types:

The process is smoother than you think! Simply log in, select your stock, choose the order type, enter the quantity (or fractional share), and confirm. Your broker will handle the rest.

- Market order: Executes immediately at the current price.

- Limit order: Sets a maximum buy or minimum sell price.

- Stop order: Triggers a market order once a specified price is hit.

The process is smoother than you think! Simply log in, select your stock, choose the order type, enter the quantity (or fractional share), and confirm. Your broker will handle the rest.

Step 4: Manage Your Portfolio

Investing isn’t “set and forget.” We recommend:

Keep an eye on earnings reports, macroeconomic data, and sector trends. A well-balanced portfolio can smooth out volatility and harness compounding growth.

- Diversification: Spread capital across sectors and countries to reduce risk.

- Periodic rebalancing: Review allocations every quarter or semi-annually.

- Long-term perspective: Resist the urge to time the market; time in the market wins.

Keep an eye on earnings reports, macroeconomic data, and sector trends. A well-balanced portfolio can smooth out volatility and harness compounding growth.

Practical Example: Investing 1,000 AED

If you start with 1,000 AED, here’s a simple approach:

1. Choose a platform (e.g. Amana or Multibank Group) that supports fractional shares.

2. Allocate roughly 20% (200 AED) to a UAE blue-chip ETF for stability.

3. Divide the remainder across two or three companies in different sectors (finance, telecom, healthcare).

4. Use a limit order to target an entry price below today’s market rate.

5. Monitor and rebalance every three months.

This strategy balances growth potential with risk control.

1. Choose a platform (e.g. Amana or Multibank Group) that supports fractional shares.

2. Allocate roughly 20% (200 AED) to a UAE blue-chip ETF for stability.

3. Divide the remainder across two or three companies in different sectors (finance, telecom, healthcare).

4. Use a limit order to target an entry price below today’s market rate.

5. Monitor and rebalance every three months.

This strategy balances growth potential with risk control.

Key Takeaways

- Obtain your NIN (if you're directly investing) to unlock access to any UAE exchange.

- Compare fees, platforms, and support when choosing a broker.

- Place market, limit, or stop orders through your broker’s portal.

Diversify and adopt a long-term view to maximise returns and minimise risk.

FAQs

How to invest in Middle East stocks?

Apply for your NIN, select a regional or international broker, research companies or ETFs, place your orders, and manage your portfolio as you would in any mature market.

How to buy stocks in UAE?

Obtain an NIN via DFM, ADX, or NASDAQ Dubai; open an account with a local or online broker; fund your account; then issue market or limit orders to purchase shares.

What is the 7% rule in stocks?

The 7% rule suggests you shouldn’t allocate more than 7% of your portfolio to any single stock—this helps prevent overexposure and caps potential losses.

How to invest 1,000 AED in UAE?

Use a broker that enables fractional-share purchases. You can allocate portions of your 1,000 AED across ETFs and two to three individual stocks, then rebalance periodically to fit your investing style.

Apply for your NIN, select a regional or international broker, research companies or ETFs, place your orders, and manage your portfolio as you would in any mature market.

How to buy stocks in UAE?

Obtain an NIN via DFM, ADX, or NASDAQ Dubai; open an account with a local or online broker; fund your account; then issue market or limit orders to purchase shares.

What is the 7% rule in stocks?

The 7% rule suggests you shouldn’t allocate more than 7% of your portfolio to any single stock—this helps prevent overexposure and caps potential losses.

How to invest 1,000 AED in UAE?

Use a broker that enables fractional-share purchases. You can allocate portions of your 1,000 AED across ETFs and two to three individual stocks, then rebalance periodically to fit your investing style.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

Not investment advise. Content above is only for educational purposes.