By Sam Reid

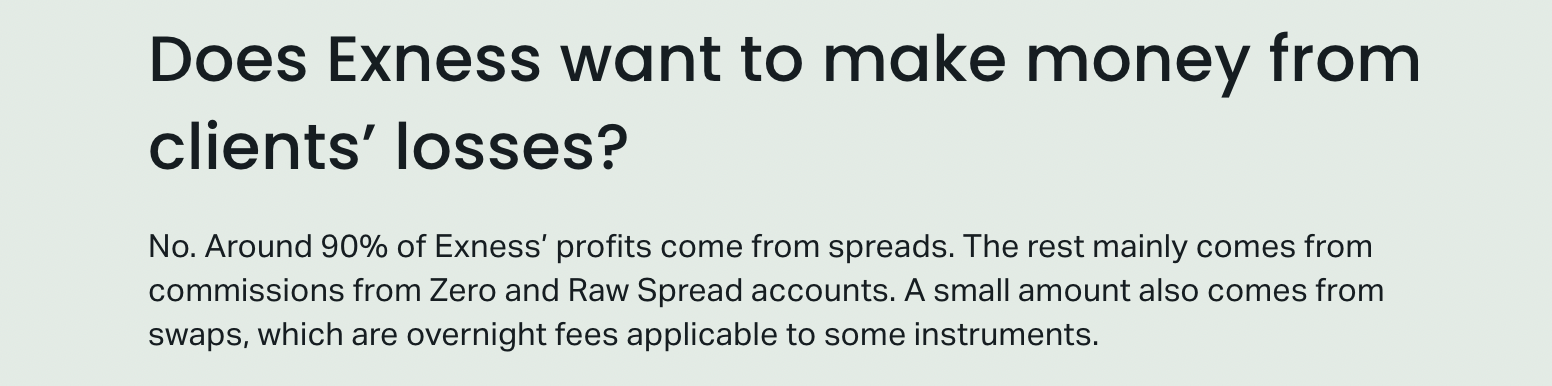

There’s a fascinating statistic circulating among forex traders: roughly 90% of Exness' profits come from spreads alone. That might surprise some traders who assume brokers earn primarily from client losses. It’s a solid reminder that understanding how fees, spreads, and commissions work can make or break your experience in the market.

In this article, we’ll walk through the essentials of Exness fees and spreads, referencing key insights from three in-depth resources. We’ll see why spreads matter, how different account types come into play, and how all these factors can fit into your trading strategy.

If you’re searching for clarity on what your trades will actually cost, you’re in the right place.

In this article, we’ll walk through the essentials of Exness fees and spreads, referencing key insights from three in-depth resources. We’ll see why spreads matter, how different account types come into play, and how all these factors can fit into your trading strategy.

If you’re searching for clarity on what your trades will actually cost, you’re in the right place.

Why Spreads Matter in Forex Trading

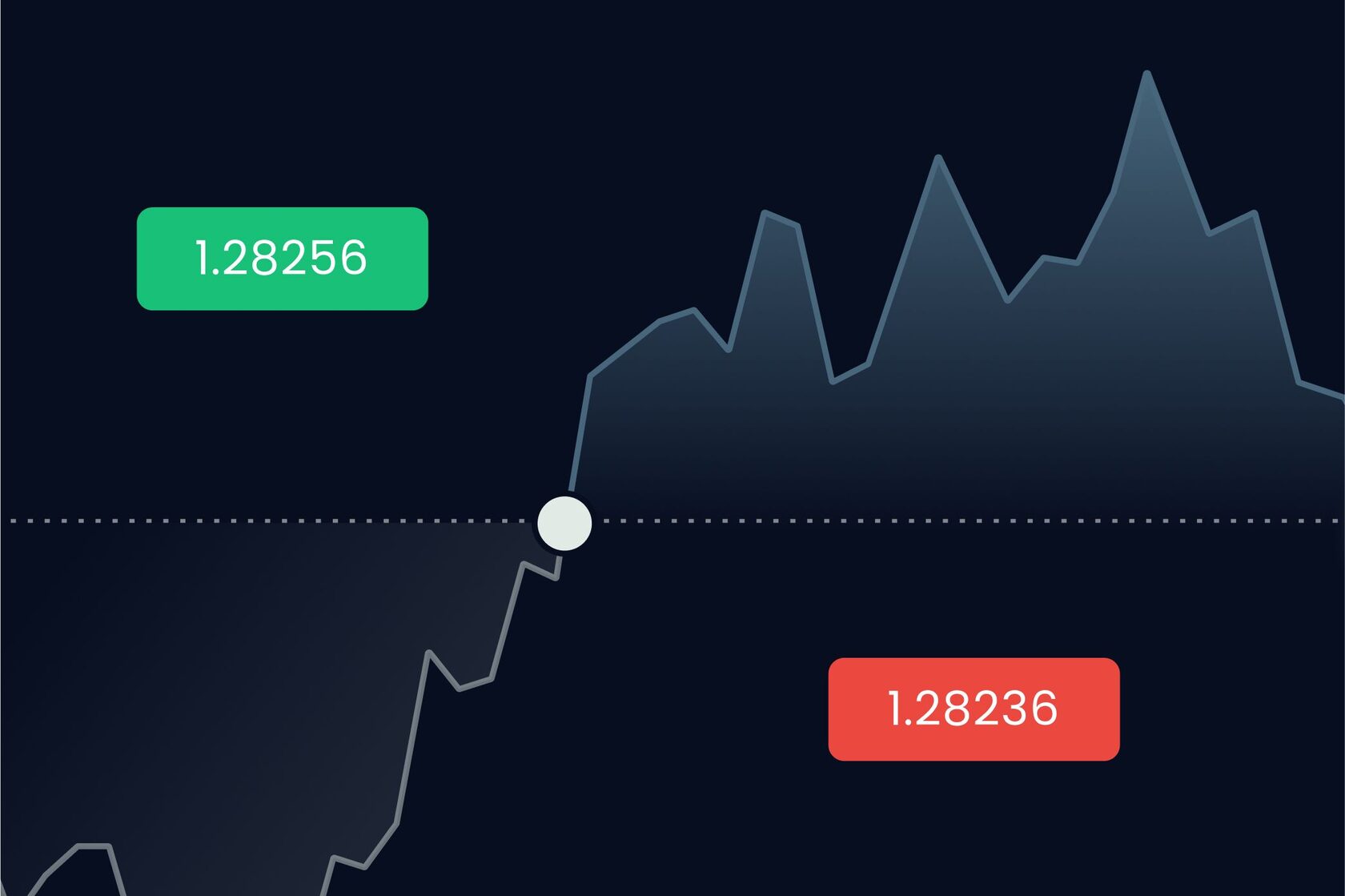

At its core, a spread is the difference between the bid and ask price of a financial instrument. It’s also one of the main ways brokers, including Exness, make money. When you open a position, you effectively pay this difference as your “entry fee.”

In forex, even small changes in the spread can have a noticeable impact on your bottom line, especially for traders who run high-frequency strategies or place many short-term trades. If the spread is too large or unpredictable, it can eat into any potential profits.

According to one of our referenced articles, Exness stands out by maintaining stable spreads for around 95% of the trading day, even though it’s impossible to avoid spikes during massive news releases or extreme market volatility.

In limiting these big jumps, Exness can give traders better cost predictability.

In forex, even small changes in the spread can have a noticeable impact on your bottom line, especially for traders who run high-frequency strategies or place many short-term trades. If the spread is too large or unpredictable, it can eat into any potential profits.

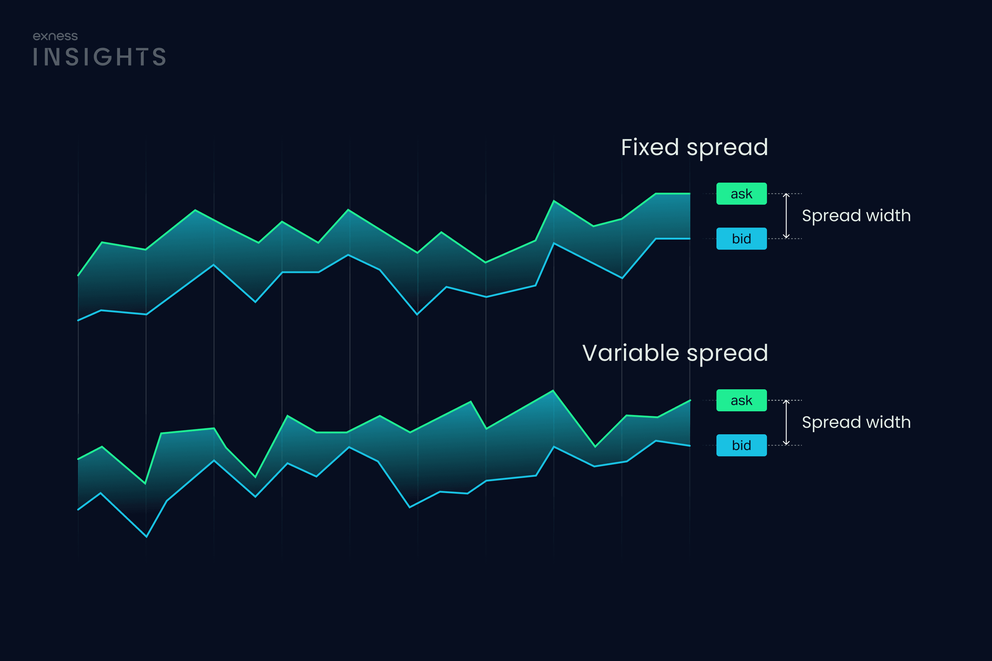

- Floating spreads: These move up or down in response to market conditions, liquidity, news, and other factors.

- Fixed spreads: Rare in the forex world, these remain constant regardless of market conditions, but they’re not truly reflective of how real-time markets function.

- Stable spreads: Offered by Exness, these typically do not fluctuate wildly and remain close to an average value most of the time.

According to one of our referenced articles, Exness stands out by maintaining stable spreads for around 95% of the trading day, even though it’s impossible to avoid spikes during massive news releases or extreme market volatility.

In limiting these big jumps, Exness can give traders better cost predictability.

Overview of Exness Fees and Charges

A good Exness review can’t skip over the subject of fees and charges. Besides spreads, there are commissions, swap rates, and (in some cases) currency conversion fees.

Fortunately, Exness is transparent about what you’re paying.

Fortunately, Exness is transparent about what you’re paying.

Spreads as the Primary Fee

For many instruments, especially in standard or pro accounts, the spread is the main fee you’ll encounter. According to one breakdown, the Exness commission-free Standard account features an average EUR/USD spread of around 1.0 pip, or $10.00 per 1.0 standard lot. If you step up to a Pro account, you may see that spread drop to around 0.6 pips on EUR/USD, which equates to $6.00 for each round lot.

For many instruments, especially in standard or pro accounts, the spread is the main fee you’ll encounter. According to one breakdown, the Exness commission-free Standard account features an average EUR/USD spread of around 1.0 pip, or $10.00 per 1.0 standard lot. If you step up to a Pro account, you may see that spread drop to around 0.6 pips on EUR/USD, which equates to $6.00 for each round lot.

Commissions

Traders focused on raw spreads—especially those who scalp or use algorithmic strategies—may prefer accounts with a commission.

For instance, there’s a $7.00 per round lot commission if you want raw spreads from 0.0 pips in the right account setup. Equity traders, meanwhile, pay asset-dependent commissions, ranging from $0.81 to $28.76, depending on the stock and the platform specifics.

Swap Rates (Overnight Financing Fees)

Swap rates apply to positions you hold overnight, and they can triple on Wednesdays to account for weekend trading sessions. If you’re someone who opens and closes trades within the day, swaps might not matter much. However, if you hold positions long term, keep an eye on this cost. It can quietly become the biggest fee in your strategy if you’re not careful.

Swap rates apply to positions you hold overnight, and they can triple on Wednesdays to account for weekend trading sessions. If you’re someone who opens and closes trades within the day, swaps might not matter much. However, if you hold positions long term, keep an eye on this cost. It can quietly become the biggest fee in your strategy if you’re not careful.

Non-Trading Fees

One big advantage of Exness is that it doesn’t charge internal deposit or withdrawal fees. Also, there’s no inactivity fee, making it appealing for traders who occasionally take a break from the markets.

The only potential non-trading cost you might face is currency conversion if you deposit or withdraw in a different currency than your account’s base currency.

One big advantage of Exness is that it doesn’t charge internal deposit or withdrawal fees. Also, there’s no inactivity fee, making it appealing for traders who occasionally take a break from the markets.

The only potential non-trading cost you might face is currency conversion if you deposit or withdraw in a different currency than your account’s base currency.

Why This Matters for Traders

Keeping costs low is essential. After all, every pip or point you lose to spreads and fees is a pip or point you can’t put toward potential profit. For traders picking trading brokers in the UAE market or those just exploring different forex venues, reviewing fee structures is a crucial step before opening an account.

Professional Account Choices

Exness offers multiple account types tailored to various trading styles. While the Standard account is an excellent place to start for beginners, three primary “professional” accounts come with unique perks:

Pro Account

- Minimum deposit: $3,000

- Spread: From 0.1 pips

- Commission: No commission

- Execution type: Instant (for most instruments), market (for cryptocurrencies)

- Key appeal: This account generally has low spreads and zero commissions. For many traders aiming for short-term trades but wanting cost transparency, this is a solid choice.

Zero Account

- Minimum deposit: $3,000

- Spread: From 0 pips

- Commission: Starts as low as $0.05 each side per lot

- Execution type: Market execution

- Key appeal: Zero or near-zero spreads, particularly on the top 30 instruments. It’s especially attractive for scalpers, day traders, or algorithmic traders who rely on minimal spread fluctuation.

Raw Spread Account

- Minimum deposit: $3,000

- Spread: From 0 pips

- Commission: Up to $3.50 each side per lot

- Execution type: Market execution

- Key appeal: It splits the cost between a low spread and a moderate commission, giving you flexibility across varying market conditions and trading strategies.

Each professional account requires a $3,000 minimum deposit, which might be intimidating for some traders. However, it’s important to note that these accounts deliver greater control over your trading costs.

If you regularly trade large positions, even small differences in the spread can translate to big savings over time.

If you regularly trade large positions, even small differences in the spread can translate to big savings over time.

How Exness Stays Competitive

Several factors set Exness apart when it comes to fees and spreads:

- Stable Spreads – Exness invests in server infrastructure and advanced technology to maintain consistent spreads.

- Zero Commission on Many Instruments – Not every broker offers commission-free trading on a wide range of popular instruments.

- Swap-Free Options – Many liquid assets come with no swap fees, useful for mid- to long-term traders seeking low financing costs.

- Transparent Practices – Exness publicly shares data such as average spreads, and it covers third-party deposit and withdrawal costs, minimizing unexpected deductions from your account.

In many ways, the company’s approach revolves around the idea that if its clients succeed, they’ll trade more. Since 90% of Exness’ revenue comes from spreads, it doesn’t rely on traders losing money.

That means its core profits grow when customers place more trades—an alignment of interests that fosters ongoing innovation and improvement.

That means its core profits grow when customers place more trades—an alignment of interests that fosters ongoing innovation and improvement.

How Does This Compare to Other Brokers?

Every trader has a different set of requirements: some focus exclusively on the tightest possible spreads, while others want zero commissions or flexible deposit methods.

Although many platforms attempt to match or beat Exness on at least one pricing point, few can match its blend of consistent spreads, minimal commissions, and broad asset coverage.

When you combine these competitive fees with advanced account types, you get a balanced trading environment.

If you check an Exness review from experienced market participants, you’ll often see praise for the broker’s unique swap-free offering on many instruments, straightforward cost structure, and stable trading environment.

This is particularly important for advanced traders and professionals who rely on speed, reliability, and transparency to execute sophisticated strategies.

Although many platforms attempt to match or beat Exness on at least one pricing point, few can match its blend of consistent spreads, minimal commissions, and broad asset coverage.

When you combine these competitive fees with advanced account types, you get a balanced trading environment.

If you check an Exness review from experienced market participants, you’ll often see praise for the broker’s unique swap-free offering on many instruments, straightforward cost structure, and stable trading environment.

This is particularly important for advanced traders and professionals who rely on speed, reliability, and transparency to execute sophisticated strategies.

Exness Frequently Asked Questions (FAQs)

Here are some of the most commonly asked questions about fees, spreads, and other aspects of the Exness trading environment:

1. How much is 0.01 lot in Exness?

A 0.01 lot is often called a “micro lot,” representing 1,000 units of the base currency in forex. For a currency pair like EUR/USD, if each pip is worth about $1 in a 1.0 standard lot, that means a 0.01 lot typically yields $0.10 per pip. However, the exact value can vary depending on the instrument and account type. You can use Exness’ trading calculator to see how much the pip value is in real time.

2. Does Exness have a commission fee?

Yes, but it depends on the account. Standard and Pro accounts usually have no commissions, while Zero and Raw Spread accounts feature commissions in return for tighter spreads (sometimes near zero). For example, with a Zero account, you could face commissions starting from $0.05 per side per lot, which is quite competitive.

3. What are the rules for Exness trading?

Exness follows standard retail forex rules, including compliance with relevant regulators, margin requirements, and position sizing limits. Keep in mind:

For more detailed guidelines, consult the official Exness website or your chosen platform’s “terms and conditions.”

4. How to get 0 spread in Exness?

To achieve near 0 pips or even 0 pips for some instruments, you can select either the Zero account or the Raw Spread account. The Zero account often provides spreads starting from 0 pips on the top 30 instruments, and the Raw Spread account also begins at 0 pips but charges a modest commission for each trade. Keep in mind that 0 spread does not necessarily mean zero cost—commission fees still apply.

5. Can I trade with $10 on Exness?

Yes. While some professional accounts require a minimum deposit of $3,000, the Standard account allows you to start with a lower deposit. That means you can open a live account and begin trading with as little as $10 or even less, depending on your funding method. However, small deposits limit position sizes, so it’s crucial to practice risk management carefully.

6. How much is 1 pip in gold?

With gold, the pip location can differ from standard forex pairs. For example, if a typical forex pip is the fourth decimal place, gold might have a different price format. The best way to see how much 1 pip is worth in gold is by using the Exness trading calculator. Enter the instrument (XAU/USD), your lot size, and your account type to get the exact pip value in real time.

A 0.01 lot is often called a “micro lot,” representing 1,000 units of the base currency in forex. For a currency pair like EUR/USD, if each pip is worth about $1 in a 1.0 standard lot, that means a 0.01 lot typically yields $0.10 per pip. However, the exact value can vary depending on the instrument and account type. You can use Exness’ trading calculator to see how much the pip value is in real time.

2. Does Exness have a commission fee?

Yes, but it depends on the account. Standard and Pro accounts usually have no commissions, while Zero and Raw Spread accounts feature commissions in return for tighter spreads (sometimes near zero). For example, with a Zero account, you could face commissions starting from $0.05 per side per lot, which is quite competitive.

3. What are the rules for Exness trading?

Exness follows standard retail forex rules, including compliance with relevant regulators, margin requirements, and position sizing limits. Keep in mind:

- You must maintain the required margin at all times.

- You cannot let your account dip below the stop-out level (0% for most instruments, subject to specific conditions).

- You must adhere to instrument-specific trading hours and volatility constraints, especially around major news events.

For more detailed guidelines, consult the official Exness website or your chosen platform’s “terms and conditions.”

4. How to get 0 spread in Exness?

To achieve near 0 pips or even 0 pips for some instruments, you can select either the Zero account or the Raw Spread account. The Zero account often provides spreads starting from 0 pips on the top 30 instruments, and the Raw Spread account also begins at 0 pips but charges a modest commission for each trade. Keep in mind that 0 spread does not necessarily mean zero cost—commission fees still apply.

5. Can I trade with $10 on Exness?

Yes. While some professional accounts require a minimum deposit of $3,000, the Standard account allows you to start with a lower deposit. That means you can open a live account and begin trading with as little as $10 or even less, depending on your funding method. However, small deposits limit position sizes, so it’s crucial to practice risk management carefully.

6. How much is 1 pip in gold?

With gold, the pip location can differ from standard forex pairs. For example, if a typical forex pip is the fourth decimal place, gold might have a different price format. The best way to see how much 1 pip is worth in gold is by using the Exness trading calculator. Enter the instrument (XAU/USD), your lot size, and your account type to get the exact pip value in real time.

Final Thoughts

When it comes to fees, spreads, and commissions, Exness has positioned itself as one of the more competitive choices in the market. Whether you’re a brand-new trader looking for a low-barrier entry or a high-octane professional seeking tight spreads for your scalping strategy, there’s likely an account type that meets your needs.

It’s also comforting to know that Exness invests heavily in transparency and stability. By publishing real-time spreads, covering third-party costs, and offering swap-free trading on many popular assets, the broker aims to keep fees predictable and fair.

Ultimately, the right account type depends on how you prefer to trade. If you’re a frequent intraday trader or run automated algorithms, zero-spread conditions might be your priority—even if it means paying a commission. If you’d rather stick with a straightforward spread-based model, the Pro account could be ideal, especially given its relatively tight average spread on many instruments.

In any case, be sure to incorporate a reliable cost assessment into your overall trading plan. Even if you find yourself paying a fraction of a pip more or less on each trade, those small differences add up. Exness appears keenly aware of this, structuring its spreads, fees, and commissions to suit just about any trading approach in a transparent way.

Remember, no matter which approach you take or which broker you ultimately work with, always factor fees and spreads into your strategy from the start. Over the long term, a few pips saved here and there could be the difference between losing money or walking away with a meaningful profit.

It’s also comforting to know that Exness invests heavily in transparency and stability. By publishing real-time spreads, covering third-party costs, and offering swap-free trading on many popular assets, the broker aims to keep fees predictable and fair.

Ultimately, the right account type depends on how you prefer to trade. If you’re a frequent intraday trader or run automated algorithms, zero-spread conditions might be your priority—even if it means paying a commission. If you’d rather stick with a straightforward spread-based model, the Pro account could be ideal, especially given its relatively tight average spread on many instruments.

In any case, be sure to incorporate a reliable cost assessment into your overall trading plan. Even if you find yourself paying a fraction of a pip more or less on each trade, those small differences add up. Exness appears keenly aware of this, structuring its spreads, fees, and commissions to suit just about any trading approach in a transparent way.

Remember, no matter which approach you take or which broker you ultimately work with, always factor fees and spreads into your strategy from the start. Over the long term, a few pips saved here and there could be the difference between losing money or walking away with a meaningful profit.

Ready to Start Trading? Register with Exness Today!

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.