By Sam Reid

Experts estimate that the daily turnover in the forex market often exceeds $7 trillion, making it by far the largest and most liquid financial market worldwide.

This immense trading volume can present traders with remarkable opportunities, especially when combined with the power of leverage and margin. But with these advantages comes an equally significant responsibility to learn exactly how leverage and margin function—and how they can rapidly affect both profits and losses!

Here, we’ll explore what leverage and margin mean specifically for Exness traders, share practical examples, highlight the role of stop out in risk management, and provide essential tips for handling these powerful tools. By the end, you’ll have a clear and thorough understanding of how to harness leverage and margin effectively.

This immense trading volume can present traders with remarkable opportunities, especially when combined with the power of leverage and margin. But with these advantages comes an equally significant responsibility to learn exactly how leverage and margin function—and how they can rapidly affect both profits and losses!

Here, we’ll explore what leverage and margin mean specifically for Exness traders, share practical examples, highlight the role of stop out in risk management, and provide essential tips for handling these powerful tools. By the end, you’ll have a clear and thorough understanding of how to harness leverage and margin effectively.

Understanding Leverage and Margin

What Is Leverage?

Leverage is the ratio that allows you to open larger trades than your deposit would normally allow. If you have 1:100 leverage, for every $1 you deposit, you can effectively control $100 in buying or selling power. This amplification of market exposure can create exciting gains if the market moves in your favor. Conversely, it can also magnify losses if prices swing against you.

Some trading brokers online offer very high levels of leverage. On Exness, for example, you could theoretically use leverage as high as 1:Unlimited under certain conditions. However, this option is not automatically available at all times.

As your balance grows, your maximum available leverage often decreases, especially around major news releases like non-farm payrolls. This dynamic approach helps reduce the chance of large, rapid losses.

Leverage is the ratio that allows you to open larger trades than your deposit would normally allow. If you have 1:100 leverage, for every $1 you deposit, you can effectively control $100 in buying or selling power. This amplification of market exposure can create exciting gains if the market moves in your favor. Conversely, it can also magnify losses if prices swing against you.

Some trading brokers online offer very high levels of leverage. On Exness, for example, you could theoretically use leverage as high as 1:Unlimited under certain conditions. However, this option is not automatically available at all times.

As your balance grows, your maximum available leverage often decreases, especially around major news releases like non-farm payrolls. This dynamic approach helps reduce the chance of large, rapid losses.

What Is Margin?

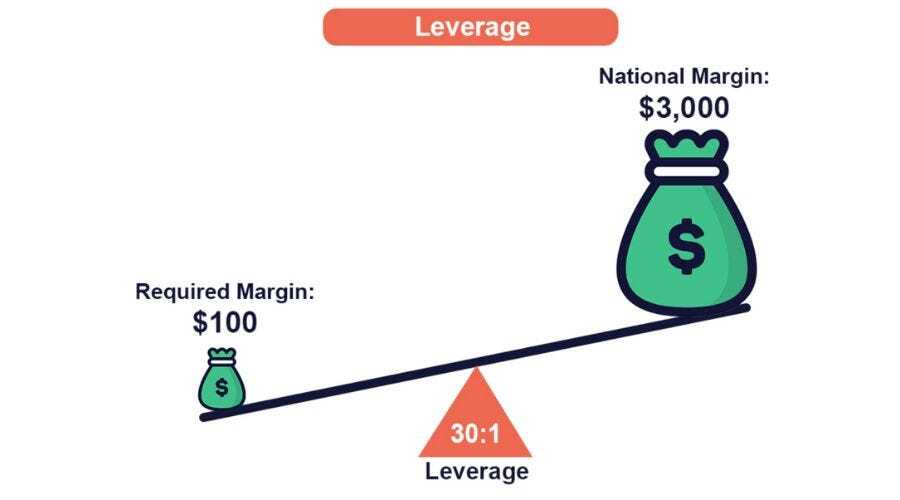

Margin is the “good faith” deposit required to keep your positions open. It’s a fraction of your overall trade size and depends on your chosen leverage. The higher your leverage, the smaller your margin requirement needs to be. If you use 1:500 leverage to open a $50,000 position, you might only need $100 as margin in your account. However, that also means your trade is more sensitive to smaller fluctuations in the market.

Here’s how margin typically functions on Exness (and on similar trading brokers online):

- Balance: the actual money you’ve deposited into your account.

- Equity: your balance plus/minus floating profits or losses from open positions.

- Used Margin: the portion of your equity set aside as collateral for your open trades.

- Free Margin: what’s left of your equity that you can use to open new trades or absorb further losses.

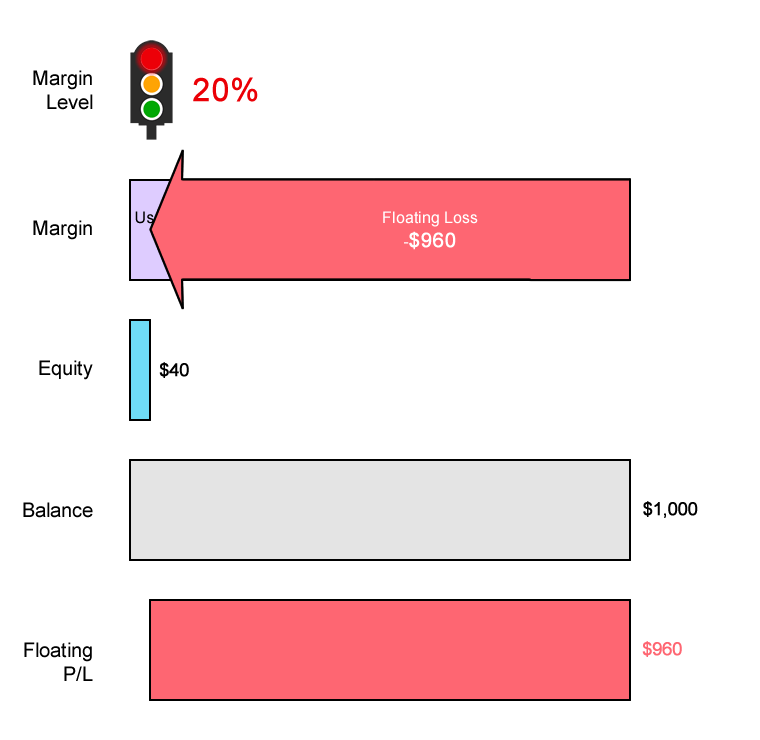

- Margin Level (%): (Equity ÷ Used Margin) × 100. A lower margin level indicates greater risk of a stop out.

When your trades go into drawdown (losses), your equity declines. If it falls too close to your used margin, you risk hitting the stop-out level, where the broker automatically closes positions to prevent your account from going negative.

Leverage at Exness

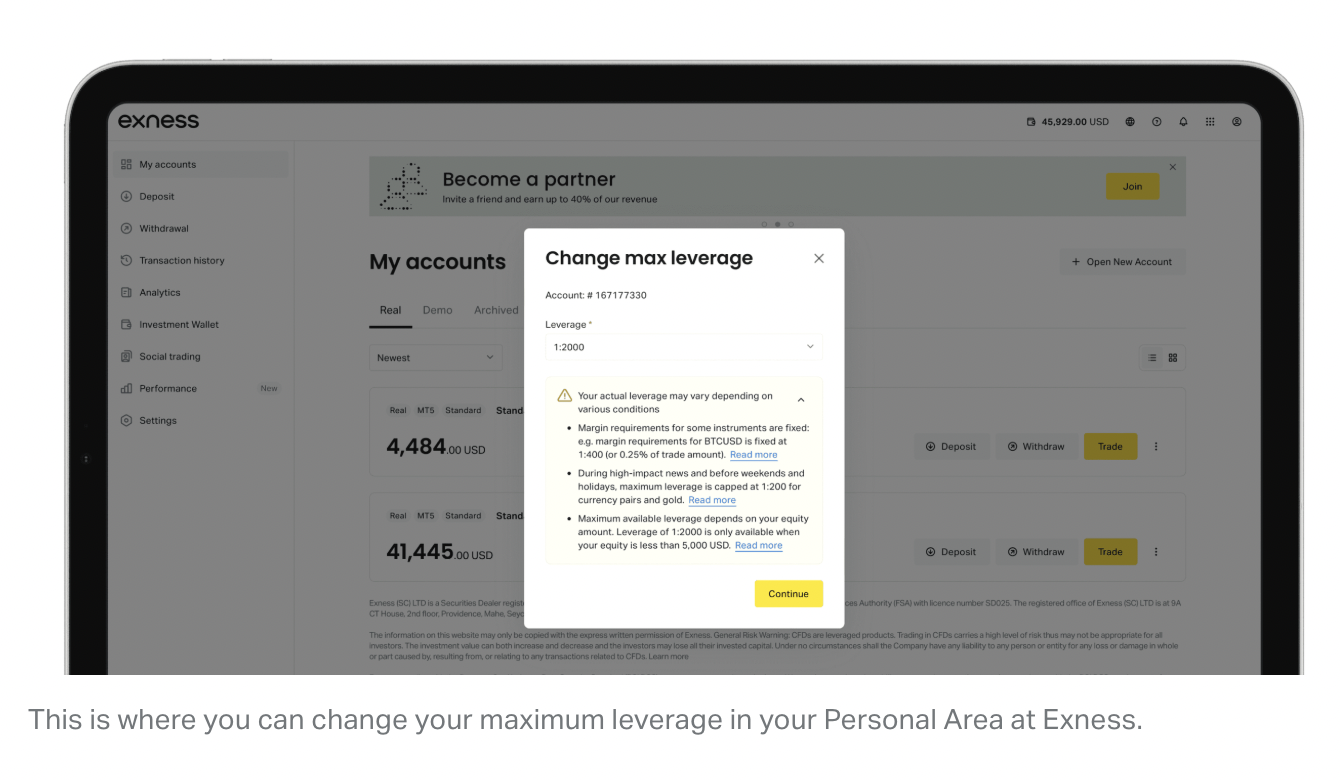

At Exness you can get both fixed and variable leverage options, depending on the trading instrument. While instruments come with fixed leverage, others allow traders to benefit from adjustable leverage settings.

A standout feature is Exness’s Unlimited Leverage, giving eligible traders the ability to trade without traditional leverage caps. This option might be appealing to experienced traders employing advanced risk management tactics.

However, Unlimited Leverage comes with conditions as stated on the Exness website.

Balance Limitations: Traders with account balances above $5,000 (or equivalent) are ineligible. You can regain access by withdrawing funds or opening a new account.

Instrument Restrictions: Unlimited Leverage is not available for exotic pairs, cryptocurrencies, commodities (like energies), stocks, indices, XPD, and XPT pairs.

High-Impact News + Events: During key economic releases (e.g the US Non-Farm Payrolls), leverage on new positions is capped at 1:200 for most instruments and 1:50 for indices, from 15 minutes before until 5 minutes after the news.

For more details on Exness leverage conditions and eligibility, registered users can access the Help Center via their Personal Area after they sign up with Exness.

A standout feature is Exness’s Unlimited Leverage, giving eligible traders the ability to trade without traditional leverage caps. This option might be appealing to experienced traders employing advanced risk management tactics.

However, Unlimited Leverage comes with conditions as stated on the Exness website.

Balance Limitations: Traders with account balances above $5,000 (or equivalent) are ineligible. You can regain access by withdrawing funds or opening a new account.

Instrument Restrictions: Unlimited Leverage is not available for exotic pairs, cryptocurrencies, commodities (like energies), stocks, indices, XPD, and XPT pairs.

High-Impact News + Events: During key economic releases (e.g the US Non-Farm Payrolls), leverage on new positions is capped at 1:200 for most instruments and 1:50 for indices, from 15 minutes before until 5 minutes after the news.

For more details on Exness leverage conditions and eligibility, registered users can access the Help Center via their Personal Area after they sign up with Exness.

Why Leverage and Margin Matter

Amplifying Gains—and Losses

Using leverage effectively can multiply your profits. For example, if you open a $1,000 position of euro-dollar (EURUSD) without leverage and it moves in your favor by 1%, you’d gain $10. But if you had used 1:100 leverage and controlled a $100,000 position, that same 1% move could net you $1,000—one hundred times more!

The flipside is that a similar 1% move against you with high leverage would also magnify your losses. This is why well-tested risk management strategies, such as strict stop losses or carefully monitored margin requirements, are crucial for maintaining consistency.

Using leverage effectively can multiply your profits. For example, if you open a $1,000 position of euro-dollar (EURUSD) without leverage and it moves in your favor by 1%, you’d gain $10. But if you had used 1:100 leverage and controlled a $100,000 position, that same 1% move could net you $1,000—one hundred times more!

The flipside is that a similar 1% move against you with high leverage would also magnify your losses. This is why well-tested risk management strategies, such as strict stop losses or carefully monitored margin requirements, are crucial for maintaining consistency.

The Relationship to Stop Out

A stop out occurs when your margin level hits 0% (though the exact percentage can differ slightly from broker to broker). At this point, your equity can no longer cover the margin needed to keep trades open. By default, the broker closes your trades at current market prices to prevent further losses.

High leverage makes your trades more prone to stop out if the market moves rapidly against you. Conversely, lower leverage reduces the risk of a large margin call by requiring more of your own funds on each trade—effectively giving you a buffer against small price swings.

Real-World Example of Stop Out

Imagine you have $100 in your account using 1:500 leverage. This might allow you to open a $50,000 position (because $100 × 500 = $50,000). You’re immediately at risk because each 1% price swing can represent a $500 fluctuation, and your account only holds $100. Even a small 0.2% negative move could wipe out a sizeable portion of your equity, quickly triggering a stop out.

With 1:50 leverage, on that same $100 deposit, you’d only open a $5,000 position, which experiences a much smaller dollar impact if the market moves against you by 1%. Here, you’d lose $50, leaving you still with half your equity intact. This difference can be the fine line between a forced exit and having room to wait for a potential recovery.

Practical Tips for Trading with Leverage

1. Start with Lower Leverage

If you’re new to leveraged trading or not yet confident in your approach, consider beginning with a smaller leverage ratio. This allows you to learn how the market behaves without risking a stop out on every minor fluctuation. As you refine your skills and see consistent results, you can gradually increase your leverage.

2. Use Stop Losses

A stop loss helps you automatically exit a trade if the market moves to a specific unfavorable price. It’s not foolproof in highly volatile markets—where slippage can occur—but it does significantly reduce the chance of letting a losing trade drag your margin level down to zero.

3. Monitor Your Margin Level

Many successful traders maintain a watchful eye on their margin level. Some even set personal thresholds—such as no new positions if the margin level dips below 200%. This discipline keeps you from overextending and might prevent emotional decisions like chasing losses.

4. Practice on a Demo Account

Platforms like Exness offer free demo accounts where you can test various leverage ratios, position sizes, and stop-loss strategies without risking real money. This is a safe environment to see how leverage and margin play out in real time. Practice until you’re comfortable with how everything works.

5. Stick to Your Trading Plan

Sound risk management is the backbone of leverage trading. Most professional traders plan each trade from entry to exit, including stop loss and take-profit levels. They also decide how much margin they’ll commit, aiming to ensure that a single unexpected market spike doesn’t ruin their entire account. If a trade goes sour, sticking to the plan and closing it can help you preserve capital for future opportunities.

If you’re new to leveraged trading or not yet confident in your approach, consider beginning with a smaller leverage ratio. This allows you to learn how the market behaves without risking a stop out on every minor fluctuation. As you refine your skills and see consistent results, you can gradually increase your leverage.

2. Use Stop Losses

A stop loss helps you automatically exit a trade if the market moves to a specific unfavorable price. It’s not foolproof in highly volatile markets—where slippage can occur—but it does significantly reduce the chance of letting a losing trade drag your margin level down to zero.

3. Monitor Your Margin Level

Many successful traders maintain a watchful eye on their margin level. Some even set personal thresholds—such as no new positions if the margin level dips below 200%. This discipline keeps you from overextending and might prevent emotional decisions like chasing losses.

4. Practice on a Demo Account

Platforms like Exness offer free demo accounts where you can test various leverage ratios, position sizes, and stop-loss strategies without risking real money. This is a safe environment to see how leverage and margin play out in real time. Practice until you’re comfortable with how everything works.

5. Stick to Your Trading Plan

Sound risk management is the backbone of leverage trading. Most professional traders plan each trade from entry to exit, including stop loss and take-profit levels. They also decide how much margin they’ll commit, aiming to ensure that a single unexpected market spike doesn’t ruin their entire account. If a trade goes sour, sticking to the plan and closing it can help you preserve capital for future opportunities.

Choosing the Right Broker

Because leverage can significantly impact your trading experience, picking a broker with a clear, reliable margin policy is essential. Exness broker is known for its flexible leverage offerings, letting you adjust your leverage in your Personal Area to match your skills and available funds. Brokers often cap leverage around major news releases to protect clients from sudden, extreme volatility.

While this may reduce your opportunities for high-leverage trades during certain times, it also helps safeguard your capital from severe overnight losses.

While this may reduce your opportunities for high-leverage trades during certain times, it also helps safeguard your capital from severe overnight losses.

Frequently Asked Questions (FAQs)

How does margin work in Exness?

Margin acts as a “good faith” deposit held by Exness for your trades. It’s part of your equity set aside to maintain any open positions. The exact margin required depends on your leverage and trade size. As the market moves, your equity fluctuates. If it drops too close to the margin amount, your margin level percentage falls, which can lead to a stop out if it reaches 0%.

How does margin and leverage work?

Leverage allows you to open positions larger than your actual deposit. Margin is the deposit needed to keep those positions active. High leverage reduces margin requirements but magnifies gains and losses. Lower leverage calls for more margin per trade and lowers your potential profit per pip, but it helps reduce the likelihood of a margin call or stop out.

What leverage is good for $10 on Exness?

With just $10 in your account, very high leverage might seem enticing, but it also makes you vulnerable to sudden market moves. A ratio like 1:50 or 1:100 is generally enough for newcomers to explore how trades behave. Once you’ve tested your strategy and become comfortable, you can gradually increase leverage—but be mindful that the smaller your account, the less volatility it can handle before hitting a stop out.

What leverage is good for $100?

A $100 balance provides slightly more flexibility than $10, but the principle remains similar. If you’re relatively new, consider something like 1:50 to 1:200 to keep risk manageable. The goal is to avoid risking your entire account on small price fluctuations. Over time, if you see consistent success, you can scale up your leverage thoughtfully.

Margin acts as a “good faith” deposit held by Exness for your trades. It’s part of your equity set aside to maintain any open positions. The exact margin required depends on your leverage and trade size. As the market moves, your equity fluctuates. If it drops too close to the margin amount, your margin level percentage falls, which can lead to a stop out if it reaches 0%.

How does margin and leverage work?

Leverage allows you to open positions larger than your actual deposit. Margin is the deposit needed to keep those positions active. High leverage reduces margin requirements but magnifies gains and losses. Lower leverage calls for more margin per trade and lowers your potential profit per pip, but it helps reduce the likelihood of a margin call or stop out.

What leverage is good for $10 on Exness?

With just $10 in your account, very high leverage might seem enticing, but it also makes you vulnerable to sudden market moves. A ratio like 1:50 or 1:100 is generally enough for newcomers to explore how trades behave. Once you’ve tested your strategy and become comfortable, you can gradually increase leverage—but be mindful that the smaller your account, the less volatility it can handle before hitting a stop out.

What leverage is good for $100?

A $100 balance provides slightly more flexibility than $10, but the principle remains similar. If you’re relatively new, consider something like 1:50 to 1:200 to keep risk manageable. The goal is to avoid risking your entire account on small price fluctuations. Over time, if you see consistent success, you can scale up your leverage thoughtfully.

Conclusion

Leverage and margin are central to the forex trading experience, offering a powerful way to amplify potential profits. They also carry the risk of equally large losses. Used wisely, they allow you to trade substantial volumes and seek meaningful returns—even on smaller deposits. Applied carelessly, however, high leverage can quickly lead to a stop out, potentially depleting your account within moments.

Balancing opportunity with safety is the key. Whether you’re brand-new to trading or a seasoned pro, it’s essential to practice disciplined risk management: setting stop losses, monitoring margin levels, and making thoughtful choices about your leverage ratio. Over time, this careful approach can help you in the markets and move you closer to achieving your trading goals.

Ready to start trading? Register with Exness today!

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

Balancing opportunity with safety is the key. Whether you’re brand-new to trading or a seasoned pro, it’s essential to practice disciplined risk management: setting stop losses, monitoring margin levels, and making thoughtful choices about your leverage ratio. Over time, this careful approach can help you in the markets and move you closer to achieving your trading goals.

Ready to start trading? Register with Exness today!

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.