By Sam Reid

“A secure, transparent trading environment isn’t just a bonus—it’s a fundamental requirement.”

That saying rings especially true if you’re looking for a reliable partner in the financial markets. In a world teeming with brokers, finding one that truly prioritizes trader safety can sometimes feel like chasing a needle in a haystack.

That’s precisely why so many people turn to detailed evaluations such as this XTB broker review.

XTB has been around for more than two decades, operates under top-tier regulators like the FCA and the DFSA and is even listed on the Warsaw Stock Exchange.

In this article, we’ll examine the broker’s overarching security framework, explore its background and reputation, and shed light on how these elements combine to create a safe trading experience.

That saying rings especially true if you’re looking for a reliable partner in the financial markets. In a world teeming with brokers, finding one that truly prioritizes trader safety can sometimes feel like chasing a needle in a haystack.

That’s precisely why so many people turn to detailed evaluations such as this XTB broker review.

XTB has been around for more than two decades, operates under top-tier regulators like the FCA and the DFSA and is even listed on the Warsaw Stock Exchange.

In this article, we’ll examine the broker’s overarching security framework, explore its background and reputation, and shed light on how these elements combine to create a safe trading experience.

Why Broker Safety Matters

When money is on the line, safety is more than a minor concern—it’s a top priority. Regulatory oversight, account segregation, data protection, and negative balance protection are just a few key features that differentiate a safe broker from one that might place clients at risk. Traders also want to see transparent fee structures, reputable institutional ties, and reliable track records.

Some brokers are lightly regulated, leaving clients vulnerable to issues like potential bankruptcy or unethical practices. In contrast, well-regulated platforms must follow strict rules that protect traders’ funds. Additionally, having an easily navigable dispute-resolution process gives customers confidence if something goes awry. That’s precisely why investigating broker safety is one of the first steps you should take before signing up.

Some brokers are lightly regulated, leaving clients vulnerable to issues like potential bankruptcy or unethical practices. In contrast, well-regulated platforms must follow strict rules that protect traders’ funds. Additionally, having an easily navigable dispute-resolution process gives customers confidence if something goes awry. That’s precisely why investigating broker safety is one of the first steps you should take before signing up.

XTB at a Glance

• Founded in 2002

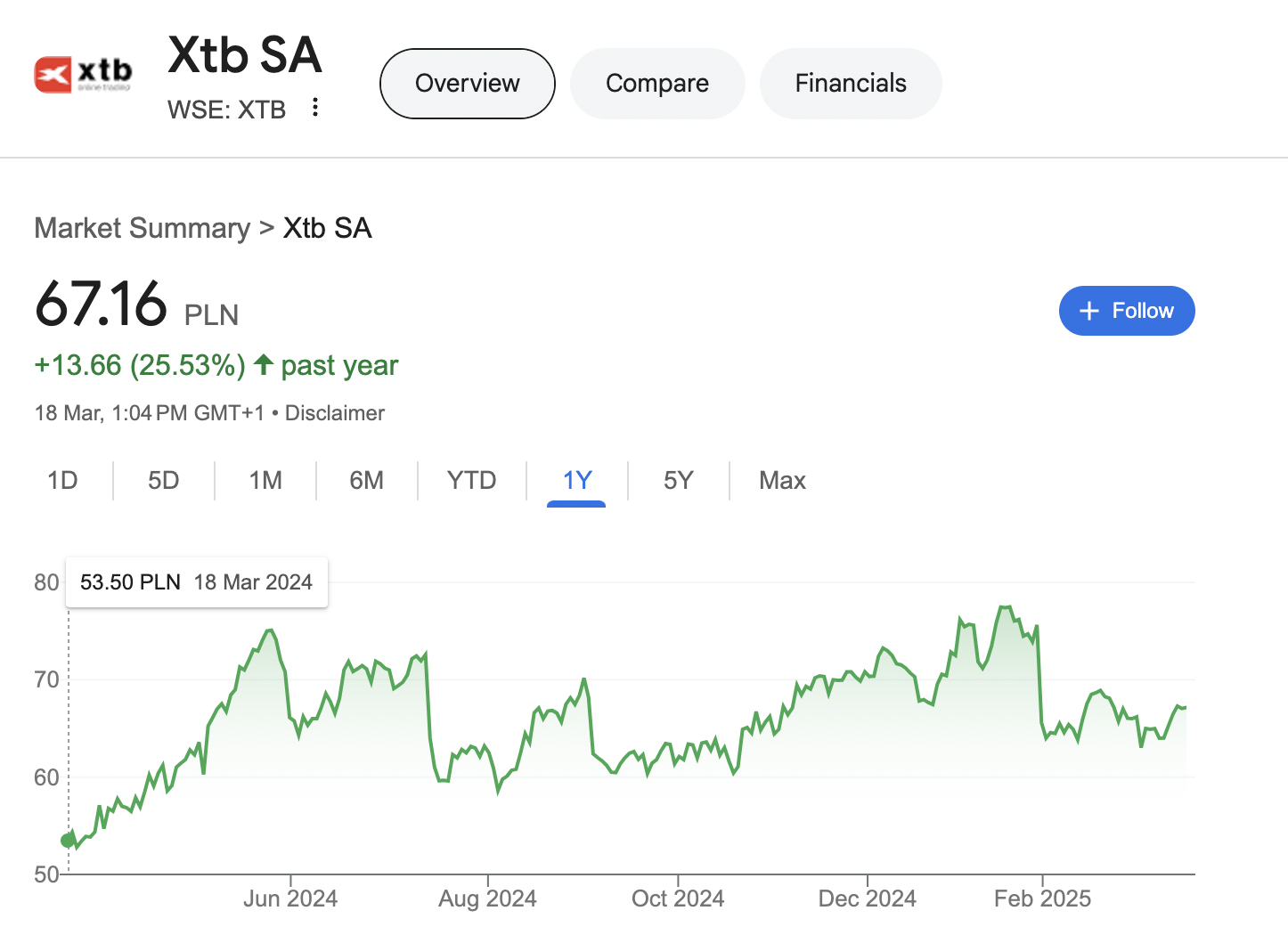

• Publicly traded on the Warsaw Stock Exchange

• Regulated by top-tier authorities such as the FCA, KNF, CySEC, FSC and DFSA

• Serves over 500,000 active traders globally

• Offers multiple trading instruments, from Forex to stocks, ETFs, commodities, and cryptocurrencies

• Publicly traded on the Warsaw Stock Exchange

• Regulated by top-tier authorities such as the FCA, KNF, CySEC, FSC and DFSA

• Serves over 500,000 active traders globally

• Offers multiple trading instruments, from Forex to stocks, ETFs, commodities, and cryptocurrencies

These fast facts illustrate why some people believe XTB stands out as a competitive contender in the brokerage world. But let’s see if it actually delivers on the promise of security.

Regulatory Oversight: The Bedrock of Security

Multiple Regulatory Licenses

Regulation is arguably the most important factor when assessing broker safety. XTB operates under several licenses across different regions. For instance, the Financial Conduct Authority (FCA) in the UK mandates stringent capital requirements and enforces rules around segregated accounts. The Polish Financial Supervision Authority (KNF), Cyprus Securities and Exchange Commission (CySEC) and Dubai Financial Services Authority (DFSA) also impose strict guidelines.

Because XTB is overseen by multiple regulators, it must consistently adhere to a wide range of compliance standards. Failure to do so risks fines, operational restrictions, or even license revocation—consequences that most serious brokers work diligently to avoid.

Regulation is arguably the most important factor when assessing broker safety. XTB operates under several licenses across different regions. For instance, the Financial Conduct Authority (FCA) in the UK mandates stringent capital requirements and enforces rules around segregated accounts. The Polish Financial Supervision Authority (KNF), Cyprus Securities and Exchange Commission (CySEC) and Dubai Financial Services Authority (DFSA) also impose strict guidelines.

Because XTB is overseen by multiple regulators, it must consistently adhere to a wide range of compliance standards. Failure to do so risks fines, operational restrictions, or even license revocation—consequences that most serious brokers work diligently to avoid.

Public Listing and Transparency

XTB’s presence on the Warsaw Stock Exchange compels it to maintain strong financial disclosures and submit to external audits. This setup promotes an extra layer of transparency, since publicly listed companies have to publicly file detailed financial statements.

Such accountability gives traders a clearer view of a broker’s stability and ensures that important data—such as earnings reports or operational changes—gets disclosed in a timely manner.

Segregated Accounts and Negative Balance Protection

Where Are Your Funds Kept?

Many traders ask, “Is my money safe in XTB?” For good reason, too—nobody wants their funds mingling with a brokerage firm’s day-to-day operational money.

XTB states that client funds are stored in segregated bank accounts, a practice designed to protect traders if the company were to face insolvency. In many jurisdictions, this approach is a regulatory requirement, which XTB appears to meet.

Many traders ask, “Is my money safe in XTB?” For good reason, too—nobody wants their funds mingling with a brokerage firm’s day-to-day operational money.

XTB states that client funds are stored in segregated bank accounts, a practice designed to protect traders if the company were to face insolvency. In many jurisdictions, this approach is a regulatory requirement, which XTB appears to meet.

Shielding You From Going Below Zero

Leverage can multiply gains, but it can also supercharge losses. Negative balance protection means a trader cannot lose more than the total balance in the account. XTB offers this benefit, ensuring that an extreme market move won’t leave you in debt if a leveraged trade goes sour. While not every investor uses high leverage, knowing you can’t slip into negative territory is reassuring.

Leverage can multiply gains, but it can also supercharge losses. Negative balance protection means a trader cannot lose more than the total balance in the account. XTB offers this benefit, ensuring that an extreme market move won’t leave you in debt if a leveraged trade goes sour. While not every investor uses high leverage, knowing you can’t slip into negative territory is reassuring.

{$te}

Coverage Levels Vary By Location

Another piece of the security puzzle is investor compensation. In certain regions—like the UK—XTB clients may be eligible for coverage under the Financial Services Compensation Scheme (FSCS), up to a specific amount (commonly £85,000 per person). CySEC-regulated accounts, meanwhile, may fall under the Investor Compensation Fund (ICF), which can provide up to €20,000 per client if the broker fails financially.

It’s important to check which entity you register under because not all global jurisdictions offer identical compensation schemes. If you’re signing up from a region outside the EU or UK, you might not have the same level of coverage.

Another piece of the security puzzle is investor compensation. In certain regions—like the UK—XTB clients may be eligible for coverage under the Financial Services Compensation Scheme (FSCS), up to a specific amount (commonly £85,000 per person). CySEC-regulated accounts, meanwhile, may fall under the Investor Compensation Fund (ICF), which can provide up to €20,000 per client if the broker fails financially.

It’s important to check which entity you register under because not all global jurisdictions offer identical compensation schemes. If you’re signing up from a region outside the EU or UK, you might not have the same level of coverage.

Platform Security and Data Protection

Encryption and Data Privacy

Beyond where your funds are kept, you should also care about how your personal information is secured. XTB uses encryption protocols to protect data transmission between clients and its servers. This reduces the risk that hackers or other malicious actors can intercept sensitive information.

Two-Factor Authentication (2FA)

For an extra layer of security, XTB also provides the option for two-factor authentication. By requiring a secondary verification step—like a code sent to your phone—this significantly lowers the chances of unauthorized account access.

Beyond where your funds are kept, you should also care about how your personal information is secured. XTB uses encryption protocols to protect data transmission between clients and its servers. This reduces the risk that hackers or other malicious actors can intercept sensitive information.

Two-Factor Authentication (2FA)

For an extra layer of security, XTB also provides the option for two-factor authentication. By requiring a secondary verification step—like a code sent to your phone—this significantly lowers the chances of unauthorized account access.

Track Record and Global Footprint

Over Two Decades in Business

XTB has been around for more than 20 years, a considerable feat in an industry where new brokers pop up and disappear with disconcerting frequency. Longevity alone doesn’t guarantee safety, but it does indicate a measure of stability and the ability to adapt to ever-changing regulations and market conditions.

XTB has been around for more than 20 years, a considerable feat in an industry where new brokers pop up and disappear with disconcerting frequency. Longevity alone doesn’t guarantee safety, but it does indicate a measure of stability and the ability to adapt to ever-changing regulations and market conditions.

Geographic Reach

With over 12 global offices and a client base spanning multiple continents, XTB’s scale is undeniably international. This worldwide footing highlights a capacity to navigate diverse regulatory requirements.

If you’re seeking a trading broker dubai or an option elsewhere, this XTB broker review has shown its presence in various regions may be advantageous. But always confirm which entity covers your specific account to understand the protections you can expect.

Platform Experience and Educational Support

Trading Platforms

User-friendliness and robust functionality often go hand in hand with trust. XTB’s xStation 5, for instance, is known for being intuitive and feature-rich. It supports advanced charting tools, real-time market news, and offers a seamless user interface. A stable, transparent platform lowers the risk of technical mishaps that can cause costly errors for traders.

User-friendliness and robust functionality often go hand in hand with trust. XTB’s xStation 5, for instance, is known for being intuitive and feature-rich. It supports advanced charting tools, real-time market news, and offers a seamless user interface. A stable, transparent platform lowers the risk of technical mishaps that can cause costly errors for traders.

Educational Resources

Many new traders worry about being blindsided by hidden fees or complex market terms. XTB counters this concern by offering educational materials, webinars, and tutorials—resources that shed light on platform features, trading strategies, and risk management. Knowledge is power, and educated traders are less likely to make uninformed mistakes.

Many new traders worry about being blindsided by hidden fees or complex market terms. XTB counters this concern by offering educational materials, webinars, and tutorials—resources that shed light on platform features, trading strategies, and risk management. Knowledge is power, and educated traders are less likely to make uninformed mistakes.

User Experiences and Customer Support

What Traders Are Saying

Overall sentiment appears positive, especially regarding XTB’s customer service responsiveness and the ease of executing trades. Some clients, however, have noted occasional withdrawal delays or high spreads during periods of market volatility. While those issues are not uncommon across the industry, they’re good to keep in mind when deciding if XTB is your ideal match.

Customer Support Availability

XTB’s customer support operates via live chat, phone, and email. Quick and knowledgeable assistance is crucial when time-sensitive issues arise. Few things erode trust faster than unresponsive or inadequate support, particularly in fast-moving financial markets.

Overall sentiment appears positive, especially regarding XTB’s customer service responsiveness and the ease of executing trades. Some clients, however, have noted occasional withdrawal delays or high spreads during periods of market volatility. While those issues are not uncommon across the industry, they’re good to keep in mind when deciding if XTB is your ideal match.

Customer Support Availability

XTB’s customer support operates via live chat, phone, and email. Quick and knowledgeable assistance is crucial when time-sensitive issues arise. Few things erode trust faster than unresponsive or inadequate support, particularly in fast-moving financial markets.

Pros and Cons Recap

Pros

• Heavily Regulated (FCA, KNF, CySEC, FSC, DFSA)

• Publicly Traded, Providing Extra Transparency

• Negative Balance Protection

• Segregated Accounts for Client Funds

• High Trust Scores and Multiple Awards

Cons

• Some Users Report Withdrawal Fees

• Spreads May Widen During Volatile Markets

• Research Tools Could Be More Extensive for Advanced Traders

• Coverage Varies Depending on the Local Entity

• Inactivity Fees May Apply

• Heavily Regulated (FCA, KNF, CySEC, FSC, DFSA)

• Publicly Traded, Providing Extra Transparency

• Negative Balance Protection

• Segregated Accounts for Client Funds

• High Trust Scores and Multiple Awards

Cons

• Some Users Report Withdrawal Fees

• Spreads May Widen During Volatile Markets

• Research Tools Could Be More Extensive for Advanced Traders

• Coverage Varies Depending on the Local Entity

• Inactivity Fees May Apply

Conclusion: Our Take on XTB’s Safety

So, can you trust XTB? Given its history, regulatory licenses, publicly traded status, and emphasis on segregated funds, the broker checks many boxes associated with reliability.

Traders also benefit from negative balance protection, multiple educational resources, and multi-channel customer support. While no platform is entirely free from drawbacks—like occasional reports of withdrawal lags or less comprehensive research tools—XTB’s overall safety profile appears robust.

Ultimately, choosing the right broker depends on your priorities. If you desire a platform that offers substantial regulatory oversight, user-friendly tools, and transparent disclosures, then XTB is likely a strong contender. That said, it’s wise to review any local entity’s terms and compensation schemes to ensure you know exactly which protections you’ll receive.

Traders also benefit from negative balance protection, multiple educational resources, and multi-channel customer support. While no platform is entirely free from drawbacks—like occasional reports of withdrawal lags or less comprehensive research tools—XTB’s overall safety profile appears robust.

Ultimately, choosing the right broker depends on your priorities. If you desire a platform that offers substantial regulatory oversight, user-friendly tools, and transparent disclosures, then XTB is likely a strong contender. That said, it’s wise to review any local entity’s terms and compensation schemes to ensure you know exactly which protections you’ll receive.

XTB FAQs

How safe is XTB broker?

XTB is generally considered safe thanks to robust regulation, segregated accounts, and negative balance protection. It’s also publicly traded, meaning it must adhere to stricter financial reporting standards.

Can we trust XTB?

Yes. Many regulatory bodies—including the FCA, KNF, and CySEC—oversee its operations, requiring strict compliance with investor protection rules. XTB’s track record of over 20 years in business further solidifies its reputation.

Is my money safe in XTB?

Your funds are kept in segregated accounts, reducing the risk of loss should XTB face insolvency. UK and EU clients may also qualify for compensation under the FSCS or ICF, respectively, offering additional security.

Is XTB a real broker?

Yes, XTB is a legitimate broker with a global presence while being a top trading broker in dubai, licensing from top-tier authorities, and shares publicly traded on the Warsaw Stock Exchange. Its longevity and transparent practices underscore its credibility as a real, reputable firm.

XTB is generally considered safe thanks to robust regulation, segregated accounts, and negative balance protection. It’s also publicly traded, meaning it must adhere to stricter financial reporting standards.

Can we trust XTB?

Yes. Many regulatory bodies—including the FCA, KNF, and CySEC—oversee its operations, requiring strict compliance with investor protection rules. XTB’s track record of over 20 years in business further solidifies its reputation.

Is my money safe in XTB?

Your funds are kept in segregated accounts, reducing the risk of loss should XTB face insolvency. UK and EU clients may also qualify for compensation under the FSCS or ICF, respectively, offering additional security.

Is XTB a real broker?

Yes, XTB is a legitimate broker with a global presence while being a top trading broker in dubai, licensing from top-tier authorities, and shares publicly traded on the Warsaw Stock Exchange. Its longevity and transparent practices underscore its credibility as a real, reputable firm.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.