By Sam Reid

Welcome to the exciting world of trading! Statistics reveal that only a fraction of new traders achieve success, largely because they jump in without a plan.

Preparation, a clear strategy, and the right partner can make all the difference. In this guide, we’ll walk you through the essentials—from understanding Forex and online trading to diving into CFDs—so you can start trading confidently with Avatrade.

Preparation, a clear strategy, and the right partner can make all the difference. In this guide, we’ll walk you through the essentials—from understanding Forex and online trading to diving into CFDs—so you can start trading confidently with Avatrade.

Understanding the Trading Landscape

Trading isn’t just about watching numbers change; it’s a skill that requires knowledge, practice, and a sound strategy. Whether you’re interested in Forex, online trading, or CFDs, the fundamental principles remain the same: learn the market, choose the right instruments, manage risks, and continuously adapt.

In today’s fast-paced markets, success comes from combining education with actionable strategies.

In today’s fast-paced markets, success comes from combining education with actionable strategies.

1. Getting Started with Forex Trading

Learn the Basics

Before you jump into your first Forex trade, it’s essential to understand the market fundamentals. Forex trading involves the exchange of currencies and is influenced by factors such as economic data, geopolitical events, and market sentiment. Start by familiarizing yourself with:

A solid foundation will empower you to use essential trading tools and develop strategies tailored to your risk tolerance.

Before you jump into your first Forex trade, it’s essential to understand the market fundamentals. Forex trading involves the exchange of currencies and is influenced by factors such as economic data, geopolitical events, and market sentiment. Start by familiarizing yourself with:

- Market Structure: Understand how the Forex market is organized and the role of major players.

- Terminology: Get to grips with key terms like “pips,” “leverage,” “bid/ask spreads,” and “currency pairs.”

- Risk vs. Reward: Recognize that while the potential profits can be high, so too can be the risks.

A solid foundation will empower you to use essential trading tools and develop strategies tailored to your risk tolerance.

Choosing Your Trading Style

There are different ways to approach Forex trading. Most retail traders use products such as CFDs (Contracts for Difference) and FX options. CFDs allow you to speculate on currency price movements without owning the underlying asset. FX options, on the other hand, give you the right—but not the obligation—to trade at a predetermined price.

When selecting your method, consider factors like:

There are different ways to approach Forex trading. Most retail traders use products such as CFDs (Contracts for Difference) and FX options. CFDs allow you to speculate on currency price movements without owning the underlying asset. FX options, on the other hand, give you the right—but not the obligation—to trade at a predetermined price.

When selecting your method, consider factors like:

- Leverage: How much exposure do you want compared to your investment?

- Trading Costs: Understand the spreads and any commissions that might apply.

- Market Analysis: Decide whether you’ll rely on technical charts, fundamental news, or a blend of both.

Choosing a Broker

Choosing the right broker is a critical step. A reputable broker not only provides access to the market but also offers the tools, educational resources, and customer support you need. When evaluating brokers, consider:

AvaTrade excels in these areas, making it an excellent choice for beginners.

Choosing the right broker is a critical step. A reputable broker not only provides access to the market but also offers the tools, educational resources, and customer support you need. When evaluating brokers, consider:

- Regulation and Safety: Ensure your funds are protected by solid regulatory oversight.

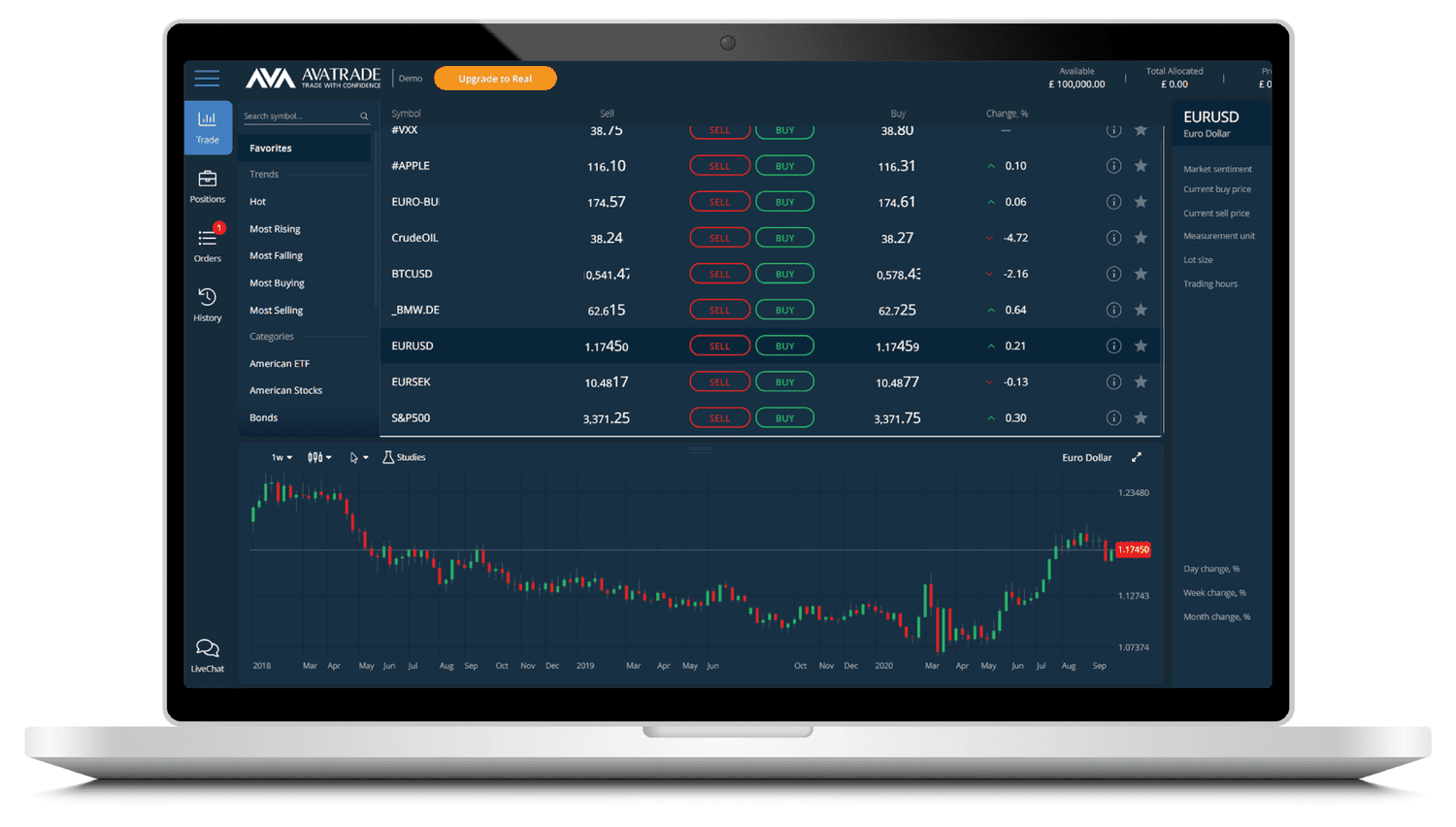

- Trading Platforms: Look for platforms that are reliable, easy to use, and equipped with advanced trading tools.

- Educational Resources: Quality articles, videos, and demo accounts are invaluable for beginners.

- Payment Methods and Support: Convenient funding options and responsive customer service are a must.

AvaTrade excels in these areas, making it an excellent choice for beginners.

Opening Your Trading Account

Once you’ve selected your broker, the next step is to open an account. Start with a demo account to practice risk-free. Once you’re comfortable, you can transition to a real account. Always review the account options and choose one that fits your trading goals.

Once you’ve selected your broker, the next step is to open an account. Start with a demo account to practice risk-free. Once you’re comfortable, you can transition to a real account. Always review the account options and choose one that fits your trading goals.

Crafting Your Trading Plan

A clear trading plan is your roadmap to success. It should detail your trading strategy, goals, risk management rules, and the criteria for entering and exiting trades. A well-thought-out plan helps you remain disciplined, avoid emotional decisions, and adapt to changing market conditions.

A clear trading plan is your roadmap to success. It should detail your trading strategy, goals, risk management rules, and the criteria for entering and exiting trades. A well-thought-out plan helps you remain disciplined, avoid emotional decisions, and adapt to changing market conditions.

2. How to Trade Online

Embrace the Digital Era

Online trading has revolutionized how we invest. With platforms that operate around the clock, traders now have the power to manage their portfolios anytime, anywhere. As you begin your online trading journey, focus on these key aspects:

Online trading has revolutionized how we invest. With platforms that operate around the clock, traders now have the power to manage their portfolios anytime, anywhere. As you begin your online trading journey, focus on these key aspects:

- Understanding Supply and Demand: Price movements occur when there’s an imbalance between buyers and sellers. Recognizing these signals can guide your trade decisions.

- Developing a Strategy: Whether you’re trading stocks, commodities, or currencies, a solid strategy based on market analysis is essential.

- Leveraging Educational Tools: Utilize webinars, tutorials, and live support to sharpen your skills.

Executing Your Trade

Once your account is funded and your strategy in place, executing a trade involves several steps:

Once your account is funded and your strategy in place, executing a trade involves several steps:

- Research: Analyze market trends and data to identify opportunities.

- Decide on Position Size and Leverage: Based on your risk tolerance, determine how much to invest and the level of leverage to use.

- Set Stop-Loss and Take-Profit Orders: These tools help you manage risk and secure profits without needing constant supervision.

- Monitor Your Position: Keep an eye on your trades and adjust your strategy as market conditions change.

3. Diving into CFD Trading

What Are CFDs?

CFDs, or Contracts for Difference, let you speculate on the price movements of various assets—including Forex, stocks, indices, commodities, and even cryptocurrencies—without owning the underlying asset. This flexibility is ideal for traders looking to profit from both rising and falling markets.

CFDs, or Contracts for Difference, let you speculate on the price movements of various assets—including Forex, stocks, indices, commodities, and even cryptocurrencies—without owning the underlying asset. This flexibility is ideal for traders looking to profit from both rising and falling markets.

Step-by-Step Guide to CFD Trading

Step 1: Choose a CFD Broker

Select a reputable broker that offers a wide range of instruments, robust trading platforms, and comprehensive support. Avatrade, for instance, is well-regulated and provides extensive educational resources to get you started.

Step 2: Open and Fund Your Account

After choosing your broker, open a demo or live trading account. Funding your account can be done through various methods such as bank transfers, credit cards, or eWallets. Start with a demo account to test your strategies risk-free.

Step 3: Select Your Market

CFDs cover numerous markets. Decide whether you want to trade Forex, stocks, indices, or commodities. Conduct thorough research and use both technical and fundamental analysis to choose the market that aligns with your strategy.

Step 4: Develop a Trading Plan

Like with Forex trading, a clear plan is crucial in CFD trading. Outline your goals, risk tolerance, and specific strategies. This plan will guide your trade decisions and help you remain disciplined.

Step 5: Place Your Trade

When you’re ready, decide on a long (buy) or short (sell) position based on your market analysis. Determine your position size and leverage carefully. Use stop-loss and take-profit orders to manage risk automatically.

Step 6: Monitor and Close Your Position

CFD trades require active management. Stay alert to market conditions and be ready to close your position if the market moves against you or when your profit target is reached.

Step 1: Choose a CFD Broker

Select a reputable broker that offers a wide range of instruments, robust trading platforms, and comprehensive support. Avatrade, for instance, is well-regulated and provides extensive educational resources to get you started.

Step 2: Open and Fund Your Account

After choosing your broker, open a demo or live trading account. Funding your account can be done through various methods such as bank transfers, credit cards, or eWallets. Start with a demo account to test your strategies risk-free.

Step 3: Select Your Market

CFDs cover numerous markets. Decide whether you want to trade Forex, stocks, indices, or commodities. Conduct thorough research and use both technical and fundamental analysis to choose the market that aligns with your strategy.

Step 4: Develop a Trading Plan

Like with Forex trading, a clear plan is crucial in CFD trading. Outline your goals, risk tolerance, and specific strategies. This plan will guide your trade decisions and help you remain disciplined.

Step 5: Place Your Trade

When you’re ready, decide on a long (buy) or short (sell) position based on your market analysis. Determine your position size and leverage carefully. Use stop-loss and take-profit orders to manage risk automatically.

Step 6: Monitor and Close Your Position

CFD trades require active management. Stay alert to market conditions and be ready to close your position if the market moves against you or when your profit target is reached.

Real-World Example: CFD Trade on Crude Oil

Imagine entering a long CFD trade on Crude Oil at $70 per barrel with a 100-barrel lot. In a positive scenario, news about OPEC production cuts drives the price to $80, resulting in a profit of $1,000.

Conversely, if unexpected geopolitical tensions push the price down to $60, you would incur a similar loss.

This example highlights the importance of effective risk management and the careful planning required for CFD trading.

Conversely, if unexpected geopolitical tensions push the price down to $60, you would incur a similar loss.

This example highlights the importance of effective risk management and the careful planning required for CFD trading.

CFD Trading Tips

- Start with a Demo Account: Practice before risking real money.

- Manage Your Leverage: Leverage can amplify both gains and losses—use it wisely.

- Diversify Your Trades: Spread your risk across different asset classes.

- Stay Informed: Regularly update yourself with market news and analysis.

If you follow these guidelines, CFD trading can be a powerful way to explore market opportunities with a trusted broker like AvaTrade.

4. Essential Trading Strategies and Risk Management

Diversify Your Strategies

A successful trader doesn’t rely on a single approach. Blend technical analysis, which looks at price charts and patterns, with fundamental analysis that considers economic indicators and news events. Use sentiment analysis to gauge market moods and refine your strategies accordingly.

A successful trader doesn’t rely on a single approach. Blend technical analysis, which looks at price charts and patterns, with fundamental analysis that considers economic indicators and news events. Use sentiment analysis to gauge market moods and refine your strategies accordingly.

The Importance of Risk Management

Risk management is the backbone of any trading plan. Some key strategies include:

One popular method among some traders is the 5-3-1 rule. Although interpretations vary, it generally refers to structure and simplify the way you trade.

The 5-3-1 strategy offers a clear, focused approach to forex trading. Instead of getting lost in countless timelines and techniques, traders select five currency pairs to master, three proven strategies to apply, and one consistent time each day to trade.

Risk management is the backbone of any trading plan. Some key strategies include:

- Setting stop-loss orders: Automatically exit a trade when it moves against you.

- Determining position size: Never risk more than a small percentage of your capital on a single trade.

- Using leverage responsibly: Understand that higher leverage increases both potential gains and potential losses.

One popular method among some traders is the 5-3-1 rule. Although interpretations vary, it generally refers to structure and simplify the way you trade.

The 5-3-1 strategy offers a clear, focused approach to forex trading. Instead of getting lost in countless timelines and techniques, traders select five currency pairs to master, three proven strategies to apply, and one consistent time each day to trade.

This method helps both beginners and experienced traders build a disciplined trading routine that suits their personal style—perfect for navigating the 24/5 nature of the forex market with confidence and clarity.

5. Why Choose AvaTrade?

AvaTrade stands out as a leader in the trading community for many reasons. Here’s why beginners can benefit from partnering with an Avatrade:

- Regulated and secure: AvaTrade is licensed by multiple international financial authorities, ensuring your funds and personal information are protected.

- Comprehensive education: With a wealth of resources including articles, videos, webinars, and demo accounts, AvaTrade empowers you to learn and grow as a trader.

- User-friendly platforms: Whether you prefer MetaTrader 4, MetaTrader 5, or the AvaTradeApp, the platforms are designed for both beginners and experienced traders.

- Innovative trading tools: Tools like stop-loss orders, trading alerts, and unique risk management features such as AvaProtect give you an edge in the markets.

- Outstanding customer support: Dedicated support teams are available to assist you with any queries, ensuring you always have guidance on your trading journey.

6. Putting It All Together

Trading requires a balance between knowledge, strategy, and the willingness to adapt. Whether you’re entering the Forex market, trading online, or exploring the world of CFDs, every step should be taken with care and precision.

Start with a solid education, craft a comprehensive trading plan, and always manage your risks. With determination and the right support from a trusted broker, you can transform market challenges into opportunities!

Start with a solid education, craft a comprehensive trading plan, and always manage your risks. With determination and the right support from a trusted broker, you can transform market challenges into opportunities!

FAQs

How does AvaTrade work for beginners?

AvaTrade offers a user-friendly platform, extensive educational resources, and risk-free demo accounts, making it easier for beginners to understand market dynamics and develop effective trading strategies. The support team is always available to assist you as you progress from learning to live trading.

What is the 5-3-1 rule in trading?

The 5-3-1 strategy offers a clear, focused approach to forex trading. Instead of getting lost in countless timelines and techniques, traders select 5 currency pairs to master, 3 proven to apply, and 1 trading session each day to trade.

Is AvaTrade a good broker for beginners?

Yes, AvaTrade is an excellent choice for beginners. With its robust educational materials, secure and regulated platforms, risk-free demo accounts, and dedicated customer support, it provides a solid foundation for those new to trading. The range of trading tools and the user-friendly interface make it easier to transition from practice to live trading.

How to start day trading step by step?

To start day trading, begin with a demo account to practice your strategy without risking real money. Learn to analyze the markets using technical and fundamental methods. Choose a reputable broker, like Avatrade, and develop a detailed trading plan that includes risk management strategies such as stop-loss orders. Start trading small amounts, monitor your performance closely, and gradually increase your exposure as you gain experience and confidence.

AvaTrade offers a user-friendly platform, extensive educational resources, and risk-free demo accounts, making it easier for beginners to understand market dynamics and develop effective trading strategies. The support team is always available to assist you as you progress from learning to live trading.

What is the 5-3-1 rule in trading?

The 5-3-1 strategy offers a clear, focused approach to forex trading. Instead of getting lost in countless timelines and techniques, traders select 5 currency pairs to master, 3 proven to apply, and 1 trading session each day to trade.

Is AvaTrade a good broker for beginners?

Yes, AvaTrade is an excellent choice for beginners. With its robust educational materials, secure and regulated platforms, risk-free demo accounts, and dedicated customer support, it provides a solid foundation for those new to trading. The range of trading tools and the user-friendly interface make it easier to transition from practice to live trading.

How to start day trading step by step?

To start day trading, begin with a demo account to practice your strategy without risking real money. Learn to analyze the markets using technical and fundamental methods. Choose a reputable broker, like Avatrade, and develop a detailed trading plan that includes risk management strategies such as stop-loss orders. Start trading small amounts, monitor your performance closely, and gradually increase your exposure as you gain experience and confidence.

Final Thoughts

The journey into trading is both challenging and rewarding. By understanding the fundamentals, choosing the right markets, and employing effective risk management strategies, you can set yourself up for success.

Whether you’re drawn to Forex, online trading, or CFDs, remember that continuous learning and a solid plan are key. With AvaTrade’s comprehensive support and innovative tools, you’re well-equipped to navigate the markets and turn your trading aspirations into reality.

Whether you’re drawn to Forex, online trading, or CFDs, remember that continuous learning and a solid plan are key. With AvaTrade’s comprehensive support and innovative tools, you’re well-equipped to navigate the markets and turn your trading aspirations into reality.