"Great companies are built on great products," said Elon Musk. Now imagine an index that captures 30 of the most iconic companies in the U.S., each shaping industries, economies, and markets worldwide. Welcome to the US30 Index—a powerhouse indicator that’s been at the heart of global investing since 1896. Whether you’re an experienced trader or a market newcomer, understanding how the US30 index works could redefine your trading strategy and open the door to a world of opportunity.

This guide breaks down everything you need to know about the US30 Index, including actionable tips on how to trade the US30, insights into when does the US30 open, and advice on where to trade the US30 effectively. Let’s dive in.

This guide breaks down everything you need to know about the US30 Index, including actionable tips on how to trade the US30, insights into when does the US30 open, and advice on where to trade the US30 effectively. Let’s dive in.

What Is the US30 Index?

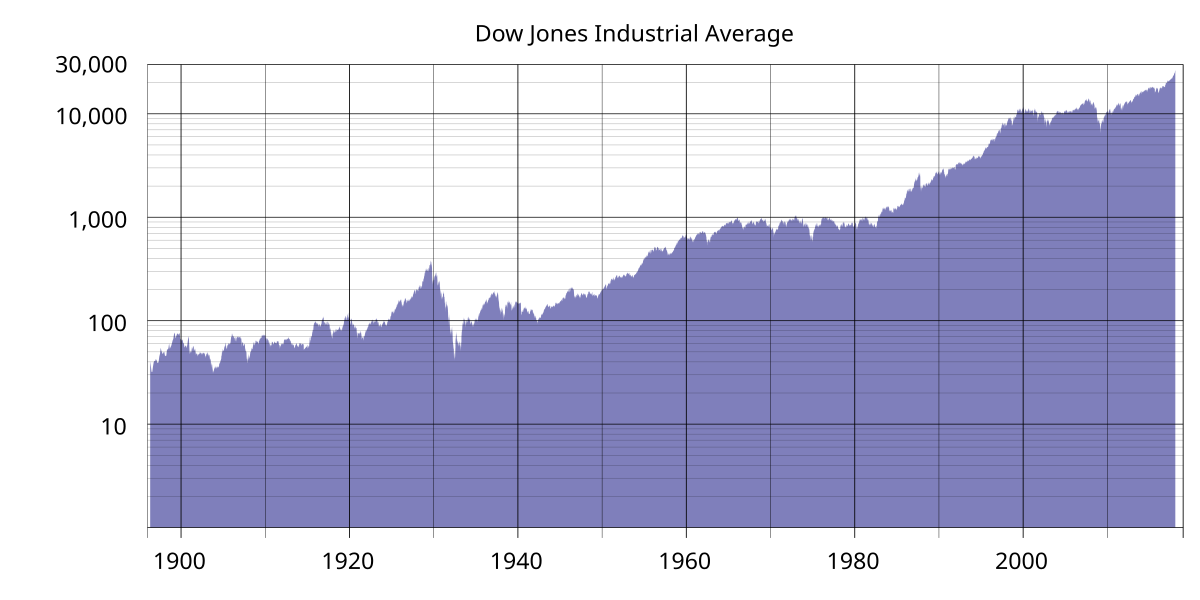

The US30 Index, also known as the Dow Jones Industrial Average, measures the performance of 30 large U.S. companies listed on the NYSE and NASDAQ. These blue-chip stocks span industries like technology, finance, and healthcare, offering a snapshot of the U.S. economy.

Unlike other indices, the US30 is price-weighted, meaning higher-priced stocks have a greater influence on its movement. Companies like Apple, Boeing, and Microsoft make up this elite list, ensuring the US30 remains a trusted barometer of market health.

Unlike other indices, the US30 is price-weighted, meaning higher-priced stocks have a greater influence on its movement. Companies like Apple, Boeing, and Microsoft make up this elite list, ensuring the US30 remains a trusted barometer of market health.

Why Is the US30 Important?

Geographic Risk Diversification

For international investors, the US30 offers exposure to the world’s largest economy. Trading in the U.S. market can diversify risk away from local economic conditions in Asia, Europe, or the UK.

A Proxy for U.S. Economic Health

The US30 reflects the broader U.S. economy’s performance. If you’re bullish on U.S. growth, investing in this index is a straightforward way to capitalize on those prospects.

Opportunities for Thematic Trading

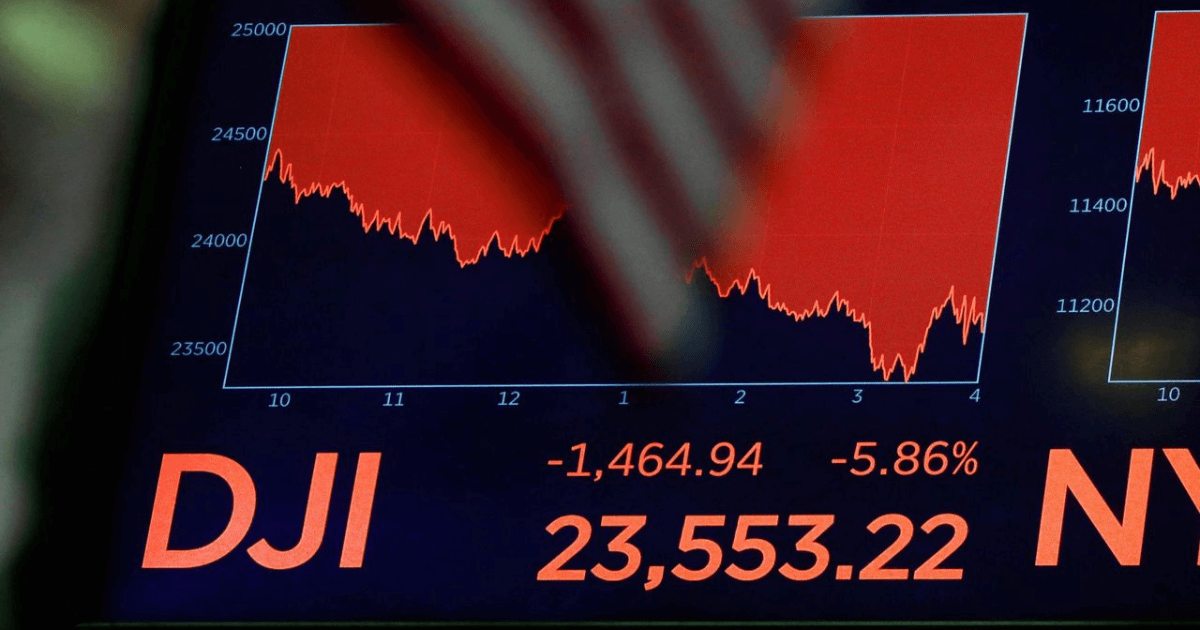

With its heavy weighting in cyclical sectors like finance and materials, the US30 is ideal for thematic plays. Traders can buy or short the index based on economic fundamentals, sector trends, or dollar strength.

How to Trade the US30

Trading the US30 involves speculating on its price movements using financial instruments like CFDs (Contracts for Differences). Trusted brokers such as Exness, XM, and Avatrade offer user-friendly platforms to start trading the index.

Steps to Trade the US30

- Choose a Broker: Sign up with a regulated broker like Exness, XM, or Avatrade for competitive spreads and tight execution.

- Analyze the Market: Use technical indicators and study economic news to assess market sentiment.

- Open a Position: Decide whether to buy or sell based on your analysis.

- Manage Risk: Set stop-loss orders to minimize potential losses.

Is US30 Good for Day Trading?

Absolutely! The index’s high liquidity and frequent price swings make it ideal for day traders looking to capitalize on short-term movements. Tight spreads offered by brokers like Exness help keep costs low.

When Does the US30 Open?

The US30 Index follows the trading hours of the New York Stock Exchange (NYSE), opening at 9:30 AM ET and closing at 4:00 PM ET. Pre-market and after-hours trading are also available, providing additional opportunities to trade.

Where to Trade the US30

You can trade the US30 on leading platforms like Exness, XM, and Avatrade. These brokers offer robust tools, competitive fees, and access to CFDs, enabling you to profit from price movements without owning the underlying stocks.

To learn more about these brokers before signing up, read our Exness broker review, XM broker review and AvaTrade broker review for traders in the UAE!

To learn more about these brokers before signing up, read our Exness broker review, XM broker review and AvaTrade broker review for traders in the UAE!

What News Affects the US30?

Several factors influence the US30’s performance:

- Economic Reports: GDP growth, inflation data, and employment figures can shift sentiment.

- Federal Reserve Policies: Interest rate changes and quantitative easing directly impact stock prices.

- Corporate Earnings: Results from heavyweights like UnitedHealth and Apple can significantly move the index.

- Global Events: Crises in Europe or Asia often spill over into U.S. markets.

FAQs About the US30

How Does Trading US30 Work?

Trading the US30 involves predicting its price movements through CFDs. You can go long (buy) if you believe the index will rise or short (sell) if you expect it to drop.

How Many Pips Is 1 Point in US30?

In the US30, 1 point equals 1 pip. This simple structure makes it easy to calculate profits and losses.

Is US30 Good for Day Trading?

Yes, the US30’s volatility and liquidity make it an excellent choice for day trading. Tight spreads on platforms like XM and Avatrade further enhance profitability.

What News Affects US30?

Economic indicators, Federal Reserve actions, corporate earnings, and global market trends all impact the US30’s movements.

Trading the US30 involves predicting its price movements through CFDs. You can go long (buy) if you believe the index will rise or short (sell) if you expect it to drop.

How Many Pips Is 1 Point in US30?

In the US30, 1 point equals 1 pip. This simple structure makes it easy to calculate profits and losses.

Is US30 Good for Day Trading?

Yes, the US30’s volatility and liquidity make it an excellent choice for day trading. Tight spreads on platforms like XM and Avatrade further enhance profitability.

What News Affects US30?

Economic indicators, Federal Reserve actions, corporate earnings, and global market trends all impact the US30’s movements.

Final Thoughts

The US30 Index isn’t just a trading tool—it’s a window into the health of a leading economy. By learning how the US30 index works and mastering how to trade the US30, you can turn market volatility into opportunity. Sign up with Exness, XM, or Avatrade today and explore the full potential of this dynamic index!