When it comes to choosing a forex and CFD broker, traders seek a platform that offers strong regulation, competitive pricing, a diverse asset selection, and advanced trading tools. MultiBank Group has positioned itself as a top contender in the online trading space, providing a comprehensive suite of platforms and services tailored to both beginner and professional traders.

With over 20,000 tradable instruments, tight spreads, and multiple account types, MultiBank Group has attracted traders worldwide. But is it the right broker for you? This MultiBank Group review will break down its pros, cons, fees, platforms, product offerings, and more to help you decide.

With over 20,000 tradable instruments, tight spreads, and multiple account types, MultiBank Group has attracted traders worldwide. But is it the right broker for you? This MultiBank Group review will break down its pros, cons, fees, platforms, product offerings, and more to help you decide.

Who is MultiBank Group?

Founded in 2005 in California, USA, MultiBank Group is a heavily regulated forex and CFD broker that has expanded its operations globally. It offers trading on six asset classes, including forex, stocks, indices, commodities, metals, and cryptocurrencies, through its proprietary MultiBank-Plus platform and MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

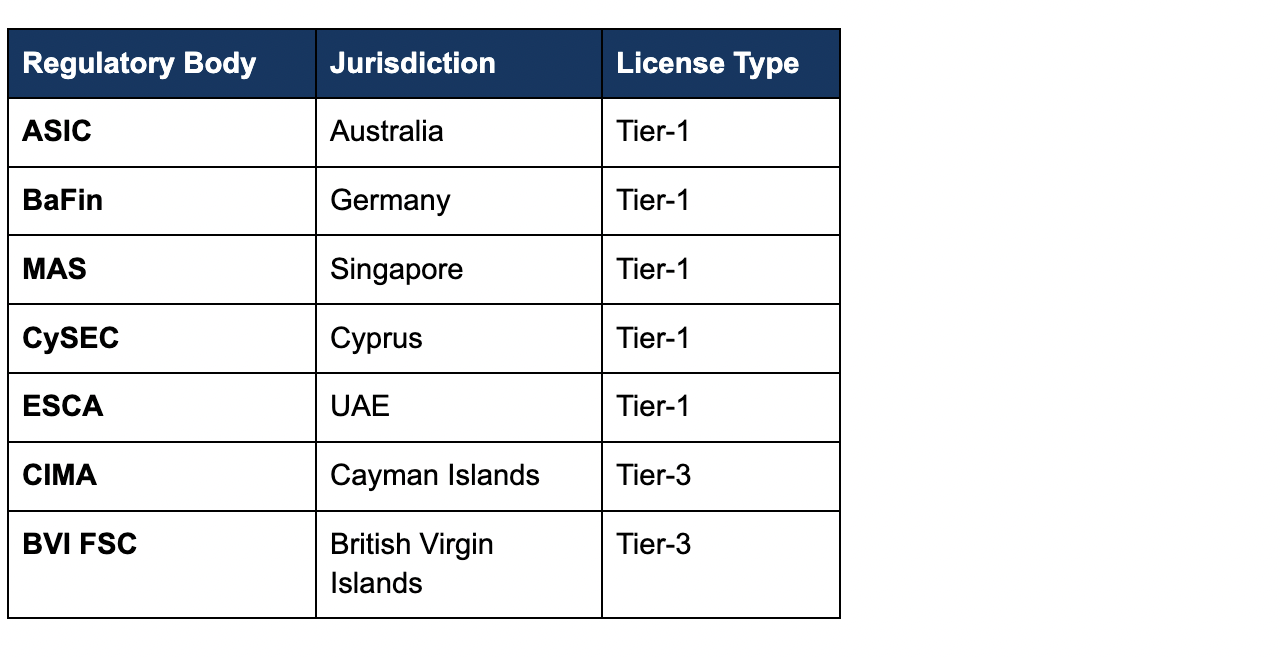

MultiBank has 10 regulated entities across different jurisdictions, ensuring compliance with financial authorities such as ASIC (Australia), BaFin (Germany), MAS (Singapore), CySEC (Cyprus), and ESCA (UAE). This strong regulatory framework adds credibility and security for traders.

MultiBank has 10 regulated entities across different jurisdictions, ensuring compliance with financial authorities such as ASIC (Australia), BaFin (Germany), MAS (Singapore), CySEC (Cyprus), and ESCA (UAE). This strong regulatory framework adds credibility and security for traders.

Pros & Cons of MultiBank Group

✅ Pros:

❌ Cons:

- Highly regulated by five Tier-1 financial authorities.

- Competitive pricing with commission-free and low-spread accounts.

- Multiple trading platforms: MultiBank-Plus, MT4, and MT5.

- Over 20,000 tradable assets, including shares and cryptocurrencies.

- Trading Central analysis, VPS hosting, and FIX API support.

- No deposit or withdrawal fees.

- 24/7 customer support in multiple languages.

❌ Cons:

- Slower execution speeds, scalping not permitted

- Strict KYC verification makes account setup time-consuming.

- Higher spreads on the Standard account compared to industry averages.

MultiBank Group Trading Accounts & Fees

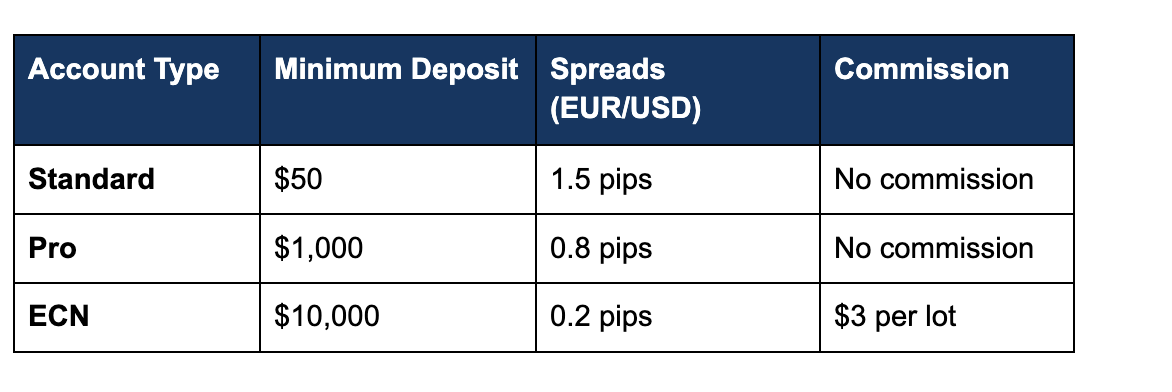

MultiBank Group offers three main account types, catering to traders with different experience levels and capital availability.

Other Fees to Consider

For active traders, MultiBank's ECN account offers the tightest spreads, while the Standard account is more beginner-friendly but comes with higher spreads.

- Inactivity Fee: $60 per month after 90 days of inactivity.

- No deposit or withdrawal fees, but third-party banking fees may apply.

For active traders, MultiBank's ECN account offers the tightest spreads, while the Standard account is more beginner-friendly but comes with higher spreads.

Trading Platforms & Tools

MultiBank Group provides multiple trading platforms to accommodate different trading styles and preferences.

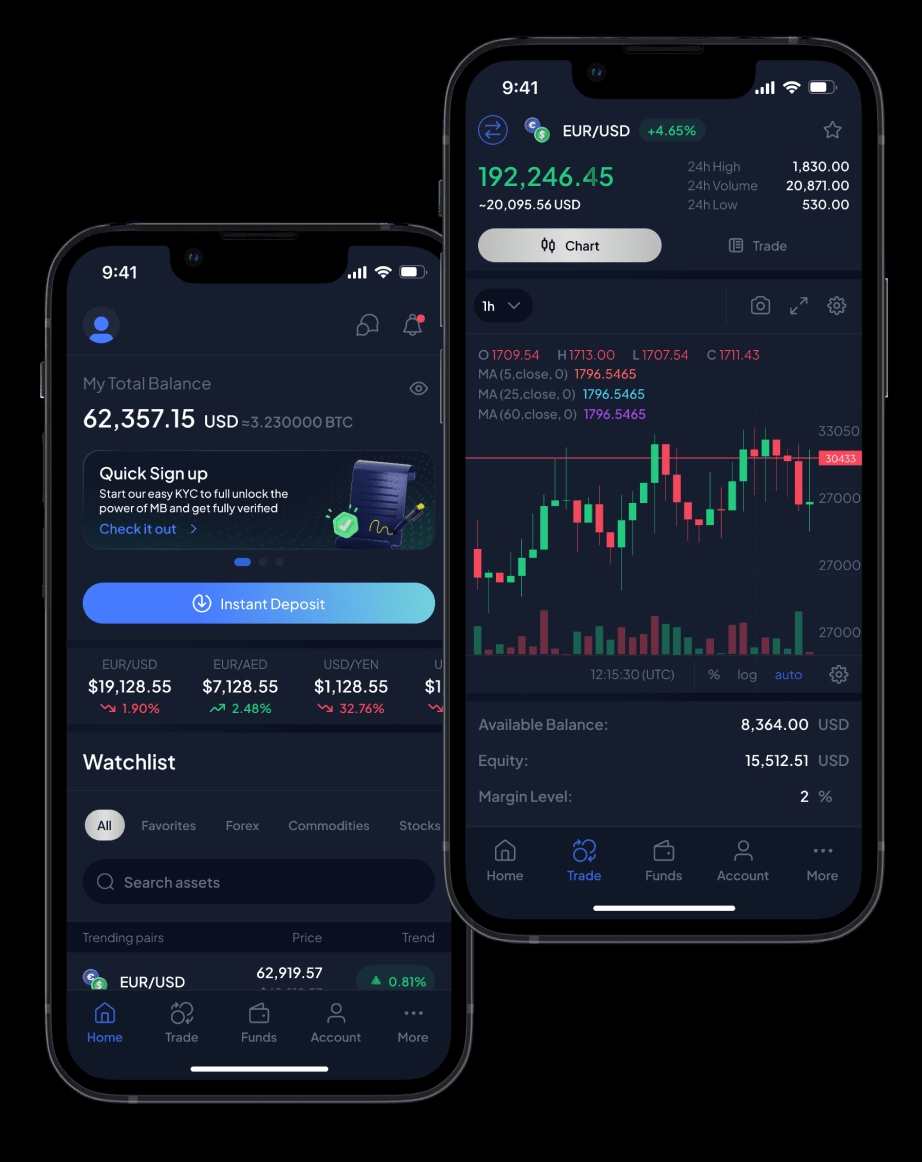

1. MultiBank-Plus (Web & Mobile)

1. MultiBank-Plus (Web & Mobile)

- Proprietary platform with a modern interface.

- TradingView-powered charts for better technical analysis.

- Copy trading & market insights included.

- Still lacks some advanced features compared to competitors.

2. MetaTrader 4 & MetaTrader 5 (MT4/MT5)

- Industry-standard platforms for forex and CFD trading.

- Automated trading with Expert Advisors (EAs).

Depth of Market (DOM) and strategy tester included.

3. Additional Trading Tools

Trading Central integration for in-depth market analysis.

- VPS hosting for low-latency trading.

- FIX API for direct market access.

Trading Central integration for in-depth market analysis.

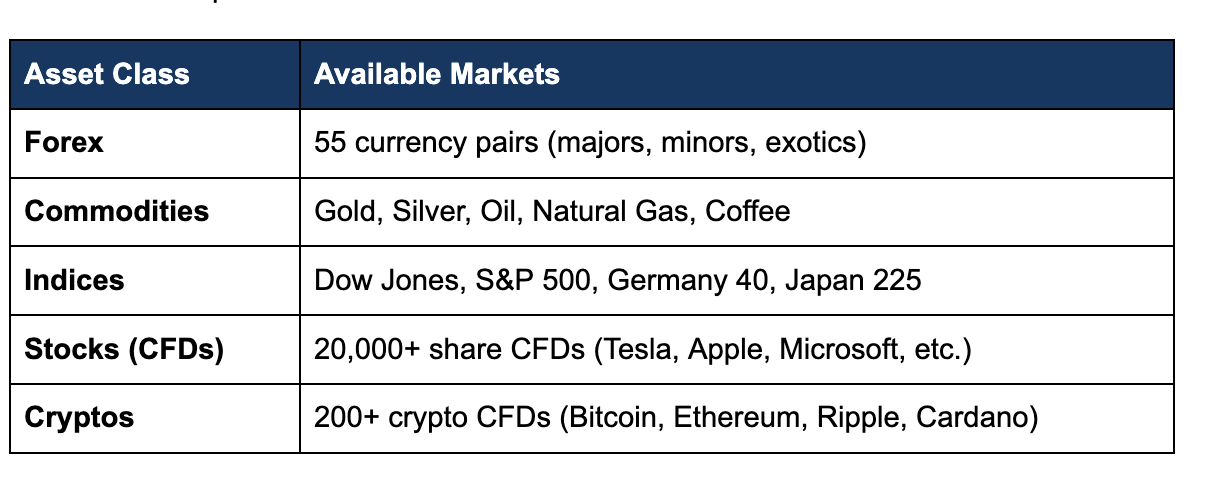

Product Offerings: What Can You Trade with MultiBank Group?

MultiBank Group offers a diverse selection of financial instruments.

MultiBank's wide range of share CFDs and cryptocurrencies makes it an attractive choice for traders looking for diversification.

Regulation & Safety: Is MultiBank Group Legit?

One of the key factors in choosing a broker is regulation and security. MultiBank Group operates under 17+ regulated entities, five of which hold Tier-1 licenses. Here are some of their most prominent.

Client Protection Measures

These safety measures make MultiBank Group one of the most trustworthy trading broker online.

- Segregated client funds to prevent misuse.

- Negative balance protection to limit trading losses.

- Insurance coverage of up to $1 million per customer via Lloyd’s of London.

These safety measures make MultiBank Group one of the most trustworthy trading broker online.

Customer Support & Payments

Customer Support

Deposit & Withdrawal Options

MultiBank supports 20+ deposit and withdrawal methods, including:

Deposits are instant for most methods, while withdrawals take 1-2 business days.

- Available 24/7 via live chat, phone, and email.

- Supports multiple languages, including English, Arabic, Russian, Spanish, and French.

- Highly responsive agents with deep knowledge of trading platforms.

Deposit & Withdrawal Options

MultiBank supports 20+ deposit and withdrawal methods, including:

- Bank wire transfers

- Credit/Debit cards (Visa, Mastercard)

- E-wallets (Skrill, Neteller, PayTrust, PayRetailers)

- Crypto wallets (Bitcoin, USDT ERC20, USDT TRC20)

Deposits are instant for most methods, while withdrawals take 1-2 business days.

Research & Education

Research Tools

- Economic Calendar to track market events.

- Trading Central analysis & signals for trade ideas.

- Live market updates for forex, stocks, and crypto.

Educational Content

- Video tutorials on technical analysis.

- Trading courses & ebooks for beginners.

- Platform guides for MT4, MT5, and MultiBank-Plus.

Final Verdict: Should You Trade with MultiBank Group?

MultiBank Group is a strong choice for traders who value tight spreads, strong regulation, diverse assets, and advanced trading tools. It excels in share CFD trading and cryptocurrency trading.

However, scalpers may find the execution speeds slow, and account verification can be tedious. Despite these minor drawbacks, MultiBank remains a leading global broker for forex and CFDs.

Pros vs. Cons Recap

✅ Highly regulated & safe

✅ Competitive pricing on Pro & ECN accounts

✅ Over 20,000 tradable instruments

✅ VPS hosting & FIX API for advanced traders

✅ Strong research & education content

❌ Slower execution speeds for scalping

❌ High spreads on the Standard account

However, scalpers may find the execution speeds slow, and account verification can be tedious. Despite these minor drawbacks, MultiBank remains a leading global broker for forex and CFDs.

Pros vs. Cons Recap

✅ Highly regulated & safe

✅ Competitive pricing on Pro & ECN accounts

✅ Over 20,000 tradable instruments

✅ VPS hosting & FIX API for advanced traders

✅ Strong research & education content

❌ Slower execution speeds for scalping

❌ High spreads on the Standard account