Admirals Trading Instruments

Admirals offers a wide range of financial instruments to trade, including Forex, CFDs on stocks, indices, precious metals and energy. They also offer a free demo account so you can practice your trading strategies before committing to a live account. Here is a comprehensive view of Admirals full product offering.

Forex Trading

Admiral offers 80+ major, minor and exotic forex pairs. This is a very competitive range of currency pairs with 50+ exotics to choose from. UAE traders can also benefit from fast execution and support from extra features including a pip calculator.

Stock Trading and Investing

Admirals clients based in Dubai and the UAE can trade CFDs on an impressive range of 3350+ stocks from 17 different global exchanges with low commissions. Traders can also physically invest in company shares directly with low commissions, along with fractional investing for clients looking to invest with smaller budgets.

CFD Trading

Trade CFDs on forex, stocks, indices, commodities, ETFs and bonds with variable leverage up to 1:500. The broker provides great value to traders with six free trades per day on US, UK and European stocks, tight spreads on forex and low commissions on ETFs. UAE clients can also access 11 commodity futures and 5 metal CFDs.

Admirals Commissions, Spreads and Fees

Admirals incorporates its fees within the spread of the traded instrument, although the specifics can differ based on the platform and account type you select. Admiral Markets offers four distinct account types, each associated with its unique fees and trading features. More details about the fee variations among Admirals’ account types can be found in the ‘Account Type’ section.

Across all account types, the overall cost of trading remains consistent, featuring spreads ranging from 0.5 to 0.7 pips. Notably, commission-free accounts offer spreads starting from 0.5 pips (EUR/USD), while Zero Accounts entail commissions of 6 USD (round turn) along with competitive spreads of 0.1 pips (EUR/USD) – a highly attractive proposition.

For stock and ETF trading with Admirals, there is a transaction fee of $0.02 per trade.

Regarding non-trading fees, Admirals imposes an inactivity fee for accounts inactive for over 2 years, amounting to a monthly charge of $10. Overnight positions incur swap rates, also referred to as interest fees, yet this can be avoided through Admirals’ Islamic Swap-Free forex account.

However, this option replaces overnight fees with an administration fee for positions held beyond 3 days.

Looking at withdrawal fees, UAE clients will find that only one withdrawal request per month is free, while subsequent requests are subject to a 1% withdrawal fee.

Admirals Deposits and Withdrawals

Deposits

With Admirals, Traders from Dubai and the rest of the UAE can fund their account using a variety of methods, including bank transfer, MasterCard and Visa payments. None of the above will charge any extra transfer fees. You can also use e-wallet payment methods such as Neteller, Skrill and PayPal.

The minimum deposit for UAE clients trading with Admirals is $250 for MT4 accounts, and range from $1-$250 for its range of MT5 accounts.

Don’t be put off by the relatively high minimum deposit of Admiral Markets; brokers with larger minimum deposits often offer extra premium services that can’t easily be found for free. B

rokers that have smaller minimum deposits cater to more mainstream traders who aren’t interested in the more advanced technical features. Other brokers that don’t even require a minimum deposit usually do that in order to win as many new clients as possible.

Withdrawal

For withdrawals, Admirals offers the same methods as mentioned above when depositing trading funds. With the exception of bank transfers, which might take up to 3 days, all withdrawals are handled instantly. When a withdrawal is requested, Admiral Markets provides the relevant bank codes.

Traders are entitled to one free withdrawals every month, with a minimum withdrawal of $1. Any withdrawal request made after the first within the same month will be subject to a 1% withdrawal fee.

This puts Admirals as a disadvantage compared to competitors that offer unlimited free withdrawals.

Admirals Trading Platforms

Admirals has joined forces with MetaQuotes to present an extensive selection of MetaTrader platforms. These encompass MT4, MT5, MetaTrader WebTrader, and the MetaTrader Supreme Edition.

For Mac users, Admirals extends compatibility through Parallels, ensuring seamless utilization of MetaTrader platforms on Mac devices.

MetaTrader 4 (MT4)

MetaTrader 4, renowned as the world’s premier retail trading platform, shines particularly in forex and CFD trading. This software is accessible for download on both Mac and Windows devices. Recognized for its speed and reliability, MT4 comes equipped with a host of valuable features:

1. Multiple time frames

2. Automated trading facilitated by APIs.

3. Customizable trading indicators

4. Comprehensive historical data

5. Advanced charting capabilities

6. One-click trading

MetaTrader 5 (MT5)

MetaTrader 5 stands as the evolution of MT4, tailored to cater to the preferences of more experienced traders.

With an array of advanced technical analysis tools and a fully customizable interface, MT5 emerges as a potent all-encompassing platform. Admirals extends MT5 for stock and ETF investing, boasting distinctive features such as:

1. Educational market integration

2. Provision of free market data

3. Live news feeds

4. Support for VPS services

MetaTrader Supreme Edition

Designed with more advanced traders in mind, the MetaTrader Supreme Edition offers an arsenal of potent tools for optimizing trade operations.

This platform showcases an array of sophisticated technical analysis indicators, award-winning pattern recognition technology, diverse holding timeframes, day trading strategies, and the added convenience of Global Opinion widgets for streamlined management of multiple currencies and orders.

Admiral’s Proprietary Trading App

In addition to its MT4 and MT5 lineup, Admirals also offers its in-house proprietary mobile app that is sleek, intuitive and easy to set up. This all-in-one app allows UAE clients to invest in shares and ETFs from as little as $1, and trade CFDs and forex from $100.

The app gets extra bonus points for its free educational resources that are built-in.

Admirals Account Types

Trade.MT5 Account

The Trade.MT5 Account mandates a minimum deposit of 250 USD, offering leverage of up to 500:1. For Forex trading, no commissions are levied. Spreads start at 0.6 pips for the EUR/USD pair.

Furthermore, this account category extends the option for an Islamic swap-free feature.

Zero.MT5 Account

Incorporating a minimum deposit requirement of 250 USD, the Zero.MT5 account stands out with spreads commencing at an impressive 0.0 pips for the EUR/USD.

However, a commission ranging from 1.8 to 3 USD is applied per lot per side.

Invest.MT5 Account

Invest.MT5 remains dedicated to authentic stock and ETF investments. Notably, this account class sets a low bar for entry with a minimum deposit amount of just $1, facilitating fractional investing.

UAE clients gain access to a substantial array of more than 4500 stocks and over 200 ETFs through this account, enhancing their investment opportunities.

Trade.MT4 Account

The Trade.MT4 Account aligns with a minimum deposit requirement of 250 USD. This account variety offers competitive spreads, starting at 0.5 pips for the EUR/USD pair, without any commission charges. It’s important to note that Islamic swap-free options are not available within this account type.

Zero.MT4 Account

Crafted for precision, the Zero.MT4 Account mandates a minimum deposit of 250 USD and extends leverage of up to 500:1. It stands out with its ultra-tight spreads from 0.0 pips on the EUR/USD pair.

However, this comes in exchange for a commission that ranges between 1.8 and 3 USD per side per lot traded, contingent upon trading volume. It’s important to mention that this account class does not offer Islamic swap-free alternatives.

Admirals Research & Education

Education

Admirals stands out for its extensive educational and support resources, as evident from our Admirals review. Through a range of seminars, analytical research, and daily client support, the broker ensures that even beginners feel at ease with their services.

Furthermore, Admirals offers complimentary market news and analysis from Dow Jones, coupled with integrated trading tools and platform extensions. This comprehensive approach empowers traders to make informed decisions by leveraging the latest information and analytics.

Admirals’ education receives a strong rating of 8 out of 10 from our testing. The broker excels in providing educational materials, high-quality research, and a robust Academy that includes webinars and exceptional trading videos.

Trading Tools

The trading tools offered by Admiral Markets are notably superior when compared to similar brokers. Their MetaTrader Supreme Edition stands out as one of the premier MetaTrader plugins in the market.

Integrated into this edition is Trading Central, along with an array of other valuable tools. Additionally, Admirals offers a VPS service for enhanced trading convenience.

Admirals has entered into a partnership with Trading Central, integrating their indicators such as Forex Featured Ideas and Technical Insight into the MetaTrader Supreme Edition. These versatile tools, highly customizable to suit individual preferences, offer pattern recognition and technical analysis across a wide spectrum of financial instruments.

Furthermore, Admirals extends a VPS service to clients who maintain a minimum equity amount of 5000 EUR (or equivalent) in their trading accounts. This service enhances trading efficiency by providing a virtual private server for seamless operations.

Admirals Regulation

Admirals is a well-regarded global brokerage with licenses from multiple regulatory authorities. One of its entities, Admiral Markets UK Limited, is licensed by the Financial Conduct Authority (FCA).

In addition to its FCA license, the group holds licenses from various other regulatory bodies, including the Estonian Financial Supervision Authority, the Cyprus Securities and Exchange Commission (CySEC), the Jordan Securities Commission (JSC), and the Australian Securities and Investments Commission (ASIC).

To adhere to regulatory requirements, Admirals ensures the segregation of client funds from the company’s own assets. This practice is maintained by storing client capital in an EEA-regulated credit institution.

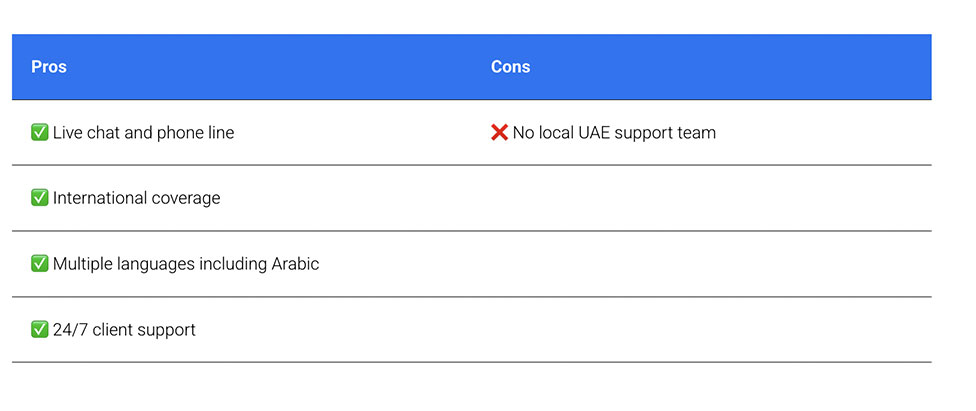

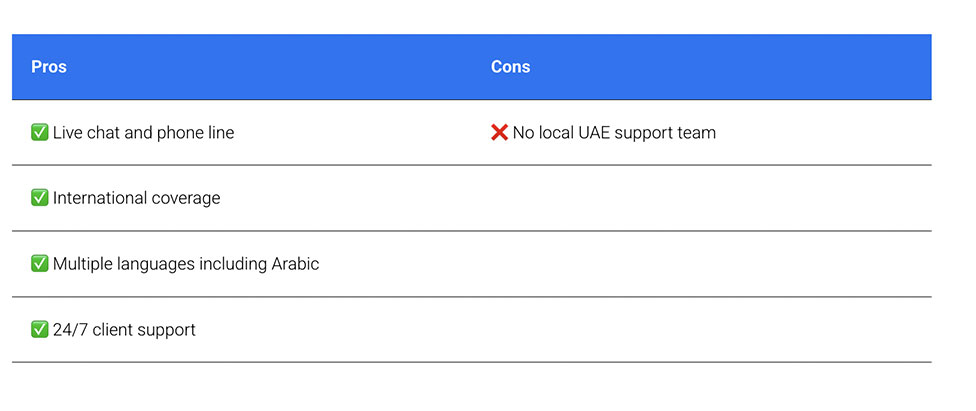

Admirals Customer Support

Admirals traders have convenient avenues for reaching out to customer support, including phone assistance, a live chat room, email correspondence, and direct communication with representatives.

The broker’s customer service teams exhibit a high level of responsiveness and professionalism, assuring traders of reliable support from their end.

When evaluating the quality of customer support at Admiral Markets, it received a favorable rating of 7 out of 10 based on our testing. The support staff demonstrates expertise and is available around the clock, proficiently assisting clients in 23 languages, which is a notable advantage.

During our testing, we experienced prompt responses on the live chat, and the ease of accessibility to support resources was also noteworthy.

Admirals: The Bottom Line

To summarize the review, Admirals is a distinguished global broker catering to traders and investors in the UAE and beyond. With strong regulatory oversight from authorities such as the FCA and ASIC, the broker offers a wide spectrum of leveraged CFD instruments, including forex, stocks, indices, commodities, and cryptocurrencies.

Backed by over 21 years of experience, Admirals has established itself as a reliable brand, providing traders of all skill levels with essential tools and resources for effective trading.

One of the standout features of Admirals is its diverse range of trading instruments, combined with the flexibility to choose from various account types.

Admirals excels in education and support, offering seminars, research, and daily assistance, ensuring that even beginners feel at ease. Integration of market news, analysis, and trading tools empowers traders to make informed decisions. While customer support is readily available through multiple channels, the absence of local UAE support is a point to consider.

In summary, Admirals emerges as a reliable partner for UAE traders, offering a comprehensive trading experience driven by regulatory compliance, a diverse range of instruments, educational resources, and responsive customer support.

Written by Sam Reid

Written by Sam Reid Fact checked by Freddie Ricks

Fact checked by Freddie Ricks Last updated 1 day ago

Last updated 1 day ago