“When the Federal Open Market Committee (FOMC) speaks, the world takes notice.”

Few institutions wield as much power over the global economy as the FOMC. But what is the FOMC, and why does it matter to traders like you? Whether you trade forex, gold, or stocks, understanding the FOMC can be the difference between capitalizing on market moves and getting caught off guard. Let’s unpack its influence and show you how to stay ahead.

Few institutions wield as much power over the global economy as the FOMC. But what is the FOMC, and why does it matter to traders like you? Whether you trade forex, gold, or stocks, understanding the FOMC can be the difference between capitalizing on market moves and getting caught off guard. Let’s unpack its influence and show you how to stay ahead.

What Is the FOMC? A Trader’s Guide to the Fed’s Powerhouse

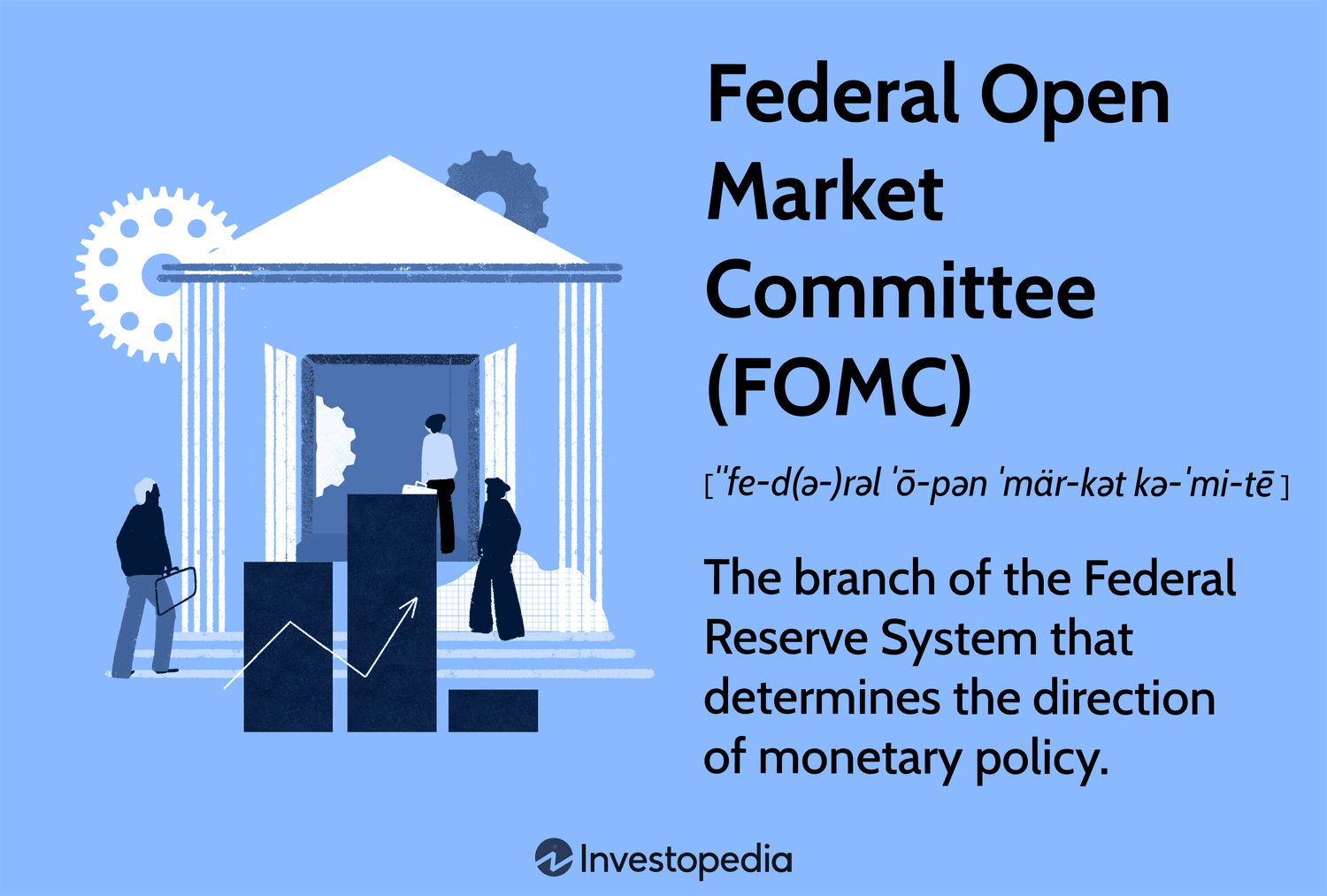

The Federal Open Market Committee (FOMC) is the decision-making arm of the U.S. Federal Reserve (aka “the Fed”), and its primary job is to manage monetary policy. This 12-member committee sets the tone for interest rates, controls the money supply, and oversees open market operations (OMOs)—all with the aim of fostering maximum employment and stable prices.

In simple terms, the FOMC makes the big calls that ripple through financial markets. Its eight scheduled meetings per year are like a roadmap for where the economy—and the markets—are heading.

In simple terms, the FOMC makes the big calls that ripple through financial markets. Its eight scheduled meetings per year are like a roadmap for where the economy—and the markets—are heading.

Why Is FOMC Important? The Lifeblood of Market Movement

If you’ve ever wondered, “Why is FOMC important?”, here’s your answer: the FOMC’s decisions impact everything from mortgage rates to forex pairs like EUR/USD and even the price of gold. These decisions affect how much it costs businesses and consumers to borrow, spend, and invest.

For traders, the FOMC is like the ultimate market influencer. Its announcements can cause major volatility in assets tied to the U.S. dollar and interest rates. Whether you’re trading gold, forex, or indices, you’ll want to keep FOMC dates circled on your calendar.

For traders, the FOMC is like the ultimate market influencer. Its announcements can cause major volatility in assets tied to the U.S. dollar and interest rates. Whether you’re trading gold, forex, or indices, you’ll want to keep FOMC dates circled on your calendar.

How Does the FOMC Work?

Who Are the FOMC Members?

The FOMC consists of 12 voting members:

This group balances regional economic perspectives to ensure a comprehensive policy approach.

- Seven members from the Federal Reserve’s Board of Governors.

- The President of the Federal Reserve Bank of New York (a permanent member).

- Four other regional Federal Reserve Bank presidents who rotate annually.

This group balances regional economic perspectives to ensure a comprehensive policy approach.

How FOMC Meetings Affect Traders

FOMC and Forex Trading

When the FOMC announces changes to the federal funds rate, the U.S. dollar reacts. A hawkish stance (rate hikes) strengthens the USD, while a dovish approach (rate cuts) weakens it. For forex traders, understanding how the FOMC affects forex is crucial for trading pairs like USD/JPY or GBP/USD.

FOMC and Gold Prices

Gold often dances to the FOMC’s tune. Higher interest rates make gold less attractive as a non-yielding asset, pushing prices down. On the flip side, rate cuts or dovish signals usually send gold soaring as investors flock to its safe-haven status. If you’ve ever asked, “How FOMC affects gold?”, it’s all about interest rate expectations.

FOMC Meeting Minutes: A Treasure Trove for Traders

The FOMC Meeting Minutes, released three weeks after each meeting, offer insights into the Fed’s thinking. Traders use these minutes to predict future policy shifts, especially when the minutes reveal divisions among FOMC members. A hawkish tone can lift the dollar, while dovish commentary can send it tumbling.

Trading the FOMC: Strategies That Work

Stay Ahead with Reliable Brokers

To trade FOMC events effectively, you need a fast, reliable platform. Brokers like XM and Avatrade offer real-time tools, tight spreads, and the infrastructure you need to execute trades quickly during high-volatility periods.

Want to learn more about these top UAE brokers? Read our XM review and AvaTrade review now!

Want to learn more about these top UAE brokers? Read our XM review and AvaTrade review now!

Key Strategies for FOMC Trading

1. Pre-Positioning: Analyze historical market reactions to similar FOMC scenarios to anticipate movements.

2. Post-Meeting Trading: Wait for the initial volatility to settle and trade based on the market’s interpretation.

3. Use Stop-Loss Orders: Protect yourself from sharp reversals during FOMC announcements.

4. Watch the USD: Keep an eye on dollar index movements as they often set the tone for other markets.

2. Post-Meeting Trading: Wait for the initial volatility to settle and trade based on the market’s interpretation.

3. Use Stop-Loss Orders: Protect yourself from sharp reversals during FOMC announcements.

4. Watch the USD: Keep an eye on dollar index movements as they often set the tone for other markets.

FAQs About FOMC

What Is the Main Purpose of the FOMC?

The FOMC’s main job is to manage monetary policy to ensure maximum employment and stable prices.

How Does the FOMC Affect the Money Supply?

The FOMC uses OMOs to adjust the money supply by buying or selling U.S. government securities.

How Do FOMC Meeting Minutes Affect USD?

The FOMC meeting minutes reveal internal discussions and future policy hints, which traders use to gauge the Fed’s next move, often impacting the USD’s strength.

How Does the Market React to FOMC?

Markets react swiftly to FOMC announcements, particularly forex and gold. The reaction depends on whether the committee’s stance is perceived as hawkish (tightening) or dovish (easing).

What Is the Most High-Impact News in Forex?

FOMC meetings and rate announcements are among the most significant market-moving events for forex traders.

The Bottom Line

The FOMC is more than just a committee—it’s a market mover. Whether you trade gold, forex, or stocks, understanding what is the FOMC and its policies can give you an edge. Prepare for volatility, follow the minutes, and trade with a trusted broker like XM or Avatrade to make the most of these opportunities. When the FOMC speaks, smart traders act. Will you be ready?