Introduction: Why Day Trading is the Everest of Financial Markets

Imagine this: 90% of day traders lose money, but the top 10%? They don’t just survive—they thrive. They make decisions in milliseconds, execute trades worth thousands (or millions), and ride the adrenaline of volatile markets. Can day trading be profitable? Absolutely. But only for those equipped with the right knowledge, tools, and discipline.

In this guide, we’ll break down how day trading works, dive into what day trading means, and explore whether day trading can be a career. From understanding essential strategies to choosing platforms like Exness and Avatrade, this article has everything you need to begin—and sharpen—your day trading journey.

In this guide, we’ll break down how day trading works, dive into what day trading means, and explore whether day trading can be a career. From understanding essential strategies to choosing platforms like Exness and Avatrade, this article has everything you need to begin—and sharpen—your day trading journey.

Understanding How Day Trading Works

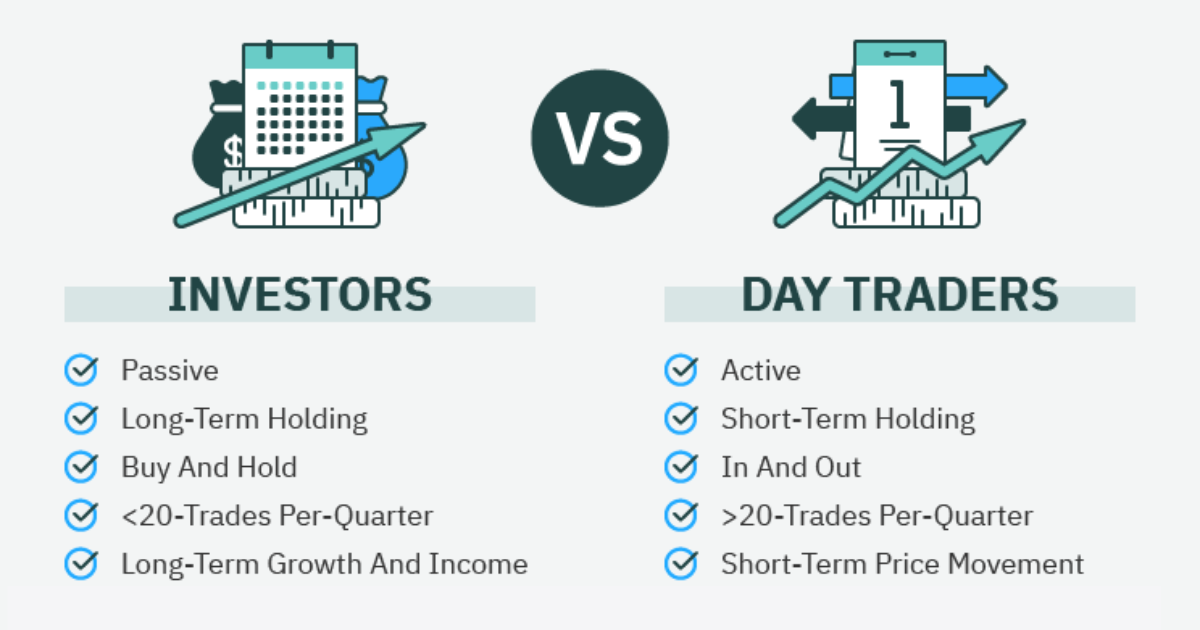

Day trading is simple in concept but complex in execution. It involves buying and selling financial instruments—stocks, forex, options, or futures—within a single trading day. The goal? Profit from small price movements. Unlike long-term investing, day traders don’t hold positions overnight.

What sets day trading apart is its focus on short-term market inefficiencies. Day traders aren’t looking for investments they can hold for years; they’re looking for trades they can close in minutes or hours. This fast-paced approach is driven by technical analysis, market news, and real-time data, often requiring multiple screens and split-second decision-making.

What sets day trading apart is its focus on short-term market inefficiencies. Day traders aren’t looking for investments they can hold for years; they’re looking for trades they can close in minutes or hours. This fast-paced approach is driven by technical analysis, market news, and real-time data, often requiring multiple screens and split-second decision-making.

What Day Trading Means in Today’s Financial Landscape

At its core, what day trading means is quick, decisive action. Success depends on liquidity, volatility, and timing. The goal isn’t to find the next Amazon but to ride short-term waves for incremental gains.

Day traders often rely on:

The modern trading environment has made day trading accessible to retail traders with platforms like Exness and Avatrade, which provide tools that were once reserved for institutional players. Understanding these tools and their applications is critical to success.

Day traders often rely on:

- Technical Analysis: Using charts, patterns, and indicators like RSI and MACD to predict price movements.

- Momentum Trading: Riding trends sparked by news or market events.

- Scalping: Capitalizing on micro price gaps for fast profits.

The modern trading environment has made day trading accessible to retail traders with platforms like Exness and Avatrade, which provide tools that were once reserved for institutional players. Understanding these tools and their applications is critical to success.

Can Day Trading Be a Career?

Yes, but with a caveat. Can day trading be a career for everyone? Not quite. For those who master risk management, discipline, and strategy, it can be a lucrative pursuit. However, the majority fail due to a lack of preparation or emotional decision-making.

Professionals often benefit from access to institutional-grade tools, trading desks, and large capital reserves. Retail traders, on the other hand, must work harder to compete. Platforms like Exness and Avatrade offer powerful analytics, fast execution, and resources to help bridge this gap, making where to day trade a critical consideration. Learn more about these platforms in our Exness UAE broker review and our AvaTrade UAE broker review.

Professionals often benefit from access to institutional-grade tools, trading desks, and large capital reserves. Retail traders, on the other hand, must work harder to compete. Platforms like Exness and Avatrade offer powerful analytics, fast execution, and resources to help bridge this gap, making where to day trade a critical consideration. Learn more about these platforms in our Exness UAE broker review and our AvaTrade UAE broker review.

How to Start Day Trading

Starting your day trading journey doesn’t mean diving into deep waters unprepared. Here's a step-by-step guide to get started:

1. Educate Yourself: Learn how day trading works by studying technical analysis, trading psychology, and risk management. Platforms like Exness and Avatrade offer educational resources to help traders build foundational skills.

2. Create a Trading Plan: Define:

3. Choose the Right Platform: Opt for brokers like Exness (ideal for forex) and Avatrade (versatile for stocks, options, and forex) for intuitive interfaces, low fees, and robust tools.

4. Start Small: Limit positions to minimize risk while gaining experience. Can you day trade with 100 dollars? Yes, but expect slower progress. Focus on fractional shares or micro-lots to minimize risk while learning.

5. Manage Risk: Use stop-loss orders to cap losses and define clear profit targets. Without a solid risk management strategy, even the best trades can backfire.

6. Practice on a Demo Account: Before committing real money, use a demo account to simulate trading. This allows you to refine strategies without financial risk.

1. Educate Yourself: Learn how day trading works by studying technical analysis, trading psychology, and risk management. Platforms like Exness and Avatrade offer educational resources to help traders build foundational skills.

2. Create a Trading Plan: Define:

- Entry/exit strategies.

- Risk tolerance (e.g., only risking 1%-2% per trade).

- Daily and weekly profit targets.

3. Choose the Right Platform: Opt for brokers like Exness (ideal for forex) and Avatrade (versatile for stocks, options, and forex) for intuitive interfaces, low fees, and robust tools.

4. Start Small: Limit positions to minimize risk while gaining experience. Can you day trade with 100 dollars? Yes, but expect slower progress. Focus on fractional shares or micro-lots to minimize risk while learning.

5. Manage Risk: Use stop-loss orders to cap losses and define clear profit targets. Without a solid risk management strategy, even the best trades can backfire.

6. Practice on a Demo Account: Before committing real money, use a demo account to simulate trading. This allows you to refine strategies without financial risk.

Can Day Trading Be Profitable?

The big question: can day trading be profitable? For disciplined traders, yes. Studies show that consistent profitability requires winning just 50%-60% of trades—as long as winners are larger than losers. Tools like candlestick charts and level 2 quotes can help you identify high-probability opportunities.

However, profitability isn’t just about executing good trades. It’s also about minimizing losses, staying disciplined, and accounting for transaction costs and taxes. Traders must continuously evaluate their performance and adapt their strategies to changing market conditions.

However, profitability isn’t just about executing good trades. It’s also about minimizing losses, staying disciplined, and accounting for transaction costs and taxes. Traders must continuously evaluate their performance and adapt their strategies to changing market conditions.

Advanced Tools for Day Trading Success

Successful day traders leverage advanced tools to improve their edge. Platforms like Exness and Avatrade provide features such as:

Investing in the right platform can make the difference between profitability and losses, so consider your options carefully.

- Real-Time Market Data: Up-to-the-second pricing and news feeds.

- Automated Trading: Algorithms that execute trades based on pre-set criteria.

- Risk Management Tools: Built-in stop-loss and take-profit settings.

Investing in the right platform can make the difference between profitability and losses, so consider your options carefully.

FAQs About Day Trading

Is Day Trading Actually Profitable?

For a minority, yes. Success demands discipline, education, and strict risk management.

How Do Day Traders Get Paid?

Day traders earn by capturing small price movements. Profits are deposited into their trading accounts after closed trades.

Can You Day Trade With $100?

Yes, but success will take time and patience. Starting with $100 is possible using brokers that support fractional trading, like Exness or Avatrade.

How Does Day Trading Work for Beginners?

Beginners should focus on education, start small, and practice on demo accounts before committing real money. Platforms like Avatrade provide simulated trading to build confidence.

Where to Day Trade

When choosing where to day trade, prioritize brokers that offer fast execution, low fees, and advanced tools.

Exness is excellent for forex traders, offering tight spreads and robust analytics. Avatrade is ideal for multi-asset trading, with features like risk management tools and deep market insights.

For a minority, yes. Success demands discipline, education, and strict risk management.

How Do Day Traders Get Paid?

Day traders earn by capturing small price movements. Profits are deposited into their trading accounts after closed trades.

Can You Day Trade With $100?

Yes, but success will take time and patience. Starting with $100 is possible using brokers that support fractional trading, like Exness or Avatrade.

How Does Day Trading Work for Beginners?

Beginners should focus on education, start small, and practice on demo accounts before committing real money. Platforms like Avatrade provide simulated trading to build confidence.

Where to Day Trade

When choosing where to day trade, prioritize brokers that offer fast execution, low fees, and advanced tools.

Exness is excellent for forex traders, offering tight spreads and robust analytics. Avatrade is ideal for multi-asset trading, with features like risk management tools and deep market insights.

The Bottom Line

Day trading is not for the faint of heart. It’s a challenging, high-risk endeavor requiring sharp skills, discipline, and a strong grasp of how day trading works. Can day trading be a career? For some, yes. But whether you’re starting with $100 or $100,000, success lies in preparation and persistence.

With platforms like Exness and Avatrade at your fingertips, you’re better equipped than ever to tackle this demanding world. By following a structured plan, managing risk, and continuously improving, you can increase your chances of success in this fast-paced trading environment.

With platforms like Exness and Avatrade at your fingertips, you’re better equipped than ever to tackle this demanding world. By following a structured plan, managing risk, and continuously improving, you can increase your chances of success in this fast-paced trading environment.