Forex trading is all about precision. Every pip counts, every trade size matters, and knowing what are lot sizes in forex can make or break your strategy. Here's a surprising fact: a single pip on a standard lot can be worth $10! That means a small move in the market could lead to significant gains—or losses—depending on how you manage your trade sizes.

If you've ever wondered how lot size is calculated or what lot size you can trade with $100, you're in the right place. Whether you’re a beginner dipping your toes in the market or a seasoned trader fine-tuning your trading strategy, this article dives deep into what lot size should you use and helps you master this essential aspect of forex trading.

Let’s break it down, step by step, in a way that’s clear, actionable, and tailored for traders who want results.

If you've ever wondered how lot size is calculated or what lot size you can trade with $100, you're in the right place. Whether you’re a beginner dipping your toes in the market or a seasoned trader fine-tuning your trading strategy, this article dives deep into what lot size should you use and helps you master this essential aspect of forex trading.

Let’s break it down, step by step, in a way that’s clear, actionable, and tailored for traders who want results.

What Are Lot Sizes in Forex?

In forex, a lot size refers to the standardized unit used to measure the volume of a trade. It's like buying groceries in bulk versus individual items—except here, you're trading currency pairs. Lot sizes determine how much of a currency you’re buying or selling, and they directly impact your potential profit, loss, and risk.

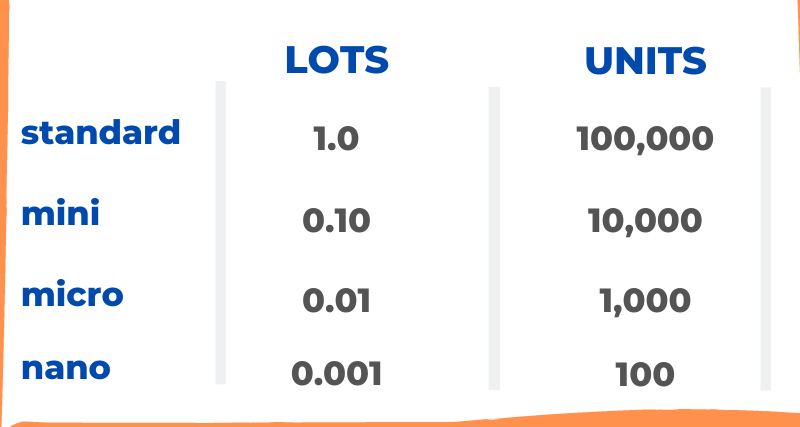

There are four common lot sizes in forex:

For instance, trading a 0.01 lot size means you're controlling 1,000 units of currency. This smaller trade size is often favored by beginners or those with smaller accounts.

There are four common lot sizes in forex:

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units (0.1 of a standard lot).

- Micro Lot: 1,000 units (0.01 of a standard lot).

- Nano Lot: 100 units (0.001 of a standard lot).

For instance, trading a 0.01 lot size means you're controlling 1,000 units of currency. This smaller trade size is often favored by beginners or those with smaller accounts.

How Lot Size Is Calculated

Calculating how lot size is calculated is easier than it seems. Here’s a simple formula:

Lot Size = Trade Volume ÷ Contract Size

For example, if you’re trading the EUR/USD pair at a rate of 1.2500, the value of a standard lot (100,000 units) would be: 1.2500×100,000=$125,0001.2500 × 100,000 = \$125,0001.2500×100,000=$125,000

But don’t worry—brokers like XM and Exness offer leverage, which allows you to trade large positions with smaller deposits. For instance, with 1:100 leverage, you’d only need $1,250 as a margin to control that $125,000 trade.

Lot Size = Trade Volume ÷ Contract Size

For example, if you’re trading the EUR/USD pair at a rate of 1.2500, the value of a standard lot (100,000 units) would be: 1.2500×100,000=$125,0001.2500 × 100,000 = \$125,0001.2500×100,000=$125,000

But don’t worry—brokers like XM and Exness offer leverage, which allows you to trade large positions with smaller deposits. For instance, with 1:100 leverage, you’d only need $1,250 as a margin to control that $125,000 trade.

What Lot Size Should You Use?

This depends on your account size, risk tolerance, and strategy. Here’s a rule of thumb:

What lot size you can trade with $100? A safe bet would be 0.01 lots to keep potential losses manageable. For a $1,000 account, you could trade 0.1 lots, depending on your stop-loss strategy.

- If your account is $100 or less, start with micro lots (0.01 lot size) to minimize risk.

- For accounts around $1,000, mini lots (0.1) offer a balance between risk and reward.

- Larger accounts can handle standard lots (1.0), but only if you're comfortable with the risks.

What lot size you can trade with $100? A safe bet would be 0.01 lots to keep potential losses manageable. For a $1,000 account, you could trade 0.1 lots, depending on your stop-loss strategy.

Why Lot Sizes Matter

The size of your trade determines the value of each pip movement. Here’s a quick breakdown:

Imagine trading gold (XAU/USD). For one standard lot (100 ounces) with a price of $1,902 per ounce, you’d control a $190,200 position. With leverage, you’d need a fraction of that as a deposit, but the pip value and risk increase exponentially with higher lot sizes.

- Standard Lot (1.0): $10 per pip

- Mini Lot (0.1): $1 per pip

- Micro Lot (0.01): $0.10 per pip

- Nano Lot (0.001): $0.01 per pip

Imagine trading gold (XAU/USD). For one standard lot (100 ounces) with a price of $1,902 per ounce, you’d control a $190,200 position. With leverage, you’d need a fraction of that as a deposit, but the pip value and risk increase exponentially with higher lot sizes.

What Lot Size Is Better for Beginners?

For beginners, micro lots (0.01 lot size) are ideal. They allow you to trade smaller amounts and test strategies without risking large sums of money. Using brokers like XM or Exness, you can even start with nano lots if you’re trading a cent account.

Want to learn more about these brokers? We dive deep into their platforms, account types, trading education, regulations, and more in our detailed XM review and Exness review!

Want to learn more about these brokers? We dive deep into their platforms, account types, trading education, regulations, and more in our detailed XM review and Exness review!

Practical Examples

1. Trading with $100:

2. Trading with $1,000:

3. How Much Can You Make Day Trading with $1,000?

4. Can You Trade Forex with $10?

Yes, but you’ll need a cent account to trade nano lots. Your profits and risks will be minimal, but it’s a good way to practice.

- Best lot size: 0.01 (micro lots).

- Risk: Low; each pip movement costs $0.10.

2. Trading with $1,000:

- Best lot size: 0.1 (mini lots), depending on your risk management.

3. How Much Can You Make Day Trading with $1,000?

- With proper risk management and average daily market moves, a 1% profit per day could yield $10, or around $300 monthly.

4. Can You Trade Forex with $10?

Yes, but you’ll need a cent account to trade nano lots. Your profits and risks will be minimal, but it’s a good way to practice.

FAQs About Lot Sizes

What does 0.01 lot size mean?

It means you’re trading 1,000 units of the base currency. Each pip movement is worth $0.10.

How much is 1.00 lot size?

One standard lot equals 100,000 units of currency, with each pip valued at $10.

What is the best lot size for $10?

For a $10 account, use nano lots (0.001) to minimize risk.

What is the lot size for a $100 account?

The best lot size is 0.01 (micro lots) to ensure manageable losses.

How many dollars is 1 lot in forex?

A standard lot equals $100,000 of the base currency.

Can you day trade forex without $25k?

Yes, unlike stocks, forex doesn’t have a pattern day trading rule. Brokers like XM and Exness allow day trading with much smaller accounts.

How many dollars is 1 pip?

Standard lot: $10 per pip.

Mini lot: $1 per pip.

Micro lot: $0.10 per pip.

How much is 1 lot in XAU/USD?

One lot of gold equals 100 troy ounces. If gold is $1,902 per ounce, 1 lot equals $190,200.

It means you’re trading 1,000 units of the base currency. Each pip movement is worth $0.10.

How much is 1.00 lot size?

One standard lot equals 100,000 units of currency, with each pip valued at $10.

What is the best lot size for $10?

For a $10 account, use nano lots (0.001) to minimize risk.

What is the lot size for a $100 account?

The best lot size is 0.01 (micro lots) to ensure manageable losses.

How many dollars is 1 lot in forex?

A standard lot equals $100,000 of the base currency.

Can you day trade forex without $25k?

Yes, unlike stocks, forex doesn’t have a pattern day trading rule. Brokers like XM and Exness allow day trading with much smaller accounts.

How many dollars is 1 pip?

Standard lot: $10 per pip.

Mini lot: $1 per pip.

Micro lot: $0.10 per pip.

How much is 1 lot in XAU/USD?

One lot of gold equals 100 troy ounces. If gold is $1,902 per ounce, 1 lot equals $190,200.

Why Choose XM or Exness for Trading Lot Sizes?

Both XM and Exness are top-rated brokers that cater to traders of all levels. They offer:

- Flexible lot sizes, from nano to standard.

- Competitive spreads and leverage options.

- Reliable platforms like MT4 and MT5 for precision trading.

Final Thoughts

Mastering what are lot sizes in forex is essential for successful trading. By understanding how lot size is calculated, selecting what lot size you can trade with $100, and determining what lot size should you use, you’ll be better equipped to manage risk and grow your account.

Start small, calculate your risks, and scale up as your confidence grows. Whether you’re trading micro lots or standard lots, platforms like XM and Exness provide the tools you need to trade with precision.

Start small, calculate your risks, and scale up as your confidence grows. Whether you’re trading micro lots or standard lots, platforms like XM and Exness provide the tools you need to trade with precision.