What is the best time frame to trade forex?

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Choosing the right timeframe is one of the most defining decisions a forex trader can make. It shapes how you read the charts, how often you trade, and how you manage risk. While many traders chase quick profits through rapid intraday moves, research and experience show that longer timeframes often produce more consistent results. Let’s break down how different timeframes behave, and which approach might align with your goals and trading routine.

What are timeframes in forex trading?

A timeframe in forex refers to the length of time each candlestick or bar represents on your chart which range from one minute to one month. Traders use these intervals to analyze market behavior, plan entries and exits, and assess price trends. Shorter timeframes like 1-minute or 15-minute charts capture high-frequency movements, while higher timeframes such as daily or weekly charts reveal broader market structure and sentiment.

Each timeframe offers a unique perspective: short intervals favor quick decision-making, while longer ones highlight stronger trends and require greater patience.

When should I trade to find the best time frame to trade forex?

Your ideal timeframe depends on your personality, goals, and availability. Beginners often gravitate toward shorter charts for excitement, yet research suggests patience pays off.

A 2021 study tracking 5,472 UK retail traders over three years found that day traders averaged –3.8% annual returns after costs, while swing traders achieved +2.1% annual returns (source: CMC Markets). Similarly, Quantified Strategies found that only 13% of day traders remain profitable after six months, dropping to below 1% after five years (source: Quantified Strategies).

Longer holding periods reduce costs and emotional strain, making swing or position trading statistically more sustainable for most retail traders.

Best forex timeframes for scalpers

Scalping thrives on 1-minute to 5-minute charts. It demands intense focus, precision, and lightning-fast execution. Traders open dozens of trades daily, targeting a few pips per move.

While this style offers frequent opportunities, it’s high-stress and fee-heavy. Transaction costs and slippage can quickly erode profits. For example, a trader executing 100 trades monthly could spend nearly $9,600 yearly in fees, compared to $960 for someone making only ten trades (source: Mind Math Money).

Scalping suits disciplined, data-driven traders with time to monitor the charts constantly, however it’s rarely the best entry point for beginners.

Best forex timeframes for day traders and the best time of day to trade forex

Day traders operate between 15-minute and 4-hour charts, closing all positions before the end of the trading day. Liquidity and volatility are key here as your success often depends on when you trade.

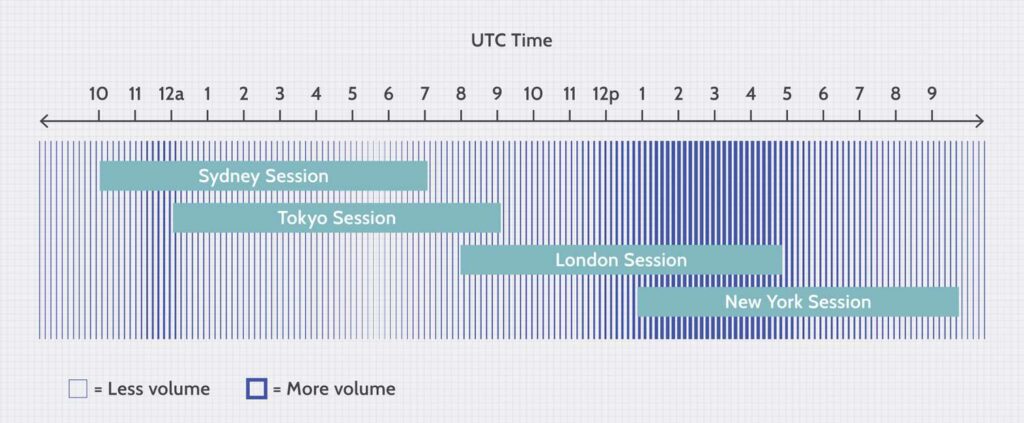

The best time of day to trade forex typically aligns with high-volume overlaps:

- London–New York overlap (3 PM–7 PM UAE time) brings the most volatility.

- Asian session (4 AM–1 PM UAE time) favors range-bound setups.

- London session (11 AM–8 PM UAE time) offers steady momentum for major pairs.

According to BIS market data, over 43% of global forex volume occurs during the London session, reinforcing why timing matters.

Platforms like Avatrade allow traders to switch between multiple chart intervals quickly, helping identify intraday opportunities while keeping spreads tight for active traders.

Best forex timeframes for swing traders

Swing trading captures price moves that unfold over several days or weeks. Commonly using 4-hour to daily charts, swing traders combine technical indicators like Bollinger Bands, MACD, and RSI with broader market context.

A case study by Alphashots.AI showed that swing traders using both technical and fundamental analysis achieved steadier results, with lower emotional stress compared to intraday traders (source).

Swing trading’s advantage lies in cost efficiency and flexibility. You do not need to monitor the market every hour, yet can still capitalize on medium-term trends.

Best forex timeframes for position traders

Position trading is the long game. These traders rely on daily, weekly, or even monthly charts and may hold trades for months at a time. They analyze macroeconomic trends, interest rate shifts, and technical zones that define major market cycles.

Because trades are infrequent, transaction costs are minimal, and decisions are based on large-scale momentum rather than short-term volatility. A study published by OLXForex reported that long-term traders focusing on fundamentally strong positions experienced higher consistency and lower drawdowns than short-term participants (source: OLXForex).

How to perform multiple timeframe analysis

Multiple timeframe analysis (MTA) is the technique of viewing a currency pair across several intervals to align the bigger picture with precise entry timing. For example, a trader might analyze the daily chart to confirm the trend, the 4-hour chart for structure, and the 1-hour chart to time entries.

This top-down method filters out noise while maintaining flexibility. It helps traders confirm direction on higher timeframes before committing capital on shorter ones. As LuxAlgo explains, MTA “reduces false signals and strengthens trend conviction” (source).

How to get started with forex trading

If you’re new to forex trading, start by:

- Choosing your platform and broker. Opt for regulated platforms offering transparent spreads and risk controls.

- Learning to read charts. Use free demo accounts to test timeframes without risk.

- Practicing on higher timeframes first. Daily or 4-hour charts help you recognize cleaner setups before progressing to faster trading styles.

- Tracking performance metrics. Log every trade including entry, exit, and result to refine your timing strategy.

Plan your trading week and know when is the best time to trade forex

Planning ahead separates disciplined traders from emotional ones. Map out the trading week using an economic calendar and identify overlapping sessions for optimal liquidity.

- Monday–Tuesday: Best for trend identification and setting up swing trades.

- Wednesday–Thursday: Typically the most volatile days, ideal for active trading.

- Friday: Suited for short-term trades before liquidity tapers off.

Aligning your trades with when the best time to trade forex occurs, during major session overlaps can help improve consistency and reduce false breakouts.

Markets

Different currency pairs behave uniquely across sessions.

- EUR/USD and GBP/USD thrive in the London–New York overlap.

- AUD/JPY and NZD/USD are more active during the Asian session.

Understanding each market’s rhythm helps you choose the timeframe and session combination that fits your lifestyle.

Trading platforms

Your trading platform should support clear multi-timeframe charting, customizable alerts, and low spreads. Platforms like Avatrade and MetaTrader 5 offer robust charting tools where you can toggle between 1-minute and monthly views effortlessly. The goal is to match the platform’s flexibility with your chosen timeframe.

Analytical summary: comparing performance and timeframes

| Trading Style | Average Retail Returns | Institutional Returns | Key Risks/Costs | Success Rate | Best Timeframe |

|---|---|---|---|---|---|

| Scalping / Day Trading | –3.8% per year (retail) source | Up to 18% (top 10%) source | High fees, stress, execution errors | < 13% after 6 months | 1 min – 1 hr |

| Swing Trading | +2.1% per year (retail) source | Varied | Moderate risk, overnight exposure | Higher than day trading | 4 hr – Daily |

| Position Trading | Higher for fundamental setups source | Varied | Market cycle risk | Most consistent | Daily – Weekly – Monthly |

Longer holding periods statistically improve survival rates for retail traders. However, effective risk management, position sizing, stop-loss placement, and discipline matter more than timeframe alone.

Conclusion: finding the best time frame to trade forex

So, what is the best time frame to trade forex? For most traders, the daily chart offers the cleanest setups and most reliable signals, while the 4-hour chart balances flexibility with opportunity. Shorter charts amplify both reward and risk, demanding greater precision.

Ultimately, your best timeframe depends on your strategy, psychology, and ability to manage risk. Start slow, focus on clarity over frequency, and let experience NOT impulse, determine how you trade.

Disclaimer: Remember that CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

08th Nov 2025

08th Nov 2025