Scalping Trading Step by Step: How Fast Traders Manage Risk, Spreads, and Slippage

Sam Reid

Staff Writer

Sam Reid

Staff Writer

‘Scalping trading rewards traders who treat execution like a craft, because tiny costs and tiny delays decide whether the day finishes green or frustratingly flat.’

Summary

- We explain the scalp trading meaning in practical, trade-by-trade terms.

- We map a simple process to illustrate entries, exits, and risk control on the 1-minute chart.

- We show how spreads and slippage quietly shape results more than most indicators do.

- We include a real example on scalpers based on an EUR/USD 1-minute scalper using RSI and divergence.

Key takeaways

- Scalping is a game of liquidity, timing, and discipline. Prediction helps, but execution decides.

- When your target is a few pips, spreads and slippage are not “small details.” They are the strategy.

- A fixed risk rule, like 0.5% per trade, keeps one mistake from erasing a strong session.

- The 1-minute chart can work, but only when you control noise with rules and trade selection.

Understanding scalping

At a high level, scalping is short-term trading where positions are held for seconds to minutes, aiming to capture small price movements repeatedly. That definition is accurate, but incomplete. The practical version is simpler: scalpers are paying for speed. We pay with spread, occasional slippage, and mental energy. In return, we get frequent opportunities and limited exposure time in any single trade.

This is why most scalping approaches depend on two things: whether the market is liquid enough, and whether the trader is disciplined enough to treat every entry and exit like a routine, not an impulse.

How scalping differs from day trading and swing trading

Daytrading can still be fast, but it often targets larger intraday moves and holds trades longer. Swing trading targets multi-day moves and accepts overnight risk as part of the plan. Scalping compresses everything. Entries are closer to the “moment,” exits are quicker, and transaction costs become a bigger percentage of each trade’s potential. So the skill emphasis shifts. Scalping leans heavily toward execution quality and cost control, while swing trading leans more toward patience and broader market structure.

Key characteristics of scalping

- Short holding time: seconds to minutes, typically flat by the end of the session.

- High frequency: multiple trades per session, but only if setups meet strict criteria. Not to be confused with algorithmic high frequency trading.

- Small targets: often a few pips, which makes costs highly influential.

- Liquidity dependence: tight spreads and depth matter more than “perfect signals.”

- Strict exits: hesitation turns small losses into session killers.

Tools for scalping

Because scalping is sensitive to friction, tools matter. Not in a flashy way, in a practical way.

- Fast, stable execution: platform responsiveness, reliable order handling, and minimal downtime.

- Real-time pricing: spreads, tick movement, and clean chart updates.

- Order control: quick market orders, limit orders, and a smooth way to place and adjust stops.

- Simple layouts: fewer distractions, clearer decisions, faster action.

Important

When we scalp, the platform is part of the edge. In our experience, spread stability during events is a real differentiator because it reduces the “surprise cost” that ruins otherwise decent entries. If you are choosing a platform with that specific goal, it is reasonable to look for the best trading platform for scalping based on execution and spread behavior, and we would keep it practical and lean toward Exness for that decision path when those factors are a priority.

Types of scalping strategies

There is no single scalping template. Most approaches fall into a few families. The names matter less than the logic behind them.

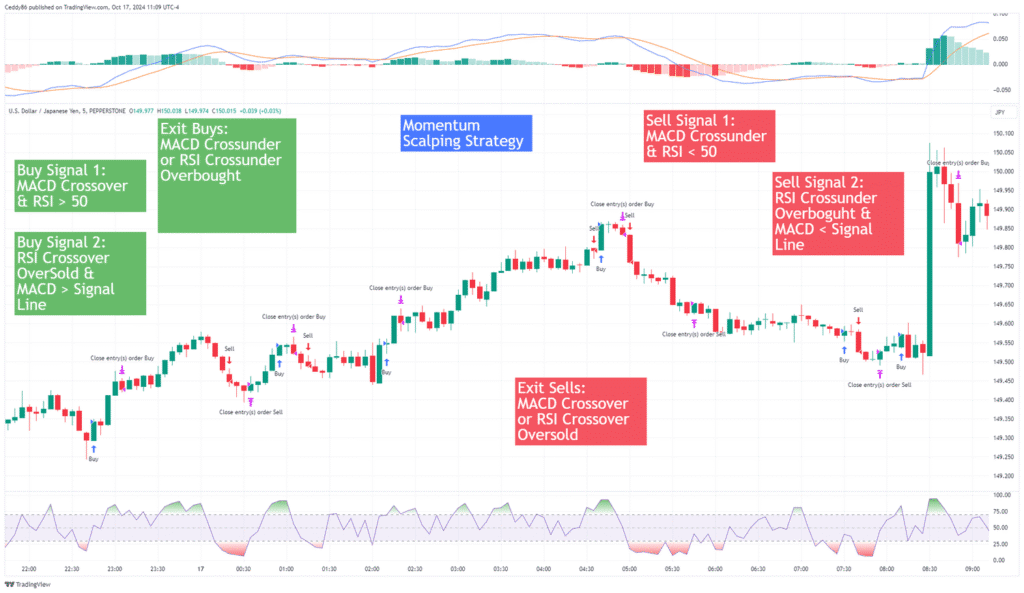

1) Momentum scalping

This aims to capture a quick continuation burst after a micro-breakout or a strong push. The trader enters with momentum, exits fast, and avoids letting the trade “turn into a swing.”

2) Mean reversion scalping

This looks for short-term overextension and expects a snap-back toward a reference level. VWAP, moving averages, and volatility bands are often used as context. Stops must be tight, because overextension can extend further.

3) Range scalping

When price is boxed between support and resistance, scalpers repeatedly buy near the lower boundary and sell near the upper boundary. It sounds straightforward. The challenge is avoiding entries when the range is about to break.

4) News and volatility scalping

This is the most seductive and the most dangerous. The movement is larger, but slippage and spread expansion can be brutal. We treat this as risky, especially for newer traders or anyone without a tested plan for volatility conditions.

5) Micro-structure and liquidity scalping

This relies on order flow cues, quick reactions, and an understanding of where liquidity sits. It can be effective, but it usually demands more screen time and experience than indicator-driven scalping.

(Example)

Scalp trading forex

Forex is a natural home for scalpers because major pairs can offer deep liquidity during active sessions. Still, not all forex conditions are equal. For scalp trading forex, we prefer highly liquid pairs where spreads are consistently tight, especially around session overlaps. EUR/USD is a common choice because it tends to have strong depth during London and New York activity.

How to scalp trade step by step

This is the practical core. A scalper’s “edge” often looks boring on paper. That is a good sign!

Step 1: Choose the right session

- Focus on high-liquidity windows such as London, New York, and their overlap.

- Avoid low-liquidity hours where spreads widen and moves become choppy.

Step 2: Set a strict risk rule before the first trade

We use 0.5% risk per trade as a practical ceiling. It is enough to matter, but small enough to survive a rough patch without spiraling.

- Define a daily loss limit, for example 2% to 3%.

- Stop trading when you hit it. That rule saves accounts.

Step 3: Pick one repeatable setup

To keep this consistent, we recommend one core setup first, then variations later. Your first goal is not creativity, it is repeatability.

Step 4: Use the 1-minute chart for entries, not for “belief”

We favor the 1-minute chart for execution. The trap is letting every wiggle feel meaningful. The solution is structure and rules.

Step 5: Define exits before you enter

- Take profit: a clear target, often a few pips, based on recent micro-structure.

- Stop loss: a logical invalidation point, not a random number.

- Time stop: if it does not move within X candles, exit. Time is risk in scalping.

Step 6: Track spread and slippage like performance metrics

Many traders track win rate and forget the real leak: cost per trade. If your average target is 5 pips, a spread change and a small slip can cut your expectancy fast.

Case study: EUR/USD 1-minute scalper using RSI and divergence

Here is a real example that highlights how many scalpers actually think and operate.

A trader describes scalping EUR/USD on the 1-minute chart using RSI and divergence, targeting about 5 pips on retracements after exhaustion moves. The trader reports turning a 100k demo account into 300k in roughly six weeks, then moving to a 4k live account while aiming for similar percentage performance. The emphasis is on short, frequent trades and quick exits rather than holding through uncertainty.

We treat the headline numbers as context, not as a promise. Demo fills and psychology can differ from live. Still, the case is useful because it shows the real operating mindset:

- One pair, one timeframe, one core logic.

- Small targets that demand tight execution.

- High repetition, but only within a defined pattern.

- Clear exits after exhaustion signals, not hope-based holding.

If you want to use this style responsibly, keep the lesson focused on process.

Time frames most commonly used in scalping

- 1-minute: primary execution view, fast feedback, high noise.

- 5-minute: structure and cleaner swing points for context.

- 15-minute to 1-hour: directional bias and key levels, not entry precision.

- Tick charts: useful for some, but not required for most manual scalpers.

Technical indicators that work well for scalping

Indicators do not remove risk. They help structure decisions.

- EMA: quick bias and micro-trend alignment.

- Bollinger Bands: short-term volatility and overextension context.

- RSI: momentum shifts, exhaustion cues, divergence setups.

- VWAP: mean reference and intraday “fair” area.

- Stochastic: short-term momentum exhaustion, best used with structure.

In practice, fewer tools used consistently is often better than many tools used inconsistently.

Best time of day to scalp the market

- London open: increased volume and cleaner movement.

- London and New York overlap: strong liquidity, frequent setups.

- New York open: volatility and opportunity, but watch spreads around releases.

We also define “no trade” windows. Low liquidity hours are where spreads and slippage tend to feel unfair, even when you did everything right.

How volatility affects a scalper

Volatility creates opportunity, but it also creates execution risk. That trade-off is central to scalping.

- Opportunity: more movement means targets get hit faster.

- Risk: spikes can cause slippage and spread expansion, especially around news.

- Adaptation: the same setup may need wider stops or smaller size during fast markets.

Our stance is soft but clear: news scalping is risky. Most traders should treat it as an advanced mode, not a default habit.

Risk management for scalping

Scalping is one of the fastest ways to learn discipline, because the feedback is immediate. It is also one of the fastest ways to lose a month of progress in one emotional session.

- Risk per trade: 0.5% ceiling as a disciplined baseline.

- Daily stop: define it and respect it.

- Trade cap: limit the number of trades to prevent spiraling into revenge trading.

- One setup rule: if the setup is not present, no trade.

Psychology: what scalpers should watch for

Stress and pressure

Fast decisions feel urgent. Urgency invites mistakes. We reduce this by making decisions before the session starts: what we trade, when we trade, and what we avoid.

Emotional control

Scalping punishes emotional improvisation. A small loss is normal. A revenge trade is optional. We want fewer optional mistakes.

Decision fatigue

After a certain number of rapid decisions, judgement degrades. Breaks help. Trade caps help. “One more trade” often hurts more than it helps.

Common mistakes and how to avoid them

- Overtrading: set a maximum number of trades and stop when you hit it.

- Ignoring transaction costs: track spreads and fees per trade, not just wins and losses.

- Poor execution: practice order placement until it is automatic and clean.

- Trading low liquidity: if spreads widen, step aside. The market is telling you something.

- Moving stops: scalping without discipline turns into gambling quickly.

How to evaluate a scalping trading strategy

We evaluate scalping with a small set of metrics that reflect reality, not ego.

- Expectancy: average result per trade after costs.

- Profit factor: gross profit divided by gross loss.

- Average win vs average loss: a simple truth test.

- Slippage log: how often, how large, and under what conditions.

- Consistency: weekly performance matters more than one great day.

A trading journal is not optional if you want to improve. It is how you turn “feelings” into data.

Pros and cons of scalping

Pros

- Frequent opportunities during active sessions.

- No overnight exposure when you stay flat.

- Clear feedback loop for skill development.

Cons

- Costs matter more than in slower styles.

- Mental fatigue can creep in quickly.

- Slippage can distort results during fast markets.

Is scalping trading profitable?

It can be profitable, but the conditions are strict. The trader needs a repeatable process, cost awareness, and the discipline to stop when the session turns messy. The most common failure pattern we see is not a “bad strategy.” It is a strategy that ignores spreads, slippage, or trade selection. Small leaks compound quickly when you trade frequently.

Is scalping good for beginners?

For most beginners, scalping is a tough starting point. It demands quick decisions, clean execution, and emotional control before those skills are fully developed. Beginners can still learn from scalping concepts, though. We suggest practicing in demo, limiting trade frequency, and treating early sessions as execution training rather than profit missions.

What is the 1-minute scalping strategy?

The phrase is popular, but a timeframe is not a strategy by itself. A 1-minute approach becomes a strategy only when it has:

- Clear entry criteria.

- Clear exit rules.

- Defined risk and daily limits.

- A rule for when not to trade.

Without those, the 1-minute chart becomes a noise machine.

Wrapping it Up

Scalping can be a sharp tool when we treat it as a disciplined routine: controlled risk, selective entries, and honest tracking of spreads and slippage. It is not for everyone, and that is fine. When the process is solid, small wins can stack. When the process is loose, costs and emotion take over quickly.

FAQs

Is scalping trading profitable?

It can be, but profitability depends on execution quality and cost control. Tight risk rules, selective trading during liquid sessions, and consistent tracking of spread and slippage are usually the difference between steady results and frustration.

What is scalping in trading?

Scalping is a short-term style where trades last seconds to minutes, aiming to capture small price movements repeatedly. The goal is to accumulate many small outcomes while minimizing time exposed to the market.

Is scalping good for beginners?

It is generally challenging for beginners because the pace amplifies mistakes. Beginners often do better learning structure and risk control first, then using demo practice to build execution skills before trading a fast style with real money.

Disclaimer: This content is for educational purposes only and not to be construed as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

08th Jan 2026

08th Jan 2026