By Staff Writer

By Staff Writer

CFD broker ThinkMarkets has expanded its product lineup with the addition of synthetic indices, now available on its ThinkTrader and MetaTrader 5 (MT5) platforms in select regions.

These algorithm-generated instruments simulate real-world market behavior while remaining unaffected by economic data, news events, or central bank policies.

By removing external volatility factors, synthetic indices aim to deliver smoother, more predictable price movements, allowing traders to refine strategies without the impact of sudden market shocks.

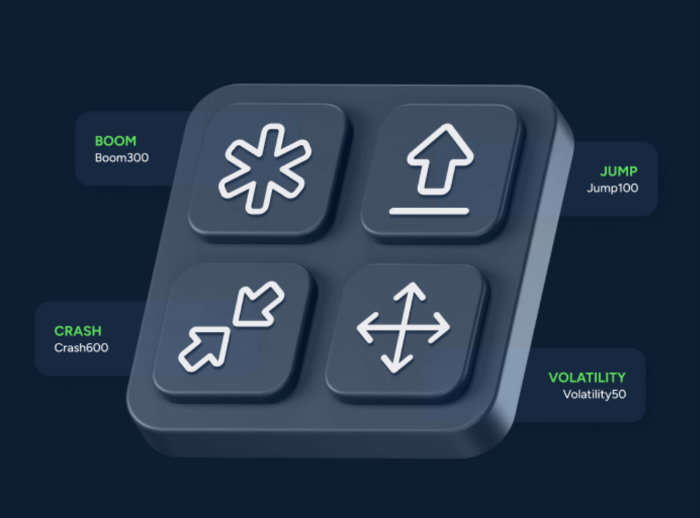

ThinkMarkets’ offering includes several categories, each designed for different volatility levels and trading styles:

Volatility Indices: Volatility 50, 75, and 100

Boom Indices: Boom 300, 600, and 1000

Crash Indices: Crash 300, 600, and 1000

Jump Indices: Jump 10, 25, 50, 75, and 100

Each index provides distinct trading conditions, catering to both new and experienced traders seeking controlled risk exposure and 24/7 access.

“We’re excited to add synthetic indices to our product offering, giving clients 24/7 trading access with consistent volatility,” said Nauman Anees, CEO and Co-Founder of ThinkMarkets. “Synthetics allow clients to start trading, learn how prices move, and fine-tune their skills on our flagship platform, ThinkTrader. Our goal is to give clients every opportunity to improve their trading strategy and performance.”