By Staff Writer

By Staff Writer

Ripple’s US dollar-pegged stablecoin, RLUSD, has received regulatory approval for institutional use within the Abu Dhabi Global Market (ADGM), marking another step in the company’s Middle East expansion strategy.

The Financial Services Regulatory Authority (FSRA), which oversees ADGM’s international financial centre, has designated RLUSD as an Accepted Fiat-Referenced Token. This approval allows regulated institutions in the financial zone to use the stablecoin for permitted activities, such as payments and collateral, subject to strict compliance requirements on reserve management and transparency.

“With a market capitalization of over $1 billion and growing adoption in core financial uses like collateral and payments, RLUSD is quickly becoming a go-to USD stablecoin for major institutions,” said Jack McDonald, Senior VP of stablecoins at Ripple.

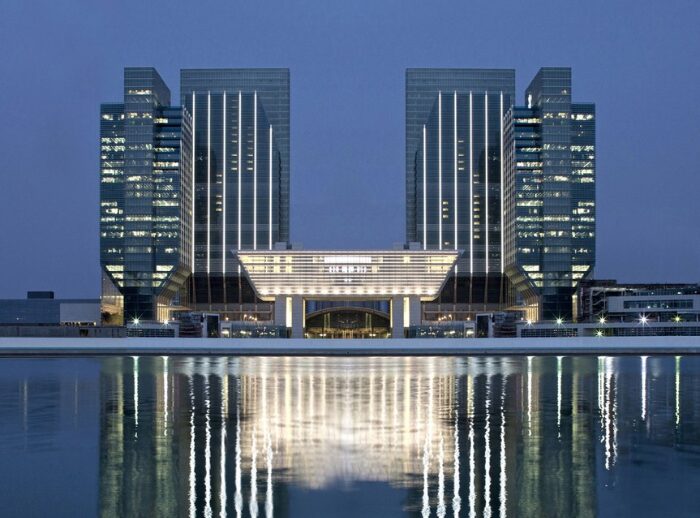

Ripple has been steadily growing its footprint in the UAE. After pursuing licensing from the Dubai Financial Services Authority (DFSA) in late 2024, Ripple secured full approval in March 2025 to offer crypto-based cross-border payment services in the Dubai International Financial Centre (DIFC).

In June, the DFSA approved RLUSD for use within the DIFC, making it available for regulated applications such as treasury operations and crypto payments. Ripple has also partnered with regional players like Zand Bank and fintech app Mamo to power blockchain-based payment infrastructure across the UAE.