By Staff Writer

By Staff Writer

London has once again proven why it remains the beating heart of global financial markets. According to the latest Bank for International Settlements (BIS) Triennial Survey, the United Kingdom has extended its lead as the world’s top centre for foreign exchange (FX) and over-the-counter (OTC) interest rate derivatives trading.

The survey, conducted every three years across more than 50 jurisdictions, provides the most comprehensive snapshot of global trading activity. The 2025 results reaffirm the UK’s position at the core of international finance.

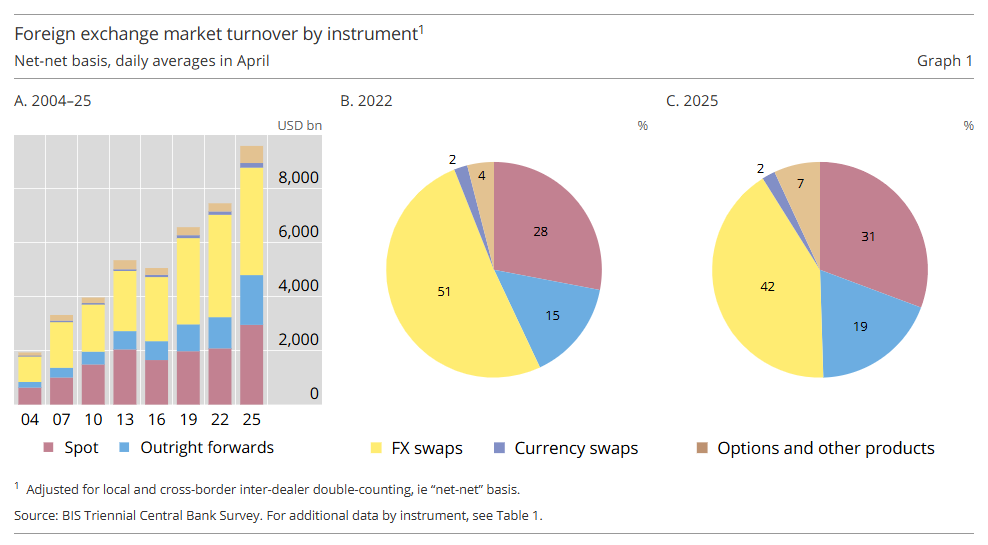

In April 2025, average daily FX turnover in the UK reached $4.75 trillion, up sharply from $3.74 trillion in 2022. That represents nearly a 38% share of global FX trading, maintaining London’s long-held status as the largest foreign exchange centre in the world.

Several structural advantages continue to support this leadership. London’s time zone places it between Asia’s close and North America’s open, concentrating global trading flows within the city’s session. Its deep liquidity pool, extensive network of counterparties, and reliable infrastructure make it an efficient venue for high-volume transactions across currencies, products, and regions.

The UK market has also benefited from a continued shift toward electronic and algorithmic trading, which now dominates both interbank and client-dealer activity. This technology-driven evolution allows faster execution, reduced spreads, and improved transparency, qualities that attract serious institutional participants.

London’s dominance extends well beyond currency markets. In the OTC interest rate derivatives segment — which includes instruments such as swaps used by firms to hedge rate exposure — the UK recorded $4.32 trillion in average daily turnover in April 2025. This is nearly double the $2.36 trillion reported in 2022 and marks a return to levels last seen before the pandemic.

The UK now accounts for 49.6% of global OTC interest rate derivatives turnover, just below the record 50.6% reached in 2019. The increase reflects both heightened volatility in global interest rates and strong demand for risk management tools as central banks around the world adjusted policy in response to inflation.

London’s infrastructure, which includes world-class clearing houses, margining systems and collateral management frameworks, continues to support trading at scale and provide resilience during periods of market stress.

The BIS Triennial Survey serves as the global benchmark for trading activity across currencies and interest rate markets. It captures data directly from financial institutions and adjusts for double counting to provide a reliable measure of market depth and concentration.

For regulators and policymakers, the survey highlights where global liquidity is concentrated and how market structures are evolving. For investors and industry participants, it offers valuable insight into trading trends, execution patterns, and the competitive positioning of key financial centres.

Read the full report here.