By Staff Writer

By Staff Writer

eToro UK reports a 144% profit increase, reaching $6 million for 2024 amid a rebound in crypto and market activity.

Revenue jumped 41% to $177.7 million driven by higher trading commissions and revived investor confidence.

The company’s cash reserves more than doubled, with client funds hitting $472 million, signaling strong financial health.

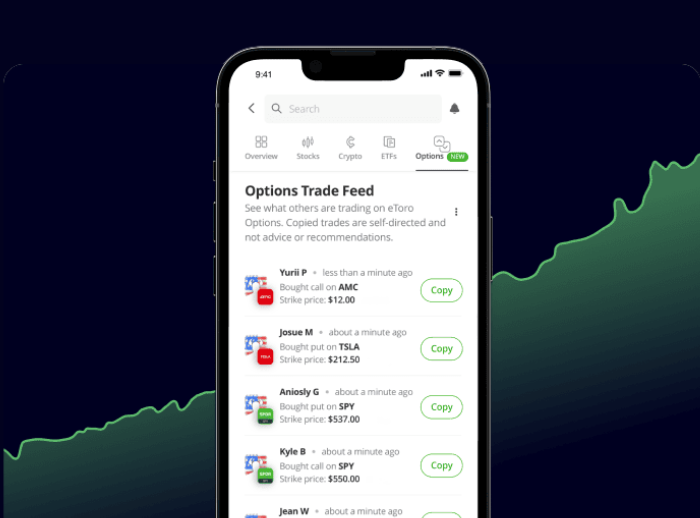

eToro UK has posted a striking 144% surge in annual profit, buoyed by a sharp rebound in trading activity and renewed investor enthusiasm across crypto and traditional markets.

The platform recorded $6 million in net profit for 2024, up from $2.5 million in 2023, marking one of its strongest performances in recent years.

Revenue climbed 41% year-on-year to $177.7 million, supported by a 38% increase in trading commissions as clients returned to active trading during the final quarter. The company cited both the crypto market recovery and heightened political events as key drivers behind this surge in engagement.

However, this growth also came with higher costs, with trading expenses more than doubling to $9.9 million. Other commissions, such as marketing and currency conversion fees jumped 77% to $24 million. It signals that expanding operations are working to support growing demand.

eToro UK’s balance sheet also strengthened considerably during the year. Cash reserves more than doubled, while client money held rose to $472 million, underscoring robust liquidity and confidence from users in the platform’s services.