How to Trade Crude Oil Online

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Understanding Crude Oil Trading

Crude oil trading involves buying and selling oil contracts to profit from price changes rather than owning the physical barrels. Global oil prices are shaped by a combination of supply and demand, production decisions by OPEC+, and broader economic indicators. Because oil underpins industries such as transport, energy, and manufacturing, even a small shift in demand can cause noticeable price movements.

When you trade crude oil, you’re speculating on whether its price will rise or fall. For example, if traders expect a production cut from OPEC+, they might buy contracts expecting prices to increase. Conversely, if global supply grows faster than demand, short positions can benefit from price drops.

The ability to go long or short, combined with high market liquidity, makes crude oil one of the most popular instruments among retail and institutional traders alike.

Why Traders Choose Crude Oil

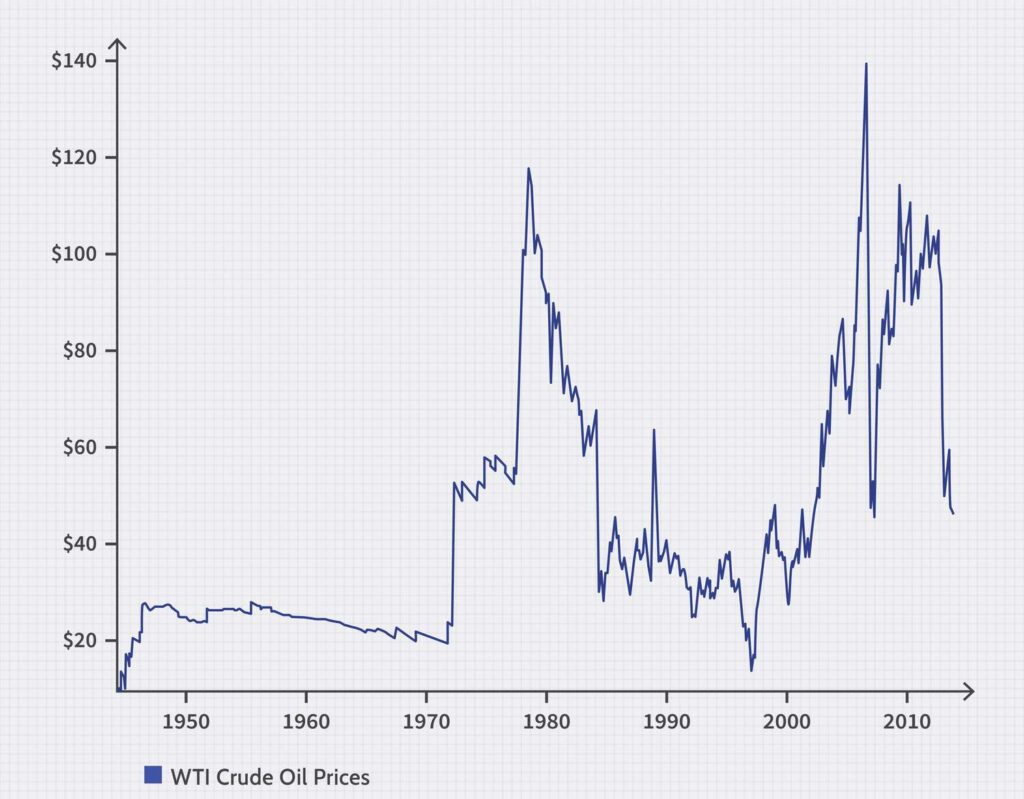

Crude oil offers strong price volatility, making it a favored market for day traders and swing traders. Historically, significant events such as geopolitical conflicts, economic slowdowns, or policy changes by major producers have caused sharp price swings that create both risk and opportunity.

In addition, crude oil’s global importance means price trends are backed by a constant stream of data. From weekly U.S. inventory reports to monthly OPEC+ meetings, traders have ample information to form forecasts and strategies.

Many traders use oil to diversify their portfolios beyond forex or stock indices, as it often reacts differently to global events.

Major Types of Crude Oil Benchmarks

1. Brent Crude

Brent Crude is the world’s most widely used oil benchmark, priced on the Intercontinental Exchange (ICE). It reflects oil produced from the North Sea and serves as a reference for international markets.

2. West Texas Intermediate (WTI)

WTI, traded on the New York Mercantile Exchange (NYMEX), represents U.S. oil output. It has lower sulfur content and is often slightly cheaper than Brent due to transport and refining factors.

Both benchmarks influence global pricing and provide the foundation for most crude oil trading products available on online platforms.

Ways to Trade Crude Oil Online

1. Spot Oil Trading

Spot trading involves speculating on the current price of crude oil, often through Contracts for Difference (CFDs). With CFDs, traders don’t own the underlying asset but can profit from both upward and downward price movements. This makes CFDs a flexible choice for traders seeking short-term opportunities.

2. Oil Futures Contracts

Futures are standardized agreements to buy or sell crude oil at a fixed price on a specific future date. They are commonly used by energy companies to hedge risk, but retail traders can also participate through brokers offering access to futures markets. Futures tend to be high-volume instruments and are influenced by expiration dates and contract rollovers.

3. Oil ETFs and Stocks

Exchange-traded funds (ETFs) and oil company stocks provide indirect exposure to oil prices. These are suitable for investors who prefer a longer-term approach, as they move in correlation with overall crude trends.

4. Oil Options

Options provide the right, but not the obligation, to buy or sell oil at a set price before expiration. They’re popular among experienced traders who use them to hedge positions or capitalize on volatility without committing to a full futures contract.

How to Trade Crude Oil Step by Step

Step 1: Choose a Trusted Broker

Select a regulated online broker that offers access to oil markets, fast execution, and reliable risk management tools. In the UAE, Exness stands out for its intuitive platform, strong regulatory oversight, and access to both Brent and WTI crude CFDs. Traders can open an account in minutes, deposit in AED or USD, and start trading directly from desktop or mobile.

Step 2: Understand What Moves the Market

Before you trade crude oil, you need to know the main price drivers:

- OPEC+ decisions: Production cuts or increases directly influence global supply.

- Economic data: GDP growth, inflation, and employment data impact oil demand forecasts.

- Geopolitical events: Conflicts or sanctions can disrupt supply and cause price spikes.

- Inventory reports: Weekly data from the U.S. Energy Information Administration (EIA) provides insights into short-term demand trends.

Step 3: Open and Fund Your Account

After selecting your broker, complete registration, verify your identity, and deposit funds. Many brokers, including Exness, allow deposits through local cards, e-wallets, or regional payment systems like STC Pay and bank transfers.

Step 4: Analyze the Market

Use both technical and fundamental analysis to decide entry and exit points:

- Technical tools: Moving averages, Bollinger Bands, and RSI help identify momentum and reversals.

- Fundamental analysis: Track OPEC news, U.S. inventory changes, and macroeconomic trends.

Most successful traders combine both to confirm opportunities.

Step 5: Place Your First Trade

Choose whether to go long (buy) or short (sell). If you believe oil prices will rise, open a buy position. If you expect them to fall, sell instead. Start with smaller positions until you’re comfortable with volatility.

Step 6: Manage Risk

Oil is known for large price swings. Always set a stop-loss to limit potential losses and take-profit levels to lock in gains. Avoid risking more than 2% of your capital on any single trade.

Best Time to Trade Crude Oil

Crude oil markets are most active during U.S. and European trading hours, typically from 4 PM to midnight UAE time. During these hours, liquidity is high and spreads are tighter. Economic data releases, OPEC announcements, or EIA inventory reports often occur during this window, making it ideal for traders seeking volatility.

For UAE traders, this means late afternoon and evening sessions are often the best times to capture meaningful price movements.

Popular Crude Oil Trading Strategies

1. Trend Following Strategy

Identify market direction using moving averages (for example, the 50-day and 200-day). When the shorter average crosses above the longer one, it often signals a bullish phase.

2. Range Trading Strategy

In sideways markets, traders can buy near support and sell near resistance using oscillators like RSI or Stochastic indicators to confirm entries.

3. Breakout Strategy

When oil breaks through a major support or resistance level following a consolidation, traders anticipate strong follow-through in the breakout direction.

4. News-Based Trading

Oil prices respond instantly to OPEC decisions or geopolitical news. Traders often position themselves before major announcements but must use tight stop-losses due to volatility risk.

5. Mean Reversion

This approach assumes that extreme price moves will revert to their average. Bollinger Bands are particularly useful here, signaling potential reversals when prices touch the upper or lower band.

Risk Management in Crude Oil Trading

Because crude oil prices can change quickly, disciplined risk management is essential. Professional traders follow three key principles:

- Position sizing: Never commit more capital than your risk tolerance allows.

- Diversification: Avoid relying solely on crude oil. Balancing exposure with other commodities or currency pairs reduces risk.

- Stop-losses: Predetermine exit levels to control potential losses and remove emotion from trading decisions.

Brokers like Exness offer advanced tools such as trailing stops and negative balance protection to help traders stay secure in volatile conditions.

How to Invest in Crude Oil in the UAE

Investing in crude oil can take several forms depending on your time horizon. Short-term traders may prefer CFDs due to flexibility, while long-term investors can buy shares of oil companies or ETFs through brokers offering global market access.

For UAE residents, using a broker regulated by top authorities such as the DFSA or CySEC ensures protection and compliance. Exness, for example, provides transparent pricing, AED deposits, and access to global energy markets without complex account structures.

Conclusion

Learning to trade crude oil successfully requires understanding the global energy landscape, analyzing key price drivers, and managing risk effectively. Whether you choose to trade through CFDs, futures, or ETFs, consistency and discipline are what separate profitable traders from impulsive ones.

For traders in the UAE, having access to a fast and reliable broker like Exness can make the process smoother. With competitive spreads, real-time execution, and the ability to fund accounts locally, Exness allows traders to focus on strategy rather than logistics.

Trading crude oil remains one of the most dynamic ways to participate in global markets. Start small, learn continuously, and trade with a plan. The right preparation can turn volatility into opportunity.

FAQs

Which platform can I trade crude oil on?

You can trade crude oil through online brokers that offer CFDs or futures on Brent and WTI markets. Platforms like Exness provide direct access to global energy markets with professional charting tools and competitive spreads.

How to invest in crude oil in the UAE?

UAE investors can trade crude oil CFDs or invest in ETFs and energy stocks via regulated brokers. Look for platforms that support AED deposits and comply with DFSA or CySEC regulations.

Can I trade crude oil in forex?

Yes. Many forex brokers include crude oil among their tradable instruments. You can open buy or sell positions just as you would with currency pairs, using similar margin and leverage mechanisms.

How much money is required for crude oil trading?

The amount depends on your broker and position size. With leveraged products like CFDs, you can start with a few hundred dollars, though it’s advisable to maintain a larger balance to manage risk effectively.

Disclaimer: Remember that CFD trading involves high risk. This content should not be construed as investment advice. It is meant for educational purposes only. Always do your own research and never invest what you cannot afford to lose.

18th Oct 2025

18th Oct 2025