Gold Brokers 101: Understanding Spreads, Contracts, and Accounts

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Introduction

Gold has always been more than a precious metal. For centuries, it has been a symbol of wealth, a form of currency, and today, one of the most actively traded commodities in global financial markets. Traders turn to gold not only for its investment appeal but also for its role as a hedge against inflation, currency risk, and geopolitical uncertainty. Yet, for anyone starting out in gold trading, the journey begins with one crucial decision: choosing the right broker.

A gold trading broker online acts as the gateway to the market. Brokers offer access to contracts, trading platforms, spreads, and customer support systems that shape the trading experience. Understanding how spreads work, what contract options exist, and what account requirements apply is essential to avoid costly mistakes.

This article serves as a comprehensive guide. We will explore how spreads influence your returns, break down the different types of contracts offered by brokers, explain account setup essentials, and highlight strategies to manage risks effectively. Along the way, we will draw on practical examples and industry data while introducing Exness as one of the brokers traders often turn to for competitive gold spreads and reliable platforms.

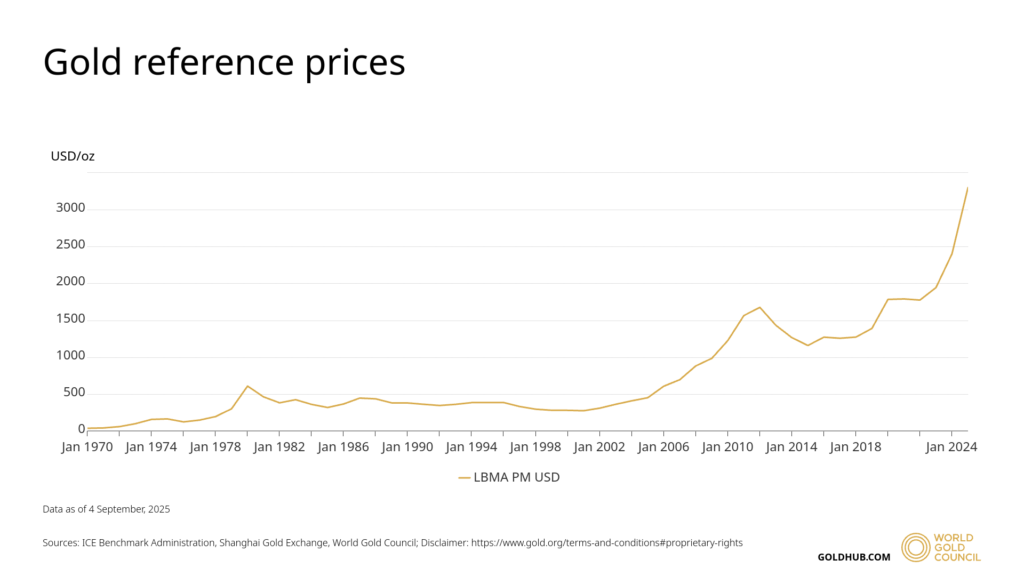

(Historical Gold Prices. Source: World Gold Council)

The Role of a Gold Trading Broker

A broker is more than just an intermediary. They provide the trading infrastructure that connects retail and institutional investors with global gold markets. Their services typically include:

- Access to trading platforms for CFDs, futures, or spot gold.

- Market data feeds and analysis tools.

- Account management services and risk controls.

- Transparent pricing structures, including spreads and commissions.

- Customer support for resolving issues around deposits, withdrawals, or order execution.

Without a broker, most retail traders would have no direct pathway into the highly liquid and fast-moving gold market. The key is to choose one that is well-regulated, cost-efficient, and aligned with your trading strategy.

Understanding Spreads in Gold Trading

When you open a position in gold, the first number you see in your account is not your profit, but often a small loss. This difference is caused by the spread.

What is a spread?

A spread is the difference between the bid price (what buyers are willing to pay) and the ask price (what sellers are offering). For example, if the bid for gold is $2,300 per ounce and the ask is $2,301, the spread is $1. Traders pay this spread as part of the transaction cost.

Why spreads matter

- Cost efficiency: Narrower spreads mean lower costs and better profitability.

- Liquidity indicator: Brokers offering very tight spreads often have access to deep liquidity pools.

- Risk management: Wide spreads during volatile conditions can eat into profits and even trigger stop losses prematurely.

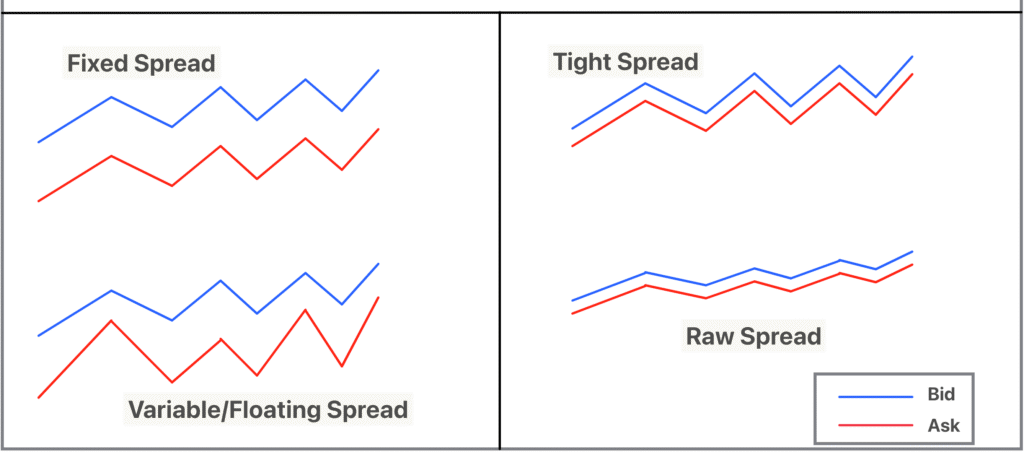

Types of spreads

- Fixed spreads: The spread stays constant regardless of market volatility. This offers predictability but may come at a higher average cost.

- Variable spreads: The spread fluctuates with market conditions. During quiet periods, spreads may be razor-thin, but during volatility they can widen substantially.

Example in practice

Suppose a trader enters ten gold CFD trades in a week, each worth one lot (100 ounces). If the broker’s spread is $0.50 per ounce, the cost per trade is $50. Over ten trades, that’s $500 in costs. A broker offering a $0.25 spread would cut that cost in half, saving the trader $250.

This is why many professionals prioritize choosing gold spread brokers that are transparent and competitive.

(Types of Spread)

Types of Brokers and Contracts

Not all brokers operate in the same way. Depending on your strategy, you may need different types of accounts or instruments.

- Full-service brokers: Provide in-depth research, portfolio management, and dedicated advisors. Common among high-net-worth individuals but often expensive.

- Discount and online brokers: Focus on execution and low fees, providing cost-effective access without personalized advisory services.

- DMA brokers: Direct Market Access brokers provide traders direct access to liquidity providers, offering very tight spreads and fast execution.

- CFD brokers: Allow retail traders to speculate on gold price movements without owning the metal. CFDs often come with leverage.

- Futures contracts: Standardized agreements traded on exchanges like COMEX or TOCOM. Standard contracts typically represent 100 ounces, though microcontracts also exist.

- Physical gold dealers: Specialize in bullion, offering coins and bars along with storage solutions.

Account Setup: What to Expect

- Age and identification: Most brokers require you to be at least 18 years old. Valid identification such as a passport or government ID is mandatory.

- Proof of funds: A bank account is usually needed for deposits and withdrawals.

- Risk disclosures: Brokers will require you to sign documents acknowledging the risks of leveraged trading.

- Knowledge tests: Some brokers may test your understanding of derivatives and leverage.

- Deposits and margin requirements: Futures often require 5–10% of contract value. CFDs vary depending on leverage caps set by regulators.

Institutional accounts require more documentation, including company registration certificates, tax records, and internal risk management systems.

Trading Platforms and Features to Look For

The trading platform is your primary tool, and it can make or break your strategy.

- User-friendly interface and customizable workspace.

- Real-time market data and price feeds.

- Advanced charting tools like moving averages, Fibonacci retracements, and Bollinger Bands.

- One-click trading for fast execution.

- Risk management tools such as stop-loss and take-profit orders.

- Mobile trading apps for flexibility on the go.

Exness, for example, is known for providing access to MetaTrader platforms with advanced charting tools and competitive execution speeds, making it an attractive choice for traders focusing on gold.

Security and Regulation

Trust in your broker is built on regulation and security. A regulated broker must segregate client funds, provide transparent reporting, and comply with anti-money laundering rules.

Major regulators to look for include the SEC and CFTC in the US, FCA in the UK, ASIC in Australia, CySEC in Cyprus, and DFSA or SCA in the UAE. Security measures such as encryption, two-factor authentication, and secure payment gateways are equally vital.

Proven Strategies for Gold Trading

Technical analysis

- Bollinger Bands: A breakout above the upper band may suggest a buying opportunity. A move below the lower band can signal a sell.

- Moving averages: Crossovers of 50-day and 200-day averages can indicate long-term trend shifts.

- RSI and MACD: Popular tools for spotting momentum changes.

Sentiment and seasonal trading

- Investor fear during crises often drives gold higher.

- Demand spikes in India and China during festival seasons often lift prices.

- Monitoring the VIX can provide clues to risk sentiment.

Risk management

- Always use stop-loss and take-profit levels.

- Keep position sizes proportional to account equity.

- Avoid over-leveraging, even when spreads look attractive.

Transparency in Pricing

Transparent pricing means clearly disclosed spreads, commissions, and overnight financing costs. It helps traders calculate exact breakeven points and builds trust. Exness is often cited as a broker offering highly competitive spreads with no hidden commissions.

Real-World Example: How Spreads Affect Profits

Consider two traders, both trading gold CFDs. Trader A uses a broker with a $1 spread per ounce, while Trader B uses a broker offering $0.25 spreads.

- Trader A opens 20 trades in a month, each for one lot (100 ounces). Spread costs total $2,000.

- Trader B opens the same trades, but their costs are only $500.

The $1,500 difference can represent the line between profit and loss over time.

FAQs

Which broker has the best spread for gold?

Spreads vary depending on liquidity, account type, and market conditions. Brokers such as Exness are known for offering some of the tightest spreads on gold, especially for active traders. Always compare multiple brokers before making a decision.

What is spread in gold trading?

A spread is the difference between the bid and ask price of gold. It represents a cost to the trader and is one of the main ways brokers generate revenue. Narrower spreads mean lower trading costs.

Which broker chart is best for gold?

Charts provided by MetaTrader 4 and 5 platforms are widely regarded for gold trading. They include advanced indicators, customizable layouts, and reliable data feeds. Many brokers, including Exness, offer these platforms with full gold charting capabilities.

How do you understand gold trading?

To understand gold trading, start with the basics: know what drives gold prices (inflation, currency shifts, supply and demand), study historical trends, learn how to read technical charts, and practice with a demo account before committing real funds. Understanding spreads, contract types, and account setup is essential to trade confidently.

Conclusion

Trading gold successfully requires more than guessing price movements. It starts with selecting the right broker, understanding spreads, knowing contract options, and setting up a secure account. A well-regulated and cost-efficient broker ensures transparency and fairness in every trade.

Spreads can make a significant difference to profitability, while platform features, account setup, and security protocols influence the day-to-day trading experience. By applying disciplined strategies, combining technical tools with an understanding of sentiment and history, traders can approach the gold market with confidence.

For traders seeking competitive spreads, advanced platforms, and strong regulation, Exness stands out as a gold trading broker online worth considering. With the right broker and a systematic approach, your gold trading journey can be both profitable and sustainable.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

05th Sep 2025

05th Sep 2025