Why Demo Results Rarely Match Live Trading

Sam Reid · Senior Financial Markets Analyst

Staff Writer

Sam Reid · Senior Financial Markets Analyst

Staff Writer

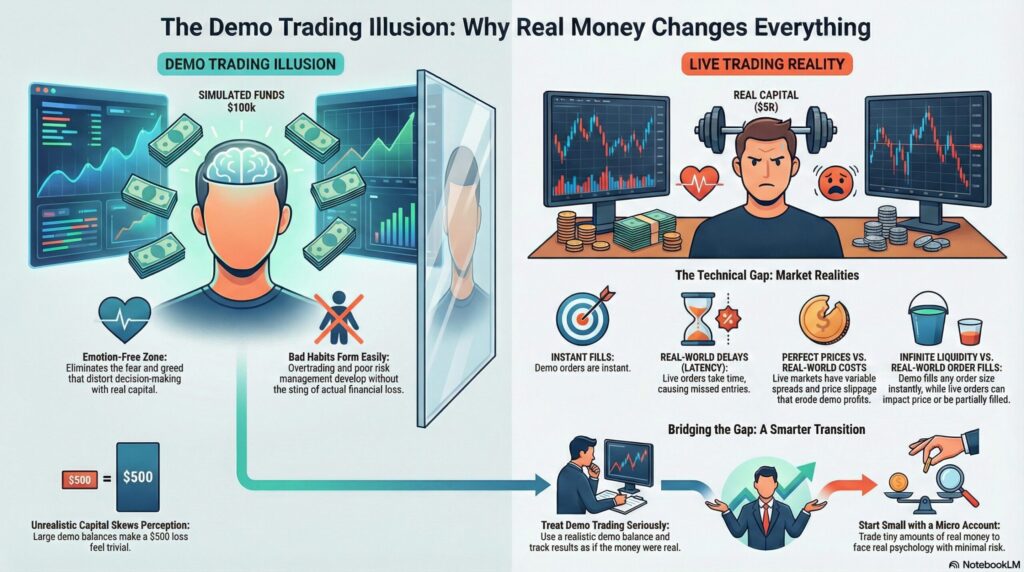

A trader spends three months perfecting a strategy on a demo account. The win rate sits at 68%, the risk-reward ratio looks stellar, and the equity curve climbs steadily upward. Confidence is high. Then comes the switch to real money, and within two weeks, that same strategy hemorrhages capital. The win rate drops to 45%, stops get hit that never triggered in practice, and emotional decisions start overriding the plan.

This scenario plays out constantly across forex, stocks, and crypto markets. Why demo results rarely match live trading isn’t a mystery once you understand the mechanics, but most traders learn these lessons the expensive way. The gap between demo trading vs live trading extends far beyond simple psychology. It encompasses execution differences, market microstructure realities, and behavioral patterns that only emerge when actual money sits on the line.

Understanding these discrepancies before transitioning to live capital can save thousands of dollars and months of frustration. The demo account vs live account divide is real, measurable, and far more nuanced than most trading education acknowledges.

The Psychology of Risk in Demo Trading vs Live Trading

Absence of Financial Loss and Emotional Detachment

Demo accounts create a peculiar mental state that’s almost impossible to replicate with real money. When a trade moves against you in a practice environment, the worst outcome is a number changing on a screen. There’s no rent payment at risk, no credit card bill waiting, no opportunity cost of that capital sitting elsewhere.

This emotional vacuum allows traders to execute their strategies with mechanical precision. They follow entry rules without hesitation, hold through drawdowns without flinching, and take profits exactly where planned. The problem is this isn’t trading skill being developed. It’s trading in a consequence-free simulation that bears little resemblance to actual market participation.

Studies on trading psychology consistently show that loss aversion is roughly twice as powerful as the pleasure of equivalent gains. A $500 loss hurts more than a $500 profit feels good. Demo accounts completely eliminate this asymmetry, creating an artificial confidence that evaporates the moment real money enters the equation.

The Impact of Fear and Greed on Decision Making

Fear and greed aren’t character flaws to overcome. They’re hardwired responses that served our ancestors well but wreak havoc on trading decisions. When real capital is at stake, fear manifests as premature exits from winning trades, hesitation on valid setups, and widening stop losses to avoid taking a loss.

Greed shows up differently: overriding profit targets hoping for more, sizing up after wins, and revenge trading after losses. None of these behaviors appear during demo trading because the emotional triggers simply aren’t present. A trader might intellectually understand these pitfalls while remaining completely unprepared for their visceral impact.

The transition to live trading often reveals that what seemed like a robust strategy was actually just a set of rules that worked when followed perfectly. The strategy itself might be sound, but human execution under pressure introduces variables that demo testing never captured.

Technical Discrepancies Between Demo and Real Accounts

Order Execution Speed and Latency Issues

Demo platforms typically execute orders instantaneously at the displayed price. Click buy, get filled immediately at that exact level. This creates unrealistic expectations about how markets actually function.

Live trading involves routing orders through brokers, clearing systems, and exchanges. Even with modern technology, this process takes milliseconds to seconds depending on market conditions and broker infrastructure. During high-volatility events like news releases or market opens, execution delays can stretch considerably longer.

A scalping strategy that shows consistent profits on demo might depend on getting filled within a specific price window. In live markets, that window often closes before the order reaches the exchange. The 2-pip profit target becomes a 1-pip profit or a small loss, and suddenly the entire edge disappears.

Slippage and the Reality of Requotes

Slippage occurs when an order fills at a different price than requested. On demo accounts, slippage is typically minimal or nonexistent. Live markets tell a different story, particularly during volatile conditions or when trading larger position sizes.

A stop loss set at 1.0850 might execute at 1.0847 or 1.0853 depending on available liquidity and market momentum. Over hundreds of trades, this slippage accumulates into a meaningful drag on performance. A strategy backtested with perfect fills might show 15% annual returns, while the same strategy with realistic slippage assumptions drops to 8% or turns negative.

Requotes present another challenge entirely. When price moves between order submission and execution, some brokers reject the order and offer a new price. During fast markets, traders can receive multiple requotes in succession, watching their intended entry slip away while they frantically click buttons.

Bid-Ask Spread Variations in Volatile Markets

Demo accounts often display fixed or artificially tight spreads that don’t reflect live market conditions. A EUR/USD spread might show as 0.8 pips consistently on demo while the live spread fluctuates between 0.6 pips during quiet periods and 4-5 pips during news events.

Spread widening during volatility is precisely when many traders want to enter positions. A breakout strategy that looks profitable with 1-pip spreads might become a consistent loser when spreads triple at the moment of entry. The demo results show winning trades that, in reality, would have been stopped out before ever reaching profit territory.

Some brokers maintain different liquidity pools for demo and live accounts. Demo accounts might access synthetic pricing that looks realistic but doesn’t reflect actual available liquidity. This creates a systematic bias toward better fills in practice than traders will experience with real money.

Market Liquidity and Order Filling Realities

The Illusion of Instant Fills on Large Orders

Demo accounts typically fill any order size instantly at the displayed price. Want to buy 50 standard lots of EUR/USD? Done, filled at 1.0850 with no market impact. This bears no resemblance to how large orders actually execute in live markets.

Real markets have limited liquidity at each price level. A large order consumes available liquidity and moves price against the trader. A 50-lot order might get partial fills at 1.0850, 1.0851, 1.0852, and 1.0853, with an average fill price significantly worse than expected.

Even retail traders with relatively modest position sizes can encounter this issue in less liquid markets or during off-hours trading. The demo account suggests a strategy scales linearly, while live execution shows returns degrading as position sizes increase.

How Live Market Depth Impacts Entry and Exit

Market depth refers to the volume of orders sitting at various price levels. Demo platforms rarely display accurate depth information, and even when they do, the demo execution engine ignores it entirely.

In live trading, visible market depth influences both execution quality and price movement. Large orders sitting at specific levels can act as support or resistance. When those orders get filled or pulled, price can move rapidly through zones that appeared solid on the chart.

Exiting a position during a fast-moving market often means accepting worse prices than the last traded price suggested. A trader watching price hit their profit target might find their limit order sitting unfilled as price reverses, or they might need to market out at a significantly worse level to guarantee execution.

Behavioral Habits Developed in a Demo Account

Overtrading and Poor Risk Management Discipline

The absence of real consequences encourages habits that become devastating with live capital. Overtrading is perhaps the most common: taking marginal setups, trading during suboptimal sessions, and entering positions out of boredom rather than conviction.

On demo, overtrading might slightly reduce returns but rarely causes catastrophic drawdowns. With real money, overtrading combines with emotional decision-making to create rapid account depletion. Each unnecessary trade carries commission costs, spread costs, and the risk of emotional escalation if it moves against you.

Risk management discipline also suffers in demo environments. Position sizing rules feel academic when losses don’t sting. A trader might consistently risk 5% per trade on demo, telling themselves they’ll reduce to 1% when going live. But habits formed over months of practice don’t change overnight, and the first few live trades often carry the same oversized risk.

The Danger of ‘Unrealistic’ Capital Balances

Most demo accounts start with $50,000 or $100,000 in virtual capital. This creates two problems. First, it allows position sizes that a trader’s actual capital won’t support. Second, it distorts the psychological relationship with money.

A $500 loss on a $100,000 demo account feels trivial. The same $500 loss on a $5,000 live account represents 10% of capital and triggers entirely different emotional responses. The percentage-based thinking that seemed natural on demo suddenly feels very different when the absolute numbers represent real purchasing power.

Traders who practice with inflated demo balances often struggle to adapt their strategies to smaller real accounts. The position sizes that produced comfortable profits on demo become impractical, and the reduced trade frequency tests patience in ways the demo never did.

Bridging the Gap Between Demo and Live Performance

Transitioning with Micro or Nano Accounts

The most effective bridge between demo and live trading involves real money at minimal risk. Micro accounts let you trade tiny sizes. For many USD-quoted pairs, a micro lot (0.01) is roughly $0.10 per pip, so a 100-pip move is about $10. A nano lot (0.001) is roughly $0.01 per pip, so 100 pips is about $1.

This approach introduces real money psychology while limiting potential damage during the learning curve. Losses still sting because they’re real, but a bad month might cost $50 rather than $5,000. The emotional circuitry activates, habits get tested under pressure, and execution realities become apparent.

Spending three to six months trading micro sizes provides data on how your strategy actually performs with live execution and real emotions. The win rate, average profit, and drawdown metrics from this period are far more predictive of future performance than any demo results.

Treating Virtual Capital with Real-World Gravity

For traders who must use demo accounts, creating artificial stakes can partially bridge the psychological gap. Some traders commit to donating their demo losses to charity or imposing real-world consequences for rule violations. Others reduce demo capital to match their intended live account size.

Tracking demo results with the same rigor as live trading helps build discipline. Maintaining detailed journals, calculating realistic commission and slippage adjustments, and reviewing trades as if real money were at stake creates better habits than casual demo trading.

The goal isn’t to perfectly replicate live conditions, which is impossible, but to minimize the adjustment shock when transitioning. Every habit built during demo trading will transfer to live trading, so building good habits matters even when the stakes are artificial.

Making the Transition Successfully

The gap between demo and live performance catches most traders off guard because they underestimate its breadth. Technical execution differences alone can transform a profitable strategy into a losing one. Add psychological factors and behavioral habits, and the demo results become almost meaningless as predictors.

Successful traders acknowledge this reality rather than fighting it. They treat demo trading as skill development and hypothesis testing, not performance prediction. They transition to live trading with minimal capital, expecting a learning curve and budgeting for it. They track live results separately from demo results and adjust expectations accordingly.

The question isn’t whether your live results will differ from demo. They will. The question is whether you’ve prepared for that difference by understanding its sources and building a transition plan that accounts for them. Traders who approach this gap with eyes open and capital protected give themselves the best chance of eventually matching, and exceeding, what they achieved in practice.

Disclaimer: This content is for educational purposes only and not to be construed as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

30th Jan 2026

30th Jan 2026