Daytrading CFD Explained: Tools, Strategies, and Risk Management

Sam Reid Staff Writer

Sam Reid Staff Writer

Quick Introduction to Daytrading CFDs

What is CFD Trading?

CFD stands for contract for difference. Instead of buying a share, index, commodity, or currency directly, you trade a contract that mirrors its price movement. If the price moves in your favour, the contract pays you the difference. If it moves against you, you pay the difference.

You do not own the underlying asset. You are simply speculating on whether it will go up or down. This makes CFDs flexible for short term trading, especially for those who care more about price movement than long term ownership, dividends, or voting rights.

What is Daytrading CFDs?

Daytrading CFDs is a style of trading where you open and close CFD positions within the same trading day. You use short term moves on indices, forex pairs, gold, oil, or single stocks to seek small but frequent gains. Positions are not held overnight, which means you avoid overnight funding charges on most cash CFD products and you reduce the risk of gaps between sessions.

Daytrading CFD relies on fast execution, tight spreads, and clear rules. It tends to suit traders who can stay focused, follow a plan, and accept that losses are part of the process.

Why Do People Trade CFDs?

Traders are drawn to CFDs for several reasons. You can speculate on rising and falling markets, you can access a wide range of instruments from a single platform, and you can use leverage to control larger positions with a smaller deposit. For UAE based traders, CFDs also offer a way to access global markets during US and European sessions without opening accounts in multiple jurisdictions.

On the other hand, leverage multiplies both gains and losses. If risk is not controlled, CFD daytrading can damage a trading account very quickly. The rest of this guide is about putting structure around that risk.

CFD Trading in the UAE

Is CFD Trading Legal in the UAE?

Yes, CFD trading is legal in the UAE when you use firms that are properly regulated. Onshore brokers fall under the Securities and Commodities Authority, while firms in financial free zones are supervised by the Dubai Financial Services Authority in the DIFC or the Financial Services Regulatory Authority in Abu Dhabi Global Market.

Regulations

Regulators in the UAE expect CFD providers to meet capital requirements, keep client money segregated from company funds, provide clear risk warnings, and offer fair pricing. As traders, we look for brokers that publish their license details, policies, and risk statements in a transparent way. If a broker does not clearly state who regulates them, that is usually a red flag.

Is CFD Trading Taxed in the UAE?

For individual traders, one of the advantages of living in the UAE is the lack of personal income tax and capital gains tax. Profits from CFD daytrading are not taxed at the personal level under current rules.

If trading is done through a corporate structure that falls under the UAE corporate tax rules, then tax may apply if profits exceed the relevant thresholds. In these cases, professional tax advice is important. For most retail traders using personal accounts, the focus is more on risk than tax.

Trading Hours

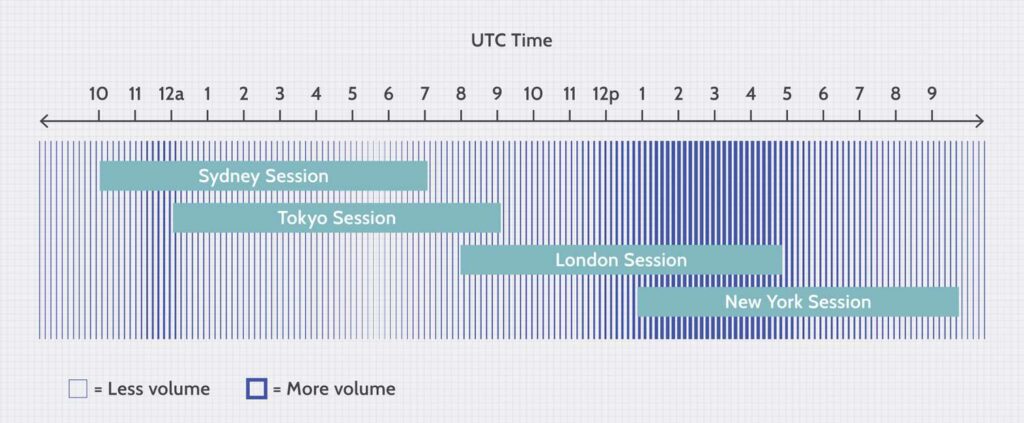

UAE time sits between Asian and European sessions, which makes it convenient for CFD daytrading. You wake up with late Asian markets still active, you can trade the full European session in the afternoon, then move into US indices and US stocks in the evening.

Many CFD brokers offer extended hours on major indices and key US stocks, along with nearly 24 hour forex trading during weekdays. This lets UAE based daytraders build a routine that fits around work and family, while still accessing the most liquid parts of the global day.

(Market Hours)

CFD Daytrading Essentials

You Can Go Long or Short with CFDs

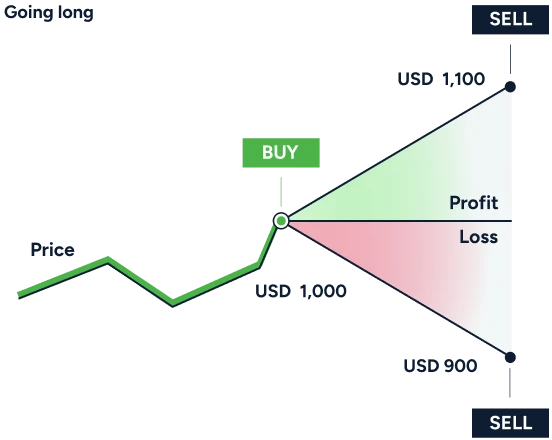

With CFDs you can buy if you expect a market to rise, or sell if you expect it to fall. Going long means you profit from upward moves. Going short means you profit from downward moves. This is one of the main differences from many spot share accounts, where short selling is limited or not available at all.

For daytraders, this flexibility is crucial. A strong move lower on an index can be just as attractive as a rally. The key is having a plan to manage both scenarios rather than guessing on direction.

(Example of going long using CFDs)

CFD Trading Is Leveraged

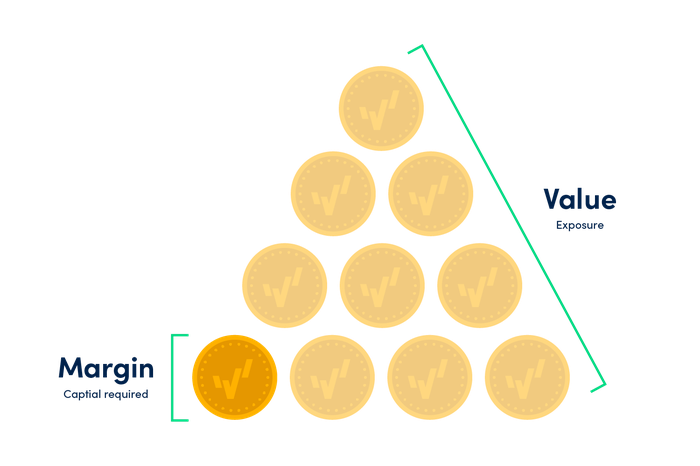

Leverage means you only put down a fraction of the full value of the trade as margin, while your profit or loss is calculated on the entire position. This is powerful and dangerous at the same time.

You’ll Open a Leveraged Position with Margin

Imagine you want to trade an index CFD with a notional value of 40,000 dollars. If your broker requires 20 percent margin, you only need 8,000 dollars to open the position. If the market moves 1 percent in your favour, you make about 400 dollars before costs. If it moves 1 percent against you, you lose about 400 dollars.

Daytraders often work with much smaller percentage moves, but the same principle applies. Margin is the deposit, not the maximum risk. The real risk is the distance between your entry and your stop loss, multiplied by position size.

Can You Trade CFDs Without Leverage?

In practice, CFDs are almost always offered as leveraged products. You can reduce the effective leverage by trading smaller size relative to your account, or by keeping a large cash balance, but the underlying product still uses margin. If you want to avoid leverage completely, spot products held in full amount are usually a better match.

CFDs Behave Similarly to Their Underlying Market

CFD prices track the underlying market, with a spread and sometimes a small adjustment for costs. If for instance the DAX index rises ten points, the DAX CFD should move around ten points as well. For daytrading, this means you can focus analysis on the underlying chart while executing through the CFD ticket.

Popular Markets

For CFD daytrading from the UAE, we commonly see traders focus on:

- Major indices such as US 500, US Tech 100, Germany 40, and FTSE 100

- Liquid forex pairs such as EURUSD, GBPUSD, USDJPY, and sometimes AED linked pairs for hedging

- Gold and oil, due to strong intraday volatility and clear reaction to macro news

- Large cap US and European stocks for earnings plays

More Markets

Beyond the common instruments, many brokers also offer crypto CFDs, sector indices, volatility products, and thematic baskets. For beginners, narrow focus tends to work better. It is easier to learn how one or two instruments behave during specific sessions than to chase every possible market on the platform.

Are CFDs and Daytrading Right for You?

Learn Your Profile

Before committing real capital, it helps to learn what kind of trader you are. Do you prefer fast decisions with many small trades, or slower setups that you can check a few times a day. CFD daytrading leans toward the first type. If you find rapid intraday swings stressful, swing trading or investing might fit better.

Financial Aspect

Financially, CFD daytrading is demanding. You need money you can afford to lose, awareness of leverage, and realistic expectations. Many new traders overestimate how quickly they can grow an account. In our view, survival and consistency matter more than aggressive targets, especially in the first year.

Insights

From our own testing of CFD platforms and tools, the traders who tend to last longest share a few traits. They keep position sizes small relative to account equity, they journal trades, they keep a schedule around specific sessions instead of trading all day, and they treat daytrading as a structured project rather than a quick path to wealth.

Best CFD Brokers In The UAE

Platforms and Features

When we look at brokers who serve UAE residents, our focus is on platform stability, order execution, charting, and risk tools. Many traders will use MetaTrader 4 or MetaTrader 5, cTrader, or a proprietary web and mobile platform. Robust watchlists, depth of market views, and one click trading are especially useful for CFD daytrading.

Third Party Platforms

Some brokers plug into popular third party platforms, such as MetaTrader, TradingView integration, or specialist futures style platforms for indices and commodities. This adds flexibility if you like a specific charting style or you already use a particular platform in demo.

Integration Options

Integration can matter more than it seems. Being able to connect your trading account to analytics tools, copy trading services, or risk dashboards can help you monitor performance. API access is more niche, but some active daytraders use it for custom tools or partial automation.

Compare Platforms

We suggest comparing at least three aspects across brokers you shortlist, such as AvaTrade, Exness, and XTB:

- Average spreads during the sessions you plan to trade

- Execution quality and slippage on market and stop orders

- Stability of web and mobile platforms during volatile events

Tools

Brokers differ in the tools they offer. Some add sentiment indicators, depth of market, market analysis feeds, or integrated economic calendars. Others keep the platform lean and expect you to use external tools. For CFD daytrading, a built in calendar, alerts, and decent drawing tools are usually non negotiable.

Costs and Processes

Account opening for UAE residents is typically done online with Emirates ID and proof of address. Costs to track include spreads, commissions on share CFDs, overnight funding, and any currency conversion fees if you trade in dollars or euros but deposit in dirhams. Funding methods might include local bank transfer, cards, or regional wallets, which can affect speed and fees when you move money in and out.

Support

Daytrading CFD involves live markets and real money. When something goes wrong, you want support that actually responds. We pay attention to live chat response times, local or regional phone numbers, and the clarity of help center articles. This often matters more than it appears on the surface.

5 Steps to Becoming a CFD Daytrader

Find Out How CFDs Work

Start with the structure of CFDs. Understand how contract size, tick value, and margin work for each instrument. If you cannot explain in simple terms what happens to your account when the market moves ten points, you are not ready to risk real money.

Learn How CFD Profit and Loss Works

Profit and loss are calculated as: position size multiplied by the number of points the market moves in your favour or against you, minus costs. Run a few hypothetical examples on a demo account and check how they show up in the P&L field. This builds intuition faster than reading formulas alone.

Find Out How to Place a CFD Trade

On most platforms, you will see a buy price and a sell price, a volume or lot size field, and optional stop loss and take profit fields. Practice placing and closing trades on demo until it feels mechanical. A common beginner mistake is misreading contract size and accidentally trading ten times more than intended.

Learn About CFD Timeframes

Daytraders often combine multiple timeframes. For example, they use the one hour chart to understand the broader trend, the fifteen minute chart to mark key levels, and the one minute or five minute chart to fine tune entries and exits. Your aim is to build a simple, repeatable routine around two or three timeframes, not to analyse every possible chart.

Know the Costs When Trading CFDs

Costs come from spreads, commissions, overnight funding, and slippage. For daytrading, overnight funding is less of a factor, since you close positions before the end of the session, but spreads and slippage matter a lot. A strategy that relies on two or three points of profit per trade can be wiped out by wide spreads during illiquid times.

Tools, Education, and News for CFD Daytrading

Tools

Core tools for CFD daytrading include real time charts, depth of market on liquid instruments, an economic calendar, and alert features. Many traders also use journaling tools or spreadsheets to track metrics like win rate, average risk per trade, and maximum drawdown.

Education

Quality education is more than motivational quotes or social media clips. Look for structured courses, webinars, and written guides that explain concepts like risk per trade, expectancy, and position sizing with clear examples. Combining education from your broker with independent sources can help balance marketing with reality.

News and Events

Economic data releases, central bank meetings, earnings reports, and geopolitical events can all move markets sharply. CFD daytraders should know which events affect their chosen instruments, what time they occur in UAE time, and how spreads and volatility normally behave around them. Often the best decision is to stand aside during the most chaotic moments.

Popular CFD Daytrading Strategies

A trading strategy is simply a set of rules that tells you when to enter, where to place your stop, where to take profit, and when to avoid trading. It should be simple enough to follow under pressure, yet structured enough to be tested over a sample of trades.

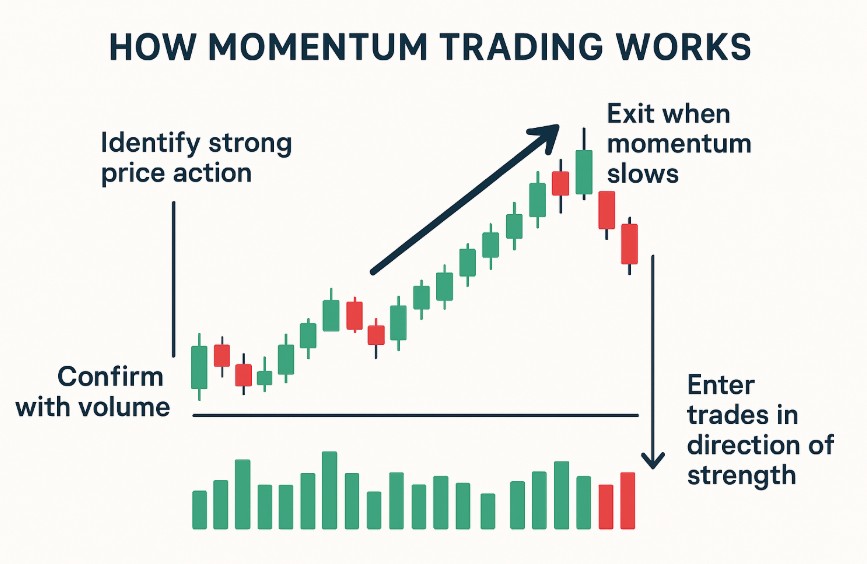

Momentum Trading Strategy

Momentum strategies look for strong moves in one direction and aim to join that move. For example, if an index breaks above the high of the previous session with strong volume, a momentum trader might buy a pullback, place a stop below a recent swing low, and aim for a reward that is at least one and a half to two times the risk.

(Momentum Trading Illustrated)

Example of Momentum Trading Strategy in CFD Trading

Imagine the US Tech 100 CFD breaks out after a major earnings release from a large technology company. Price surges through a resistance level, then pauses and pulls back slightly. A CFD daytrader might enter long when price resumes the upward move, with a tight stop under the pullback low and a target near the next resistance level. If the move continues with strong momentum, the trade can pay off quickly. If momentum fades, the stop keeps the loss contained.

Breakout Trading Strategy

Breakout strategies focus on price levels where the market has repeatedly stalled. When price finally breaks through a well respected support or resistance zone, the breakout trader enters in the direction of the break, expecting a new trend to develop.

Example of a Breakout Trading Strategy in CFD Trading

Consider a stock CFD that has bounced between a clear support and resistance band for several days. There are multiple failed attempts to break above resistance. Eventually, a strong news event pushes price through that level with a large candle and increased volume. A breakout trader might enter long just above the breakout level, set a stop back inside the prior range, and aim for a move equal to the height of the range or more.

(Example of a Breakout)

Key Considerations for CFD Daytrading

Pre-Trading Analysis and Planning

Good daytrading sessions start before any orders are placed. Mark the main support and resistance levels, check the economic calendar, and decide which instruments are in play. If nothing sets up clearly, walking away is often the best decision.

Effective Use of Stop Loss and Take Profit Orders

Stop loss orders define your maximum risk on a trade. Take profit orders lock in gains when price reaches your target. For CFD daytrading, both are essential. Moving stops wider without a clear plan usually leads to larger losses. Taking profits early on every trade can damage the long term edge of a strategy.

Risk Management for Intraday Trading

Risk management covers more than individual stops. It includes limits on total daily loss, maximum number of trades per day, and the amount of leverage used. Many experienced daytraders stop trading for the day if they hit a predefined loss limit, to prevent emotional decisions later in the session.

Managing Risk in CFD Trading: Leverage, Position Size and Market Volatility

Leverage

Leverage can make small moves meaningful in dollar terms, but it can also turn a manageable drawdown into a serious account hit. One practical way to keep leverage under control is to decide on a fixed percentage of account equity to risk per trade, rather than a fixed lot size. That way, position size automatically adjusts as the account grows or shrinks. UAE traders still show an increasing interest in using leverage as quoted in the Investment Trends report– ‘The UAE retail leverage trading market shows strength with a notable increase in reactivated and ongoing CFD/FX traders.’

Position Size and Capital Allocation

A common guideline is to risk around 1 to 2 percent of account equity per trade. To calculate position size, you choose a stop loss distance in points, decide your risk amount in dollars, then divide risk by stop distance multiplied by value per point. This might feel slow at first, but it becomes second nature with practice.

Market Volatility

Volatility can be both friend and enemy for CFD daytraders. Too little movement and there is nothing to trade. Too much movement and spreads widen, slippage increases, and stops can be jumped. Adjusting stop distances and position size for different volatility regimes is part of maturing as a trader. Sometimes the best risk management tool is simply reducing size or not trading at all during extreme events.

Common Pitfalls to Avoid in CFD Daytrading

Overtrading and Emotional Trading

Overtrading happens when you take trades outside your plan, usually out of boredom, fear, or frustration. Emotional trading often shows up after a loss or a big win, when discipline weakens and impulses take over.

How to Avoid

Set a maximum number of trades per session, keep a written checklist next to your platform, and step away from the screen after a string of losses or a large win. A short break often does more for performance than forcing another trade.

Ignoring Market News and Events

Ignoring key events leaves you vulnerable to sudden spikes. Even purely technical traders need to know when central banks are speaking or major data is released.

How to Avoid

Build the economic calendar into your daily routine. Mark times when spreads usually widen, such as non farm payrolls or major rate decisions, and decide whether your strategy can handle that volatility or if you will stand aside

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Nothing in this article is financial advice. Always do your own research and only trade with money you can afford to lose.

16th Nov 2025

16th Nov 2025