How to Change Leverage on MT4

Sam Reid

Staff Writer

Sam Reid

Staff Writer

MetaTrader 4, better known as MT4, is one of the most popular trading platforms for forex and CFD traders worldwide. Many traders eventually want to adjust their leverage, and doing so is straightforward once you know where to look. To change leverage on MT4, you log in to your broker’s client portal, go to your account settings, select your MT4 account, choose a new leverage ratio from the list, and confirm the change. While you view charts and place trades in MT4, the actual leverage settings are managed entirely through your broker.

In this guide, we will walk through the exact steps to change leverage, explain why you might want to adjust it, outline the risks, and share best practices for using leverage wisely. Understanding these factors can help you get the most out of MT4 without taking unnecessary risks.

Understanding MT4 and Leverage

Before making any changes, it is important to understand the relationship between MT4 and leverage. MT4 is simply the interface where you see prices, analyse charts, and place orders. It does not control leverage directly. Leverage is set by your broker in their system.

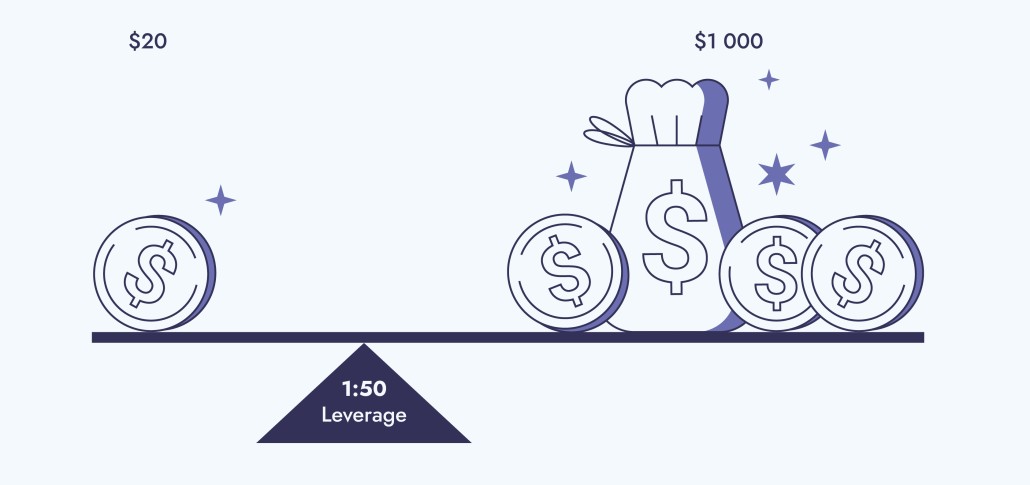

Leverage lets you control a position that is larger than the money you have in your account. For example, with a ratio of 1:100, a trader with 1,000 dollars can open a position worth 100,000 dollars. This can increase potential profits but also increases potential losses.

Brokers offer different maximum leverage depending on regulations, your account type, and your experience. In the European Union, the cap for retail forex traders is 1:30. In the United States, it is 1:50. Brokers in offshore jurisdictions may allow 1:500 or even higher.

Why Leverage Matters to Traders

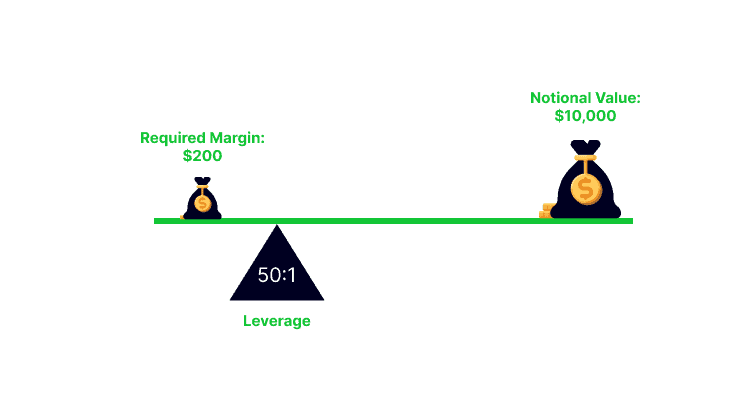

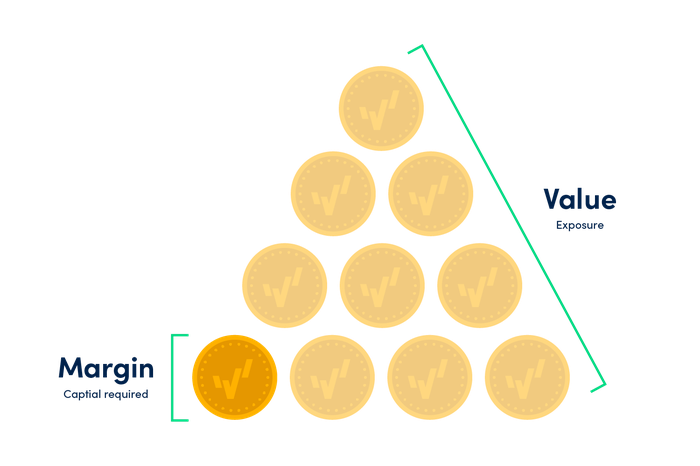

Leverage directly affects your margin requirement, which is the minimum amount of funds needed to open and maintain a trade. Higher leverage lowers the margin requirement, giving you more flexibility to open positions. This can be helpful if you want to spread your capital across multiple trades or avoid tying up too much money in one position.

However, high leverage also magnifies losses. A small market move can cause large changes to your account balance. Using too much leverage without a clear plan can lead to quick losses and even a margin call, where your broker closes positions to protect the account from going negative.

How to Check Your Current Leverage in MT4

Since leverage is managed by your broker, MT4 itself will not give you a setting to change it instantly. However, you can usually see your current leverage in your broker’s client portal.

A typical process looks like this:

-

Log in to your broker’s secure client area.

-

Go to the section where your accounts are listed.

-

Select your MT4 account. The leverage setting is often shown in the account details. If not, check the account settings page.

Some brokers may also display leverage within MT4’s account information window, but the most reliable place to check is through your broker’s portal.

How to Change Leverage on MT4

When people talk about changing leverage on MT4, what they are really doing is changing it through their broker’s account management tools. The process is generally the same across most brokers:

-

Log in to your broker’s client portal.

-

Navigate to your account management section.

-

Select the MT4 account you want to change.

-

Look for an option labelled “Change Leverage” or “Edit Account Settings.”

-

Choose your preferred leverage from the list of available ratios.

-

Confirm the change. Some brokers update this instantly, while others may require approval.

Lowering your leverage will increase the margin requirement for any open trades. Make sure you have enough free margin to keep trades open after the change. If not, the broker may close some positions.

Choosing the Right Leverage Ratio

Knowing how to change leverage on MT4 is only part of the equation. The bigger decision is choosing the right level for your needs.

Your leverage choice should fit your trading strategy, your comfort with risk, and your level of experience.

-

Beginners often start with 1:10 or 1:20. This reduces the effect of volatility and provides more breathing room before losses become significant.

-

Traders with moderate experience may use 1:50 or 1:100 depending on their style.

-

Experienced traders sometimes use high leverage such as 1:200 or more, but only with strict risk controls.

Ratios like 1:500 can be tempting, but they carry much higher risk. If you choose high leverage, it should be part of a disciplined plan.

The Pros and Cons of Adjusting Leverage

Advantages

-

Allows you to open larger positions with less capital.

-

Lets you diversify by opening multiple trades without tying up all your funds.

-

Can increase profit potential when used with a solid strategy.

Disadvantages

-

Increases the size of potential losses.

-

Raises the risk of margin calls.

-

Can lead to overtrading if not carefully managed.

Best Practices for Using Leverage

If you plan to use leverage effectively, follow these tips:

-

Always set a stop loss to limit losses.

-

Risk only a small percentage of your account on each trade. Many traders aim for 1 to 2 percent.

-

Test different leverage levels on a demo account first.

-

Avoid using the highest available leverage just because it is offered.

-

Monitor your margin level, especially in volatile markets.

Common Mistakes When Changing Leverage

Some traders make changes without thinking through the impact. Common mistakes include:

-

Increasing leverage during a losing streak in an attempt to recover losses quickly.

-

Forgetting that lowering leverage will require more margin for open trades.

-

Overestimating their ability to handle larger positions.

These mistakes can be avoided by having a clear plan and sticking to it.

Practical Example of Leverage Impact

Suppose you have 1,000 dollars in your account and select 1:100 leverage. You could open positions worth up to 100,000 dollars. A 1 percent favorable market move could double your account. However, a 1 percent adverse move could wipe it out entirely.

If you chose 1:20 leverage instead, your maximum position size would be 20,000 dollars. That same 1 percent move would result in a 200 dollar gain or loss, giving you more room to recover if things go against you.

Final Thoughts

The process of changing leverage is simple. You log in to your broker’s portal, select your MT4 account, choose a new ratio, and confirm it. The more important step is choosing a level that suits your trading style and risk tolerance.

Leverage can be a valuable tool for increasing efficiency, but it must be used with caution. Always test changes on a demo account and make sure your risk management strategy can handle the increased exposure before applying it to live trading.

FAQs

How do you change the leverage on MT4?

You log in to your broker’s client portal, select your MT4 account, choose the “Change Leverage” option, select a new ratio, and confirm the change.

Can you change your leverage?

Yes, most brokers allow this, but options depend on your location, account type, and broker policies.

What leverage is good for 10 dollars?

With such a small balance, you may need higher leverage to open trades, but the risk is high. Using micro-lots with lower leverage can give you more control.

Is 1:500 leverage good for small accounts?

It can allow small accounts to trade larger positions, but even small price moves can cause big losses. Lower leverage is safer for most traders starting out.

15th Aug 2025

15th Aug 2025