What is the 7% Rule in Stock Trading?

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Every successful trader knows that managing risk is just as important as identifying opportunities. Whether you trade manually or through algorithmic systems, having a clear framework for cutting losses is crucial. One of the simplest yet most powerful principles in this regard is the 7% rule in stock trading. It acts as a safety net, helping traders stay disciplined, preserve their portfolios, and avoid catastrophic drawdowns.

Understanding the 7% Rule in Stock Trading

The 7% rule is a straightforward concept: if a stock falls 7% or more below your purchase price, you should sell it immediately. The idea was popularized by William J. O’Neil, founder of Investor’s Business Daily and creator of the CAN SLIM method. The principle is based on decades of market analysis showing that most fundamentally strong stocks don’t decline beyond 7–8% without signaling weakness.

In other words, the 7% threshold acts as a built-in stop-loss point. It helps you preserve capital during uncertain markets and gives you the chance to reinvest in stronger setups rather than holding onto a losing position.

Why 7%? The Logic Behind the Rule

At first glance, 7% may seem arbitrary, but there’s solid reasoning behind it. O’Neil’s research found that in normal market conditions, stocks that fall more than 7–8% from their buy point often continue to weaken. By exiting at this point, traders prevent small losses from turning into portfolio-damaging drawdowns of 20% or more.

Three Core Principles of the 7% Rule

- 1. Protect Your Capital: By limiting any single loss to 7%, you ensure that even multiple small losses can be recovered by just a few strong winning trades.

- 2. Preserve Emotional Discipline: Emotional trading—especially hope or denial—leads many investors to hold onto losing positions. The 7% rule eliminates hesitation by enforcing a clear exit plan.

- 3. Maintain Consistency: The rule gives traders a uniform method of managing risk, keeping their strategy systematic rather than impulsive.

How the 7% Rule Works in Practice

Let’s take an example. Suppose you buy a stock at AED 100 per share. According to the 7% rule, you should set your stop-loss at AED 93. If the price falls to this level, you sell the position automatically.

This approach can be implemented manually or through automated systems offered by brokers for stock trading. Many trading platforms now allow you to preset stop-loss triggers so that the system executes exits instantly, without emotional interference. This feature is particularly useful for traders in the UAE, where markets move quickly and active participation during Gulf hours is essential.

Practical Benefits

- Protects capital from unexpected downturns.

- Encourages a rule-based trading mindset.

- Helps avoid paralysis during volatile sessions.

- Frees up funds for stronger opportunities.

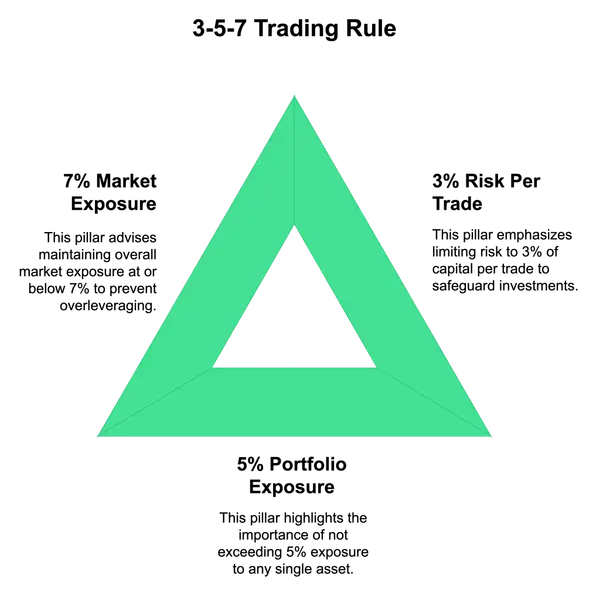

Comparing the 7% Rule with the 3-5-7 Framework

While the 7% rule focuses on loss limitation, the 3-5-7 rule adds a multi-layered approach to portfolio management. It suggests risking no more than 3% of your capital per trade, maintaining a 5% exposure across open trades, and targeting at least 7% profit on winning trades. Both methods share one purpose: protecting traders from disproportionate losses.

For example, if you’re trading with AED 20,000, under the 3-5-7 rule, your maximum loss per trade should not exceed AED 600 (3%), and your total exposure should stay within AED 1,000 (5%). If you combine this with a 7% stop-loss, your portfolio remains structured, diversified, and protected against emotional overreaction.

How UAE Traders Can Apply the 7% Rule

Trading in the UAE offers unique advantages like long Gulf trading hours, access to both regional and global markets, and several online trading brokers in UAE that support automated stop-loss features. Whether you’re investing in DFM-listed companies, US tech stocks, or ETFs, applying the 7% rule can serve as a universal risk management tool.

Step-by-Step for UAE Traders

- Choose a regulated platform: Select a DFSA or SCA-licensed broker that allows you to set conditional stop-loss orders.

- Plan your entry and exit before trading: Define the maximum 7% risk in AED terms before placing a buy order.

- Use automation when possible: Automated stop-loss settings reduce emotional interference and ensure execution during off-peak hours.

- Review performance monthly: Check whether 7% stops are too tight or too wide for your chosen assets and adjust accordingly.

Pros and Cons of the 7% Rule

| Pros | Cons |

|---|---|

| Reduces large drawdowns by exiting early. | Might trigger premature exits during short-term volatility. |

| Promotes emotional control and discipline. | Less suitable for long-term investors who tolerate wider price swings. |

| Easy to automate with most online platforms. | May generate small repeated losses before major gains. |

Integrating the 7% Rule into a Broader Strategy

The 7% rule is not meant to stand alone—it works best when combined with sound portfolio management techniques. Traders often pair it with tools like moving averages, the Average True Range (ATR), or relative strength indicators to refine their exits. For example, a break below a 50-day moving average plus a 7% price drop provides a strong technical confirmation to exit.

Additionally, modern brokers for stock trading often provide trailing stop options. Instead of keeping a static 7% limit, a trailing stop moves upward with price gains, locking in profits while maintaining downside protection. This is particularly helpful in trending markets where you want to stay invested without giving back too much profit.

Position Sizing and Portfolio Allocation

Risk control starts with position sizing. Even with a 7% stop-loss, allocating too much capital to one stock can distort your portfolio’s balance. To manage this, determine your trade size based on your total capital and risk appetite. For instance, if you’re comfortable losing a maximum of 2% of your account on any single trade, calculate your position size so that a 7% drop equals that 2% risk exposure.

When to Adjust or Ignore the 7% Rule

While effective, the 7% rule isn’t inflexible. Traders may adjust their thresholds depending on market conditions or volatility levels. For highly liquid blue-chip stocks, 7% might work perfectly. However, for more volatile assets, like small-cap or tech startups, a wider range of 8–10% might prevent premature stop-outs.

Conversely, for slow-moving defensive sectors such as utilities or healthcare, a tighter stop around 5–6% might be more efficient. The goal is to tailor the rule to your trading personality and market type while maintaining discipline.

Technology and Automation: A Modern Edge

Advancements in trading technology have made it easier for investors to integrate risk management rules into their workflow. Many online trading brokers in UAE now offer advanced order types such as conditional stops, algorithmic triggers, and API-based automation. This allows traders to execute precise risk limits like the 7% rule without manual monitoring, ensuring consistent performance even during volatile sessions.

For algorithmic traders, platforms like Tradetron or MetaTrader 5 can automate the rule with a simple logic condition such as:

[LTP] < [Entry Price] * 0.93 → Exit Position

This ensures that any position falling beyond the 7% threshold is exited automatically, reducing emotional trading errors.

Local Relevance for UAE Investors

In the UAE, where many retail traders actively follow both regional and global markets, risk management is essential to maintaining long-term profitability. With platforms offering access to Nasdaq, DFM, and Tadawul-listed equities, applying a consistent stop-loss rule helps protect AED-denominated portfolios from foreign market swings.

Furthermore, traders using local payment systems such as Wio Bank, STC Pay, or Mada cards can manage their trading accounts conveniently while maintaining capital protection strategies. The 7% rule aligns perfectly with this disciplined, tech-driven trading approach favored by modern investors in the region.

Key Takeaways

- The 7% rule is a practical stop-loss principle that safeguards your trading capital.

- It promotes emotional discipline by enforcing predefined exit levels.

- Combining it with tools like ATR and position sizing enhances performance.

- Modern UAE-based trading platforms support easy automation of this rule.

Conclusion

The 7% rule in stock trading remains one of the most timeless and effective methods of risk management. It may not predict market reversals, but it ensures you live to trade another day. For traders in the UAE and worldwide, integrating this principle through modern platforms and disciplined portfolio strategies can make all the difference between long-term success and early burnout.

FAQs

Does the 7% stock rule work?

Yes, the 7% stock rule has stood the test of time. It prevents small losses from becoming large ones and enforces consistent decision-making. While not every 7% stop will be perfect, over time it protects your capital and promotes disciplined trading habits.

What is Warren Buffett’s 70/30 rule?

Warren Buffett’s 70/30 rule generally refers to portfolio allocation—70% in stable, long-term investments and 30% reserved for higher-risk or opportunistic assets. It reflects a balanced approach that manages risk while leaving room for growth.

How much do I need to invest in stocks to make $1000 a month?

This depends on your return expectations and risk profile. If you target a 5% monthly return (which is quite high), you’d need around $20,000 in active capital. However, most investors should focus on realistic, sustainable returns through steady compounding rather than aiming for fixed monthly profits.

What is the 70/20/10 rule in trading?

The 70/20/10 rule divides trading focus: 70% of efforts on core strategies, 20% on new experiments, and 10% on high-risk opportunities. It encourages diversification of ideas and helps maintain a balanced approach to innovation and consistency.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose. This content is for educational purposes only and should not be interpreted as investment advice or a sufficient basis for making investment decisions.

30th Oct 2025

30th Oct 2025