What is Commodity Trading?

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Answering the Core Question

Commodity trading is the practice of taking positions in raw or primary products that power the real economy. These include energy products, precious and base metals, and agricultural goods. Positions can be taken in the physical market for immediate delivery or through financial instruments such as futures and options that settle now or at a later date.

Traders engage in commodity trading to hedge business risks, diversify investment portfolios, and seek returns from price movements in supply driven and demand driven markets.

What Is a Commodity

A commodity is a standardized raw material used in production and consumption. One ounce of exchange-grade gold meets the same standard regardless of producer. One barrel of benchmark crude has a common specification across counterparties on the relevant exchange contract.

Types of Commodities

- Hard commodities: metals such as gold, silver, copper; energy such as crude oil, gasoline, natural gas.

- Soft commodities: agriculture such as wheat, corn, soybeans, coffee, sugar; livestock such as cattle and hogs.

How Commodity Markets Work

Modern commodity markets operate in two ways. The spot market is where physical goods are exchanged for immediate delivery. The derivatives market lists standardized futures and options that reference the spot price but settle at a future date or give the right to transact at a preset price.

- Spot markets: immediate delivery and payment.

- Futures: contracts to exchange a commodity at a fixed price on a future date.

- Options: calls give the right to buy, puts the right to sell without obligation.

Major exchanges include CME Group for grains, energy, metals, and livestock, ICE for soft commodities, and the London Metal Exchange for base metals. These venues standardize contracts and provide transparent price discovery.

Why Traders Use Commodities

- Diversification: commodity returns often move differently from stocks and bonds.

- Inflation hedge: metals and energy can help protect purchasing power.

- Business hedging: airlines lock fuel costs, farmers lock grain prices, manufacturers hedge raw materials.

- Speculation: traders seek profits from volatility in oil, metals, or agriculture.

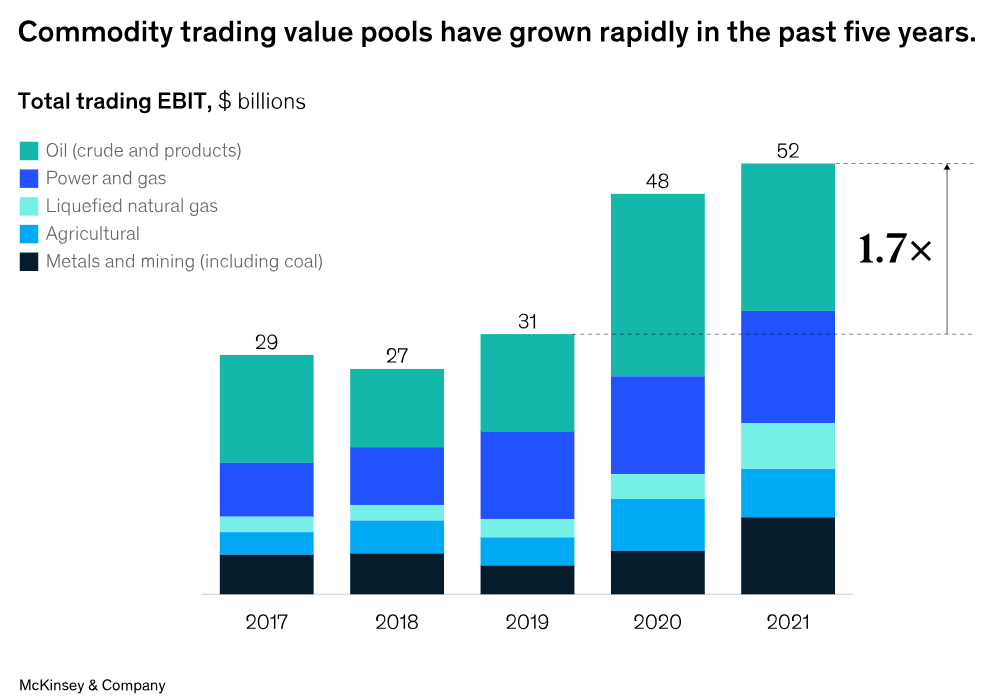

Growth in Commodity Trading From 2017-2021 (Source: McKinsey)

Price Drivers Traders Watch

- Supply and demand conditions

- Geopolitical developments

- Weather and seasonality

- Macroeconomic trends such as growth, inflation, and interest rates

- Speculative positioning by large traders

How to Trade Commodities

If you are wondering how to trade commodities, the process is structured. Choose your instrument, define a plan, size positions carefully and manage risk.

- Direct trading in spot markets

- Using futures or options contracts

- Buying commodity ETFs for diversification

- Investing in commodity-related stocks

- Exploring forex and commodity trading on multi-asset platforms

How to Open Commodity Trading Account

- Select a regulated broker that offers commodity access.

- Complete KYC and verification steps.

- Fund your account via bank, card, or e-wallet.

- Choose your market: oil, gold, agriculture, or ETFs.

- Practice with a demo account before live trading.

Commodity Trading vs Stock Trading

- Commodities are physical goods; stocks are ownership shares.

- Commodities can be more volatile.

- Stocks may pay dividends; commodities do not.

- Commodity traders often include producers and hedgers, while stocks attract corporate investors.

Risks of Commodity Trading

- High volatility and rapid price changes.

- Leverage magnifies gains and losses.

- No dividends or coupons, returns come only from price changes.

- Global events can trigger sudden moves.

Example of a Commodity Trade

Suppose a trader buys a futures contract for crude oil at $80 per barrel, covering 1,000 barrels. If oil rises to $85, the profit is $5,000. If it falls to $75, the loss is also $5,000. This shows the high risk and reward nature of commodity futures.

Key Participants in Commodity Markets

Commodity markets thrive on the interaction of several types of participants. Understanding who they are helps a trader anticipate market moves.

- Hedgers: Businesses that rely on commodities for production, such as airlines or food processors, hedge to lock in predictable costs.

- Speculators: Individuals or institutions aiming for profit from price changes, providing liquidity but adding volatility.

- Arbitrageurs: Traders who exploit small price discrepancies across markets or contract months.

- Institutional investors: Pension funds, asset managers, and hedge funds allocating to commodities through ETFs or index products.

Tools and Resources for Traders

Modern commodity trading relies on data and analysis. Useful tools might include:

- Fundamental reports: Weekly oil inventories, crop condition reports, OPEC announcements.

- Technical indicators: Moving averages, RSI, MACD, Bollinger Bands.

- Trading platforms: Regulated brokers providing charting, news feeds, and execution tools.

- Risk calculators: Margin and position size calculators to prevent overexposure.

Mistakes to Avoid in Commodity Trading

- Ignoring leverage risk: Futures and CFDs magnify both profits and losses.

- Overtrading volatile commodities: Oversized positions in oil or gas can wipe accounts.

- Lack of diversification: Concentration in one commodity increases exposure.

- Neglecting stop losses: Not defining exits risks large drawdowns.

- Chasing news headlines: Entering after geopolitical events often means trading at peak volatility.

Conclusion

Commodity trading connects the financial world with the physical economy. It affects everything from the cost of food to the price of travel. To succeed, traders need to understand what commodities are, how markets function, and how to open a commodity trading account with a regulated broker. With knowledge, discipline, and risk management, commodity trading can become a valuable part of a balanced investment approach.

FAQs

What do you mean by commodity trading?

It is the buying, selling, and speculating on raw materials such as oil, gold, and wheat through spot, futures, options, or ETFs.

What is an example of a commodity trade?

A farmer selling wheat futures to lock in a fixed harvest price, or an investor buying a gold ETF expecting prices to rise.

Who are the big 4 commodities traders?

The global leaders are Glencore, Cargill, Archer Daniels Midland (ADM), and Bunge.

What does a commodity trader do?

A commodity trader buys and sells physical goods or contracts. They may hedge costs, speculate for profit, or provide liquidity to the market.

Disclaimer: This content is for educational purposes only and not to be conscrued as investment advice. Remember that CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

26th Aug 2025

26th Aug 2025