What is a Trailing Stop Loss

Sam Reid

Staff Writer

Sam Reid

Staff Writer

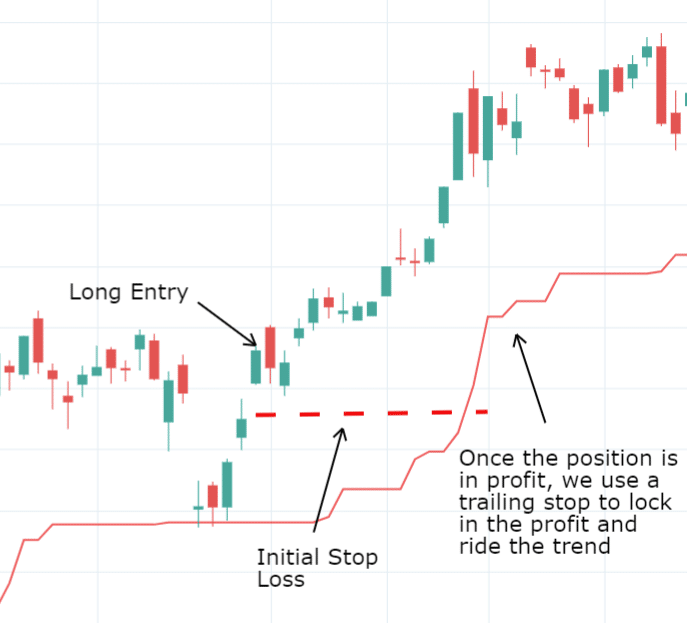

Trading often comes down to how well you manage your exits, not just your entries. A trailing stop loss is one of the most effective tools available to help traders lock in profits while limiting downside risk. In simple terms, a trailing stop loss is a dynamic version of the stop loss order that automatically adjusts with the market price. It moves up when the market moves in your favor but stays fixed when the price turns against you. This mechanism ensures you can ride profitable trends while having a safety net that prevents a winning trade from turning into a losing one.

In this article, we will explain what a trailing stop loss is, how it works, when it can be useful, the advantages and disadvantages of using it, and practical ways traders can set trailing stops in real market conditions. We will also explore common mistakes to avoid, recommended percentages, and how traders across different time frames can tailor this strategy to their needs.

Understanding What a Trailing Stop Loss Is

A trailing stop loss is an automated trading order set at a fixed distance, either as a percentage or a monetary value, from the current market price. Unlike a traditional stop loss that stays fixed at one level, a trailing stop follows the price upward for long positions or downward for short positions. When the price moves in your favor, the stop order automatically adjusts accordingly. If the price reverses by the set distance, the stop remains stationary and triggers a market exit.

For example, if you buy a stock at 100 with a trailing stop set at 10 percent, the initial stop is at 90. If the stock rises to 120, the trailing stop moves up to 108. If the price then falls to 108, the position is closed, locking in an 8 percent gain.

This feature makes the trailing stop loss particularly valuable for trend following strategies, where the goal is to stay in profitable trades as long as the market continues in the desired direction.

How a Trailing Stop Loss Works in Practice

The mechanics of a trailing stop loss can be broken into three parts:

-

Initial Placement: The trader sets the trailing distance, either as a percentage or as a specific monetary amount.

-

Price Adjustment: As the market moves in favor of the trade, the stop order automatically trails behind at the set distance.

-

Triggering the Exit: When the market reverses and reaches the stop level, the order is executed and the trade is closed.

This automation takes the emotion out of decision making and enforces discipline.

Key Features of Trailing Stops

-

Dynamic adjustment that moves automatically with favorable price changes

-

Fixed protection that remains steady during unfavorable moves

-

Customizable settings that can be placed as a percentage or absolute value

-

Broad applicability that works in bullish and bearish markets

-

Platform integration, available in most modern trading platforms without additional cost

Trailing Stop Loss Examples

Example 1: Equity Trade

Suppose you buy shares of a company at 500 AED with a trailing stop set at 5 percent. The initial stop is at 475 AED. If the price climbs to 600 AED, the stop automatically adjusts to 570 AED. If the market dips to 570 AED, your shares are sold, ensuring a profit.

Example 2: Forex Trade

A trader goes long on EUR/USD at 1.1000 with a 50 pip trailing stop. If the price rises to 1.1200, the stop moves up to 1.1150. If the pair then declines, the position closes at 1.1150, locking in 150 pips.

Example 3: Commodity Futures

Buying gold futures at 7,300 AED with a trailing stop of 150 AED means the stop starts at 7,150 AED. If gold rises to 7,600 AED, the stop adjusts to 7,450 AED. Should the market reverse, the trader still secures a 150 AED gain.

When to Use a Trailing Stop Loss

Trailing stops are most effective in certain trading conditions:

-

Trending markets where prices are moving consistently in one direction

-

Swing trading to capture multi day moves while avoiding sudden reversals

-

Volatile conditions that can shift abruptly and require risk protection

-

For busy traders who cannot monitor trades constantly

They may not be suitable in sideways or choppy markets, where frequent price swings can trigger premature exits.

Advantages of Trailing Stops

-

Protects profits and ensures gains are locked in as prices move higher

-

Reduces emotional trading by automating the decision to exit

-

Provides a disciplined approach to risk management

-

Offers unlimited upside since losses are capped but profits can grow with the trend

-

Easy to use since most brokers allow simple setup without extra cost

Disadvantages of Trailing Stops

-

Not always suitable in rangebound markets

-

Risk of slippage in rapid price declines where orders may execute at worse levels

-

Premature exits if the stop is set too close to the market price

-

Dependence on brokers since not all allow trailing stops on every instrument

-

Potential over reliance which can reduce a trader’s own market analysis skills

What is a Good Trailing Stop Percentage

This is one of the most common questions traders face. The answer depends on the asset, time frame, and volatility:

-

Stocks: Many investors use 7 to 15 percent trailing stops

-

Forex: Ranges from 30 to 100 pips depending on volatility

-

Futures: Often set in monetary terms, such as 150 to 300 AED on contracts like gold or oil

The key is balance. Too tight and you risk being stopped out by normal market noise, too loose and you may give back much of your gains.

Mistakes to Avoid with Trailing Stops

-

Setting stops arbitrarily without considering volatility

-

Ignoring fundamental events such as earnings or economic data releases

-

Using the same percentage across all markets without adjustment

-

Failing to review and refine stop strategies regularly

Combining Trailing Stops with Other Tools

Trailing stops can be more effective when combined with technical indicators:

-

Moving averages, with stops placed near 20 day or 50 day averages to align exits with trend shifts

-

ATR (Average True Range), which helps adjust stops based on volatility

-

Support and resistance levels, placing stops just beyond key levels to reduce the chance of false triggers

FAQs

Is trailing stop better than stop loss?

Neither is universally better. A fixed stop loss is simple and useful for clearly defined exit levels. A trailing stop is more dynamic and better for capturing profits in trending markets.

What is a good trailing stop loss percentage?

There is no single best number. For stocks, 7 to 15 percent is common, while forex and commodities often use volatility based distances. The best percentage balances room for natural price fluctuations with protection against reversals.

What does a 25 percent trailing stop mean?

It means the stop is always set 25 percent below the current market price. If a stock rises from 100 AED to 200 AED, the stop moves from 75 AED to 150 AED. If the stock then falls to 150 AED, the order is triggered.

What is the 7 percent stop loss rule?

The 7 percent rule means investors sell a stock if it falls 7 percent below their purchase price. It is a fixed stop, not a trailing one, but it serves a similar purpose of limiting downside.

Conclusion

A trailing stop loss is more than a safety net. It is a versatile strategy for managing risk and maximizing gains. By automatically adjusting to favorable price movements while standing firm during reversals, it provides traders with discipline and peace of mind. The right trailing stop settings depend on the asset, volatility, and time frame. When used alongside sound analysis and risk management, a trailing stop loss can help traders protect their capital and capture profits more consistently.

20th Aug 2025

20th Aug 2025