What Are the 3 Main Trading Sessions in the Forex Market?

Sam Reid

Staff Writer

Sam Reid

Staff Writer

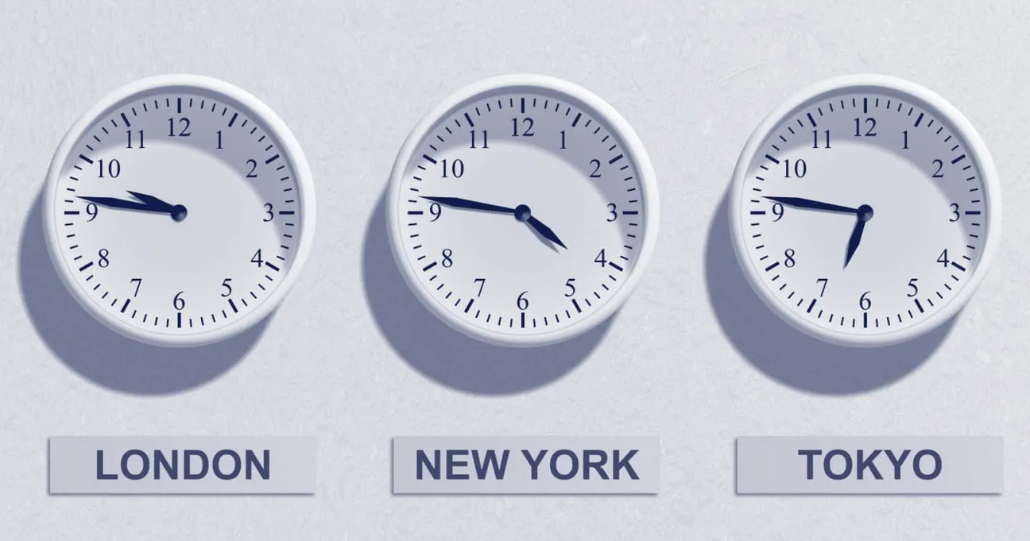

Ever dipped your toes into the world of forex? You’ve might’ve heard people talking about the Tokyo Session, or the London Session, or maybe the New York Session.

These aren’t fancy conferences or events. They refer to the three major trading sessions that make up the forex market’s 24-hour cycle. To understand the forex market and exactly how it works, you need to understanding these 3 sessions. It’s crucial for smarter forex trading, especially in the UAE where time zones can sometimes feel a little tricky.

The forex market is unlike any other financial market because it never sleeps during the week. From Monday morning in Asia until Friday night in New York, there’s always a market open somewhere. But just because you can trade 24/5 doesn’t mean the forex market always acts the same.

Some hours are buzzing with activity, while other periods in the day can feel like a ghost town with low activity and liquidity. Knowing when the action peaks and when it slows can help you align your trades with the market’s natural flow. Let’s go ahead and break down the forex market’s three main sessions.

The Asian Session (Tokyo Session)

For UAE traders, the Asian session kicks off just before 3:00 am and runs until around 12:00 pm UAE time. While that might sound like an early start, it’s worth paying attention if you’re interested in pairs involving the Japanese yen (JPY), the Australian dollar (AUD) or the New Zealand dollar (NZD).

The Asian session sets the tone for that trading day. It’s can be quieter compared to the sessions that follow, but don’t let that fool you into thinking it’s unimportant. Market participants in Tokyo, Sydney, and Hong Kong use this period to establish early trends, and these can ripple into the following European and US sessions.

One defining feature of the Asian hours is their lower volatility. Price movements can be tighter, which means this session suits traders who prefer a more range-bound, technical style. If you’re the kind of trader who enjoys scalping or spotting small but consistent opportunities, these quieter hours might just work in your favor.

It’s also the time when key economic news from Japan, China, and Australia drops. For example, an interest rate decision from the Reserve Bank of Australia (RBA) can create sharp moves in AUD pairs while much of the rest of the world is still asleep.

In short: the Asian session might not always deliver fireworks, but it sets the stage and is particularly useful for those trading Asia-Pacific currencies.

The European Session (London Session)

By the time most of us in the UAE are awake and sipping on our morning coffee, the European session is getting ready to begin. It generally runs from 11:00 am to 8:00 pm UAE time, making it the most convenient session for traders based here.

You can think of the London sesion as the beating heart of global forex. Around 30–35% of all daily forex transactions happen during these hours, making this the most liquid session of the three. Banks, hedge funds, corporations, and retail traders all pile in, creating strong price movements and plenty of opportunities.

Unlike the range-bound vibes of the Asian session, the London session is known for high market volatility and strong trends. Big news releases from the eurozone or the UK such as GDP reports or inflation data can trigger sharp and sustained moves in pairs like EUR/USD or GBP/USD.

Another reason this session is so active is the overlap with the tail end of the Asian hours. For a few hours in the morning, both regions are trading simultaneously, which can boost liquidity even further.

North American Session (New York Session)

Once the European session is in full swing, the North American session joins in. For UAE traders, this session starts around 4:00 pm and continues until about 1:00 am the next morning. It overlaps with London for several hours, creating probably the most exciting and volatile trading period of the forex day.

New York is the second-largest forex hub after London, and it accounts for roughly 15–20% of global daily volume. While that’s slightly less than Europe, the influence of US economic data makes this session one of the most important to watch.

Key US releases like Nonfarm Payrolls (NFP), inflation figures, or Fed announcements can cause massive swings in USD pairs. If you’re trading EUR/USD, GBP/USD, or USD/JPY for example, this is the time you’ll often see the biggest moves.

One thing to note about the New York session is its “two personalities.” The first half of the day, when London is still open, is highly liquid and full of momentum. But when Europe winds down, the second half can sometimes slow leading to choppier price action as US traders take the reigns.

If you’re trading from the UAE, the timing can be both an advantage and a challenge. The overlap period (from 4:00 pm to around 8:00 pm) is perfect for trading after work. However, the later hours of the US session stretch into the night, which might not be practical for everyone.

Overlaps and Opportunities

As we touched on above, some of the most exciting (and risky) times of forex trading is what happens when sessions overlap. During these periods, activity from two regions occur hand-in-hand at the same time, resulting in higher liquidity and bigger moves. Let’s take a look below and show how it plays out for UAE traders.

-

Asian–European Overlap (11:00 am – 12:00 pm UAE time). A short but usually lively window where Tokyo and London cross paths.

-

European–North American Overlap (4:00 pm – 8:00 pm UAE time). What many traders would call the golden hours of forex. This is when some of the largest daily moves occur, especially on major pairs. This part of the forex trading day can create the most opportunities due to the higher volatility.

These overlaps are often considered prime trading opportunities because spreads tighten, volatility increases and trends get established more clearly.

Final Thoughts

The forex market may run 24 hours a day, but not all hours are equally worth your attention. For traders in the UAE, knowing these sessions and their personalities is like understanding a song’s rhythm . You may not need to dance through every beat, but as long as you know when the tempo rises, you can step in at the right moment.

For UAE traders, that often means focusing on the London and New York overlaps, the hours when the market comes alive and opportunities are at their peak. Remember to trade wisely and that sometimes, timing is just as important as the strategy you use.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

24th Aug 2025

24th Aug 2025