Understanding STP vs ECN vs Market Maker Brokers

Sam Reid

Staff Writer

Sam Reid

Staff Writer

If you’re looking to trade forex or CFDs, one of the most important and often overlooked decisions you’ll make is what type of broker you should choose. Most traders focus on spreads, leverage or account types, but the underlying execution model your broker uses can significantly impact your trading experience.

Whether you go for an STP, ECN, DMA or Market Maker, each model comes with its own advantages, risks and trade-offs. In this short guide, we will break down what each broker type actually does and how they execute your trades. By the end, you should have a better idea of each model and which might best suit your trading style best.

What’s an ECN Broker?

An ECN (Electronic Communication Network) broker provides direct access to the interbank market by connecting traders to multiple liquidity providers, including banks, hedge funds, and other traders, through an electronic system. Instead of taking the opposite side of your trade, the broker acts as a matchmaker between buyers and sellers.

The key benefits of ECN brokers include:

- Ultra-tight spreads, often as low as 0.0 pips

- Transparent pricing from multiple sources

- Fast execution speeds, ideal for scalping and high-frequency trading

- No conflict of interest — the broker doesn’t profit from your losses

However, ECN brokers typically charge a commission per trade, and their platforms may be less beginner-friendly due to the raw market data and variable spreads.

What’s an STP Broker?

STP (Straight Through Processing) brokers also send your orders directly to liquidity providers, but they don’t use an ECN system. Instead, they route orders to their own pool of external providers which may include ECNs, banks, or even market makers. Like ECNs, STP brokers don’t usually trade against you.

STP brokers may:

- Add a small markup to the spread instead of charging a fixed commission

- Route different orders to different providers based on pricing or volume

- Offer simpler interfaces and broader market access for retail traders

This model tends to blend the efficiency of ECN with a more user-friendly approach. However, spreads can vary, and some STP brokers may still have dealing desk elements behind the scenes, depending on how their routing is set up. STP brokers can also be more expensive to trade with.

What’s a DMA Broker?

DMA (Direct Market Access) brokers are similar to ECN and STP models in that they offer non-dealing desk execution, but with one key difference. This is that clients have full visibility into the market’s order book and can place trades directly at quoted prices without interference.

DMA is ideal for experienced traders and institutions who want:

- Full control over trade execution

- Transparent pricing directly from liquidity pools

- Lower slippage and reduced latency

That said, DMA accounts often come with higher minimum deposit requirements and more complex order systems. The environment is less forgiving to beginners, as you’re essentially trading as close to the raw market as possible with no broker cushioning.

What’s a Market Maker Broker?

Unlike ECN or STP brokers, Market Maker brokers take the opposite side of your trades. Rather than routing your orders to an external market, they create their own internal market and match your trades in-house. In simple terms, when you win, they lose and vice versa.

This model has gotten a mixed reputation over the years, but it does come with certain benefits.

- Fixed spreads and no commissions

- Often lower minimum deposit requirements

- Guaranteed liquidity, even in volatile markets

- More account features, bonuses, and platform tools

However, since Market Makers profit from your losses, there’s an inherent conflict of interest. In some cases, they may use techniques like re-quotes or slippage to manage risk which can frustrate active or experienced traders.

While many reputable brokers operate as Market Makers, it’s essential to ensure they are properly regulated and transparent about how they handle order execution.

STP vs ECN vs DMA vs Market Maker. Which One Should You Choose?

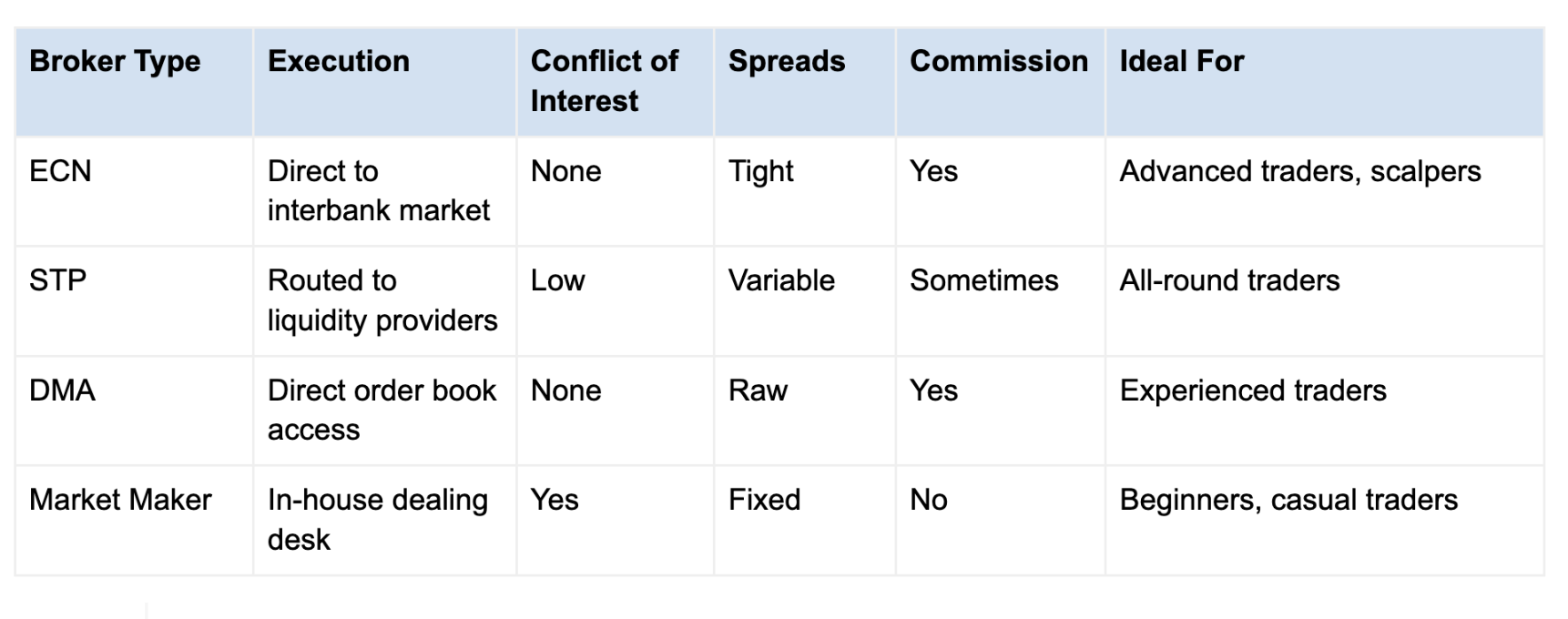

The broker model that suits you best would usually depends on your experience level, trading strategy and priorities, whether that’s cost, speed, transparency or support. Here’s a quick summary of how they differ:

If you’re looking for maximum transparency and institutional-style execution, ECN or DMA accounts may be the way to go. However, if you’re just starting out or prefer fixed costs and easier onboarding, a Market Maker might feel more comfortable as long as the broker is regulated and reputable.

Final Thoughts

Understanding the difference between broker types is critical — not just for pricing but for the overall trust and experience you’ll have while trading. Many brokers today operate on hybrid models, where part of the order flow goes through ECN/STP channels, while others may be internalized.

No model is inherently “better” — what matters is whether the broker is transparent about its execution, properly licensed, and fits your trading style. When in doubt, start with a demo account, test execution speed and spreads, and always check the regulatory details before funding your account.

Ready to find a broker that fits your needs? Browse our updated broker comparison listings at Chooseabroker.ae to make a more informed decision.

03rd Aug 2025

03rd Aug 2025