Day trading is a fast-paced trading strategy that can hold lots of profit potential when done correctly. But, it requires the right tools, knowledge, and most importantly, the right broker.

In this article, we’ll break down what day trading actually is, why choosing the right broker is crucial for UAE traders, and the things to look for in a broker that can enhance the way you day trade.

In this article, we’ll break down what day trading actually is, why choosing the right broker is crucial for UAE traders, and the things to look for in a broker that can enhance the way you day trade.

What is Day Trading?

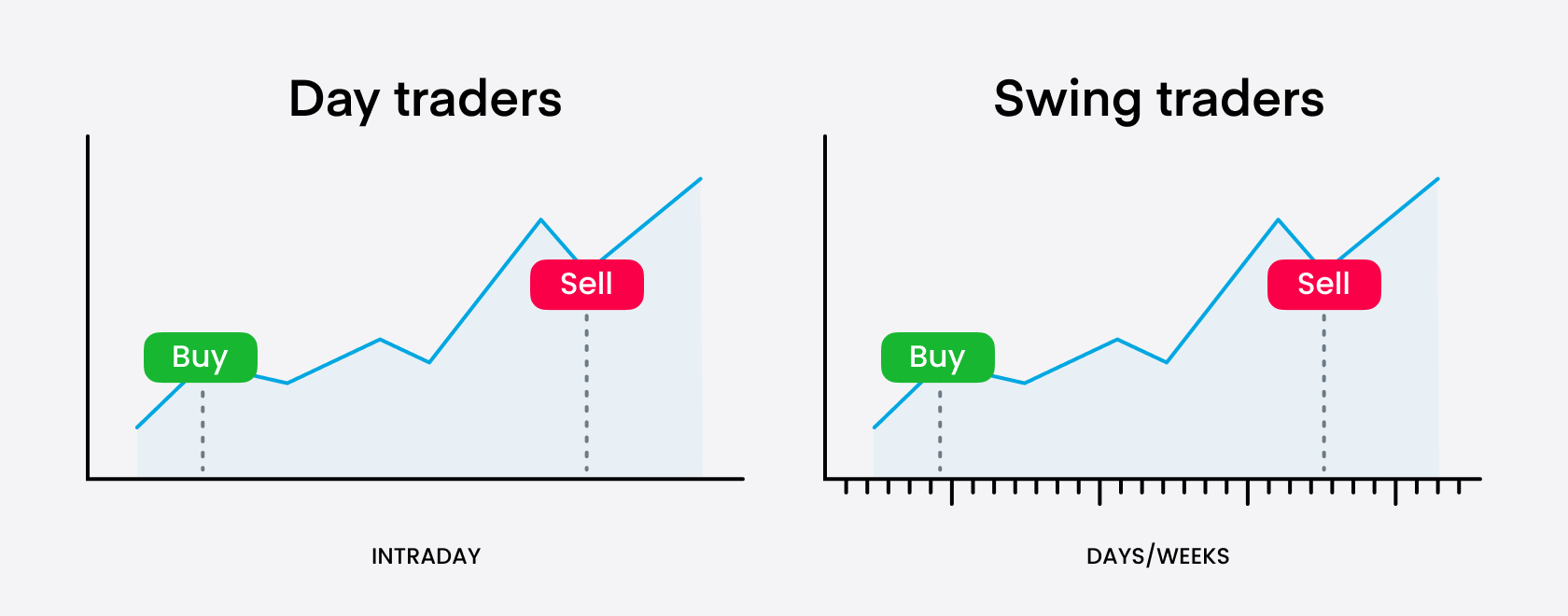

Day trading involves the buying and selling of financial products, such as forex, stocks, or CFDs, within the same trading day. This is essentially the opposite of long-term investments, which instead tries to take advantage of long-term price increases. Day trading on the other hand focuses on short-term price movements by taking on positions for only minutes or hours.

For instance,

A trader might find an opportunity in the EUR/USD forex pair due to market news, grabbing the chance to make a profitable trade on a small price movement.

Alternatively, they may trade CFDs on indices, like the FTSE 100, or commodities like gold, all on a short-term basis.

Day trading demands accuracy, speed, and the access to a robust trading platform with rapid execution. For this reason, selecting a broker that meets all those requirements becomes an important decision for any serious day trader.

For instance,

A trader might find an opportunity in the EUR/USD forex pair due to market news, grabbing the chance to make a profitable trade on a small price movement.

Alternatively, they may trade CFDs on indices, like the FTSE 100, or commodities like gold, all on a short-term basis.

Day trading demands accuracy, speed, and the access to a robust trading platform with rapid execution. For this reason, selecting a broker that meets all those requirements becomes an important decision for any serious day trader.

Why It’s Important to Choose the Right Broker for Day Trading

When day trading, your online trading broker is quite literally your trading partner. Their features and conditions will massively influence your efficiency and profit potential when operating in the market. Here's why it matters:

Speed and Execution

In day trading, it's not only the minutes that matter. Every single second counts. Having a broker with fast execution means your orders are being filled with no slippage, so even on the tiniest change in price, you are able to capitalize.

Speed and Execution

In day trading, it's not only the minutes that matter. Every single second counts. Having a broker with fast execution means your orders are being filled with no slippage, so even on the tiniest change in price, you are able to capitalize.

Low Trading Costs

Considering that day traders can perform many trades throughout the day, expenses such as spreads and commissions quickly rise. Competitive trading conditions and pricing from your broker enables you to retain more of your profit.

Access to Markets

Most day traders usually stick to forex trading, although some also trade in CFDs across stocks, indices, commodities, futures and more. Having a larger access to more markets offered by your broker means you’ll have access to more opportunities to trade and diversify.

Advanced Tool and Technology

Day trading necessitates deep technical market analysis. Brokers with feature-rich trading platforms, such as MT5, equipped with advanced charting tools, indicators, and customization options, make analysis easier and faster.

Leverage

A large number of day traders use leverage to amplify their exposure to nominal price movements. A broker that offers flexible and stable leverage levels and aligns with UAE regulations can give you an edge while managing risk.

Considering that day traders can perform many trades throughout the day, expenses such as spreads and commissions quickly rise. Competitive trading conditions and pricing from your broker enables you to retain more of your profit.

Access to Markets

Most day traders usually stick to forex trading, although some also trade in CFDs across stocks, indices, commodities, futures and more. Having a larger access to more markets offered by your broker means you’ll have access to more opportunities to trade and diversify.

Advanced Tool and Technology

Day trading necessitates deep technical market analysis. Brokers with feature-rich trading platforms, such as MT5, equipped with advanced charting tools, indicators, and customization options, make analysis easier and faster.

Leverage

A large number of day traders use leverage to amplify their exposure to nominal price movements. A broker that offers flexible and stable leverage levels and aligns with UAE regulations can give you an edge while managing risk.

Customer Support

Markets move fast, and access to quality, attentive customer support ensures that issues or queries are dealt with without a lag. Look for 24/7 support with fast channels and swift replies.

Markets move fast, and access to quality, attentive customer support ensures that issues or queries are dealt with without a lag. Look for 24/7 support with fast channels and swift replies.

What Should UAE Day Traders Look for in a Broker?

As a trader in the UAE, your needs will vary slightly from other regions. Here's how to prioritize when you choose a broker to day trade.

1. Regulation and Security

The UAE's financial market is on a growth trajectory, but making sure your broker is regulated protects your funds and trades. Your broker should be licensed by authorities such as the UAE Securities and Commodities Authority (SCA) or other reputable Tier 1 bodies like the FCA, CySEC, or ASIC.

2. Competitive Spreads and Low Commissions

Day traders in the UAE should prioritize brokers that offer tight spreads on major forex pairs like EUR/USD or USD/JPY. Some brokers also offer zero-commission trading, which can significantly reduce your costs.

With many local traders favoring instruments like gold and US oil, it’s also worth checking their pricing on these instruments too.

3. Reliable Trading Platforms

Platforms like MT5 or proprietary platforms with fast execution, one-click trading, and advanced analytics are ideal for day traders. Ensure the platform is stable and accessible on desktop and mobile for flexibility.

1. Regulation and Security

The UAE's financial market is on a growth trajectory, but making sure your broker is regulated protects your funds and trades. Your broker should be licensed by authorities such as the UAE Securities and Commodities Authority (SCA) or other reputable Tier 1 bodies like the FCA, CySEC, or ASIC.

2. Competitive Spreads and Low Commissions

Day traders in the UAE should prioritize brokers that offer tight spreads on major forex pairs like EUR/USD or USD/JPY. Some brokers also offer zero-commission trading, which can significantly reduce your costs.

With many local traders favoring instruments like gold and US oil, it’s also worth checking their pricing on these instruments too.

3. Reliable Trading Platforms

Platforms like MT5 or proprietary platforms with fast execution, one-click trading, and advanced analytics are ideal for day traders. Ensure the platform is stable and accessible on desktop and mobile for flexibility.

4. Local Payment Methods

UAE traders can benefit from brokers offering localized payment methods for deposits and withdrawals, such as local bank transfers, e-wallets, or local credit cards, ensuring fast and seamless transactions at a cheaper rate.

5. Leverage and Risk Management

Look for brokers offering flexible leverage options, as this can amplify potential returns. However, ensure they also provide robust risk management tools like stop-loss orders to protect your trades.

6. Education and Analysis

Trading in forex or any other financial market, especially as a day trader, is a constant learning process. Look for a broker who will help you stay ahead with their bank of educational resources, webinars, and daily market analysis.

UAE traders can benefit from brokers offering localized payment methods for deposits and withdrawals, such as local bank transfers, e-wallets, or local credit cards, ensuring fast and seamless transactions at a cheaper rate.

5. Leverage and Risk Management

Look for brokers offering flexible leverage options, as this can amplify potential returns. However, ensure they also provide robust risk management tools like stop-loss orders to protect your trades.

6. Education and Analysis

Trading in forex or any other financial market, especially as a day trader, is a constant learning process. Look for a broker who will help you stay ahead with their bank of educational resources, webinars, and daily market analysis.

7. Customer Support in Your Time Zone

Day traders mostly trade during market hours that coincide with open global trading sessions. Access to local UAE customer support during these hours is priceless for traders based in the region. Having a broker with a regional office can also help you in the long-term.

Day traders mostly trade during market hours that coincide with open global trading sessions. Access to local UAE customer support during these hours is priceless for traders based in the region. Having a broker with a regional office can also help you in the long-term.

Top Tips to Pick a Broker for Day Trading

Do Your Research: Visit broker review platforms like Chooseabroker.ae to compare brokers based on spreads, fees, and platform features.

Try a Demo Account: Test the broker’s platform and tools using a demo account to ensure it meets your needs before committing real money.

Check Reviews: Look for feedback from other UAE traders to gauge the broker’s reliability and performance.

Speed and Reliability: Find a broker whose infrastructure will support swift, unimpeded trading, even during periods of high market volatility.

Try a Demo Account: Test the broker’s platform and tools using a demo account to ensure it meets your needs before committing real money.

Check Reviews: Look for feedback from other UAE traders to gauge the broker’s reliability and performance.

Speed and Reliability: Find a broker whose infrastructure will support swift, unimpeded trading, even during periods of high market volatility.

Popular Trading Instruments for UAE Day Traders

The forex market, with its high liquidity and accessible 24-hour market, is usually the main domain of day traders in the UAE. Major currency pairs, such as the EUR/USD, GBP/USD, and USD/JPY, have substantial daily price fluctuations and, hence, are fit for fast trades.

Some traders in the UAE might also look into CFDs on:

Indices: Financial instruments such as the Nas 100 or S&P 500 offer volatility suitable for day trading.

Commodities: Gold and oil are still the favorites of UAE traders because of their market dynamics and relevance to the region.

Some traders in the UAE might also look into CFDs on:

Indices: Financial instruments such as the Nas 100 or S&P 500 offer volatility suitable for day trading.

Commodities: Gold and oil are still the favorites of UAE traders because of their market dynamics and relevance to the region.

Why Choose a Broker with Chooseabroker.ae?

At Chooseabroker.ae, we streamline the process of finding the best broker for day trading in the UAE. To this end, we compare important features that every trader needs: regulation, fees, platform features, and customer support, to name a few.

Whether you are focused on forex trading or delving into other markets, our platform will provide in-depth insight to find a broker that meets your needs and intentions regarding trading.

Whether you are focused on forex trading or delving into other markets, our platform will provide in-depth insight to find a broker that meets your needs and intentions regarding trading.

Final Thoughts

Day trading can be a very exciting, dynamic approach with lots of new opportunities opening up for traders in the UAE. But it’s important to note that this approach will require selecting the right broker since success largely relies on fast execution, competitive fees, reliable platforms, and great support to enhance your trading experience.

With the right broker by your side, day trading can be rewarding and efficient. Explore our top-listed online trading brokers today. At Chooseabroker.ae, we’re here to help you choose a broker that caters to your every trading need.

With the right broker by your side, day trading can be rewarding and efficient. Explore our top-listed online trading brokers today. At Chooseabroker.ae, we’re here to help you choose a broker that caters to your every trading need.