Top 10 Brokers for Forex Scalpers

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Forex scalping is a fast-paced trading style that focuses on capturing small price movements, often within seconds or minutes. In the UAE, this approach has gained traction among experienced traders who value quick entries and exits, tight spreads, and high-speed execution. Choosing the right broker is critical for scalpers because even a small delay or wider spread can erode profits.

The following guide highlights the top trading brokers in UAE that are best suited for scalping, based on execution speed, spreads, leverage, and platform support. Whether you trade majors like EUR/USD or exotic pairs linked to regional currencies, these brokers provide the infrastructure you need to perform in the scalping space.

What to Look for in a UAE Forex Scalping Broker

Before diving into the broker list, it’s important to understand the key features a scalper should prioritize:

-

Ultra-tight spreads: Ideally starting from 0.0 pips for major currency pairs.

-

Fast execution speeds: The faster the order fills, the less chance for slippage.

-

No restrictions on strategies: The broker should allow scalping, hedging, and automated trading.

-

High leverage: Within regulatory limits, leverage helps magnify returns on small price moves.

-

Reliable platforms: MetaTrader 4, MetaTrader 5, or cTrader with one-click trading.

-

Low commissions: Transparent and competitive pricing structures.

-

Stable funding methods: For UAE traders, brokers should support methods like bank transfers, cards, and regional e-wallets.

Top 10 Brokers for Forex Scalpers in the UAE

1. Exness

Exness is a trusted broker for UAE traders, offering raw spreads from 0.0 pips and execution speeds that suit high-frequency scalpers. It supports MT4 and MT5, both optimized for automated strategies. With leverage options up to 1:2000 for certain accounts and 24/7 customer support, Exness remains a top choice for professional scalpers in the region.

2. AvaTrade

AvaTrade combines competitive spreads with nine regulatory licenses, including approval from Abu Dhabi Global Market (ADGM). UAE traders benefit from tight spreads on majors, leverage up to 1:400, and a range of trading platforms including MT4, MT5, and its own AvaTradeGO app. Scalpers can take advantage of fast execution and advanced trading tools.

3. XTB

XTB delivers exceptional execution speed and offers both forex and CFDs. Its proprietary xStation 5 platform is a highlight, providing advanced charting, one-click trading, and market sentiment tools. UAE clients can access spreads from 0.1 pips on popular pairs and benefit from fast withdrawals via local banking options.

4. XM

XM stands out for its micro, standard, and zero accounts, all of which allow scalping without restrictions. UAE traders can enjoy leverage up to 1:1000 depending on the account type and tight spreads starting from 0.0 pips on the Zero account. XM also offers extensive educational resources for traders refining their scalping skills.

5. Multibank

Licensed by the UAE’s Securities and Commodities Authority (SCA), Multibank provides local credibility and competitive conditions for scalpers. It offers ECN accounts with spreads starting from 0.0 pips and execution speeds that can handle rapid-fire trades. Local funding and Arabic-speaking support are additional benefits for UAE traders.

6. Amana

Amana Capital is a well-established regional broker that supports scalping strategies on MT4 and MT5. UAE traders benefit from competitive spreads, no dealing desk execution, and high leverage options. The broker also provides comprehensive Arabic-language education and market analysis tools tailored for Gulf-based clients.

7. Admirals

Admirals offers a professional-grade trading environment with multiple account types suitable for scalping. UAE clients can trade over 40 currency pairs with spreads from 0.0 pips on ECN accounts. The broker’s MetaTrader Supreme Edition plugin adds advanced analytics and execution tools ideal for scalpers.

8. HFM

HFM (formerly HotForex) provides tight spreads and fast execution on MT4 and MT5 platforms. Scalpers benefit from flexible leverage and advanced VPS hosting for automated trading. UAE traders also have access to localized payment solutions and customer support in both English and Arabic.

9. FBS

FBS is known for its high leverage offerings and zero-spread accounts. It supports scalping without restrictions and offers quick execution speeds suitable for high-volume trading. UAE traders can take advantage of its promotions and bonuses, as well as mobile-friendly platforms.

10. Axi

Axi is a broker favored by scalpers for its raw spread accounts and deep liquidity from top-tier providers. It offers MT4 with advanced add-ons for charting and execution speed. UAE traders can start with no minimum deposit and benefit from consistent low spreads on major pairs.

Key Technical Tools for Forex Scalpers in the UAE

Scalping requires speed and accuracy. Traders in the UAE often rely on specific tools to help them make decisions quickly and manage trades effectively.

1. Trading Platforms with One-Click Execution

For scalpers, the ability to place orders instantly is essential. Platforms like MT4 and MT5 offer one-click trading, which reduces the time from decision to execution. This feature helps prevent slippage during fast-moving market conditions, especially when trading volatile pairs during London or New York sessions.

2. Economic Calendars and News Alerts

Economic news can create sharp price swings. Many brokers provide built-in economic calendars with real-time alerts. UAE traders who scalp around major announcements like US Non-Farm Payrolls or oil inventory data can benefit from knowing exactly when volatility is likely to spike.

3. Custom Indicators and Scripts

Custom technical indicators, such as fast-reacting moving averages or volatility bands, can be tailored for scalping. Scripts for automated trade entry and exit can also be programmed, which helps remove emotional decision-making from quick trades.

Risk Management Tips for UAE Scalpers

1. Set Strict Stop-Loss Levels

Because scalping targets small profits, a single loss can quickly outweigh several gains if not managed properly. Stop-loss orders keep losses contained and protect overall capital.

2. Use Appropriate Position Sizes

Leverage is available in the UAE, but it should be handled carefully. Smaller position sizes reduce risk per trade, helping scalpers stay in the game longer without wiping out their account on a bad run.

3. Avoid Overtrading

It can be tempting to keep entering trades, but too many positions in quick succession can lead to mistakes. Focusing on quality setups rather than quantity keeps performance steady.

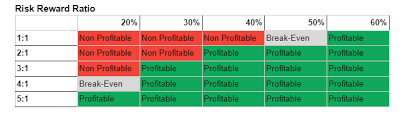

Keep in mind your risk to reward ratio on all trades!

Timing Considerations for UAE-Based Scalpers

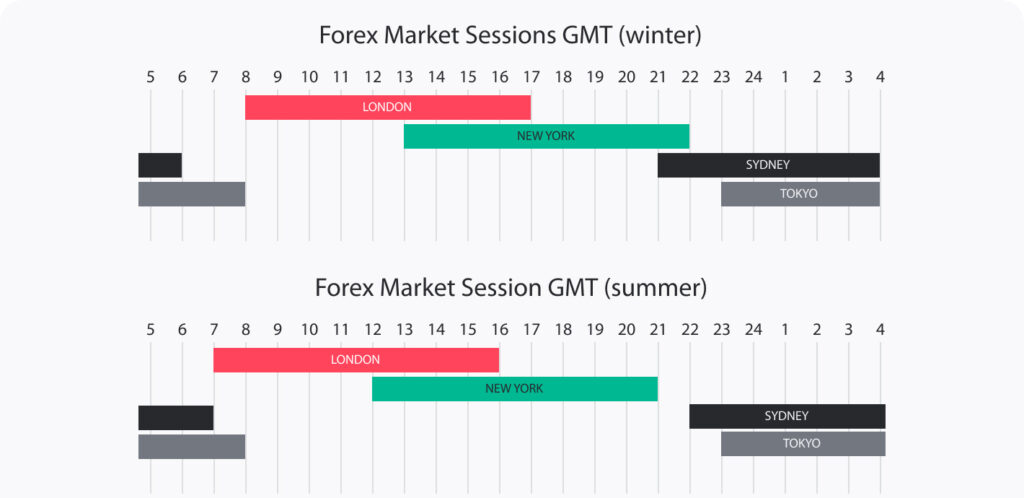

1. Overlap of London and New York Sessions

The best liquidity and tightest spreads often occur when these two major markets overlap, which in UAE time is late afternoon to early evening.

2. Regional Currency Influence

While most scalpers trade major pairs, keeping an eye on oil prices and regional economic developments can provide an edge, especially for those trading USD-linked currency pairs.

Scalping Strategies Popular in the UAE

While strategies vary, UAE traders often lean toward:

-

News Scalping: Leveraging volatility around global and regional economic announcements.

-

Momentum Scalping: Riding short bursts of price movement on liquid pairs.

-

Range Scalping: Capitalizing on small price oscillations in low-volatility sessions.

-

Moving Average Crossovers: Using short-term averages to identify quick entry and exit points.

FAQs

Which forex broker is best for scalping?

Exness, AvaTrade, and XTB are among the best for UAE scalpers, offering tight spreads, fast execution, and strategy flexibility.

Which forex is best for scalping?

Major pairs like EUR/USD, GBP/USD, and USD/JPY are most suitable due to their high liquidity and low spreads.

Which broker is best for option scalping?

AvaTrade stands out for offering vanilla options alongside forex scalping capabilities.

Who is the best scalper trader?

Globally, traders like Paul Rotter are famous for scalping success, though strategies vary by individual style and market.

Final Thoughts

For UAE traders, scalping can be a rewarding strategy if executed with precision and supported by the right broker. The brokers listed here offer the execution speed, platform stability, and trading conditions needed for success. Whether you are just starting or refining your scalping approach, choosing a well-regulated broker with UAE-friendly features is the first step toward consistent profitability.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

11th Aug 2025

11th Aug 2025