Swing Trade Workflow: Analysis, Execution, Exit

Sam Reid · Senior Financial Markets Analyst

Staff Writer

Sam Reid · Senior Financial Markets Analyst

Staff Writer

Swing trade approaches are built for traders who want structure without constant screen time. Instead of chasing every tick or committing to multi-month positions, swing trading focuses on capturing meaningful price moves that develop over days or weeks. When executed correctly, it offers clarity, repeatability, and a calm decision-making framework that suits beginners.

What Is Swing Trading?

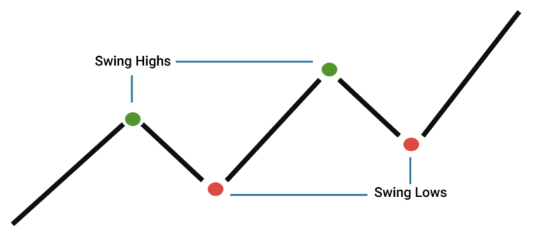

What is swing trading? Swing trading is a trading style designed to profit from short- to medium-term directional price movements, commonly referred to as price swings. Positions are typically held for several days or weeks, allowing trends and momentum to play out without the pressure of intraday noise.

Swing trading sits between day trading and position trading. Day traders close positions within the same session and rely on speed. Position traders hold for months and focus heavily on fundamentals. Swing traders operate in the middle, using technical structure to capture defined sections of market movement.

Key Takeaways

- Swing trading targets price moves lasting days to weeks.

- Trades are planned around structure, not prediction.

- Risk management matters more than win rate.

- Forex and commodities are particularly well suited to swing trading.

Understanding the Swing Trade Workflow

Successful swing trading is not about finding the perfect indicator. It is about following a clear workflow. Every swing trade should pass through three stages: analysis, execution, and exit. Skipping any step usually leads to inconsistent results.

Analysis: Defining Bias and Context

Analysis begins on higher timeframes. We establish directional bias using the daily chart. This helps answer a simple question: is the market more likely to move higher or lower over the coming days?

Once bias is defined, the 4-hour chart is used to refine structure. Support and resistance zones, trendlines, moving averages, momentum shifts, and volatility conditions all help determine whether a setup is forming. In faster conditions, the 1-hour chart may be used for entries, but only after confirming alignment with the 4-hour and daily structure.

Execution: Entering With Intent

Execution is where most beginners struggle. A swing trade entry should only occur once price confirms the idea. Market orders are used when momentum is strong and confirmation is clear. Limit orders are preferred when entering pullbacks into predefined zones.

Execution is never separated from risk. Before entering, stop-loss placement, position size, and profit targets are already defined. This removes emotion from the decision.

Exit: Managing the Trade

Exits are not an afterthought. Swing trades are managed by scaling out as price reaches key levels. Partial profits reduce risk while allowing remaining positions to benefit if momentum continues. Stops are adjusted logically based on structure.

Swing Trading Strategies That Fit the Workflow

Breakout Trading

Breakout strategies focus on price moving beyond established ranges. When consolidation ends and volume expands, swing traders look to enter in the direction of the break, targeting continuation rather than immediate reversals.

Trend Pullbacks

Trend pullbacks are among the most reliable swing setups. Price retraces into support during an existing trend, momentum slows, and continuation follows. These trades offer clean risk-to-reward profiles.

Reversals With Structure

Reversal swing trades require patience and confirmation. Rather than calling tops or bottoms, traders wait for failed continuation, divergence, or structural breaks before entering.

Technical Tools Used in Swing Trading

Relative Strength Index (RSI)

RSI helps gauge momentum and exhaustion. Overbought and oversold readings are context-dependent and work best when combined with structure.

Moving Averages

Moving averages define trend direction and dynamic support or resistance. Crosses and slope changes often signal swing transitions.

Stochastic Oscillator

The stochastic oscillator highlights momentum shifts that often precede price movement, especially in ranging or slowing markets.

Markets Best Suited for Swing Trading (Our Picks)

Forex Swing Trading

Forex is ideal for swing trading due to liquidity, clean structure, and consistent volatility. Major and minor pairs frequently provide multi-day opportunities.

Swing Trading Commodities

Commodities such as gold and oil trend strongly and respect technical levels, making them highly suitable for swing trade strategies.

Risk Management Rules Every Beginner Must Follow

The 2% Rule in Swing Trading

The 2% rule limits risk on any single swing trade to no more than 2% of total account equity. This ensures no single loss causes meaningful damage.

The 1% Rule Explained

The 1% rule is a more conservative alternative used during drawdowns or volatile conditions. Both rules prioritise longevity over short-term gains.

Stop-Loss and Take-Profit Planning

Stops are placed where the trade idea is invalidated, instead of where loss feels uncomfortable. Take-profits are aligned with structure and scaled gradually.

A Practical Swing Trade Example

Consider a gold swing trade. The daily chart shows a clear uptrend. Price pulls back into a prior support zone aligned with a rising moving average. Momentum indicators stabilise on the 4-hour chart.

A long position is entered near support using a limit order. Risk is capped at 2%. Partial profits are taken near prior highs while the remaining position is managed using structure-based trailing stops. The trade captures a controlled portion of the broader move without emotional decision-making.

Trading Psychology in Swing Trading

Discipline Over Activity

Not trading is often the correct decision. Swing trading rewards patience over frequency.

Handling Losses

Losses are expected. Consistency comes from controlling them.

Confidence Through Process

Confidence grows from following a repeatable workflow, rather than trying to predict markets.

Tools and Execution Environment

A reliable trading environment supports execution and risk management. Platforms such as Exness provide stable pricing, order flexibility, and tools suitable for swing trade execution without unnecessary complexity.

Common Swing Trade Mistakes Beginners Make (and How to Avoid Them)

Most beginners struggle with swing trade consistency not because swing trading is flawed, but because small, repeatable mistakes compound over time. Understanding these errors early can dramatically shorten the learning curve and protect trading capital.

Entering Too Early Without Confirmation

One of the most common mistakes is entering a trade simply because price has reached a support or resistance area. Levels alone are not signals. Swing trading requires confirmation that the market is responding to that level. Without evidence of slowing momentum, rejection, or structural change, entries become guesses rather than calculated decisions.

A more disciplined approach is to wait for price to show intent. This may come in the form of a strong rejection candle, a momentum shift on RSI or stochastic, or a break in minor structure on the execution timeframe. Waiting often feels uncomfortable, but it improves trade quality significantly.

Ignoring Higher-Timeframe Context

Another frequent error is focusing too heavily on the entry timeframe while ignoring the bigger picture. Swing traders who enter against the daily trend without a clear reversal structure are often stopped out by normal market movement.

The daily chart sets the battlefield. The 4-hour chart refines the setup. The 1-hour chart, when used, should only be for precision. When these timeframes are misaligned, probability drops sharply.

Overleveraging and Position Size Errors

Many beginners understand the 2% rule in theory but violate it in practice through poor position sizing. A stop-loss that is too tight combined with an oversized position often leads to unnecessary losses, even when the trade idea is correct.

Position size should always be calculated after determining stop distance. Wider stops require smaller positions. Narrow stops allow larger positions. Risk remains constant. This consistency is what allows swing traders to survive inevitable losing streaks.

Taking Profits Too Early

Fear-driven exits are another major issue. After experiencing a few losses, beginners often close winning trades early just to avoid the pain of giving profits back. This creates a poor risk-to-reward profile where losses outweigh gains over time.

Scaling out helps solve this problem. Taking partial profits at logical levels reduces emotional pressure while still allowing exposure to extended moves. Swing trading rewards patience on winners far more than activity.

Overtrading During Low-Quality Conditions

Not every market environment is suitable for swing trading. Choppy, low-volatility conditions often produce false signals and failed follow-through. Beginners frequently force trades during these periods out of boredom or the fear of missing out. Professional swing traders accept inactivity as part of the process. Capital can be preserved by staying out of poor conditions.

Lack of Review and Journaling

Without reviewing past trades, mistakes repeat unnoticed. A simple trading journal that records entry logic, stop placement, outcome, and emotional state provides invaluable feedback. Patterns emerge quickly when trades are documented honestly. Improvement in swing trading rarely comes from adding more indicators. It comes from refining execution, tightening discipline, and removing repeated errors. Avoiding these common mistakes alone often leads to measurable performance improvement.

Conclusion: Building Consistency With a Swing Trade Workflow

Swing trade success does not come from predicting markets or finding a perfect indicator. It comes from following a repeatable workflow that prioritises structure, risk control, and patience. By analysing the market on higher timeframes, executing trades with clear intent, and managing exits through scaling and structure, swing trading becomes a process rather than a gamble.

For beginners, swing trading offers a balanced path. It reduces the pressure of intraday decision-making while remaining active enough to build experience and confidence. When combined with disciplined risk management, such as the 1% and 2% rules, and a focus on probability rather than perfection, swing trading can be applied consistently across forex and commodities.

The key is not how often trades are taken, but how well each trade fits the plan. By staying selective, avoiding overtrading, and reviewing performance over time, traders give themselves the best chance of developing long-term consistency in swing trading.

FAQ

What is a swing trade?

A swing trade is a position designed to capture short- to medium-term price movements over days or weeks.

What is the 2% rule in swing trading?

The 2% rule limits the maximum risk on any single trade to 2% of total account equity.

Is swing trading profitable?

Swing trading can be profitable when combined with disciplined risk management and a structured workflow.

What is the 1% rule in swing trading?

The 1% rule limits risk per trade to 1% of capital and is often used in volatile conditions or during drawdowns.

Disclaimer: This content is for educational purposes only and not to be construed as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

20th Jan 2026

20th Jan 2026