Risks and Rewards of Online Trading: An Educational Guide

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Introduction

Online trading has transformed the way individuals access financial markets. What once required calling a broker on the phone can now be done in seconds through an online broker trading platform on your computer or mobile device. This accessibility has empowered millions of traders, but it has also introduced new challenges. Every trade carries the potential for profit, but equally, it carries the possibility of loss. Understanding both sides of this equation is essential if you want to achieve sustainable success.

Risk and reward are inseparable. Markets move because of economic data, geopolitical events, and shifts in investor psychology, and traders must constantly balance the potential for gain against the probability of loss. By studying the risks carefully and applying disciplined management strategies, you can take advantage of the benefits of online trading while reducing the chance of costly mistakes.

What Is Risk in Online Trading?

Risk refers to the uncertainty of outcomes in financial markets. No matter how confident you are in your analysis, there is never a guarantee that the market will move in your favor. This uncertainty exists because prices respond to countless factors — from central bank policy to breaking news events. Risk is unavoidable, but it can be measured and managed.

For example, if you buy a stock at $100, there is a risk that negative news could send it to $80 within a week. In leveraged trading, such as contracts for difference (CFDs) or forex positions, the impact can be even more severe. A 5% move against you might wipe out 50% of your margin deposit if your leverage is 10:1. This magnification of outcomes makes risk management an absolute necessity for active traders.

What Is Reward in Online Trading?

Reward is the potential gain from a trade or investment. It represents the profit you could make if the market moves in your favor. Rewards are often calculated as an expected return, either from historical averages or forward-looking probabilities.

Consider this example: You enter a forex trade buying EUR/USD at 1.0800, with a target of 1.1000. If you are trading one standard lot, the potential profit from a 200-pip move could be $2,000. That profit represents the reward. However, the question is whether the probability of reaching that target outweighs the chance of being stopped out.

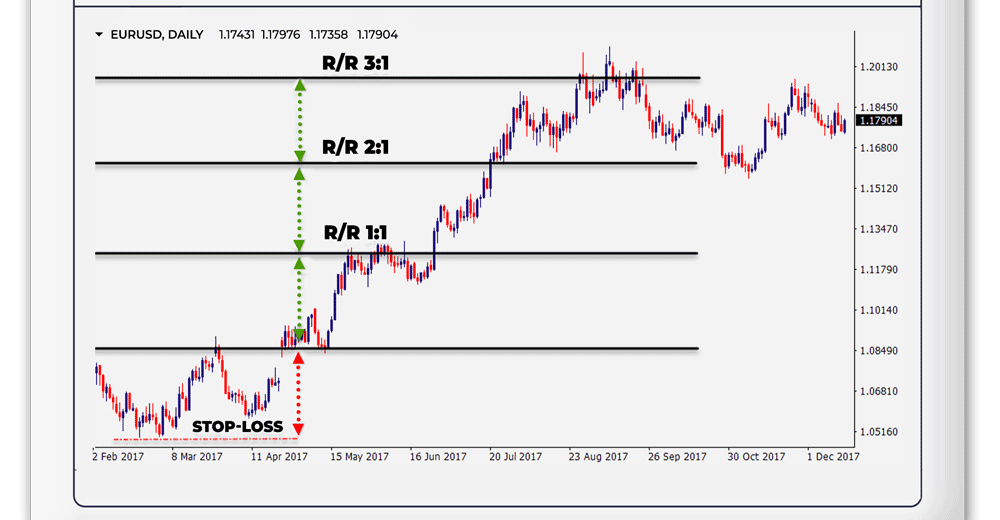

The Risk-Reward Ratio

The risk-reward ratio (R/R) is one of the most important concepts in trading. It compares the potential loss on a trade with the potential gain. For example, if you risk $100 to make $300, your ratio is 1:3. Many experienced traders aim for at least a 1:2 or 1:3 ratio, ensuring that one winning trade can offset several small losses.

Imagine you are trading a company’s stock at $130. You set a stop-loss at $110, limiting your risk to $200 for 10 shares. If your target is $200, your reward is $700. The ratio is $200 risk versus $700 reward, or about 1:3.5. Even if only half your trades succeed, you can still generate positive results over time because your winners are larger than your losers.

Why Risk and Reward Matter for Traders

Risk and reward form the backbone of every trading decision. Without understanding this relationship, you may end up taking unnecessary risks for insufficient potential gains. By focusing on risk-reward dynamics, traders can filter out bad opportunities and concentrate on trades with favorable setups.

Research has shown that many new traders lose money because they allow losing trades to run while cutting winners too quickly. By reversing this habit — keeping losses small and letting winners grow — the balance of risk and reward shifts in your favor. It is not about predicting the market perfectly but about managing the probabilities intelligently.

Types of Online Trading Risks

Market Risk

Market risk arises from unpredictable price fluctuations caused by economic news, geopolitical events, or shifts in sentiment. For example, the release of a US Non-Farm Payrolls report often creates significant volatility in forex markets.

Technical Risk

Trading relies on technology, and outages or platform glitches can cause major problems. If your internet disconnects during a crucial moment, you could miss the chance to close a losing trade. Reliable infrastructure and backup plans are critical.

Fraud Risk

Unfortunately, unlicensed brokers and scams remain common in the online space. Always check whether a broker is regulated by reputable authorities such as the UK’s Financial Conduct Authority (FCA) or Cyprus Securities and Exchange Commission (CySEC). Regulation ensures client funds are protected and platforms operate fairly.

Leverage Risk

Leverage enables you to control large positions with small deposits, but it also magnifies losses. For instance, a 5:1 leverage ratio means a 10% market move could cause a 50% loss of your margin deposit. Many traders underestimate how quickly leveraged trades can wipe out an account.

Emotional Risk

Perhaps the greatest risk is human psychology. Fear, greed, and impatience can cause traders to make impulsive decisions, like chasing losses or entering trades without proper analysis. Emotional discipline is just as important as technical skill.

Rewards of Online Trading

While risks are ever-present, the rewards of online trading are equally significant when managed carefully. Here are some of the key benefits of online trading:

- Accessibility: You can trade global markets from anywhere with an internet connection.

- Variety: From forex and commodities to stocks and crypto, an online broker trading platform provides access to multiple asset classes.

- Lower costs: Online brokers typically charge reduced commissions compared to traditional methods.

- Control: Traders can manage positions directly in real time without relying on intermediaries.

- Educational tools: Many platforms offer charting, tutorials, and analysis to help traders learn and grow.

Advanced Risk Management Rules

Diversification

Diversifying across asset classes, regions, and industries reduces exposure to individual shocks. For example, holding positions in currencies, equities, and commodities ensures that a downturn in one area does not wipe out your entire account.

Scaling In and Out

Scaling in means entering a position gradually rather than all at once, while scaling out refers to taking partial profits along the way. Both techniques reduce risk and provide flexibility.

Trailing Stop Orders

Unlike fixed stop-losses, trailing stops adjust automatically as prices move in your favor. This allows you to lock in profits while giving the trade room to develop.

Adjusting for Volatility

During high-volatility periods, such as major news releases, experienced traders often reduce position sizes or tighten stops. Flexibility is key to surviving turbulent conditions.

Journaling and Backtesting

Keeping a trading journal and testing strategies on historical data help traders refine their approach and avoid repeating mistakes. Over time, this builds a disciplined, evidence-based risk management framework.

Examples of Risk-Reward in Practice

Consider two traders. Trader A risks $100 on every trade with a target of $150. Trader B risks $100 with a target of $400. Even if Trader A has a higher win rate, Trader B may be more profitable over the long run because the average reward per trade is greater. This illustrates why focusing on ratios, not just success rates, is crucial.

Another example comes from options trading. Buying a call option involves limited risk (the premium paid) but potentially unlimited upside if the stock price rises sharply. Selling options, by contrast, can generate steady income but carries the risk of large losses. Understanding these dynamics is vital for anyone exploring derivatives.

Protecting Your Account

- Always trade with regulated brokers and verify their licenses.

- Use strong, unique passwords and enable two-factor authentication.

- Update your devices and trading software regularly to prevent cyber threats.

- Avoid using public Wi-Fi when accessing trading accounts; consider a VPN for security.

- Keep an emergency fund separate from your trading account to handle unexpected situations.

Conclusion

Online trading presents an exciting blend of opportunities and challenges. The key to long-term success lies in understanding that every potential reward carries a corresponding risk. By respecting this balance, applying strong risk management practices, and leveraging the educational tools available through an online broker trading platform, you can participate in the markets with greater confidence and security.

Trading will always involve uncertainty, but with discipline, planning, and the right strategies, you can tilt the odds in your favor. Learn continuously, stay patient, and never risk more than you can afford to lose. With this mindset, the risks and rewards of online trading can become part of a sustainable journey toward financial growth.

FAQs

What are the risks of online trading?

Risks include market volatility, leverage-related losses, technical failures, fraud from unregulated brokers, and emotional decision-making. Each risk can be managed with proper strategies such as diversification, stop-loss orders, and choosing regulated brokers.

What is the risk reward of trading?

The risk reward of trading refers to the balance between potential loss and potential gain on a trade. Traders often aim for a ratio where the expected reward is at least double or triple the potential risk.

What are the benefits of online trading?

Key benefits include accessibility, lower transaction costs, variety of asset classes, real-time control, and educational resources provided by modern online platforms.

What are the main risks and rewards of trading options?

Options trading offers limited risk for buyers (the premium paid) and significant upside potential if the market moves favorably. However, selling options can expose traders to large losses if markets move against the position. Both the risks and the rewards are amplified compared to traditional stock trading.

Disclaimer: Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

01st Sep 2025

01st Sep 2025