Plus500 Trading Instruments

Plus500 offers these markets available to trade via CFDs.

- Stocks

- Indices

- Commodities

- Forex

- Crypto

- Options

- ETFs

Plus500 delivers a solid variety of CFD trading markets and one of the widest available to UAE-based traders. Over 2,800 markets are available to trade.

One of the platform’s strongest features is its extensive coverage of stock CFDs, especially for international exposure. With Plus500 you can trade high-profile US shares alongside equity CFDs from a range of global markets, including Europe, the UK, Canada, Australia and notably, the UAE.

Over 20 local companies listed on Dubai Financial Market (DFM) are supported on their platform, which gives Plus500 an edge for local traders looking for home-grown stock exposure.

That said, it’s important to remember this is a CFD platform. The products offered are derivatives and not actual ownership of underlying assets. For someone seeking long-term investments or dividend capture, CFDs may not fit the bill.

Plus500 Commissions, Spreads and Fees

Plus500 uses a spread-only pricing structure, meaning traders are not charged a separate commission on trades. All fees are integrated into the spread itself. This makes the cost structure straightforward, though it may not always be the most cost-efficient for high-volume or cost-sensitive traders.

Spreads on Plus500 are variable and depend on the specific instrument, market conditions, and liquidity at any given time. For popular forex pairs like EUR/USD, spreads typically start from around 1 pip and average at around 1.4. While this is relatively standard, it’s not among the lowest in the market, especially when compared to brokers that offer raw spread or commission-based accounts.

Overnight funding fees, also known as swap rates, will apply when holding positions after a specified cutoff time. These can either be added to or deducted from your balance depending on the instrument and direction of the trade. During our review, these fees were in line with industry averages.

Plus500 does not charge any deposit or withdrawal fees, which is a positive for users who frequently move funds. However, the broker does apply an inactivity fee. If a user doesn’t log in for three consecutive months, a fee of up to $10 per month may be deducted until the account is reactivated or the balance is depleted.

Plus500 Deposits & Withdrawals

Plus500 does not charge any fees for deposits or withdrawals, which aligns with standard practice among most online brokers. However, it’s worth noting that payments involving international bank transfers may still be subject to intermediary or receiving bank fees, which are outside of Plus500’s control.

Deposits and withdrawals can be made using a credit or debit card (Visa or MasterCard) or via bank transfer. While these options cover the basics, they are somewhat limited compared to other brokers that offer a wider range of methods, including e-wallets, cryptocurrencies, and even UAE-specific solutions like UAE Pass.

For UAE-based traders in particular, expanding these options would enhance accessibility and convenience.

The minimum deposit is AED 500 (or $100), which is relatively low and suitable for newer traders looking to get started without committing large amounts of capital. Similarly, the minimum withdrawal amount of AED 81.

Plus500 Trading Platforms

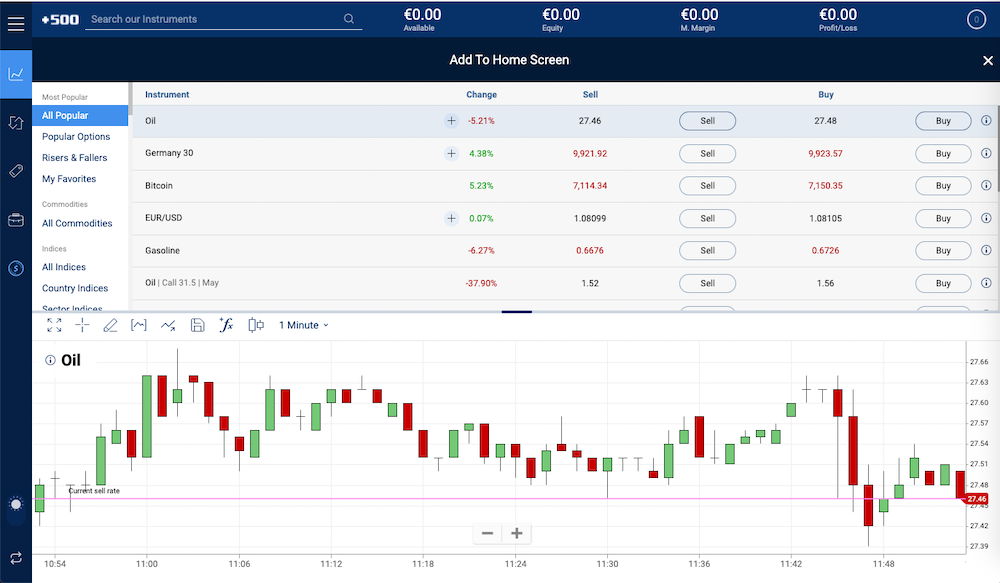

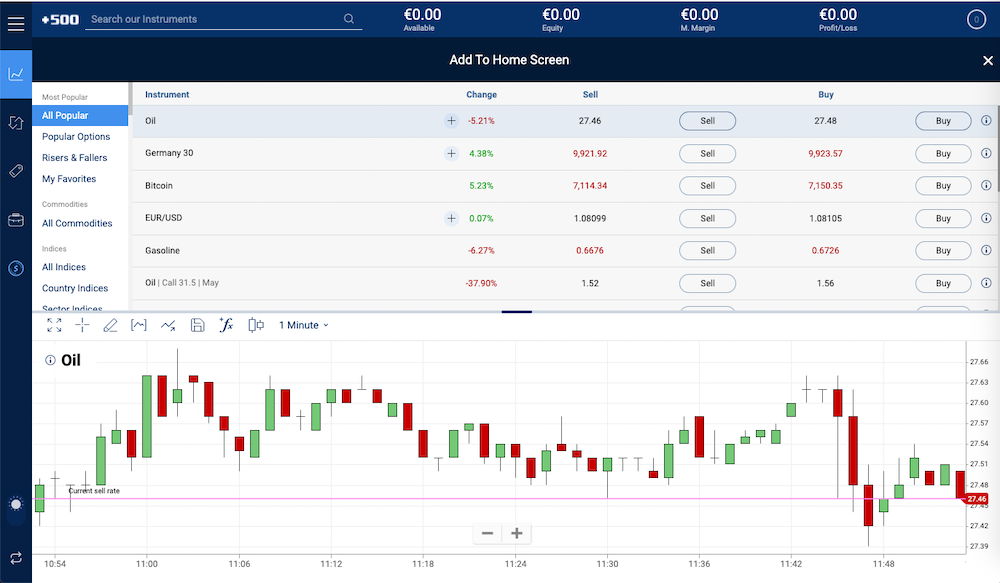

Plus500 offers its own proprietary trading platform rather than supporting third-party platforms like MT4, MT5, or cTrader. Their in-house WebTrader runs on major browsers without the need for installation.

It features a clean interface, integrated charting tools with over 100 technical indicators, and basic trade management functions. However, it lacks support for automated trading and copy trading tools, which may be limiting for some users.

The mobile app mirrors the desktop experience, offering a smooth and intuitive interface for trading on the go. It retains most core features and is available on iOS, Android, and Windows devices.

Plus500 Account Types

Plus500 keeps its account structure straightforward, offering a single standard CFD account for all retail clients. This simplicity is a plus for new traders, as it removes the confusion of choosing between multiple account types. The account provides access to the full range of trading instruments, though asset availability may vary by region due to regulatory differences.

Its other account type includes a free, unlimited demo account across both its desktop and mobile platforms, making it accessible for beginners looking to practice risk-free.

In terms of its account trading execution, Plus500 operates as a market maker, meaning it does not offer STP or ECN execution.

Plus500 Research & Education

Education

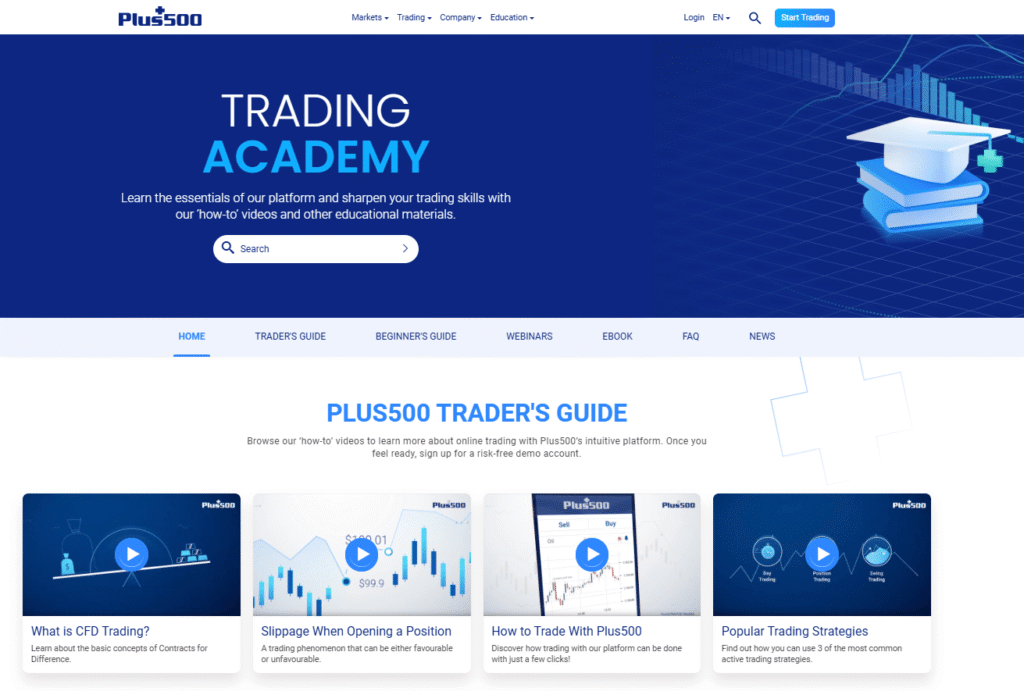

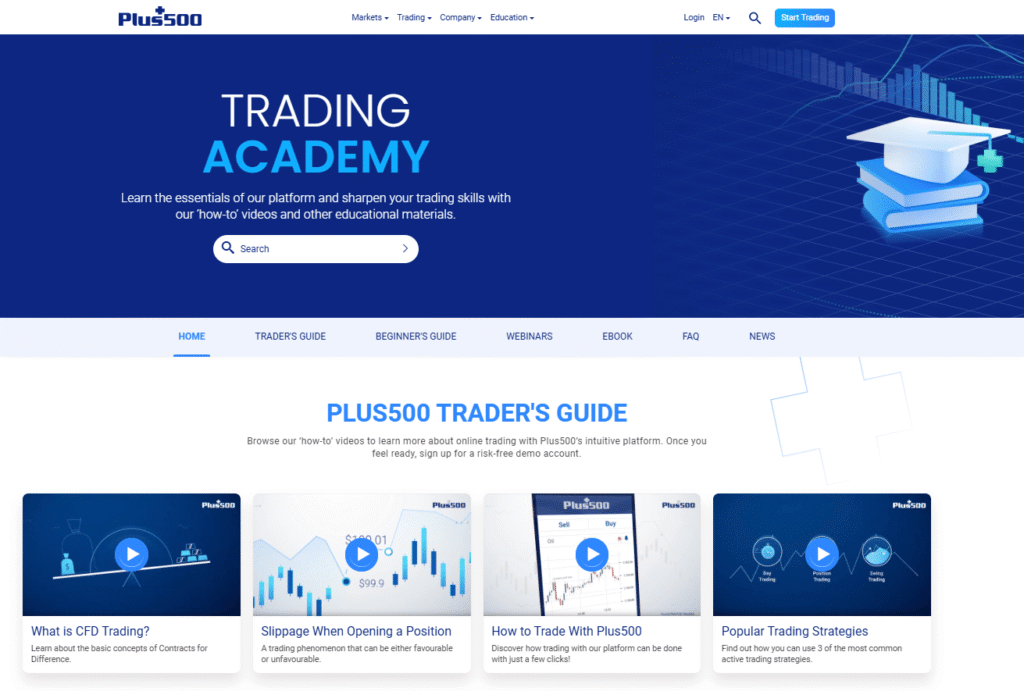

Plus500 has strengthened its educational offering through the launch of its Trading Academy, designed to support both new and experienced traders. The academy features a range of helpful resources including an eBook, short courses, a trader’s video guide, and an FAQ section.

These materials aim to simplify trading concepts and improve user confidence. Traders can read eBooks, watch step-by-step videos, and explore answers to common questions, all within an easy-to-access learning hub.

Research

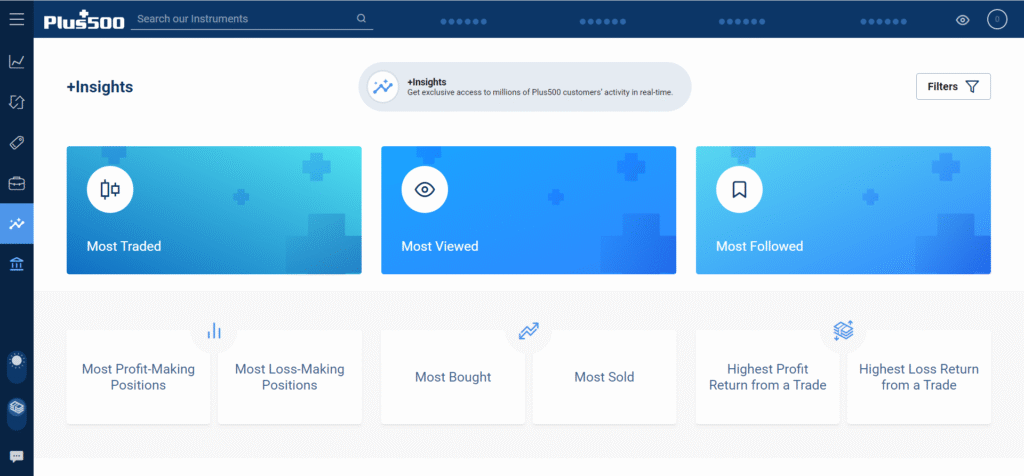

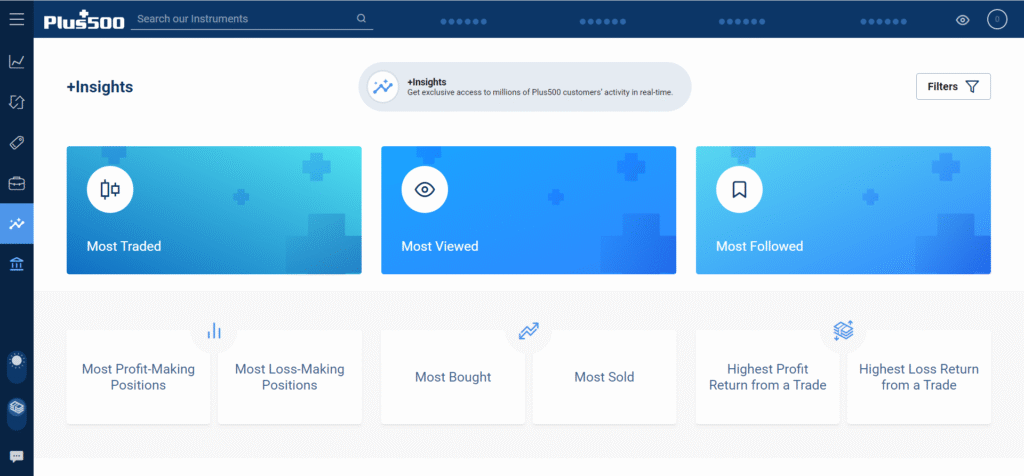

Plus500’s standout research tool is its proprietary +Insights feature, available on both the WebTrader platform and mobile app. This tool aggregates millions of real-time data points to present valuable market insights, including the most traded and most viewed instruments, trader sentiment and top-performing trades.

The Traders’ Sentiment tool reveals what percentage of users are currently buying or selling a specific instrument, giving insight into market psychology.

+Insights also displays performance-based rankings, such as the instruments generating the highest gains or losses.

In addition, the broker includes a news section on the website with regularly updated content on key market developments like economic data, central bank announcements and other key market developments. This combination of analytics and news can help traders make more informed decisions.

Plus500 Regulation

Plus500 is a globally regulated broker, authorised to operate in multiple jurisdictions across Europe, Asia-Pacific and the Middle East. The broker is licensed by reputable financial authorities in the UAE, UK, Australia, Singapore, Cyprus, Japan, South Africa, Estonia, and more ensuring it meets strict compliance standards wherever it operates.

For UAE traders, Plus500 is regulated locally by two authorities:

- Plus500Gulf Securities L.L.C. is licensed by the Securities and Commodities Authority (SCA)

- Plus500AE Ltd is regulated by the Dubai Financial Services Authority (DFSA), (License No. F005651)

This dual-regulation gives UAE traders a choice of which entity they’d like to be onboarded under. It’s worth noting that the DFSA-regulated entity typically offers lower leverage and more limited access to crypto trading, compared to the SCA option.

Client funds are also held in segregated accounts, a requirement under its regulatory licenses, providing an added layer of security for traders.

Plus500 Customer Support

Plus500 offers 24/7 customer support through live chat, WhatsApp, and email. During our tests, response times were consistently quick with live chat responses coming in under a minute and email queries being answered within a day. On each of our tests, the support team provided clear, helpful answers.

The broker also maintains an extensive FAQ section, which covers a wide range of common topics, which is useful for traders looking for quick self-service solutions.

While the overall support experience is reliable and accessible, it’s worth noting that phone support is not available, which is the only real drawback in this category.

Plus500: The Bottom Line

Plus500 is a well-established CFD broker with broad international regulation, including local oversight in the UAE from both the SCA and DFSA. Its platform is user-friendly, and its range of tradable instruments, particularly stock CFDs, is extensive, offering access to both global and local markets.

The commission-free pricing model keeps things simple, though spreads are not the most competitive in the industry. While it doesn’t support popular third-party platforms or copy trading, its proprietary platform and +Insights tool provide a solid trading experience for those focused on manual execution.

For new traders, the low minimum deposit and free demo account offer an easy entry point. Overall, Plus500 is a strong choice for UAE-based traders looking for a regulated, no-frills broker with a wide range of markets.

CFD Service. Regulated by the SCA. Trading carries risk. (خاضع لرقابة SCA. التداول يحمل المخاطر. خدمة CFD.)

Written by Sam Reid

Written by Sam Reid Fact checked by Freddie Ricks

Fact checked by Freddie Ricks Last updated 1 day ago

Last updated 1 day ago