MultiBank Group Trading Instrument

MultiBank Group’s product offering is centered around CFDs. On their website, MultiBank Group states that they offer 20,000+ CFD trading instruments, including:

- 55+ forex pairs

- 23 stock indices

- 20,000+ stocks

- 20+ commodities

- 11 cryptocurrencies

With a wide portfolio, MultiBank Group offers 6 main asset classes encompassing over 20,000+ products. However, UAE traders should note that the majority of these listed offerings include stocks, not all of which are initially accessible when logging into the broker’s platforms.

In terms of its stock offering, MultiBank offers shares from leading exchanges across the US, EU, Asia, and most recently, the UAE. This is a plus for traders looking to trade local stocks, with access to CFD shares on top UAE stocks listed on the Dubai Financial Markets (DFM) and Abu Dhabi Securities Exchange (ADX).

In reality, just over 1000 markets are readily available by default on MultiBank Group’s MetaTrader and cTrader platforms. Traders that wish to access the complete range of MultiBank’s advertised markets must manually request them via email.

MultiBank’s trading options are limited when it comes to ETFs, bonds and futures.

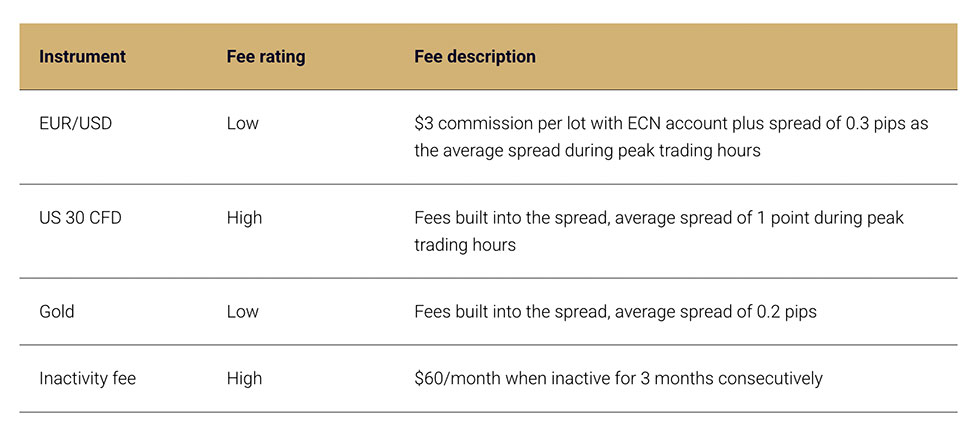

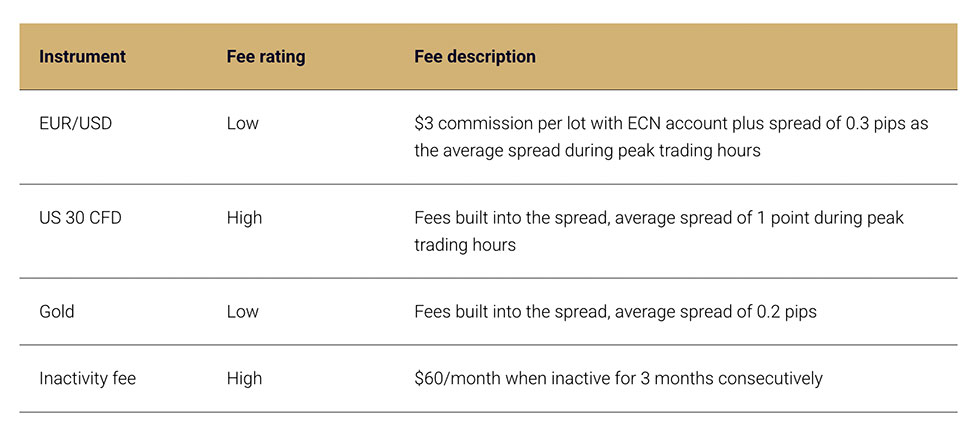

MultiBank Group Commissions, Spreads and Fees

Overall, we find that MultiBank Group offers low fees on forex, gold and indices, with the additional benefit of having zero withdrawal fees.

When it comes to trading fees, costs will vary depending on the account type you have. here is the breakdown of MultiBank Group’s spreads and commission:

Standard Account: For standard accounts, the fee is built into the overall spread. Average spreads on the standard account are around 1.4 pips, which is slightly higher than the industry average.

ECN Account: On the ECN account, which is designed more for professional traders, spreads start from 0.1 pips and a commission of $3 per lot. While this is a highly competitive option, it requires a very high trading volume and a maintained account balance of $5000.

Swap fees: In terms of swap fees, MultiBank Group offers swap-free trading on all products except forex, metals and spot oil. On the products MultiBank does include swaps on, the fees are generally average.

Inactivity fees : When it comes to non-trading fees, MultiBank Group offers zero deposit and withdrawal fees. However their inactive fee is quite heavy at $60 per month if your account is inactive for more than 3 months.

MultiBank Group Deposits & Withdrawals

Based on our findings, MultiBank offers a selection of instant, simple, and secure payment options for deposits and withdrawals which remains at your disposal to choose the best-suited one.

The minimum deposit amount for MultiBank is low at $50 for standard accounts, which goes up to $1000 for Pro accounts and $10,000 for ECN accounts. UAE clients have the following deposit options:

1. Credit/Debit cards

2. Bank transfer

3. eWallets (Neteller, Skrill, Perfect Money)

4. rypto (BTC, USDT ERC20 or USDT TRC20)

5. SEPA (for Eurozone deposits)

MultiBank Group also recently launched a cash payment service in partnership with Al Ansari Exchange in the UAE. This service allows MultiBank Group clients in the UAE to deposit and withdraw funds seamlessly through Al Ansari Exchange’s extensive branch network.

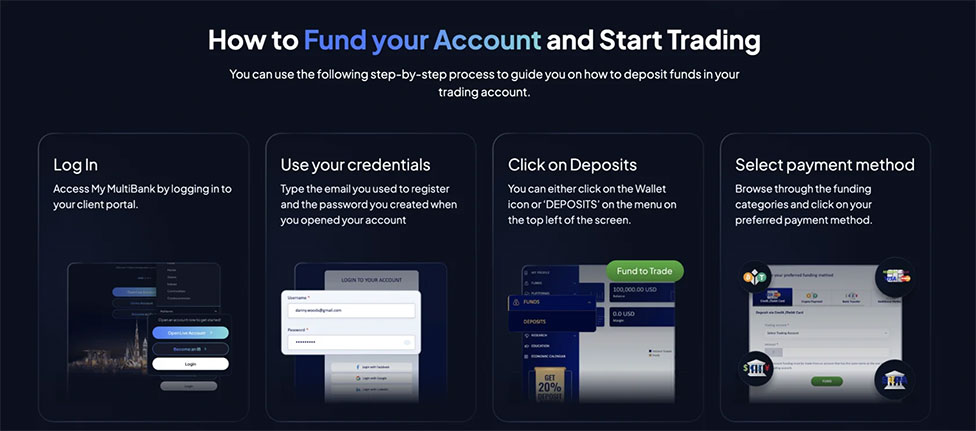

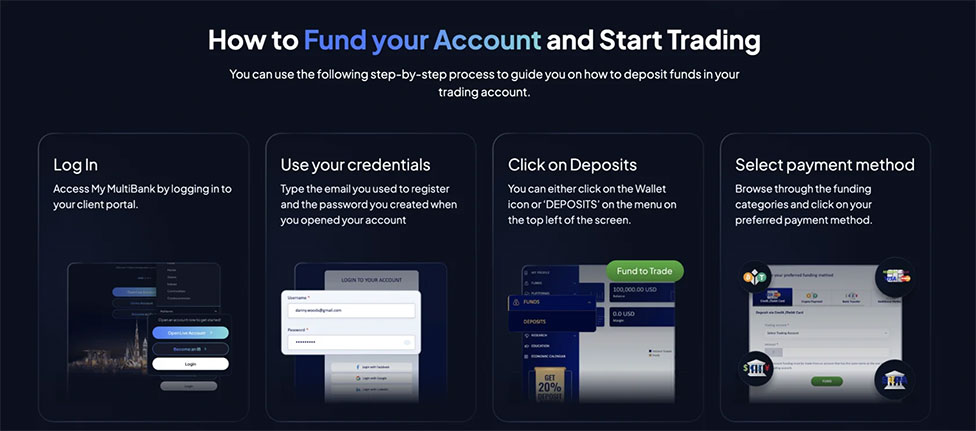

The image below shows how MultiBank Group clients can deposit.

When it comes to withdrawals, the same methods mentioned above also apply for withdrawals. Clients can only withdraw funds to accounts in their name. To proceed with withdrawals, you just need to do the following:

1. Log into MyMultiBank

2. Go to ‘Withdrawal’

3. Select your trading account

4. Give the reason for the withdrawal

5. Enter the withdrawal amount

6. Select your withdrawal method

7. Initiate the withdrawal

Deposits and withdrawals are also free of charge for MultiBank Group clients in the UAE. However there may be fees imposed by banks for local transfers.

MultiBank Trading Platforms

MultiBank provides a variety of trading options through some well-known third-party platforms such as MT4 and MT5, along with social copy trading too. While this serves as a strong foundation, MultiBank still lags behind the top forex brokers in this particular category when it comes to their own developed platforms.

MetaTrader 4/5

MultiBank Group offers the widely recognized and globally used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) desktop and web platforms. Live account holders in the UAE can gain access to streaming news headlines from Dow Jones Newswire and opportunity alerts from Acuity to enhance their trading experience.

Social Copy Trading

MultiBank Group provides two options for social copy trading. These include an in-house copy trading web platform and the MetaTrader Trading Signals (accessible with both MT4 and MT5).

MultiBank’s in-house platform doesn’t offer the same extensive range of features as industry leaders, however, we did fine it is easy to navigate and offers clear portfolio and fee reports.

Mobile App

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are MultiBank Group’s chosen platforms when it comes to mobile trading, available on both iOS and Android.

They come in an impressive 22 different languages, including English and Arabic, and can be accessed via the MEXIntGroup-Real server after downloading. It also comes with some helpful features, including alerts, watch lists, indicators and drawing tools, and an economic calendar. However the app does not offer 2 factor authentication, which does lower its security rating.

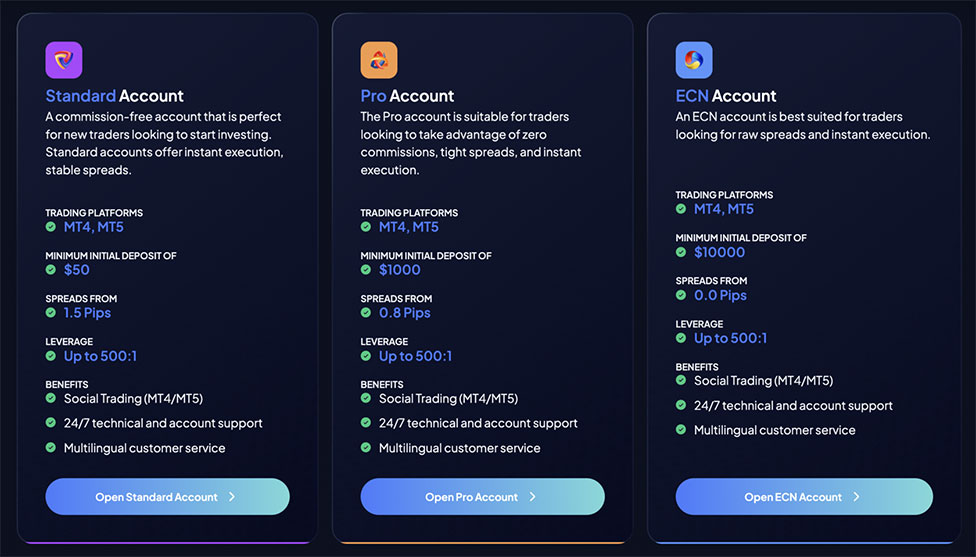

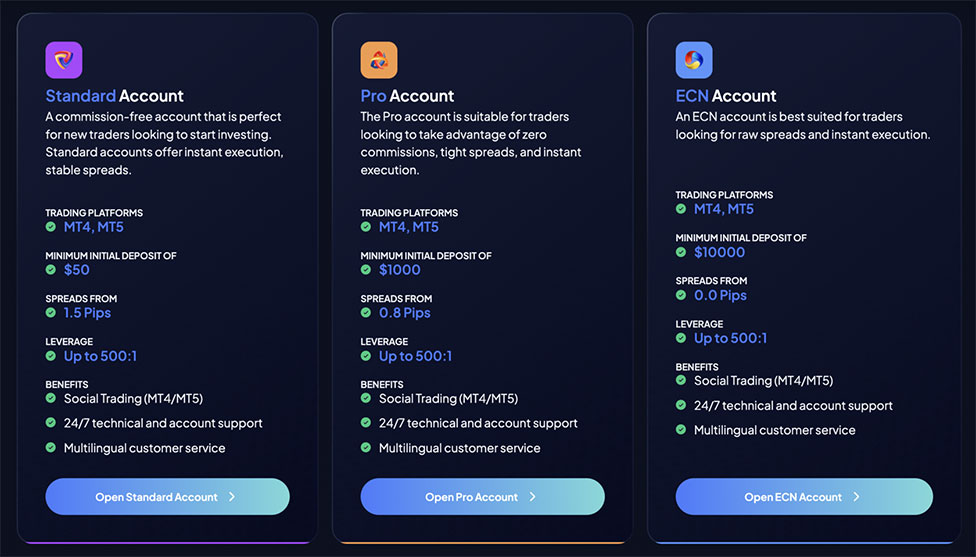

MultiBank Group Account Types

There are 3 account types to choose from with MultiBank Group to suit the needs of all types of traders. These are the Standard, Pro, and ECN accounts.

Standard Account: The Standard account is a commission-free trading account suitable for beginner forex traders. This account type does have the highest spreads from 1.5 pips and a maximum leverage of 500:1. It also has the lowest minimum deposit of $50 and can be accessed on both MT4 and MT5.

Pro Account: This account comes with higher spreads from 0.8 pips but also a higher minimum initial deposit of $1000. The same leverage and platforms also applies for the Pro account.

ECN account: MultiBank’s ECN account offers the lowest spreads for traders in the UAE from 0.0 pips. However, with a minimum initial deposit amount of $10,000, this account is suited towards professional traders only. This account type also charges a commission of $3 per lot when trading forex.

All accounts include 24/7 support, 1:500 leverage, social trading, and access to the MT4 & MT5 platforms.

MultiBank Group also offers an Islamic/swap-free Account for traders in the UAE looking to trade in accordance with Islamic principles. This removes all swap charges associated with trading when holding positions overnight.

MultiBank Group Research & Education

Overall, we found that MultiBank’s educational and research materials are quite limited compared to other brokers. This is something for beginners to take note of, since MultiBank doesn’t really provide the tools for novice traders to get started.

With that said, MultiBank has recently made more of an effort with the educational material on its website, with a limited series of videos courses.

MultiBank Group is also quite limited in the research department also. There are not many trading tools at hand, apart from standard calculators and Virtual Private Server (VPS) hosting options. MultiBank Group clients do have news provided by Dow Jones on its web platform – providing traders with updates on the biggest listed companies across global markets.

In terms of market research, MultiBank does provide market analysis and updates on social media and infrequently publishes its market updates & forecasts newsletters, which can provide valuable trading insights.

MultiBank Group Regulation

One of MultiBank Group’s key highlights is its several stringent regulations. MultiBank has 10 globally regulated entities – including CIMA (Cayman Islands), FSC (British Virgin Islands, ASIC & AUSTRAC (Australia), BAFIN (Germany), FMA (Austria), MAS (Singapore), TFG (China), VFSC (Vanuatu). As a major advantage to UAE clients, MultiBank Group is also locally regulated by the SCA.

For more information on MultiBank Group’s regulations and licenses, visit the company’s global regulations page here.

In addition, MultiBank Group offers segregated client accounts, tier 1 banking, withdrawals within 24 hours, and capital protection of up to $1 million for MEX Atlantic clients. Overall, we find that MultiBank is considered a highly safe and secure broker to trade with.

MultiBank Customer Support

MultiBank Group offers an impressive selection of methods to get in touch with customer support. These include:

- Live chat

- Phone

- Email

- WhatsApp

- Conference calls via Zoom/Teams

The quickest way to get in touch with MultiBank’s customer support is by far its live chat feature, offering almost instant replies from our testing. Email replies were received the same day and also has a working UAE number clients can call on 800203040.

Customer support is available 24/7 and has a multilingual support team, including English, Arabic, Russian, French, and more.

MultiBank: The Bottom Line

Overall, MultiBank Group is a globally regulated broker that is headquartered here in the UAE, offering clients CFDs across forex, stocks, indices, commodities, metals, and cryptocurrencies.

The main benefits include quick and easy account opening, local presence in the UAE, free deposits and withdrawals, and excellent 24/7 customer support. However, there are some drawbacks that UAE clients should be aware of.

For one, MultiBank Group has a high inactivity fee, and competitive trading conditions are only unlocked with its more advanced Pro and ECN accounts, which require higher minimum deposits of up to $10,000 and upwards. Research and educational tools are also considered below the industry standard. With these points in mind, MultiBank Group is best for more professional traders, rather than beginners.

Overall, MultiBank Group is a solid CFD broker which is excellently regulated and a decent choice for professional traders in the UAE.

Written by Sam Reid

Written by Sam Reid Fact checked by Freddie Ricks

Fact checked by Freddie Ricks Last updated 1 day ago

Last updated 1 day ago