FBS Trading Instruments

The FBS trading platform offers a wide array of instruments designed to cater to varying investment preferences. Among the instruments available for trading through FBS accounts are forex, energies, stocks, precious metals, and indices. This diversity allows traders to explore multiple avenues within the financial markets. Additionally, those interested can take advantage of the Standard Account at MetaTrader platforms and engage in risk-free practice through demo account trading.

Here is FBS’ complete instrument line up

Forex: FBS provides a comprehensive selection of more than 28 forex trading pairs across different account types. The potential advantage lies in spreads that can be as low as 0.0 pips, enhancing trading opportunities for users.

Metals: Precious metals, including silver and gold spot trading, feature prominently in FBS’s offerings. Gold, in particular, is a standout asset, known for its status as a widely traded and attractive investment option that can diversify portfolios.

Indices: FBS grants access to 11 major indices from global markets. These include AU200, DE30, FBS NASDAQ100, Dow Jones, FTSE100, and more. The flexibility of trading indices with FBS allows for positions as low as 10 lots.

Energies: The energy section introduces trading opportunities for Brent Crude Oil, Natural GAS, and WTI Crude Oil. The lot size varies, with crude oils set at 1000 and natural gas at 10,000.

Forex Exotic: FBS offers a range of 9 exotic forex pairs for trading. It’s important to note that the lot size for all exotic pairs is set at 100,000.

Stocks: FBS’ stock trading feature opens the door to top global companies. This allows traders to diversify their portfolios by engaging with leading corporations in the market.

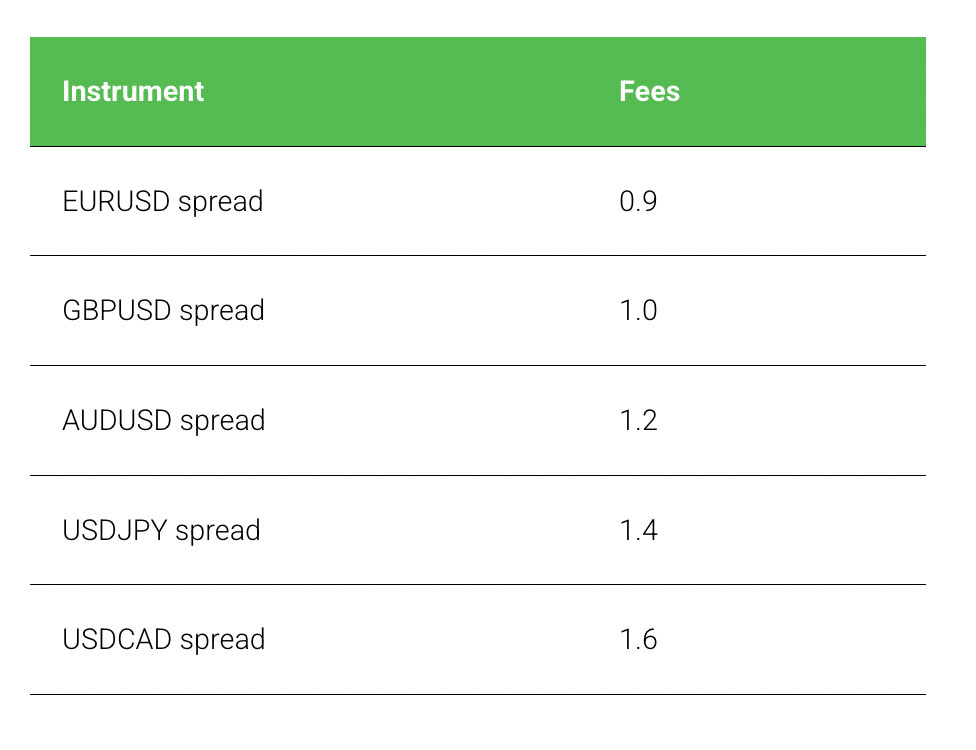

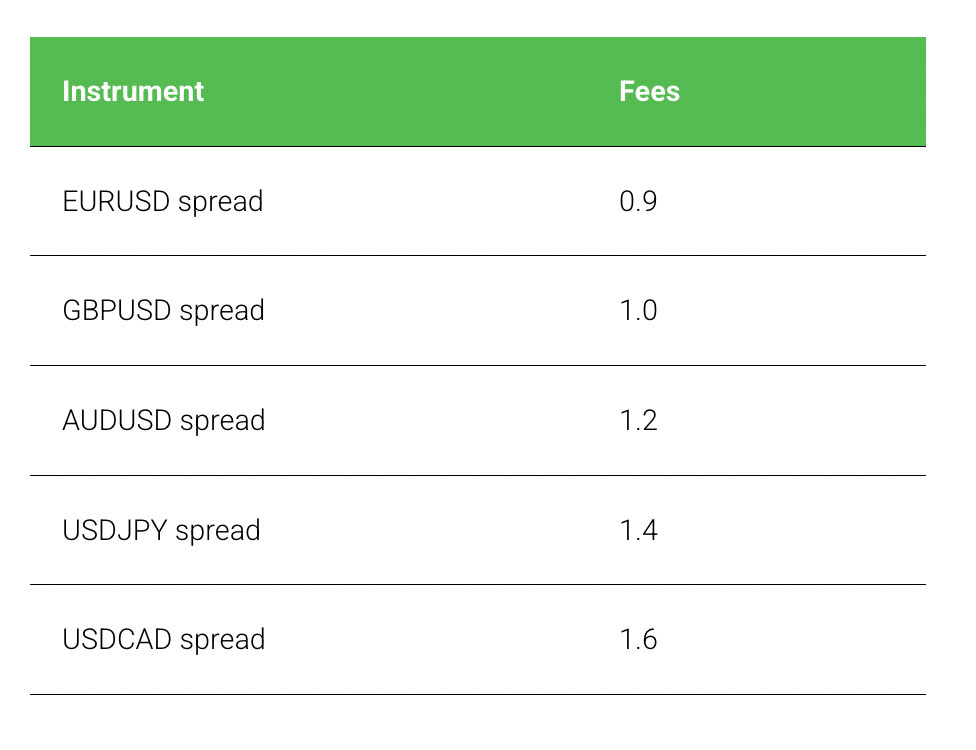

FBS Commissions, Spreads and Fees

The spread offerings at FBS exhibit variability based on factors like account type, market, and region. As an example, for the popular EUR/USD currency pair, the EU firm averages a competitive spread of 0.7 pips. A distinct cost structure is observed for US stocks, where a 0.7% commission is charged.

It’s important to emphasize that FBS adopts different cost structures for its various account types. In our review, we focused exclusively on testing the Standard account, providing insights into the fee structure associated with this particular option.

FBS does impose overnight rollover fees to its traders. While swap-free investing is an option, it’s important to note that this feature is not applicable to specific trading categories, including cryptos, forex exotics, indices, stocks, and energy instruments.

Non-trading fees

FBS stands out by refraining from imposing deposit, withdrawal, or account fees. Additionally, a notable advantage is the absence of an inactivity fee, distinguishing FBS from its closest competitors and enhancing its appeal to traders seeking a cost-efficient trading experience.

FBS Deposits & Withdrawals

FBS ensures swift and seamless deposit processing, offering an array of methods with varying fees. Among the payment methods available are credit cards (Visa and MasterCard) and e-wallets (Skrill, Neteller, Perfect Money, CashU, Bitcoin, Tether).

The minimum deposit amount for the Cent and Standard accounts is $1, making FBS a suitable broker for beginner MENA traders based in the UAE looking to trade in small volumes. Even their Pro account comes with a surprisingly low minimum deposit of only $200. This is significantly lower than competitors’ pro accounts which often require minimum deposits well above $1000. Withdrawals at FBS are designed to be convenient and user-friendly.

The process entails utilizing the same payment system used for the deposit. The minimum withdrawal amount stands at 2 USD or its equivalent, contingent upon the selected payment method. It’s important to note that withdrawal commissions differ based on the chosen payment method.

FBS also has an efficient withdrawal process, typically taking 1-2 business days for completion. Notably, the majority of withdrawal requests are expedited during business hours, with many being processed within a matter of minutes to a few hours.

FBS Trading Platforms

FBS Dubai provides its clientele with a trio of advanced trading platforms: MT4, MT5, and FBS Trader.

These platforms are designed to deliver an exceptional trading experience to both UAE and global traders. Offering an array of contemporary tools and analytical patterns, these platforms can be easily accessed through web and mobile versions.

MT4

The MT4 platform at FBS offers versatility across web, Android, iOS, Windows, and Mac. With a comprehensive set of features, it presents 50 indicators, charting tools, VPS services, four types of pending orders, built-in news updates, and one-click trading functionality.

MT5

FBS’s MT5 platform, available across web and various devices, boasts 90 indicators, charting tools, VPS services, six types of pending orders, 21 diverse timeframes, an economic calendar, integrated news updates, and the convenience of one-click trading.

FBS Trader

The proprietary FBS Trader platform stands out as FBS’ proprietary solution, accessible solely on Android and iOS. However, the FBS website enables the use of WebTrader through this platform. FBS Trader facilitates swift and secure transactions, accompanied by enticing bonuses and cashback offers. This platform empowers traders to engage in stocks, forex, metals, cryptos, and energies.

FBS Trader also offers the convenience of 24/7 customer service, tailored to your language, directly within the app. Depositing and withdrawing funds is made hassle-free, with a range of deposit methods available. By opting for the FBS Trader app, UAE traders can seize benefits such as a $100 quick start bonus (FBS 100 deposit bonus), up to 20% cashback, and access to a diverse selection of over 170 popular assets.

FBS Account Types

For clients based in the UAE, FBS offers 3 main account types. These include the Cent account, the Standard Account and the Pro Account.

Cent Account: The Cent account introduces a unique approach, as both the account balance and transactions are denoted in cents. This means that a deposit of $10 translates to 1000 cents in your account. Notably low-risk, the Cent account serves as an excellent platform for Forex beginners.

It is equally appealing to seasoned traders seeking to experiment with new strategies. The account permits trading with smaller lot sizes and requires a minimal initial deposit, making it an optimal choice for those entering the market. With just a $1 initial deposit, you can access the Cent account at FBS.

This versatile account accommodates an array of trading instruments, including Forex, metals, indices, energies, Forex exotics, stocks, and cryptocurrencies. The Cent account is compatible with both MetaTrader 4 and MetaTrader 5 platforms.

Standard Account: The Standard Account caters to traders seeking a conventional trading experience, featuring competitive spreads and zero commissions. FBS empowers you to select leverage of your choice, with options extending up to 1:3000.

This account variety offers a comprehensive range of trading instruments, encompassing Forex, metals, indices, energies, Forex exotics, stocks, and cryptocurrencies. Across MetaTrader 4, MetaTrader 5, and the FBS Trader app, you can readily access the Standard account.

Pro Account: The Pro account from FBS targets advanced traders, offering enhanced volume trading capabilities. Characterized by unlimited orders and reduced spreads, this account type presents lower margin prerequisites, empowering traders with greater command over positions and risk management.

The Pro account demands a $200 minimum deposit, providing access to an account type optimized for experienced traders seeking a more sophisticated trading experience.

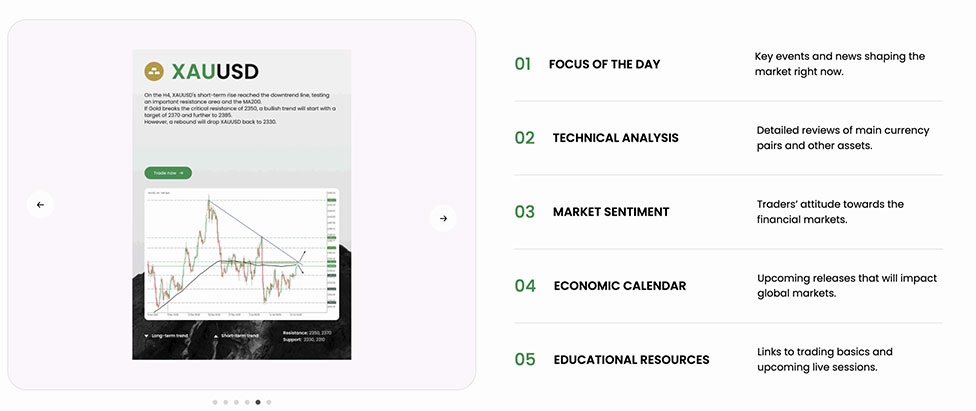

FBS FBS Research & Education

At FBS you can learn through the following channels:

1. Platform tutorial videos

2. General educational videos

3. Webinars and seminars

4. High-quality educational articles

FBS also offers a Forex Guidebook, which includes a free course put together by FBS market analysts. The course can be useful for both beginners and experienced traders, and takes an in-depth dive into the forex market.

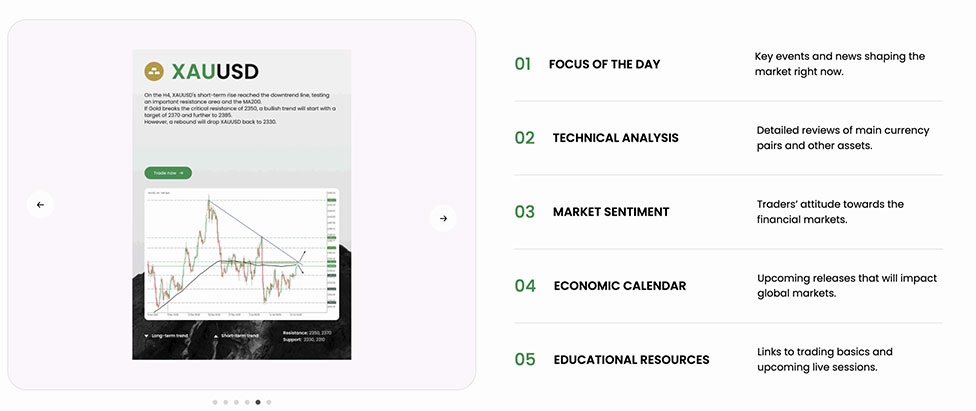

In terms of research, FBS traders in Dubai get access to real-time market news and trade ideas on the website, and have the option to filter the information issues via different asset classes. We also found a well designed Forex Calculator on the FBS website, along with an Economic Calendar to track the news and a currency converter for easy calculations.

Overall, the research and Education materials we found on FBS are quite average but still decent. However, if you are starting out as a complete beginner, you may need to find some additional resources in addition to what you might find on FBS.

FBS Regulation

FBS prioritizes the safeguarding of client funds in accordance with international regulatory standards for client protection. The company operates under the oversight of reputable regulatory bodies, including CySEC of Cyprus, IFSC of Belize and ASIC of Australia.

Client funds are maintained securely in segregated bank accounts, distinct from the broker’s operational funds. FBS adheres to international benchmarks for minimum equity and conducts regular financial audits. Additionally, FBS implements negative balance protection, providing an added layer of security for trading clients.

However, it’s important to note that FBS lacks local regulation within the UAE. However, its trading services are still available for traders in the region. Traders in Dubai and across the UAE can confidently open accounts with FBS, knowing that they are still trading with a globally-regulated broker.

FBS Customer Support

FBS offers reliable customer support in 18 languages and is available via email, live chat, phone and even social media. From our testing, we found their livechat to have the most useful and quickest response time. However, clients based in the UAE will be redirected to the broker’s global support team, since there is no FBS entity local to the UAE.

FBS: The Bottom Line

In conclusion, FBS is a globally recognized CFD broker with several attractive features for traders in the UAE. With a commitment to delivering a user-friendly trading experience, FBS offers a diverse range of trading instruments including forex, metals, indices, energies, stocks, and cryptocurrencies.

The availability of Cent, Standard, and Pro accounts caters to traders of all levels, from beginners to experienced professionals. The broker’s competitive spreads, no inactivity fees, and a variety of deposit and withdrawal methods further enhance its appeal.

FBS’ dedication to customer service is evident through its array of educational resources, including tutorial videos, webinars, and informative articles. The choice of trading platforms – MT4, MT5, and the proprietary FBS Trader – provides traders with flexibility and advanced tools to navigate the markets effectively. While FBS lacks local UAE regulation, its strong global regulatory oversight from reputable bodies ensures a secure trading environment.

Written by Sam Reid

Written by Sam Reid Fact checked by Freddie Ricks

Fact checked by Freddie Ricks Last updated 1 day ago

Last updated 1 day ago