Capital.com Trading Instruments

Capital.com offers a range of CFDs covering all major asset classes. This gives UAE traders access to global markets without owning the underlying assets. The broker provides CFD trading on forex, shares, commodities, indices and crypto.

Though note that available instruments may vary depending on your country.

Here’s what you can trade with Capital.com in the UAE.

- Forex: Access to over 120 currency pairs, including majors, minors and exotics.

- Stocks: Capital.com offers CFD trading on more than 4,000 global shares, including both US and UAE-listed companies. This allows traders to gain exposure to price movements without purchasing the actual shares. The platform also supports extended trading hours on US stocks, a handy addition where traders can react to earnings releases and after-hours news.

- Commodities: A wide range of metals, energies, and agricultural products. However these are limited to only spot prices rather than futures.

- Indices: Capital.com provides CFDs on a broad selection of global indices across the US, Europe, Asia and beyond. Many of these instruments also feature out-of-hours pricing.

- Cryptocurrencies: The broker stands out for its crypto coverage, offering CFD trading on more than 400 digital assets. This also extends to memecoin assets.

All these instruments are offered only through CFDs. Capital.com’s offering does not extend to physical stock or ETF investing.

Capital.com is featured as our best broker for CFD trading due to its flexible access across asset classes.

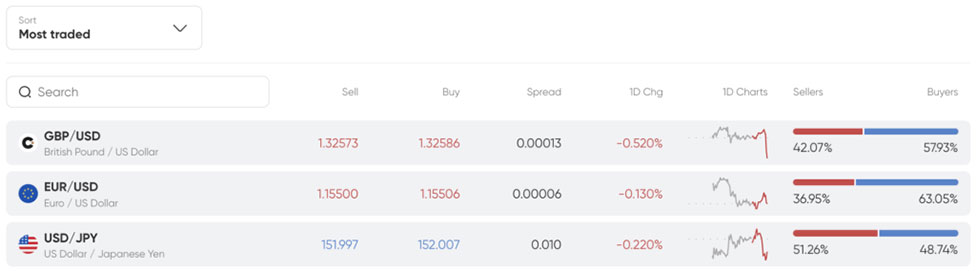

Capital.com Commissions, Spreads and Fees

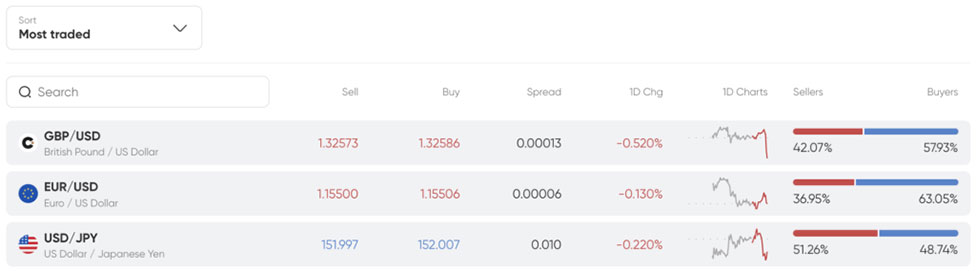

Our analysis found Capital.com’s pricing to be quite competitive. The EUR/USD spread, which is often seen as a broker’s pricing benchmark averages at around 0.6 pips, which is competitive given its 0% commission model.

Similar low-cost pricing can be found on pairs like AUD/USD and commodities such as gold, while spreads on GBP/USD and Bitcoin CFDs were on the higher side.

Spreads at Capital.com are dynamic, meaning they adjust with market conditions and liquidity levels. The broker earns revenue solely through these spreads, keeping its pricing structure simple and transparent, a good plus for traders.

Capital.com also applies swap fees on positions held overnight that are either charged or credited depending on whether a trader is long or short.

In addition, a dormant account fee of $10 per month applies after 12 months of inactivity, which is modest compared to other brokers. So as long as you are planning on trading fairly regularly, this shouldn’t deter you from opening an account.

Deposits and withdrawals are free of charge, though traders should note that third-party payment providers may apply their own fees depending on the method used.

Capital.com Deposits & Withdrawals

Deposit and withdrawal options at Capital.com will inevitably vary depending on your country and the specific entity you’re registered with. For traders registered under Capital Com MENA Securities Trading L.L.C., which is the broker’s UAE-regulated entity, there are these funding methods available.

- Direct bank transfer via Lean (available only with UAE bank accounts – fastest method)

- Traditional bank transfer

- Debit or credit card

- Apple Pay / Google Pay

According to the broker’s website, withdrawal requests are processed within 24 hours, and in 91% of cases within just 5 minutes . Depending on your payment provider, funds may take up to five business days to reach your card or bank account.

Capital.com does not charge fees for deposits or withdrawals, though traders should be aware that their payment provider may apply additional costs.

Capital.com Trading Platforms

Capital.com offers multiple trading platforms, making it a good choice for traders looking for flexibility and variety. Clients can trade via Capital.com’s proprietary web platform, its in-house mobile app, MetaTrader 4 (MT4) or connect directly through TradingView.

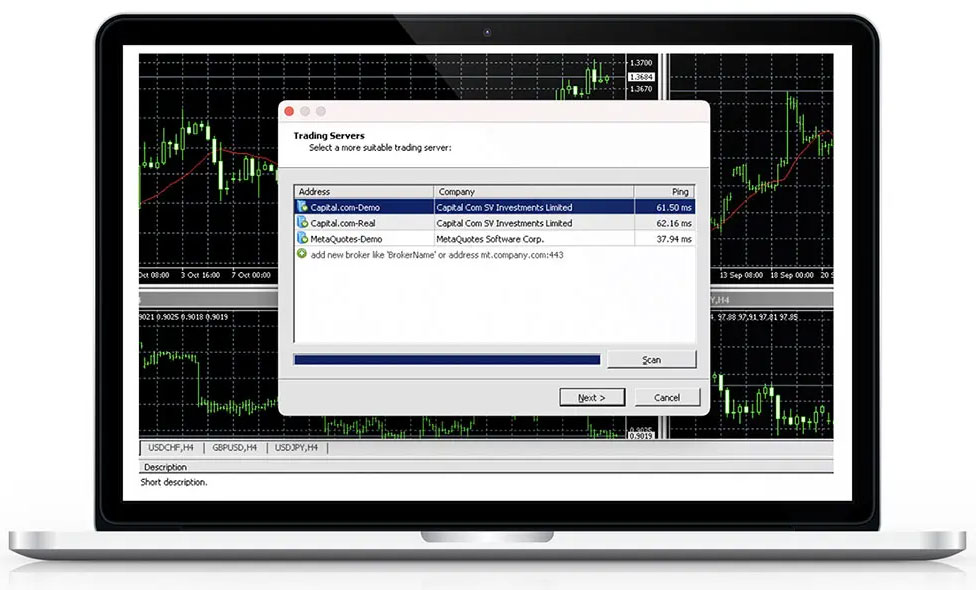

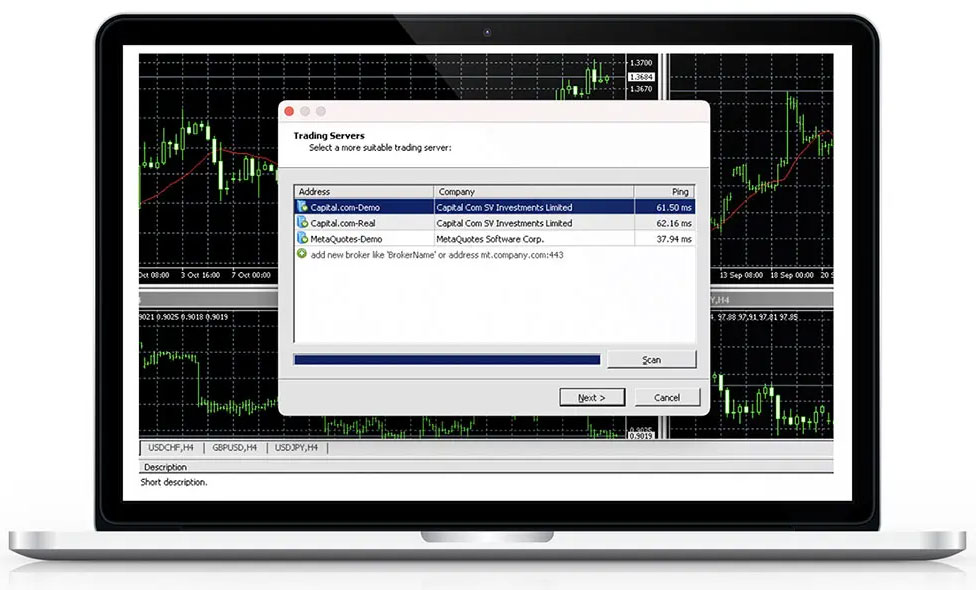

MetaTrader 4 (MT4)

Capital.com provides the classic MT4 experience directly from MetaQuotes. It’s a no-frills setup with support for Expert Advisors (EAs) for automated trading. However, there are no notable add-ons or custom tools other than this.

Also, the absence of MT5 from its platform suite may disappoint traders who prefer the newer platform’s expanded features. Still, for those who appreciate the familiarity and stability of MT4, it does the job well.

Capital.com Mobile App

Overall, we really enjoyed using Capital.com’s mobile trading app. It stands out as a well-designed, feature-rich platform and offers seamless trading anywhere with an internet connection. The app has an intuitive interface, and access to over 100 technical indicators, as well as integrated education and market analysis tools.

We particularly liked the modern interface and new features such as real-time news headlines, portfolio-tailored updates, and advanced TradingView-powered charting. Upon testing, trade execution was fast and stable.

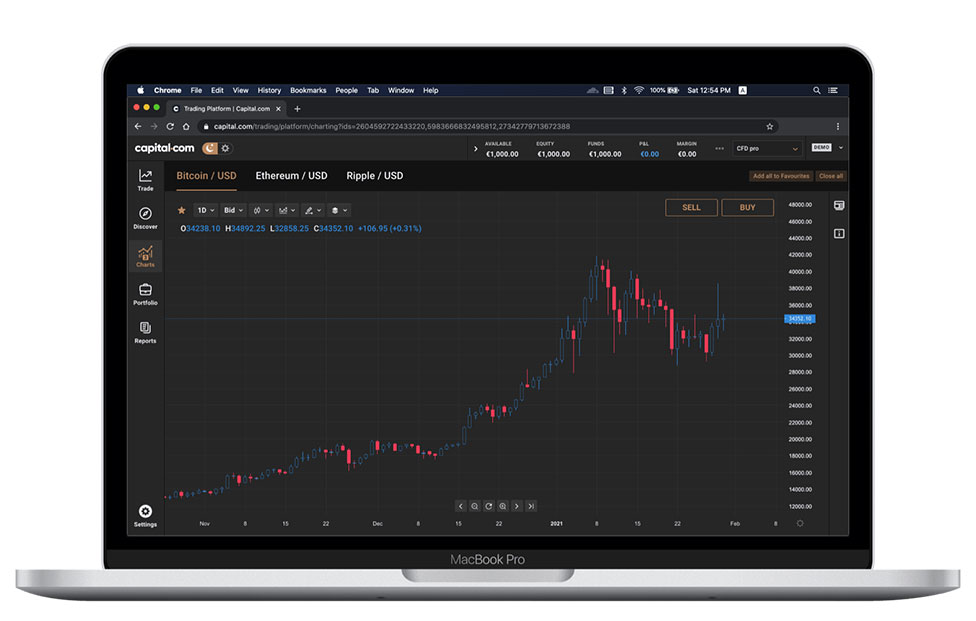

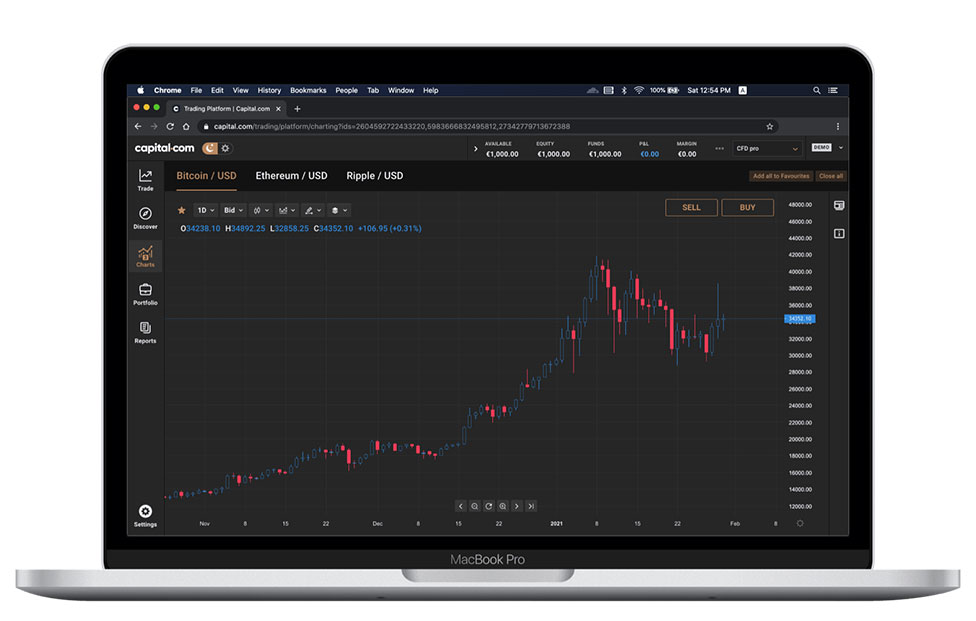

Capital.com Web Platform

Capital.com’s web-based platform mirrors the mobile experience but is optimized for larger screens and no downloads are required. The layout is clean and intuitive with advanced charting tools, customizable layouts, and numerous technical indicators and drawing tools.

We found the design user-friendly and clutter-free, allowing traders to focus on market analysis rather than searching through complex menus.

A standout feature is the Guaranteed Stop-Loss Order (GSLO), which ensures your position closes exactly at your chosen price, even during volatility or slippage. However this feature does require traders to pay a small premium and is only charged when used.

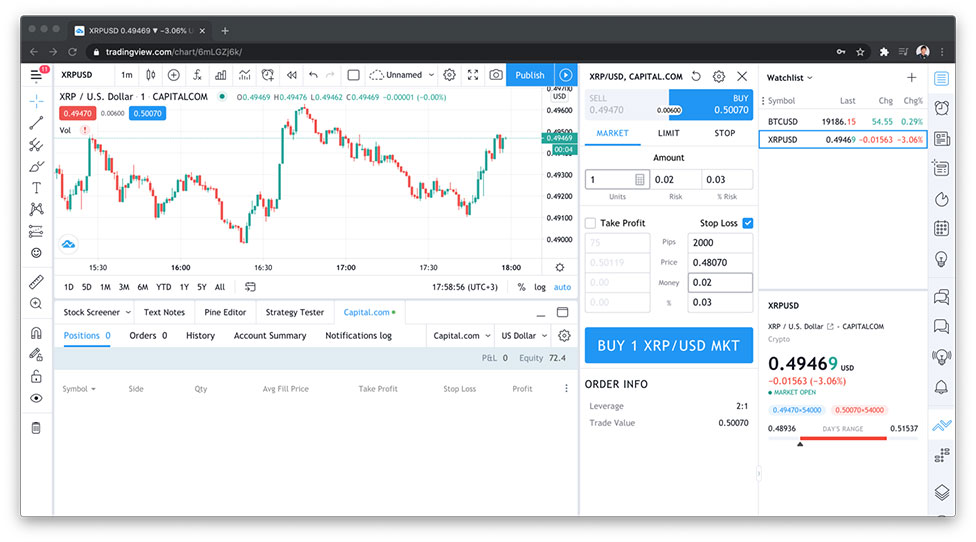

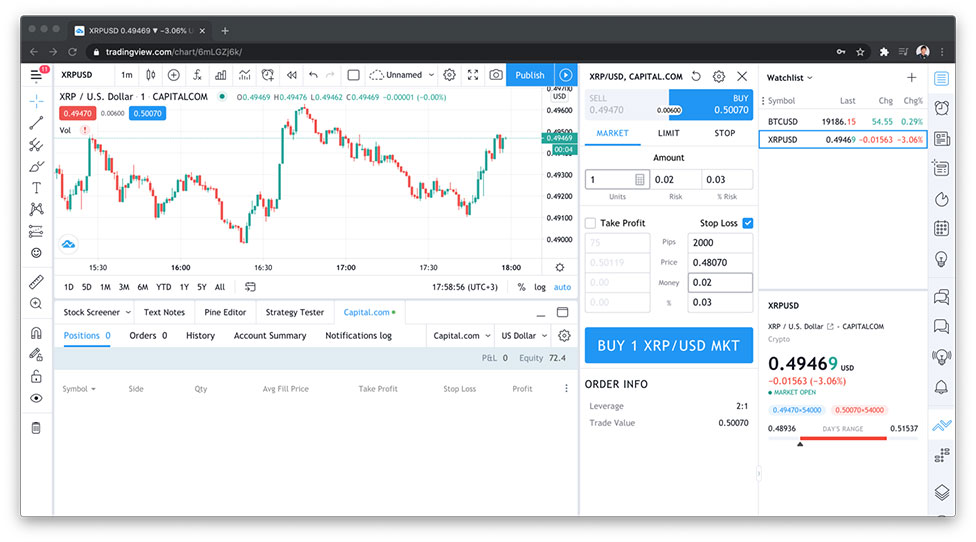

TradingView Integration

Capital.com is among the few brokers that allow traders to connect their trading accounts directly to TradingView and place trades within the TradingView interface. This integration is ideal for those who swear by TradingView for charting and analysis, and prefer not to switch between platforms.

During our testing, the integration worked smoothly, but we did notice occasional automatic logouts after short periods of inactivity.

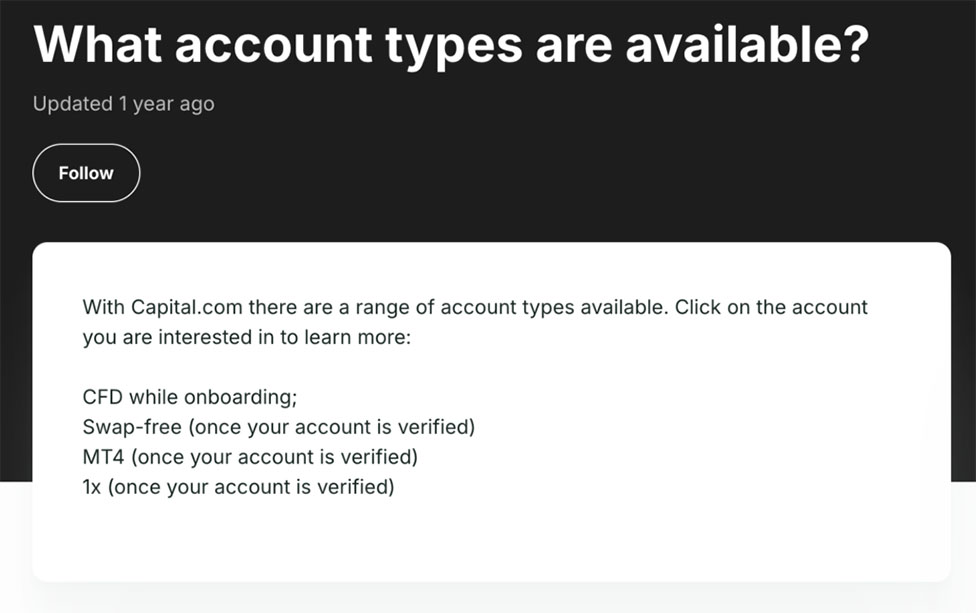

Capital.com Account Types

Capital.com offers a standard retail account and a professional account for experienced traders who meet eligibility requirements.

Creating an account takes about 15 minutes, and verification is usually completed within one business day, as long as your documents are ready and submitted correctly.

The retail account includes full regulatory protection, such as negative balance protection, standard leverage limits, and clear risk warnings making it ideal for most regular traders.

The professional account is designed for those who qualify as elective professional traders. It provides higher leverage but comes with reduced safeguards. Pro clients won’t see standard risk warnings and may lose negative balance protection (granted at the broker’s discretion).

To qualify, you’ll need to meet at least two of these three criteria:

- Traded CFDs or forex 10+ times per quarter in the last year.

- Have an investment portfolio over €500,000.

- Worked 1+ year in finance in a role related to trading.

Capital.com Research & Education

Capital.com Research Tools

Capital.com offers a few useful built-in tools to help traders analyse market movements and spot trading opportunities. While the selection is helpful, it’s somewhat limited compared to what some competitors provide.

Currency Strength Meter – The currency strength meter is accessible even without logging in and lets you quickly identify the strongest and weakest currencies based on real-time prices. It’s a simple yet handy tool for forex traders looking to gauge market momentum. We did note, however, that this feature appears only on Capital.com’s international website, not the UAE version.

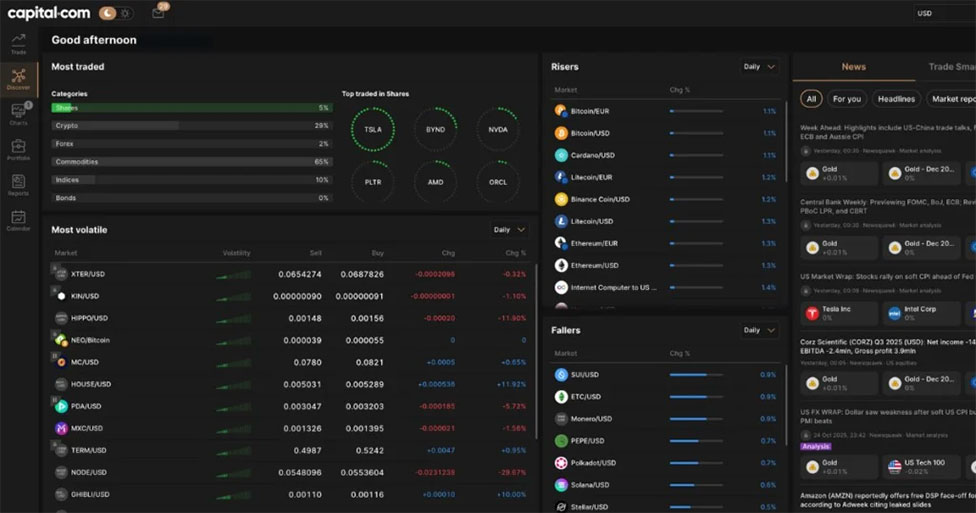

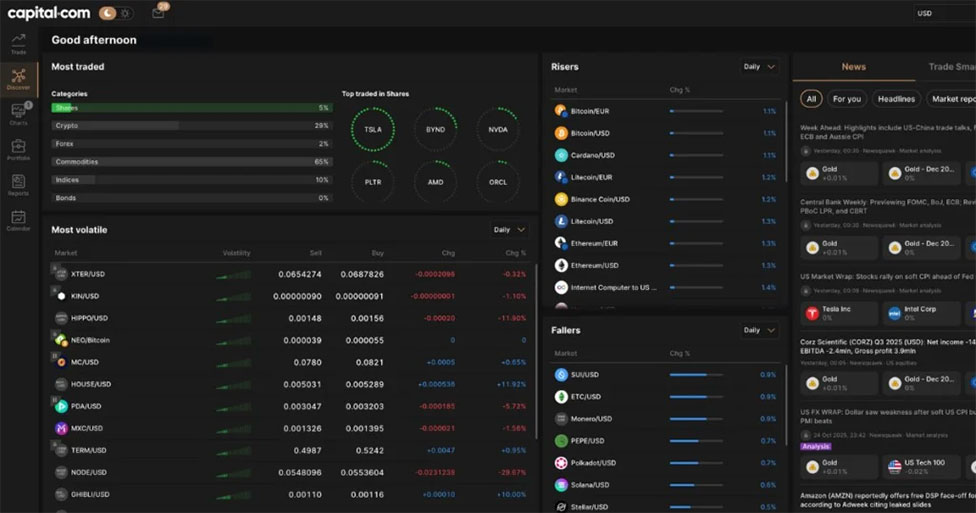

Discover Tab: Market Radar – Once logged in, the Discover tab acts as a real-time market radar, showing which instruments are rising or falling at any given moment. It also integrates a live news feed, giving traders quick context behind the moves without needing to switch platforms.

Indicators and Templates – Capital.com includes over 100 built-in technical indicators for chart analysis. You can also save your indicator setups as templates, making it easy to apply consistent strategies across multiple markets or instruments.

Overall, Capital.com’s research tools are functional and beginner-friendly, but we found them a bit underwhelming compared to the broker’s otherwise high-quality platform experience. A broader range of features such as market sentiment insights or deeper, data-driven analysis across asset classes would have made this category stand out better.

Capital.com Education Tools

Capital.com runs a dedicated “Learn to Trade” section on its website, where you’ll find detailed guides about trading concepts and financial instruments.

We noted how well-organised and clearly written these guides are, as they go beyond generic definitions and include sub-articles that explain key terms and ideas in more depth.

You also have the Investmate app, Capital.com’s free education app, available on Android and iOS. Investmate blends videos, quizzes, and progress tracking into a game-like learning experience, allowing users to learn at their own pace. Overall a very well-designed learning app for traders.

Capital.com Regulation

Capital.com operates under multiple regulatory authorities, many of which are considered top-tier, offering a strong layer of protection for traders’ funds. The broker is regulated by:

- Securities and Commodities Authority (SCA) – United Arab Emirates

- Financial Conduct Authority (FCA) – United Kingdom

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Australian Securities and Investments Commission (ASIC) – Australia

- Securities Commission of The Bahamas (SCB) – Bahamas

For UAE traders, it’s especially important to note that Capital.com is locally regulated by the SCA, operating as Capital Com MENA Securities Trading L.L.C., giving clients the benefit of trading with a broker that meets local compliance and investor protection standards.

Under these regulations, client funds are held separately from company funds, ensuring that your money remains protected even in the event of any operational issues.

Capital.com Customer Support

Capital.com offers 24/7 English support via live chat, email, phone and WhatsApp. Support is also available in Arabic, with German, Italian, French and Spanish also covered during office hours.

We noted that the AI chatbot responses were instant and great for asking simple questions. We tested the chatbot on maximum leverage settings and gave us accurate answers that matched the website.

However, we also noticed that connecting to a live agent took longer. We were placed in a queue of 11 and waited around over 40 minutes, which wasn’t the best experience.

Despite this, once we got connected to an agent, the representative was helpful and appeared to be well-informed and answered our queries without much delay.

Capital.com: The Bottom Line

All in all, Capital.com stands out as a very user-friendly and well-regulated CFD broker available to UAE and GCC traders. It comes with a broad range of instruments (notably a huge stock and crypto selection), commission-free pricing, and an excellent mobile and web platform. We deemed Capital.com a good fit for beginners and intermediate traders who want a smooth, reliable trading experience.

Education is another strong point. The Investmate app and structured learning guides make it easy to build confidence before trading live. On the downside, its research tools felt a bit limited compared to other top brokers, and live chat wait times could definitely be improved.

Overall, Capital.com is best suited for traders who value ease of use, strong regulation, and transparent pricing over deep research features or advanced tools. It’s a broker that does the basics extremely well, which is exactly what most traders want.

Capital Com MENA Securities Trading L.L.C. is a Company registered in Dubai, United Arab Emirates, and authorised by the Securities and Commodities Authority with license number 20200000176.

Risk Disclaimer: CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority. The content above is not intended to serve as investment advice or as a sufficient basis to make investment decisions. It is meant solely for informational purposes.

Written by Sam Reid

Written by Sam Reid Fact checked by Freddie Ricks

Fact checked by Freddie Ricks Last updated 1 day ago

Last updated 1 day ago