Retest Trading Explained and How Traders Use It

Sam Reid

Staff Writer

Sam Reid

Staff Writer

Summary

- Retest trading focuses on entering after a breakout by waiting for price to return to a key level and confirm it holds.

- The retest often provides more information than the breakout itself because it shows whether the market accepts the new structure.

- The break and retest trading strategy helps traders avoid false breakouts and emotional entries.

- Execution quality matters because many retests are brief and late entries can damage risk-to-reward.

Introduction: Why Traders Pay Attention to Retests

When price breaks through a well-known level, it often attracts attention fast. Traders see momentum, fear missing out, and rush to enter.

Then price pauses. Sometimes it comes back. Sometimes it tests the same level again before deciding what to do next.

That second interaction with the level is what retest trading is built around. Instead of reacting to the initial breakout, traders wait to see whether the market actually accepts the new support or resistance. This approach slows decision-making and replaces impulse with structure.

What Is a Retest in Trading?

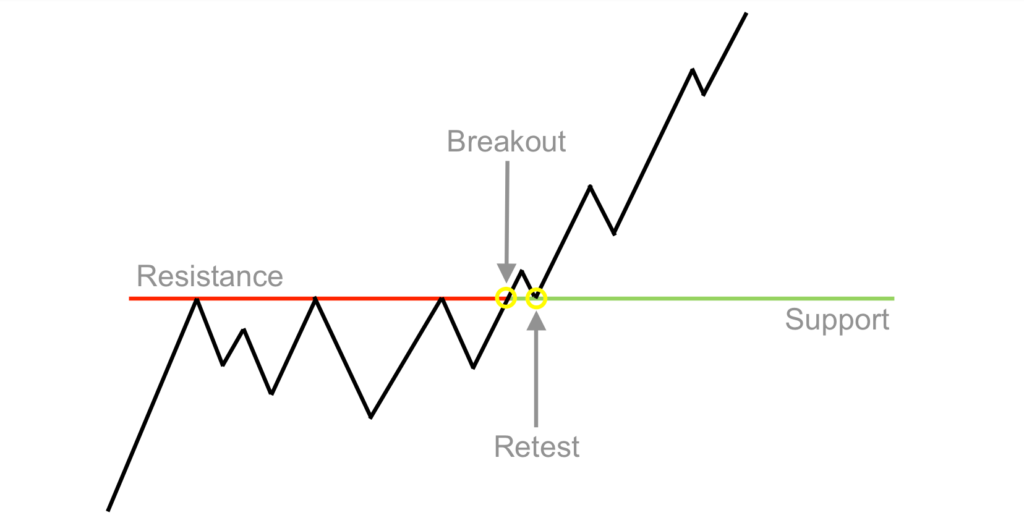

A retest in trading occurs when price breaks a key level, such as support or resistance, and then returns to that same area to test it again.

If price breaks above resistance, traders watch to see whether that old resistance now acts as support. If price breaks below support, they watch to see whether that old support turns into resistance.

This is the retest meaning in trading. It is a verification step, not a random pullback.

What Does a Retest Look Like in Trading?

Although retests vary across markets and timeframes, the structure is usually recognizable.

A typical retest sequence includes:

- A decisive break and close beyond a key level.

- A pullback toward the broken level.

- A visible reaction at that level, such as rejection or hesitation.

- Continuation if the level holds.

If price returns to the level and then settles back inside the old range, many traders treat that as a failed breakout rather than a valid retest.

Understanding Retest Trading

Retest trading is the practice of entering a trade only after price has broken a level and then confirmed it on the return. This approach contrasts with breakout trading, where entries are taken immediately as price moves through a level. While breakout entries can work in strong momentum conditions, they also expose traders to higher false breakout risk.

Retest trading prioritizes confirmation. The goal is not to catch the first move, but to enter once risk can be defined more clearly.

Understanding the Break and Retest Trading Strategy

The break and retest trading strategy follows a simple structure:

- Price breaks a key level with intent.

- Price returns to that level.

- Price reacts and confirms the level holds.

This sequence appears repeatedly across forex, gold, indices, and equities because markets often revisit important levels before continuing.

How Traders Use Retest Trading in Practice

1. Identifying Key Levels

Everything starts with the level. Retest trading depends on price reacting to areas the market already respects.

- Clear support and resistance tested multiple times.

- Recent swing highs and lows.

- Higher timeframe levels that stand out on H4 or daily charts.

2. Monitoring for a Breakout

A valid breakout usually involves more than a single wick. Traders often look for a clean close beyond the level and a change in momentum.

If the break is weak or indecisive, the retest that follows is often unreliable.

3. Waiting for the Retest

Waiting is the core discipline of retest trading.

Not every breakout produces a retest. Traders who use this strategy accept that missed trades are part of the process. The goal is quality, not frequency.

4. Confirming the Retest

Confirmation comes from price behavior at the level.

- Rejection wicks.

- Engulfing or strong directional candles.

- Brief pauses followed by continuation.

If price returns to the level and then closes deeply back into the prior range, many traders step aside.

5. Entering the Trade

Entries are typically taken after confirmation.

- Some traders wait for the confirmation candle to close.

- Others use the break of the rejection candle high or low as a trigger.

The key is that the entry is tied to evidence, not anticipation.

6. Managing the Trade

Trade management follows structure.

- Stops are placed beyond the retest zone.

- Targets are set at the next key level or using a consistent risk-to-reward approach.

- If price re-enters the old range and holds, many traders reassess or exit.

Break and Retest Trading Strategy: Case Study

A well-known example of retest trading discipline comes from Vincent Desiano, who has publicly discussed shifting away from short-term scalping toward break and retest setups on higher timeframes.

According to published interviews, he focused on retests of broken support and resistance on 4-hour and daily charts, often aligning entries with widely watched moving averages. He avoided chasing breakouts and instead waited for confirmation before committing risk.

Reported results from this approach included higher win rates above 50 percent with modest risk-to-reward targets and average holding periods of several days. The numbers themselves are less important than the process: patience, structure, and consistency.

Retest Trading vs Fakeouts

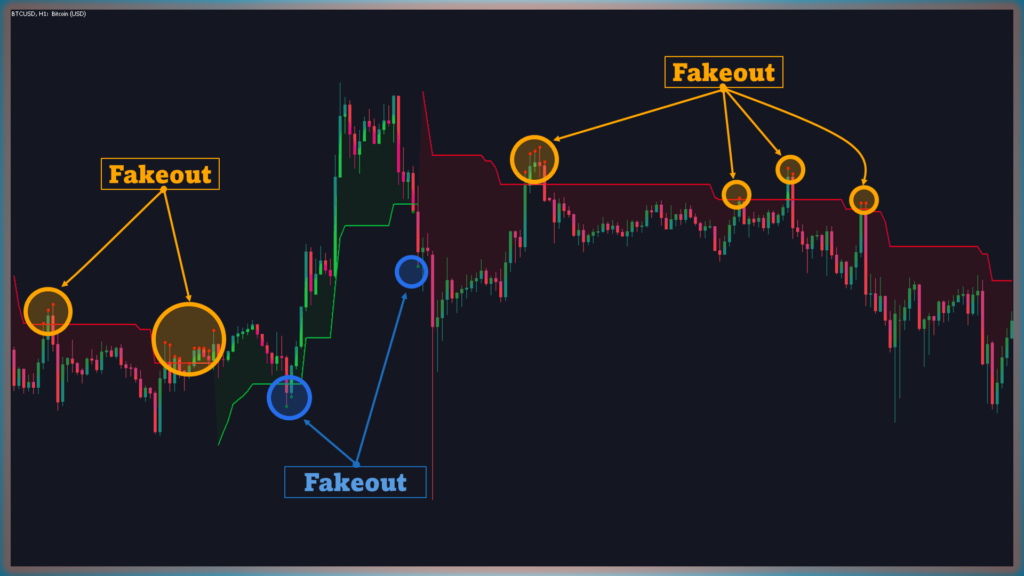

A fakeout occurs when price breaks a level but fails to hold it.

- A valid retest shows rejection and continuation.

- A failed retest sees price slide back into the old range and remain there.

Retest trading removes the need to predict outcomes. Traders wait for price behavior to reveal whether the breakout is accepted.

How Traders Confirm Retest Trading Setups

Indicators as Supporting Tools

Indicators are commonly used as confirmation rather than decision-makers.

- Moving averages can add context if the retest occurs near a widely watched level.

- Momentum indicators can help confirm that strength is not collapsing during the pullback.

Multi-Timeframe Analysis

Many traders identify levels on higher timeframes and then observe the retest on a lower timeframe. This helps filter out levels that only matter on small charts.

Fundamental Context

Scheduled news events can distort retests. Volatility spikes and spread changes can cause levels to be briefly violated before price stabilizes.

Why Execution Matters in Retest Trading

Retest trading is level-based. That makes execution quality relevant.

When retests are brief, entering late can change stop placement and reduce potential reward. In fast conditions, spreads can widen and price can move quickly away from the level.

This does not mean execution must be perfect. It means that consistently poor fills can turn a structured strategy into a different trade than intended.

Advantages of Retest Trading

- Clear structure and defined invalidation points.

- Reduced exposure to false breakouts.

- Works across markets and timeframes.

Disadvantages and Limitations

- Some breakouts do not retest.

- False retests still occur.

- Requires patience and discipline.

Checklist: How Traders Apply Retest Trading

- Identify a clear level on a higher timeframe.

- Wait for a decisive break and close.

- Mark the broken level as a zone.

- Wait for the retest.

- Enter only after confirmation.

- Place stops beyond the retest zone.

- Target logical structure.

The Bottom Line

Retest trading replaces urgency with confirmation. The retest is where the market proves whether a breakout deserves trust. The break and retest trading strategy works because it aligns entries with structure and clearly defines risk. Execution matters because retests are often brief, and late entries change the math of the trade.

For traders willing to wait, retest trading offers a repeatable framework grounded in market behavior rather than emotion.

FAQ

What is a retest in trading?

A retest in trading is when price returns to a level after breaking it, to test whether that level will hold as new support or resistance.

What does a retest look like in trading?

It usually appears as a pullback to the broken level followed by rejection and continuation. If price settles back into the old range, the retest is often considered failed.

What is the 90% rule in trading?

The 90% rule is commonly used to highlight that most traders struggle due to poor discipline, risk management, and emotional decisions. Structured approaches like retest trading aim to reduce those behaviors.

How to trade the break and retest?

Wait for a clear break and close beyond a key level, then wait again for price to return and confirm that the level holds before entering with defined risk.

Disclaimer: This content is for educational purposes only and not to be construed as investment advice. Remember that forex and CFD trading involves high risk. Always do your own research and never invest what you cannot afford to lose.

20th Dec 2025

20th Dec 2025